尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

This article is the latest part of the FT’s Financial Literacy and Inclusion Campaign

本文是FT金融掃盲與包容運動(Financial Literacy and Inclusion Campaign)的最新部分

The pandemic has transformed our relationship with money, nudging millions of people around the world to think about their safety net, examine their spending and start investing to fund long-term financial goals.

新冠疫情改變了我們與金錢的關係,促使世界各地數百萬人考慮他們的安全網,檢查他們的支出,並開始爲長期財務目標進行投資。

Yet as we approach International Women’s Day on March 8, the narrative about women and money remains deeply depressing.

然而,隨著3月8日國際婦女節(International Women』s Day)的臨近,關於女性與金錢的敘述仍然令人深感沮喪。

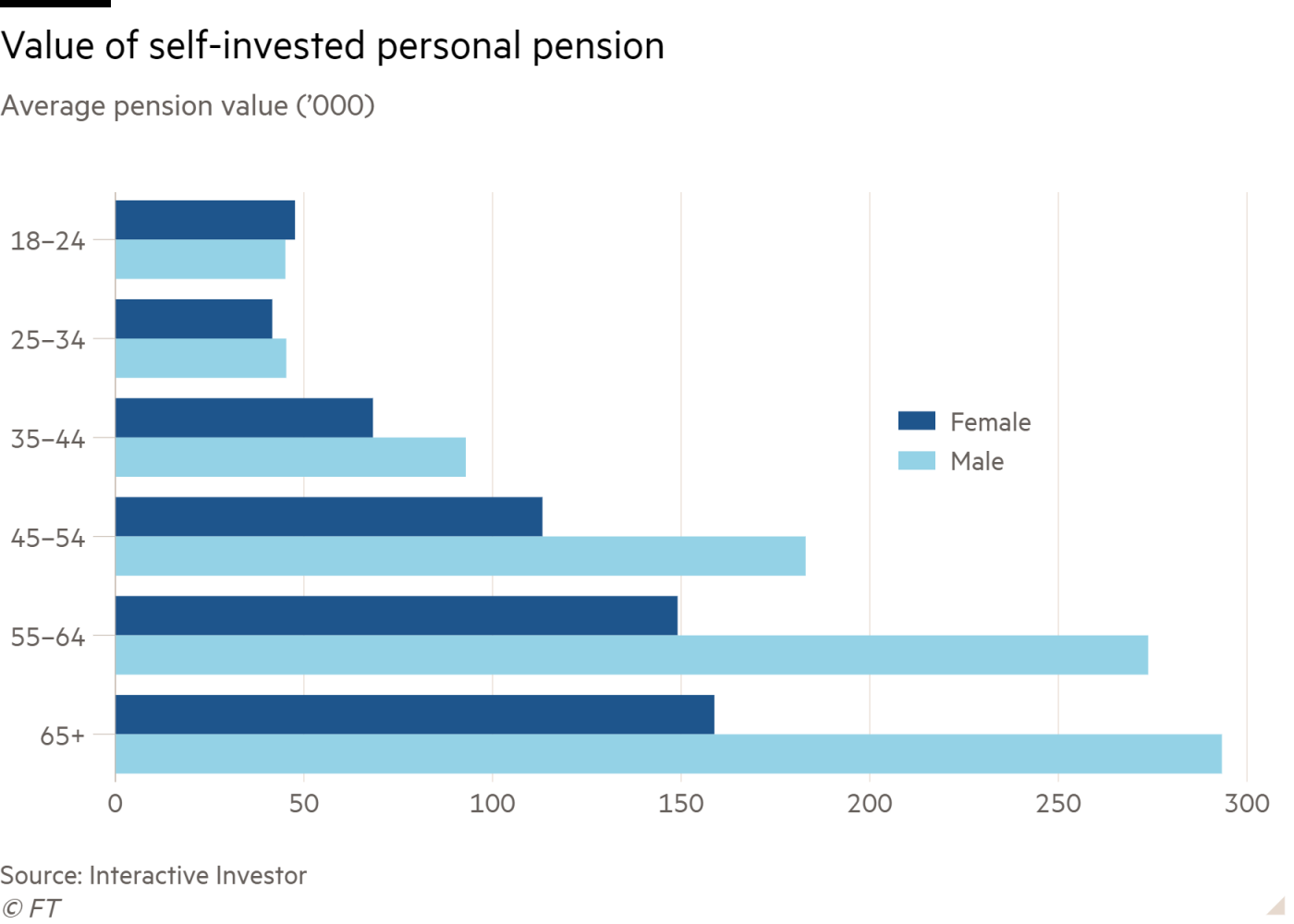

The gender pay gap has widened; our pensions tend to be puny; we live for longer, spend more of our lives caring for others and all of this negatively affects our finances.

性別收入差距擴大;我們的養老金往往微不足道;我們活得更久,花更多的時間照顧他人,所有這些都對我們的財務狀況產生了負面影響。

Now the cost of living crisis is adding to our woes, with inflation eating away at cash savings while volatility returns to global stock markets.

如今,生活成本危機加劇了我們的困境,通膨侵蝕著我們的現金儲蓄,同時波動性重返全球股市。

As someone who has been writing about finance for more than 20 years, I worry that focusing on the negatives is a further barrier to engagement. If the financial odds are so stacked against women, should we even bother?

作爲一個寫了20多年金融文章的人,我擔心,把注意力集中在負面因素上,會進一步阻礙人們的參與。如果經濟狀況對女性如此不利,我們還有必要爲此嘗試嗎?

In the spirit of the 2022 theme “Break the bias”, I want to present some inspirational ideas about money that could shift your mindset. In the seven areas below, hopefully there’s a practical takeaway that women everywhere can act on.

本著2022年婦女節「打破偏見」主題的精神,我想提出一些關於金錢的鼓舞人心的想法,這些想法可以改變你的思維。在以下七個方面,希望有一個實際的收穫,任何地方的女性都可以採取行動。

Thanks to the FT’s Financial Literacy and Inclusion Campaign, this article is free to read and share — so if you’re inspired by the expert suggestions below, please pass them on — and feel free to add your own in the comment field below.

多虧了英國《金融時報》的金融掃盲與包容運動,這篇文章可以免費閱讀和分享——因此,如果你受到了下面專家建議的啓發,請把它們傳遞下去——請隨時在下方的評論區新增你自己的建議。

1. What financial independence feels like

1. 經濟獨立的感覺是什麼樣的

For all the negativity surrounding women’s finances, I wish we could bottle the biggest positive — the feeling that financial independence gives you.

考慮到圍繞女性財務狀況的所有消極因素,我希望我們能把最大的積極因素——財務獨立給你的感覺——放在最前面來講。

I would define this as moving from feeling overwhelmed by money to feeling more in control; making your own decisions, setting financial priorities; and developing effective habits like budgeting to help you achieve your goals.

我將其定義爲從被金錢壓垮到感覺更能控制一切;自己做決定,設定財務優先順序;培養有效的習慣,比如做預算來幫助你實現目標。

“The problem is, traditional goals set by older generations [like buying a home] are not affordable for us,” say Margot and Alexia de Broglie, the 20-something co-founders of Your Juno, a new financial education app for Gen-Z women.

「問題是,老一輩人設定的傳統目標(比如買房)對我們來說是負擔不起的,」20多歲的瑪戈(Margot)和亞歷克西婭•德布羅意(Alexia de Broglie)表示。她們是針對Z世代女性的新金融教育應用「你的朱諾」(Your Juno)的聯合創辦人。

FT金融掃盲與包容運動

For the app’s users, financial independence is about “having freedom over your time”. The topics younger women most want to learn about are investing, negotiating a pay rise, becoming a freelancer and starting a business — and they want to learn from each other’s experiences.

對於這款應用的用戶來說,財務獨立意味著「在你的時間裏擁有自由」。年輕女性最想了解的話題是投資、協商加薪、成爲自由職業者和創業——她們希望從彼此的經驗中學習。

“The element of community is so incredibly empowering,” says Alexia. “So often, money is a source of shame and stress, when it should be a source of freedom, empowerment and security.”

「社區的元素是如此令人難以置信地賦予女性力量,」阿萊克西亞說。「金錢往往是羞恥和壓力的來源,而它本應是自由、賦權和安全的來源。」

During the pandemic, many more of us shared our financial fears and experiences online. From Reddit threads to “FinTok” and social media “finfluencers”, women can recognise themselves, finding role models that the traditional financial world fails to offer.

在新冠疫情期間,我們中有更多的人在網上分享了我們的金融恐懼和經歷。從Reddit貼文到「FinTok」和社群媒體網紅,女性可以認識自己,找到傳統金融世界無法提供的榜樣。

While these personal interactions cannot replace regulated financial advice, real-life stories remind us that nobody is perfect. Knowing that others are experiencing the same challenges can be a source of strength and inspiration, as the huge growth of the online debt-free community has shown. It is also a reminder that we shouldn’t confuse financial independence with financial privilege.

雖然這些個人互動無法取代受監管的金融建議,但現實生活中的故事提醒我們,人無完人。知道其他人正在經歷同樣的挑戰可以是力量和鼓舞的源泉,正如在線無債務社區的高速成長所顯示的那樣。這也提醒我們,我們不應該把財務獨立與財務特權混爲一談。

Lynn Beattie, who blogs as Mrs Moneypenny, started a viral thread on Twitter last month [February] called “Can we all be a bit more honest about how we paid for our first homes?”

上個月(2月),以「錢眼太太」(Mrs Moneypenny)的筆名寫作部落格的林恩•貝蒂(Lynn Beattie)在推特(Twitter)上發起了一個被大量轉發的貼文,名爲「我們能否對自己的第一套房子的付款方式更誠實一點?」

Viewed by over 2mn people, her tweet prompted thousands to confess they had only achieved this milestone by coming into an inheritance, receiving gifts or loans from their parents, or having a higher earning partner — as opposed to cancelling Netflix and their gym membership.

她的推特點擊量超過200萬,成千上萬的人承認他們之所以能達到這一里程碑,是因爲繼承了一筆遺產,從父母那裏得到了禮物或貸款,或者有了一個收入更高的伴侶——而不是取消Netflix和健身會員資格。

2. More women are investing — and so can you

2. 越來越多的女性在投資——你也可以

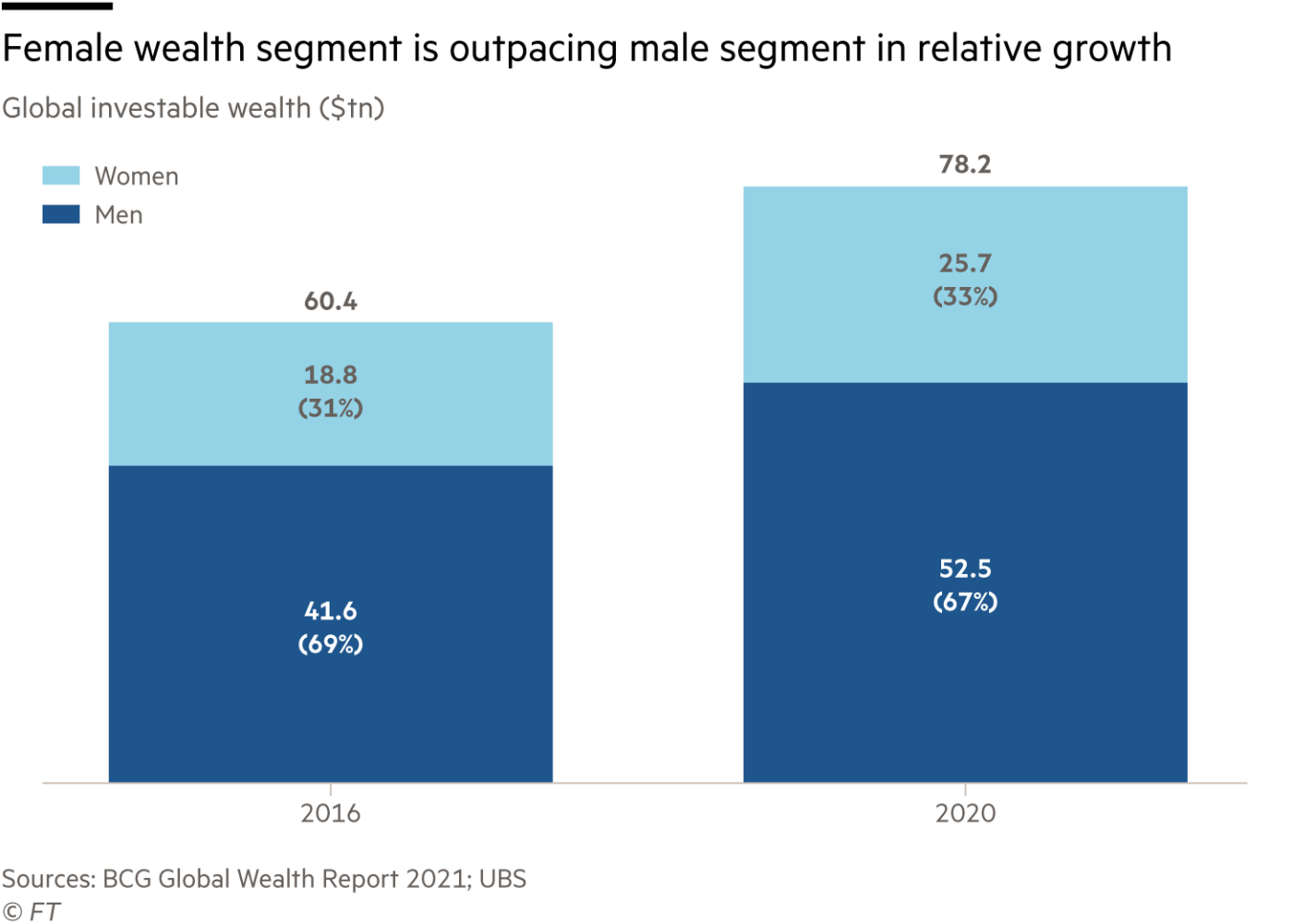

During the pandemic, investment platforms and trading apps reported a new wave of female customers. Getting started is the easy part. As markets turn choppy, thinking about your investment strategy and understanding how tax breaks can boost your investments can help newer investors hang on for the ride.

在疫情期間,投資平臺和交易程式錄得新一波女性客戶。開始投資是最簡單的部分。當市場波動時,思考一下你的投資策略,瞭解稅收優惠如何促進你的投資,可以幫助新投資者堅持下去。

“We spend so much time working hard earning the money, but not enough nurturing our wealth,” says Charlotte Ransom, founder of Netwealth. “For me, the challenge is all about getting people closer to their money.”

Netwealth創辦人夏洛特•蘭塞姆(Charlotte Ransom)表示:「我們花了這麼多時間努力工作賺錢,卻沒有足夠的時間培育財富。對我來說,挑戰在於讓人們更接近他們的錢。」

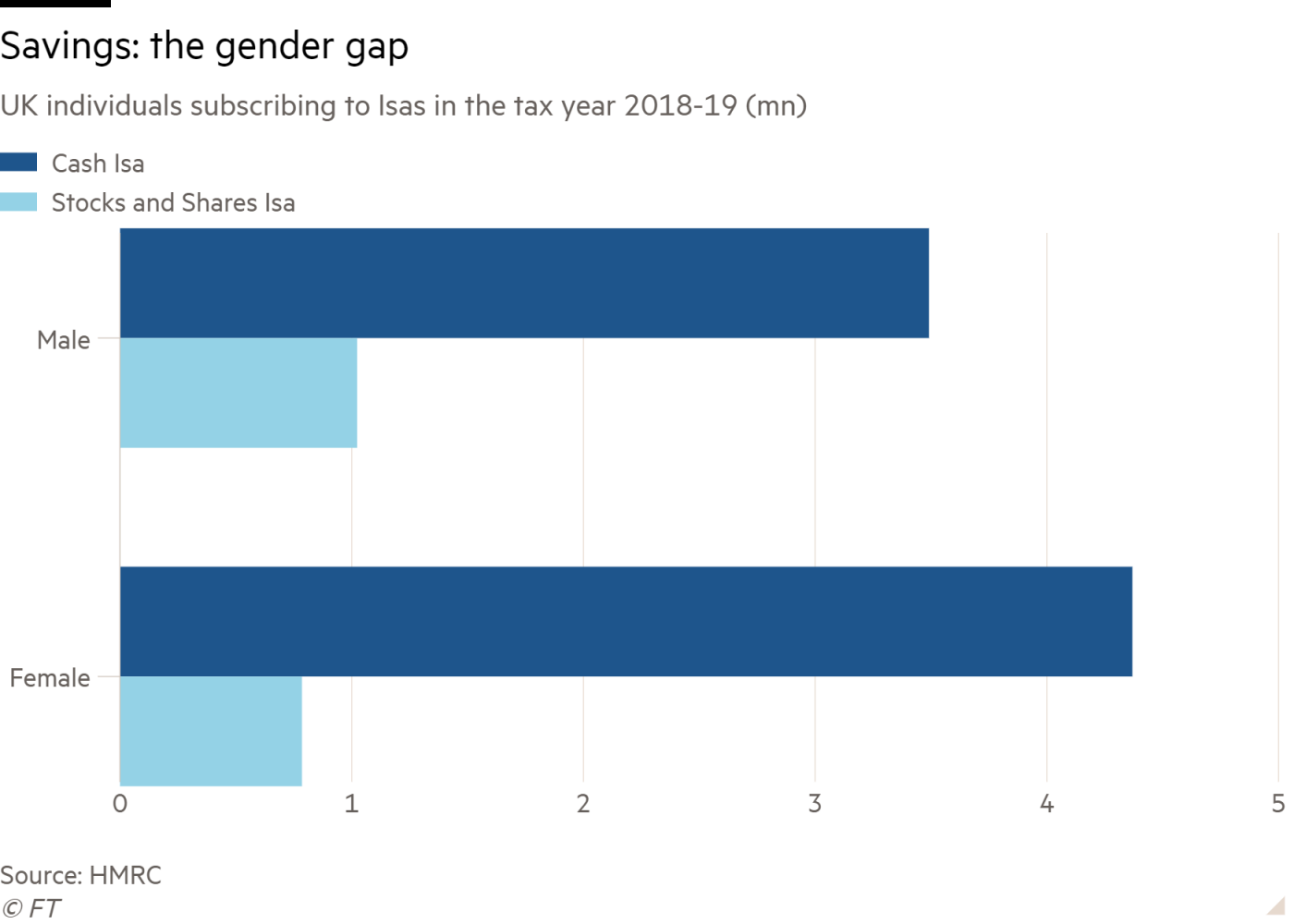

Unusually for a wealth manager, half of Netwealth’s clients are female. “Women tend to have much higher cash holdings [than men], so rising inflation is going to hit them harder,” she says.

對於一家財富管理公司來說,不同尋常的是,Netwealth一半的客戶都是女性。她表示:「女性的現金持有量往往(比男性)高得多,因此不斷上升的通膨對她們的打擊將更大。」

She is convinced that one reason women tend to hold so much cash is because “they find it harder to engage with the personal finance industry”.

她相信,女性傾向於持有這麼多現金的一個原因是,「她們發現自己更難與個人理財行業打交道」。

She argues that setting tangible long-term goals — such as a target income to aim for in retirement — is a much more powerful motivator for women than being pushed to buy a product. “Once women understand how their investments can line up against their goals, they generally show themselves to be very savvy investors,” she says.

她認爲,對女性來說,制定切實的長期目標——比如退休後的目標收入——比強迫她們購買產品更有動力。她說:「一旦女性瞭解她們的投資如何與她們的目標相匹配,她們通常會顯示出自己是非常精明的投資者。」

How might you get closer to your money? At an International Women’s Day event years ago, I asked women to raise their hands if they had money invested in the stock market (a few were raised). Next, I asked people to put their hands up if they had a company pension. Nearly every hand went up — but the “default” nature of money invested in company schemes meant most had failed to make this connection.

你如何更接近你的錢呢?在幾年前的一次國際婦女節活動上,我請婦女們舉手,看看她們是否有資金投資於股市(有幾個人舉手了)。接下來,我讓那些有公司退休金的人舉手。幾乎所有人都舉手了——但投資於公司計劃的資金的「默認」性質意味著,大多數人都未能意識到自己與股市的聯繫。

“Investing is one of the hottest topics, yet [our users] don’t want to talk about pensions,” notes Margot from Your Juno, urging women not to overlook the “free money” of pension matching offered by their employer, and to educate themselves about investment choices.

「投資是最熱門的話題之一,但(我們的用戶)不想談論養老金,」你的朱諾的瑪戈指出。她敦促女性不要忽視僱主提供的養老金配對的「免費資金」,並教育自己有關投資選擇的知識。

Even so, studies show that a lack of money, rather than a lack of confidence, is a major reason more women don’t invest.

即便如此,研究表明,更多女性不投資的主要原因是缺乏資金,而不是缺乏自信。

“Ignorance in finance is not bliss,” says Annamaria Lusardi, founder of the global financial literacy centre at George Washington University “Take some small steps to invest in financial knowledge, by setting aside as little as 10 to 15 minutes each week or month to read and learn about money.”

喬治華盛頓大學(George Washington University)全球金融掃盲中心(global financial literacy centre)的創辦人安娜瑪麗亞•盧薩迪(Annamaria Lusardi)表示:「對金融無知並不是一種幸福。採取一些小步驟投資金融知識,每週或每月抽出10至15分鐘閱讀和學習有關金錢的知識。」

3. What does your partner earn — and where is the money?

3. 你的伴侶掙多少錢?錢在哪裏?

Every woman should know the answer to this question, but a surprising number do not. But before having a conversation with your partner, try having one with your peers.

每個女人都應該知道這個問題的答案,但令人驚訝的是,有相當多的女人不知道。但是在和你的伴侶交談之前,試著和你的同齡人交談。

“In a similar way to a book club, why not meet your friends over dinner to start a conversation about financial topics?” suggests Patricia Astley, managing director at Julius Baer, a wealth manager.

「和讀書俱樂部類似,爲什麼不與朋友共進晚餐,開始一場有關金融話題的談話呢?」財富管理公司寶盛(Julius Baer)董事總經理帕特里夏•阿斯特利(Patricia Astley)建議道。

She recently did so with five friends, and they went around the table sharing what they knew about pensions, life insurance and wills.

最近,她和五個朋友一起做了這項工作,他們圍坐在桌邊,分享他們對養老金、人壽保險和遺囑的瞭解。

“Plenty knew little, or confessed they left these kinds of things to their partners,” she says. “In the UK, 42 per cent of marriages end in divorce and, even if you stay married, women live for longer than men. We need to have these conversations now.”

她說:「很多人對此知之甚少,或者承認他們把這些事情留給了自己的伴侶。在英國,42%的婚姻以離婚告終,而且即使維持婚姻關係,女性的壽命也比男性長。我們現在就需要進行這些對話。」

The pandemic has prompted one member of my own book club to tackle her (older) partner about their financial affairs.

疫情促使我自己書友會的一位成員向她(年長)的伴侶詢問他們的財務問題。

“I just came out with it and said, ‘if you were to die of Covid tomorrow, where is our money, the passwords, the financial records for our business and the deeds for our house?’” she says. Talking more about money has now become a bigger part of their daily lives.

「我突然問道,『如果你明天死於Covid,我們的錢、密碼、公司的財務記錄和房契在哪裏?』」她說。現在,更多地談論金錢已經成爲他們日常生活中更重要的一部分。

Jane Portas, a financial expert and creator of the Six Moments that Matter website, asks women if they know what their gender pension gap is — the value of their pension pot relative to their partner’s.

金融專家簡·波爾塔斯(Jane Portas)是「重要的六個時刻」(Six Moments that Matter)網站的成立者,她詢問女性是否知道男性和女性養老金差別是什麼——她們的養老金相對於伴侶的價值是多少。

“Without a conscious effort to maintain and level up finances to recognise non-financial contributions like caring for children, these gaps start to build,” she says. “All too often, people don’t realise this until they split up.”

她表示:「如果不有意識地保持和提高財務水準,以認可照顧孩子等非財務貢獻,這些差距就會開始擴大。很多時候,人們直到分手才意識到這一點。」

Don’t overwhelm yourselves by trying to have all of these conversations at once — tackling one topic at a time (perhaps over dinner) should make it more enjoyable.

不要試圖同時進行所有這些對話,讓自己不知所措——一次只談一個話題(也許是在晚餐時)應該會讓談話更愉快。

4. The financial impact of having a baby

4. 生孩子對經濟的影響

Much of the damage to women’s earnings potential occurs after they become a parent, but financial planning can help lessen the impact.

對女性收入潛力的損害大多發生在她們爲人父母之後,但理財計劃可以幫助減輕這種影響。

Tobi Asare, founder of the My Bump Pay website, suggests couples start planning “way before” they think about starting a family.

My Bump Pay網站的創辦人託比·阿薩雷(Tobi Asare)建議,夫婦們在考慮組建家庭很早之前就開始計劃。

“The most important thing is to find out what both parents are entitled to in terms of maternity pay and parental leave,” she says.

她說:「最重要的是找出父母雙方在產假和育兒假方面享有的權利。」

The directory on her website shows that some employers offer much more enhanced packages than others. Importantly, more are recognising that men want to play a greater role in the early years. In the UK, shared parental leave is slowly becoming more common, but not every company offers it, and benefits vary hugely.

她網站上的目錄顯示,有些僱主提供的薪酬比其他僱主優厚得多。重要的是,越來越多的人意識到,男性希望在早期發揮更大的作用。在英國,共享產假正逐漸變得越來越普遍,但並不是每家公司都提供這種服務,而且福利差別很大。

Asare says advance understanding of how your pay will be affected is essential for families to budget. Typically, maternity pay gradually tails off, and may even drop to zero.

阿薩雷說,提前瞭解你的工資將如何受到影響對家庭預算至關重要。一般來說,產假工資會逐漸減少,甚至可能降至零。

“Ask your employer for a schedule of payments ahead of time, so you can see exactly how much maternity pay you will receive and when, and budget around this,” is her advice.

她的建議是:「提前向你的僱主索要一份支付時間表,這樣你就能確切地知道你會拿到多少產假工資,什麼時候拿到,並據此制定預算。」

“So many women discover they can’t afford to keep up pension contributions, so they opt out, but this makes the gender pensions gap even worse.”

「很多女性發現她們無法繼續繳納養老金,所以她們選擇退出,但這使得男性和女性養老金差距更加嚴重。」

However, the greatest financial challenge is still to come. “The cost of childcare is always the biggest surprise that catches people out,” Asare says, recommending parents-to-be look at the cost of childcare options and find out if they will qualify for government assistance such as tax-free childcare.

然而,最大的財政挑戰還沒有到來。阿薩雷說:「育兒費用一直是人們最驚訝的問題。」他建議準父母們看看育兒費用的選擇,看看他們是否有資格獲得政府援助,比如免稅育兒。

5. Flexible working is not just for women

5. 彈性工作制並不僅僅適用於女性

In the City of London, high-profile female bosses have been encouraging women to stop working from home and come back to the office.

在倫敦金融城(City of London),一些知名的女老闆一直在鼓勵女性不要在家工作,回到辦公室工作。

If flexible working is something that only women are asking for, they fear this could unduly damage women’s pay and career prospects. Sadly, they stopped short of suggesting that more men should ask to work flexibly to better share childcare.

如果彈性工作制是隻有女性纔要求的,她們擔心這會過度損害女性的工資和職業前景。遺憾的是,他們沒有建議更多的男性應該要求彈性工作,以便更好地分擔育兒。

“Both men and women can benefit from the fact that the stigma around the flexible working conversation has been pushed aside,” says Patricia Astley. “Before the pandemic, many men wouldn’t approach their boss about this through fear of looking weak. That’s now eliminated, so these conversations need to be had at home.”

帕特麗夏•阿斯特利表示:「圍繞靈活工作對話的汙名已被拋到一邊,這對男性和女性都有好處。在新冠疫情之前,很多男性因爲害怕顯得軟弱而不願向老闆提出這個問題。現在已經沒有了,所以這些對話需要在家裏進行。」

Charlotte Jessop, founder of financial education platform Looking After Your Pennies, encourages couples to examine their overall finances.

理財教育平臺Looking After Your Pennies的創辦人夏洛特·傑索普(Charlotte Jessop)鼓勵夫婦們檢查他們的整體財務狀況。

“When our children were small, my partner and I looked into how our take home pay would be affected if we both went part-time,” she says. They were surprised to find they would still hang on to 70 per cent of their income if they cut their working hours by nearly 50 per cent (Charlotte moved from five days a week to two, and her partner dropped down to four days).

她說:「當我們的孩子還小的時候,我和我的伴侶研究瞭如果我們都去做兼職工作,會對我們的實得工資產生什麼影響。」他們驚訝地發現,如果他們把工作時間減少近50%,他們仍然能保住70%的收入(夏洛特從每週5天減少到2天,她的伴侶減少到4天)。

Reducing their take home pay moved the couple into lower tax bands, plus they ended up spending far less on childcare as one parent was usually at home.

減少他們的家庭收入使這對夫婦進入了較低的稅率區間,此外,由於父母中的一方通常在家,他們最終在兒童保育方面的支出也大大減少。

Other couples might find this approach could boost their entitlement to child benefit or qualify them for up to 30 hours per week of free childcare (the latter is withdrawn if one partner earns over £100,000).

其他夫婦可能會發現,這種方法可以提高他們的兒童福利,或使他們有資格獲得每週30小時的免費托兒服務(如果一方收入超過10萬英鎊,後者將被取消)。

6. How to hustle

6. 如何兼職

The need for greater flexibility has long been a driver for women to go freelance or start a business. However, statistics show that female-owned enterprises often struggle to scale up, attracting a minute proportion of money raised from outside investors.

長期以來,對更大靈活性的需求一直是促使女性從事自由職業或創業的動力。然而,統計數據顯示,女性擁有的企業往往難以擴大規模,從外部投資者那裏吸引到的資金只佔很小的比例。

Just 1.1 per cent of funding went to female-led technology companies in 2021, according to research by Atomico, which notes that diversity is lacking on both sides of the deal. In 2021, it estimated that only 12 per cent of European venture capital general partners and managing directors were female.

根據Atomico的研究,2021年,只有1.1%的資金流向了女性領導的科技公司。該公司指出,併購雙方都缺乏多樣性。據估計,2021年,歐洲風險資本的普通合夥人和董事總經理中只有12%是女性。

Your Juno founders Margo and Alexia went on a training course for women to learn “how to present more confidently” to VC investors.

你的Juno創辦人瑪戈和亞歷克西婭參加了一個針對女性的培訓課程,學習如何「更自信地」向風投投資者展示自己。

They were told that because men bidding for funding typically oversell themselves, investors expect founders to put a show on.

他們被告知,因爲競投資金的男性通常會過度推銷自己,所以投資者已經習慣於預期創辦人總是會上演一場好戲。

“Of course we questioned why we had to change our technique to fit around the mindset of male investors,” Margo says. Last week, the sisters raised $2.2mn in seed funding from a female-led board.

瑪戈說:「當然,我們質疑爲什麼我們必須改變我們的技術,以適應男性投資者的心態。」上週,姐妹倆從一家女性領導的董事會獲得了220萬美元的種子資金。

Jason Butler, the FT columnist and experienced angel investor, says that although women only account for “one in 20” people who approach him seeking an investment, his “strike rate” for investing in female-run businesses is 80 per cent, versus five per cent for those run by men. Why?

FT專欄作家、經驗豐富的天使投資者賈森•巴特勒(Jason Butler)表示,儘管在向他尋求投資的人中,女性只佔「二十分之一」,但他投資女性經營的企業的「成功率」爲80%,而男性經營的企業的「成功率」爲5%。爲什麼?

“I naturally assume that men believe that they’re great, and some of them are, yet I think many women don’t always believe in themselves enough,” he says.

他說:「我很自然地認爲,男性相信他們很偉大,他們中的一些人確實是這樣的,但我認爲很多女性並不總是足夠相信自己。」

If the numbers stack up, he believes backing female entrepreneurs gives him greater chances of a good outcome. “Women are less likely to have an ego, they’re less likely to bluster their way through or go into B.S. mode, and they tend to be harder workers,” he says.

如果這些數字累積起來,他相信支援女性企業家會給他帶來更好的結果。他說:「女性自大的可能性較小,她們不喜歡大吹大擂,也不太可能陷入廢話模式,而且她們往往更努力工作。」

“Now that is a generalisation, and I can’t really back it up with science. All I can tell you about is my experience. So I would say, if you’re a woman, don’t just think about going to women’s groups. There are many men who want to invest in female businesses.”

「這只是一種概括,我無法用科學來證明。我能告訴你的只有我的經歷。所以我會說,如果你是一名女性,不要只想著去找女性的投資。有很多男性希望投資女性企業。」

7. How to maximise your earnings potential

7. 如何最大化你的收入潛力

A “side hustle” can provide a valuable extra income, and potentially an avenue to develop your next career — but are you being paid fairly in your main hustle?

副業可以爲你提供有價值的額外收入,還可能爲你的下一份職業提供發展的途徑——但是你的副業收入公平嗎?

“Closing the gender pay gap requires you to be proactive and ask for a pay rise,” says Lusardi, accepting that part of the problem is that women are less likely to ask for an increase than men.

盧薩迪說:「縮小性別薪酬差距需要你主動要求加薪。」她接受了女性要求加薪的可能性比男性低這一問題。

Advising women to develop a greater awareness of their earnings potential, she says if negotiations do not go your way, “sometimes, the best way to increase your salary is to move jobs”.

她建議女性要對自己的收入潛力有更清醒的認識。她表示,如果談判不符合你的意願,「有時候,提高薪水的最好辦法就是換工作」。

Women are much more likely to work part-time. After having children, switching to a four-day week is common, yet plenty of women are squeezing in five days’ worth of work in return for a 20 per cent pay cut.

女性從事兼職工作的可能性要大得多。生完孩子後,每週工作4天的做法很常見,但許多女性只是將5天的工作量壓縮到4天完成,卻得到20%的減薪。

“Another common problem is women staying in the same job for a long time after they’ve had children,” says Portas, noting how women sacrifice flexibility for pay and career progression.

波爾塔斯說:「另一個常見的問題是,女性在生完孩子後還長時間呆在同一份工作上。」她指出,女性會爲了薪酬和職業發展而犧牲靈活性。

However, the new “default” of hybrid working is evident in post-pandemic job ads, making conversations about flexibility much easier to start with a potential employer.

然而,在新冠疫情後的招聘廣告中,混合工作的新「默認」顯而易見,這讓人們更容易從潛在僱主那裏開始談論彈性工作。

“In future, the conversation’s not just going to be about flexible working — it’s about flexible careers,” Portas adds. As we live for longer, we’re going to come in and out of the workplace, and people in their 50s and 60s are going to need to reskill. So moving jobs might not just be about pay; it could be about accessing other opportunities.”

波爾塔斯補充道:「未來,人們談論的話題將不僅僅是彈性工作——而是彈性職業。隨著我們壽命的延長,我們將進入和離開工作場所,五六十歲的人將需要技能。因此,跳槽可能不僅僅是爲了收入;也可能是獲得其他機會。」

The steep rise in women’s state pension age means that income streams from Isas, property investments and private pensions will all be needed to manage the transition from work to retirement.

女性法定退休年齡的大幅提高,意味著來自Isas、房地產投資和私人養老金的收入來源,都將需要管理從工作到退休的過渡。

“Even if you do not work because you are taking care of your family, try to stay employable,” advises Lusardi. “Develop skills that are useful in the job market, have a side hustle, keep connected or develop a network that can help you find a job in future.”

「即使你因爲要照顧家庭而不工作,也要努力保持就業能力,」盧薩迪建議說。「發展在就業市場上有用的技能,有一個副業,保持聯繫或發展一個網路,可以幫助你在未來找到工作。」

More than anything, she urges women to be vocal about their money issues — whether that’s asking for help, sharing experiences or campaigning for change.

最重要的是,她敦促女性對自己的金錢問題直言不諱——無論是尋求幫助,分享經驗,還是發起改變運動。

“Women are not the minority, we are 50 per cent of the population,” says Lusardi. “We are a big group — we need to have a bigger voice, and to raise that voice to make sure change happens. We need International Women’s Day to remind men of all of these things.”

「婦女不是少數,我們占人口的50%,」盧薩迪說。「我們是一個大羣體,我們需要有更大的聲音,並提高這一聲音,以確保改變發生。我們需要國際婦女節來提醒男人們這一切。」

To read more about the FT’s Financial Literacy and Inclusion Campaign, click here

要想了解更多有關英國《金融時報》金融掃盲與包容運動的資訊,點擊這裏