尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

Many one-product companies run out of road. Small plastic bricks have supported Denmark’s Lego for more than 70 years. A clear focus can pay off. But, amid a debate over the health of public markets, its success also demonstrates the benefits of its distinctive corporate structure.

許多隻生產一種產品的公司走到了盡頭。小塑膠積木支撐了丹麥的樂高(Lego)公司超過70年。明確的專注可以帶來回報。然而,在公衆市場健康狀況的爭論中,樂高的成功也展示了其獨特的公司結構所帶來的好處。

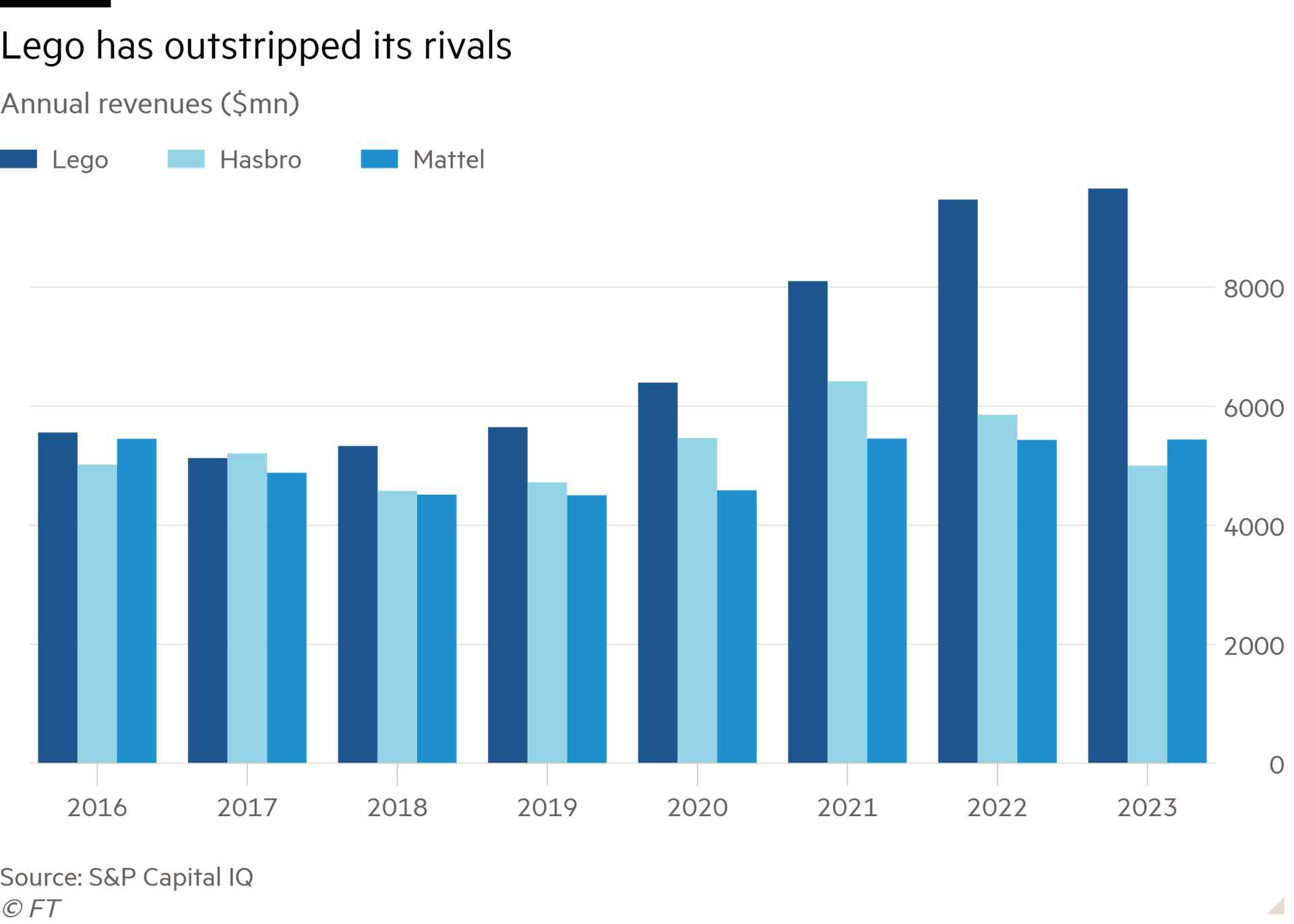

The toymaker’s sales growth of 2 per cent last year was dragged down by a weak performance in China. But it was respectable enough given a seven per cent decline in toy industry sales. Lego’s sales are not much less than the combined total of its quoted US rivals Mattel and Hasbro.

受中國市場表現不佳的影響,玩具製造商樂高去年的銷售成長率爲2%。然而,考慮到整個玩具行業銷售額下降了7%,這個成長率還算可觀。樂高的銷售額幾乎與其美國競爭對手美泰(Mattel)和娛樂集團孩之寶(Hasbro)的總和相當。

Inflation, one cause of the industry’s woes, is subsiding. Low birth rates, another problem, will persist. That is partly offset by adult fans of Lego. This group — known as Afols — creates a market for costly, complicated kits like the Titanic or Eiffel Tower. This “Icons” line made some of the biggest gains of any toy property globally in 2023, according to Circana.

通貨膨脹,作爲該行業困境的一個原因,正逐漸消退。低出生率,另一持續性問題,仍將存在。這在一定程度上得到了樂高成年粉絲(adult fans of Lego)的部分抵消。這一羣體——亦即所謂的Afols——爲諸如泰坦尼克號或埃菲爾鐵塔等昂貴複雜套裝開闢了市場。根據Circana的報告,這一「Icons」系列在2023年成爲全球玩具領域成長最快的產品線之一。

New products accounted for roughly half of Lego’s portfolio last year. Innovation isn’t without risk: novelty can damage profitability if it means fewer universal pieces that can be produced in high volumes for lots of different kits. The proliferation of parts contributed to Lego’s downturn in 2003, says academic David Robertson. However, the business has since expanded so it can use more parts without hurting the ratio of sales to profits.

去年,新產品大約佔了樂高總產品的一半。創新並非沒有風險:如果新穎性導致可以大量生產並適用於衆多不同套裝的通用零部件數量減少,那麼這可能會對盈利能力產生負面影響。學者大衛•羅伯森(David Robertson)表示,零部件數量的增加是樂高2003年經營低迷的原因之一。然而,樂高已經擴大了業務規模,因此可以使用更多的零部件,而不會影響銷售和利潤的比例。

Lego’s operating profit margin fell by 1.7 per cent to 26 per cent, as it spent more on stores, its supply chain and digital operations. Even so, that is nearly three times Hasbro’s adjusted operating figure. Were it quoted, Lego would be worth much more than the $43bn estimate arrived at by using Hasbro’s trailing EV-to-ebitda ratio of 15.5 times.

樂高的營業利潤率下降了1.7個百分點,降至26%,這主要是由於其在商店、供應鏈和數位化運營上的投入增加。然而,這個數字仍然是孩之寶調整後的運營數據的近三倍。如果樂高上市,按照孩之寶過去的EV/EBITDA比率15.5倍計算,樂高的市值將遠超過430億美元的估值。

But Lego is privately held and there is no sign of that changing. Kirkbi, an investment vehicle run by the founding family, owns 75 per cent, with the remainder owned by the Lego Foundation. When an heir opted to sell some Kirkbi shares for $930mn last year, family members took up the slack. Outside investors’ only exposure to the brand is through Legoland-owner Merlin Entertainments. Blackstone and Canadian pension fund CPPIB teamed up with Kirkbi on the £6bn take-private bid in 2019.

但樂高是私人持有,且沒有任何跡象顯示這將會改變。由創辦家族運營的投資機構Kirkbi持有75%的股份,其餘由樂高基金會(Lego Foundation)所有。去年,當一位繼承人選擇以9.3億美元的價格出售部分Kirkbi股份時,家族成員接手了這部分股份。外部投資者接觸該品牌的唯一方式是透過樂高樂園的所有者——默林娛樂公司(Merlin Entertainments)。黑石集團(Blackstone)和加拿大養老基金CPPIB在2019年與Kirkbi聯手,進行了60億英鎊的私有化收購。

External investors might have been less inclined to tolerate last year’s 10 per cent dividend cut to fund investment. There is evidence that tightly held companies like Lego benefit from a long-term perspective. Building the business, like its product, is an exercise in patience. It can yield impressive results.

去年爲了籌集投資資金而削減了10%的股息,外部投資者可能較不願意接受。有證據顯示,像樂高這樣的嚴格控股公司能從長期視角中受益。建立業務,就像其產品一樣,需要耐心。這樣做可以產生令人印象深刻的成果。