尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

Something weird is happening in America.

GDP growth for Q3 was just revised up from an already scorching 4.9 per cent to 5.2 per cent, more Americans have

jobs than at any time in history, but the public is up in arms about

economic conditions, with consumer

confidence dropping to a six-month low. There really is no pleasing some people.

美國發生了一些奇怪的事情。第三季度的國內生產總值(GDP)成長率剛剛從已經很高的4.9%上調至5.2%,美國有史以來就業人數最多,但公衆對經濟狀況感到不滿,消費者信心降至六個月低點。有些人真的是無法滿足。

With headline indicators in such rude health, we would expect the number of Americans who think they’re better off than this time last year to outnumber those who say they’re worse off by about 25 percentage points. Instead, the reportedly worse-offs outnumber the better-offs by ten points in the

latest University of Michigan’s index of Current Economic Conditions.

鑑於這些主要指標的良好表現,我們預計,自認爲比去年同期更好的美國人的數量,將比認爲自己更糟糕的人多出大約25個百分點。然而,在

最新的密西根大學(University of Michigan)當前經濟狀況(Current Economic Conditions)指數中,據報道認爲自己更糟糕的人比認爲自己更好的人多出十個百分點。

I know what you’re thinking: inflation explains all of this. People

really hate rising prices, and are reminded of them every time they buy something. Inflation’s salience drowns out other more distant or intangible gains. It’s certainly a good theory, but countries all around the world have faced steep inflation. Many

steeper than the US. Presumably their consumers are also much more pessimistic than we would expect?

我知道你在想什麼:通貨膨脹可以解釋這一切。人們

真的討厭物價上漲,並且每次購買東西時都會被提醒。通貨膨脹的顯著性淹沒了其他更爲遙遠或抽象的收益。這當然是一個好的理論,但世界各地的國家都面臨著嚴重的通貨膨脹。許多國家的通貨膨脹

比美國還要嚴重。可以推測,他們的消費者也比我們預期的要悲觀得多嗎?

Well, no actually. Extending an original

analysis by X user Quantian1, I have calculated expected consumer sentiment for a set of countries based on their underlying economic indicators, and compared it to actual sentiment. Relative to the eve of the pandemic, US consumers now appear gloomier than the French, the Germans and even the British. The Europeans all feel about as confident as one might expect based on how their economies are performing. Disproportionate doom seems to be a new American affliction.

實際上並不是這樣。

在X用戶Quantian1的原始分析基礎上,我根據各國的基本經濟指標計算了預期的消費者情緒,並將其與實際情緒進行了比較。與疫情爆發前相比,美國消費者現在似乎比法國、德國人甚至英國人更爲悲觀。歐洲人的信心水準與他們的經濟表現相符。不成比例的悲觀情緒似乎是美國人的新困擾。

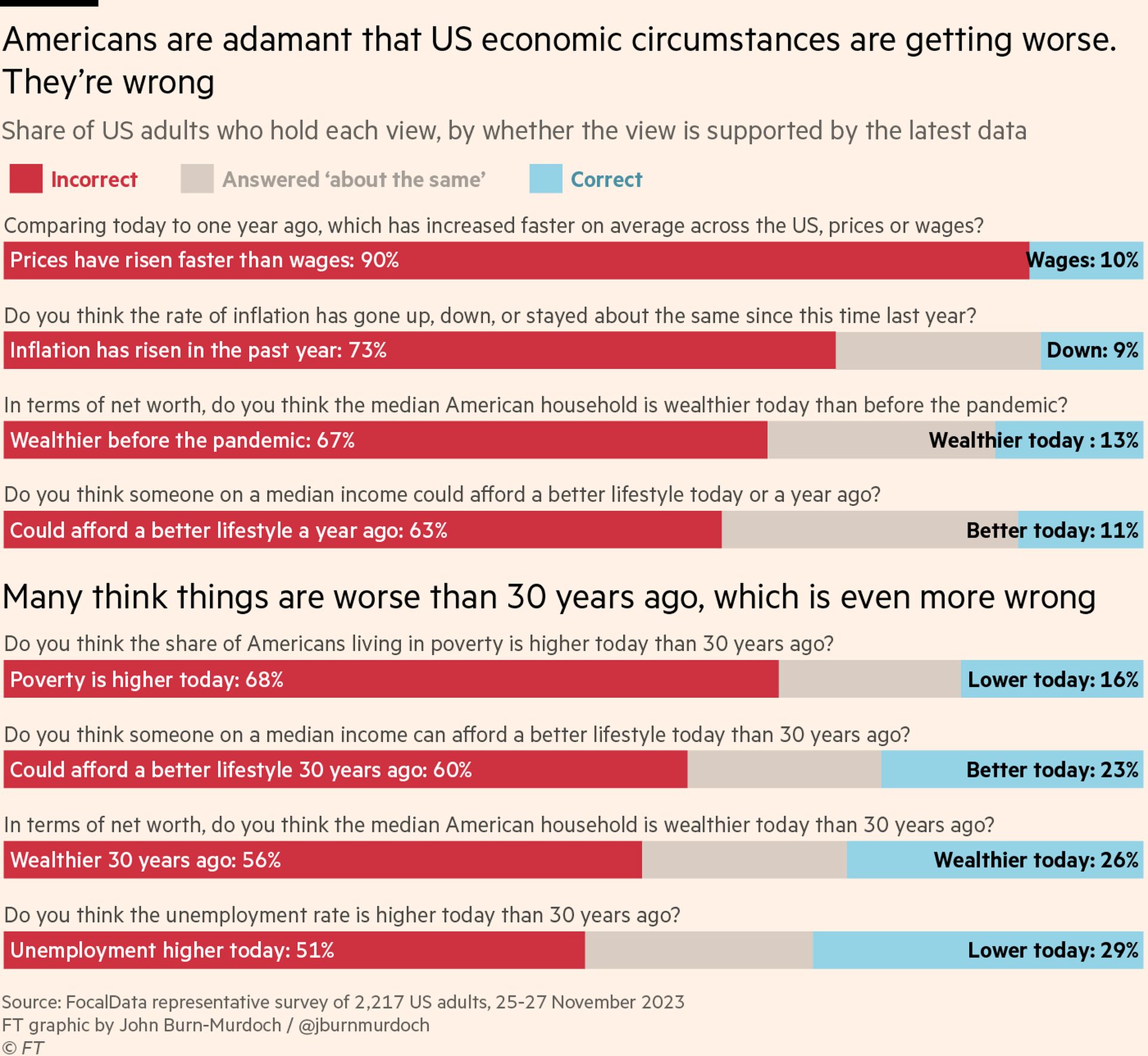

So what’s going on? Last weekend

FocalData ran a poll for me, asking a representative sample of 2,000 US adults whether they thought economic circumstances had improved or deteriorated over recent years. The results were startling: Americans are consistently wrong in the negative direction on almost every measure we polled. By huge margins, they believe inflation is still rising (

it’s falling), that it has outstripped wage growth (

wages have outpaced prices), and that they have become less wealthy (

they’ve become much wealthier).

那麼到底發生了什麼?上個週末,

FocalData爲我進行了一項調查,詢問了一組代表性的2000名美國成年人,他們認爲近年來的經濟狀況有所改善還是惡化。結果令人震驚:美國人在我們調查的幾乎每個指標上都持續錯誤地朝著負面方向。他們普遍認爲通貨膨脹仍在上升(實際上正在下降),通貨膨脹已超過工資成長,以及他們變得更加貧窮(實際上他們變得更加富有)。

Attempts to justify this sense of gloom often emphasise the challenges faced by less prosperous groups, but this also goes counter to the evidence. One explanation I heard is that the despondency comes from young people struggling with runaway rents. But

wages have risen faster for them than the old, outpacing rents. Plus young consumers are the most positive, per the Michigan survey.

試圖爲這種沮喪感找到理由的嘗試,通常強調較不富裕羣體面臨的挑戰,但這也與證據相悖。我聽到的一個解釋是,這種沮喪來自年輕人在應對飛漲的租金方面的困難。但是他們的

工資成長速度比老年人更快,超過了租金的成長速度。此外,根據密西根州的調查,年輕消費者是最積極的。

Similarly,

wages have risen faster for those on the lowest incomes,

reversing more than a third of the increase in wage inequality over the past four decades. Wealth has

risen for the least and most wealthy alike.

The most striking response from our survey concerned the sense of longer-term progress. Large majorities of Americans think the median income today pays for a worse lifestyle than 30 years ago (

demonstrably false), and that poverty is higher than it was a generation ago (

it has plummeted). One particularly revealing statistic is that Americans’ assessment of their own financial

situation has barely budged over the past five years

, but their

rating of the national economy has worsened steeply. It seems they have decided that the vibes are bad, so things must be going badly for most other people, even if not for themselves.

我們調查中最引人注目的反應涉及到長期進展的感覺。絕大多數美國人認爲,如今的中等收入無法維持比30年前更好的生活方式(

事實上是錯誤的),而貧困程度比一代人前更高(實際上已經大幅下降)。一個特別有啓示性的統計數據是,美國人對自己的財務狀況的評估在過去五年幾乎沒有變化,但他們對國家經濟的評級卻急劇惡化。似乎他們已經決定,氛圍不好,所以對大多數其他人來說情況肯定不好,即使對他們自己來說不是這樣。

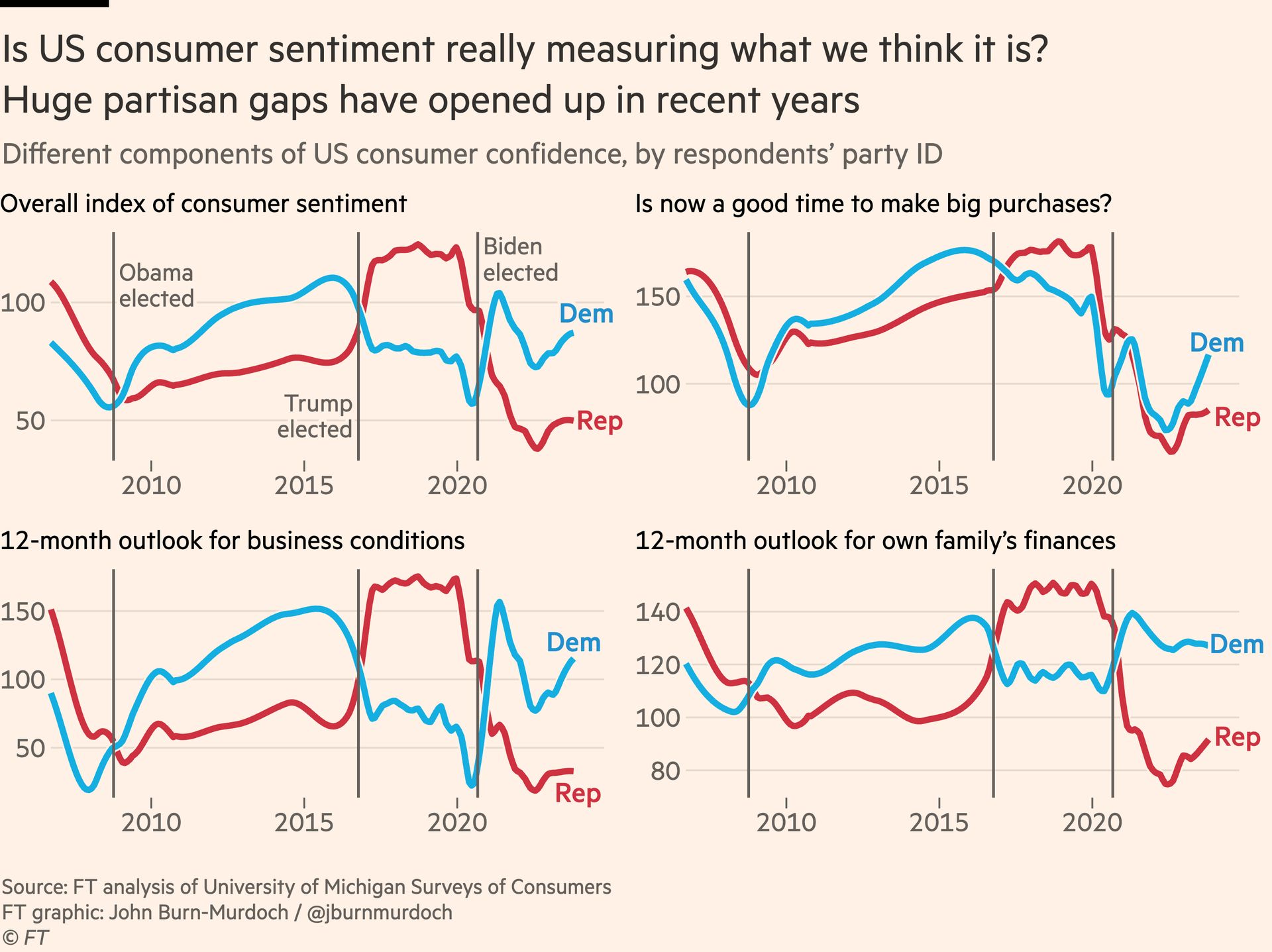

Political affiliation is also key to understanding how economic sentiments are separating from economic reality in the US. One question from the Michigan survey asks whether people think now is a good time to buy big household items. When the pandemic hit, Democrats and Republicans alike moved sharply towards “not a good time to buy”. But just months later, when Joe Biden won the presidential election — while Covid-19 still raged — Democrats suddenly declared conditions ripe for purchases of new fridge-freezers. Republicans did not.

政治派別對於理解美國經濟情緒與經濟現實的分離也是關鍵。密西根州的一項調查問卷中,有一個問題問人們是否認爲現在是購買大型家庭用品的好時機。當疫情爆發時,無論是民主黨還是共和黨,都明顯傾向於「不是購買的好時機」。但僅僅幾個月後,在新冠疫情仍然肆虐的情況下,當喬•拜登(Joe Biden)贏得總統選舉時,民主黨突然宣稱購買新冰箱冷櫃的條件成熟。而共和黨則沒有這樣做。

It seems US consumer sentiment is becoming the latest victim of

expressive responding, where people give incorrect answers to questions to signal wider tribal political or social affiliations. My advice: if you want to know what Americans really think of economic conditions, look at their spending patterns. Unlike cautious Europeans, US consumers are back on the pre-pandemic trendline and

buying more stuff than ever.

看起來,美國消費者情緒正在成爲表達回應的最新受害者,人們在回答問題時給出不正確的答案,以示更廣泛的政治或社會隸屬關係。我的建議是:如果你想知道美國人對經濟狀況的真實看法,看看他們的消費模式。與謹慎的歐洲人不同,美國消費者回到了疫情前的趨勢線,併購買了更多的東西。

Survey details and other methodology

Survey of Americans’ views on economic trends: Focaldata carried out an online survey of 2,217 US adults between 25 and 27 November 2023. Respondents were weighted to be representative of the US adult population.

Actual vs expected consumer confidence analysis: expected consumer confidence was estimated using a set of linear regression models which which established the statistical association between monthly consumer confidence and a range of economic indicators between 1988 and 2019 for each country. Those models were then used to predict what consumer confidence would have been for each month in each country since January 2020 had those same statistical relationships held true.

調查細節和其他方法論

美國人對經濟趨勢的觀點調查:Focaldata在2023年11月25日至27日對2217名美國成年人進行了在線調查。受訪者的權重經過調整,以代表美國成年人口。

實際與預期消費者信心分析:預期消費者信心是透過一組線性迴歸模型進行估計的,這些模型建立了1988年至2019年期間每個國家月度消費者信心與一系列經濟指標之間的統計關聯。然後,利用這些模型預測了自2020年1月以來每個國家每個月的消費者信心,假設這些統計關係仍然成立。