尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

European battery start-ups are jostling to meet demand as electric vehicle take-up accelerates. France’s Verkor is the latest to raise money. It secured more than €2bn this week for its first plant, in northern France.

隨著電動汽車的加速普及,歐洲電池新創企業正在競相滿足需求。法國的Verkor是最新一家融資企業。本週,該公司在法國北部的首家工廠獲得了逾20億歐元的融資。

In theory, new plants promised by domestic and international companies could quickly amount to overcapacity.

從理論上講,歐洲企業和國際企業承諾新建的工廠可能很快就會導致產能過剩。

Ten battery cell plants in production in Europe have a combined capacity of 166.5 gigawatt hours, says Benchmark Mineral Intelligence. A further 26 are planned by the end of the decade. If all materialise, total capacity would increase to 1,227 GWh.

基準礦物情報公司(Benchmark Mineral Intelligence)表示,歐洲正在生產的10家電池工廠的總產能爲166.5吉瓦。到本十年末,計劃再建26座。如果全部實現,總產能將增加到1227吉瓦。

However, actual production will be much lower, at an estimated 729 GWh. Production can take several years to ramp up. Demand in 2030 is forecast at 1,004 GWh. It is possible too that some start-ups will drop out. The US Inflation Reduction Act’s subsidies may lure other projects stateside.

然而,實際產能要低得多,估計爲729吉瓦。產能可能需要幾年時間才能上升。2030年的需求預計爲1004吉瓦。一些新創企業也有可能退出。美國《降低通膨法》(Inflation Reduction Act)的補貼可能會吸引其他項目到美國來。

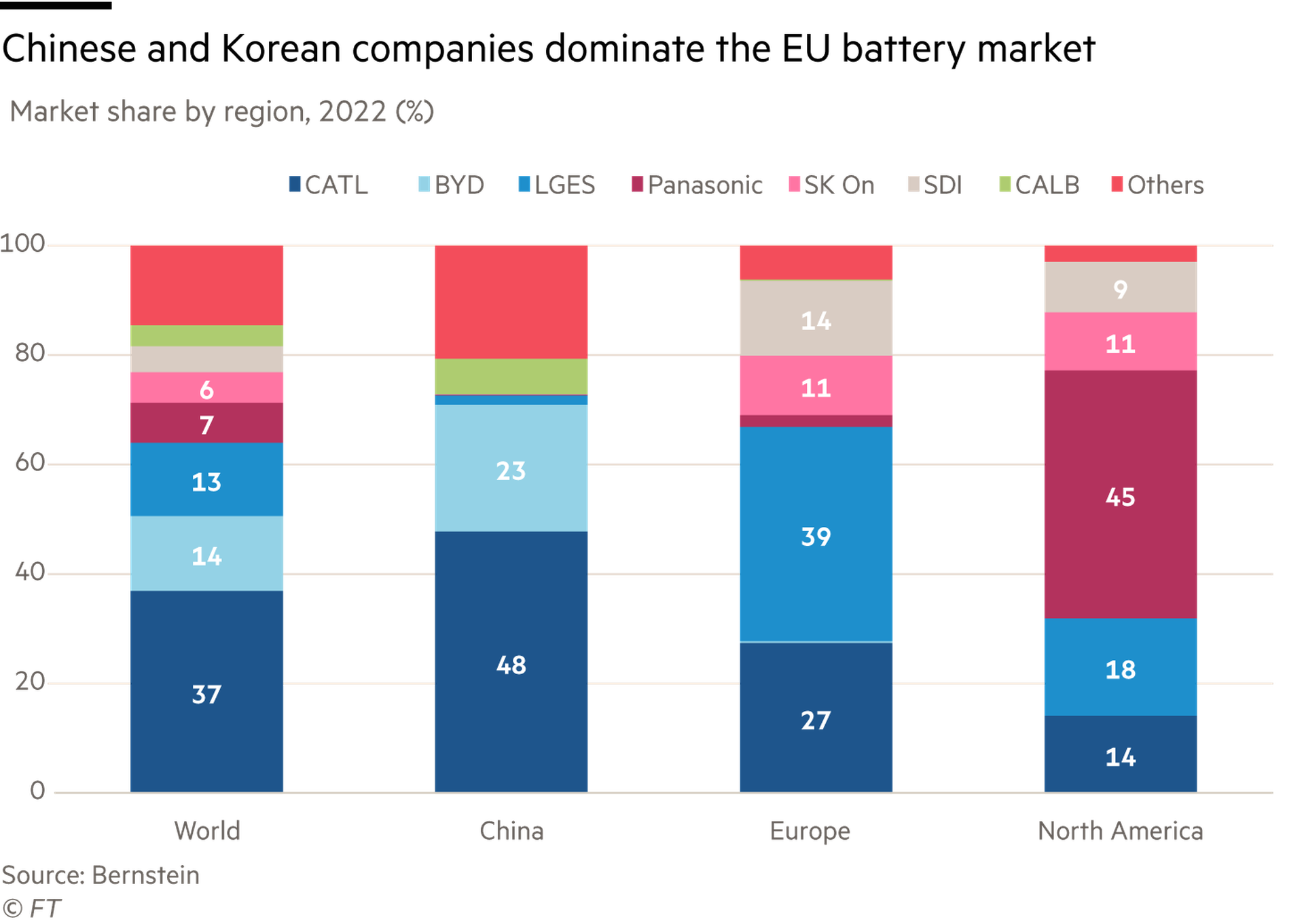

This means there is no reason for European players to decelerate. The market is dominated by Asian players such as South Korea’s LG Energy Solution and Chinese group CATL. They too have plants in Europe, including in Poland and Germany.

這意味著歐洲企業沒有理由減速。南韓LG新能源(LG Energy Solution)和中國寧德時代(CATL)等亞洲企業在這個市場佔據主導地位。他們在歐洲也有工廠,包括波蘭和德國。

About half of battery cells used in Europe last year were produced domestically. Imports from China and South Korea covered the balance, says campaign group Transport & Environment.

去年歐洲使用的電池約有一半是歐洲生產的。活動組織Transport & Environment表示,其餘從中國和南韓進口。

Raising import tariffs on battery cells would help domestic suppliers. But it risks further tensions with China. Beijing has already hit out at the EU’s anti-subsidy probe into China’s car industry.

提高電池的進口關稅將有助於歐洲供應商。但此舉也可能加劇與中國的緊張關係。北京方面已經對歐盟針對中國汽車行業的反補貼調查進行了猛烈抨擊。

A less fraught option would be for EU carmakers to use their clout to secure vital raw materials for use by their suppliers. Some are already doing this. Europe’s battery makers have a good shot at keeping pace with Asian rivals.

一個不那麼令人擔憂的選擇是,歐盟汽車製造商可以利用自己的影響力,爲其供應商獲取關鍵原材料。一些公司已經在這麼做了。歐洲電池製造商有機會趕上亞洲競爭對手的步伐。