尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

Global banks and asset managers have extended a total of $119bn of financing to 20 major agribusinesses linked to deforestation in the five years since the Paris agreement was brought into force, according to an investigation by the Global Witness campaign group.

全球見證組織(Global Witness)的一項調查顯示,在《巴黎協定》生效後的5年裏,全球銀行和資產管理公司向20家與森林砍伐有關的大型農業企業提供了總計1190億美元的融資。

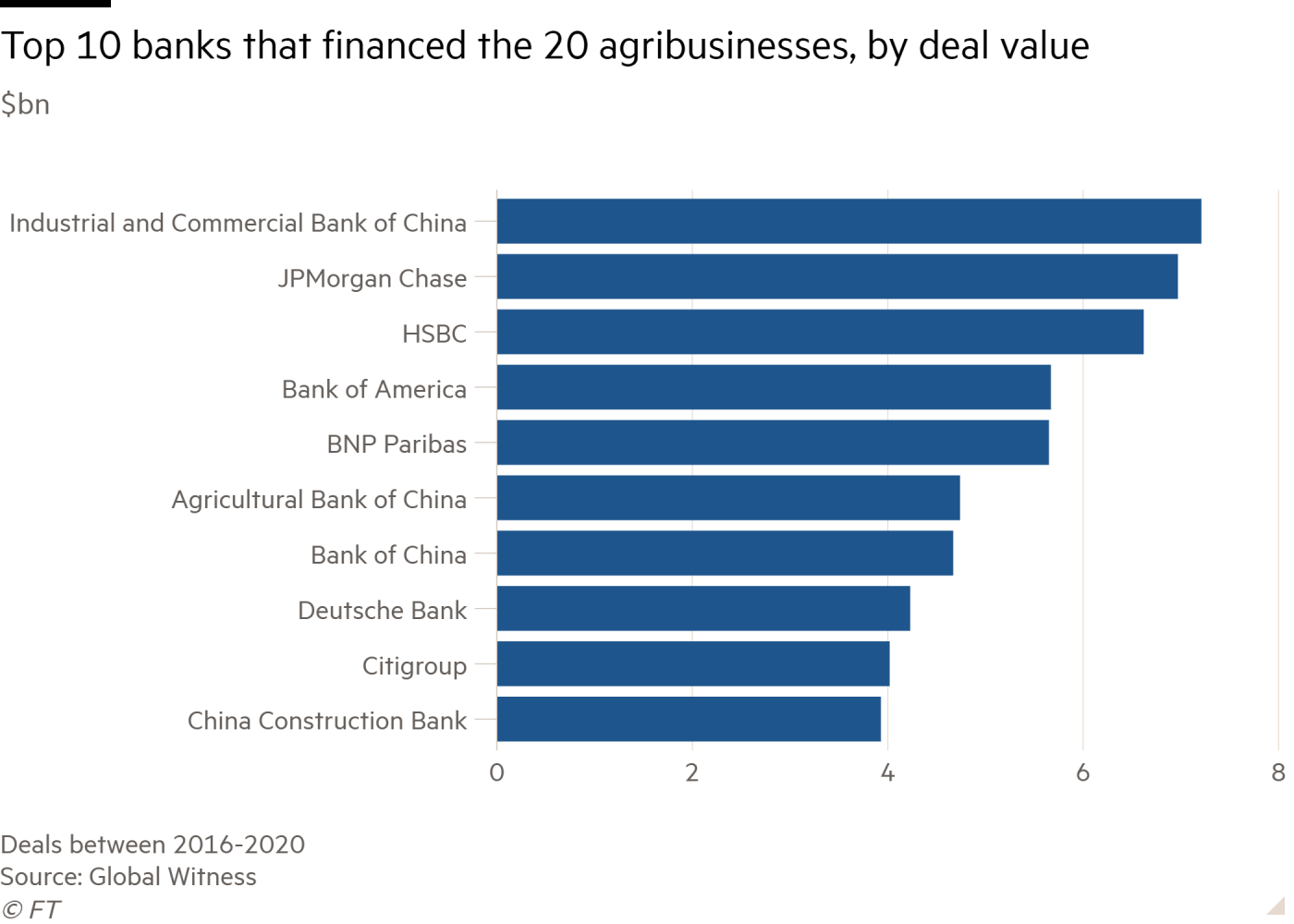

Leading global lenders JPMorgan, HSBC and Bank of America were among the biggest funders of the companies, which included Brazilian meat producer JBS, each striking dozens of funding deals between 2016 and 2020, the research found.

研究發現,全球領先的銀行摩根大通(JPMorgan)、滙豐(HSBC)和美國銀行(Bank of America)都是這些公司的最大資助者,其中包括巴西肉類生產商JBS,每家銀行都在2016年至2020年期間各達成了數十筆融資交易。

Deals included almost $730m-worth of financing for Olam International, one of the world’s largest food ingredient suppliers, and its subsidiaries from JPMorgan via revolving credit facilities, the data showed. Olam International is under investigation by the Forest Stewardship Council for allegedly destroying rainforest in Gabon.

數據顯示,這些交易包括透過循環信貸安排,爲全球最大食品配料供應商之一Olam International及其子公司從摩根大通獲得價值近7.3億美元的融資。因涉嫌破壞加彭的雨林,Olam International正在接受Forest Stewardship Council的調查。

Deforestation is a major source of carbon emissions, and tackling the issue is expected to be among the topics under discussion by global negotiators at the upcoming COP26 UN climate summit in the UK.

森林砍伐是碳排放的主要來源,解決這一問題預計將是即將在英國舉行的COP26聯合國氣候峯會上全球談判代表討論的議題之一。

Despite the growing interest among companies in planting carbon-absorbing trees, tackling deforestation in supply chains remains a less of a mainstream issue for many investors than other environmental concerns such as measuring direct corporate emissions.

儘管企業對種植可吸收碳的樹木的興趣日益濃厚,但對許多投資者來說,解決供應鏈中的森林砍伐問題仍然不如衡量企業直接排放等其他環境問題那樣成爲一個主流問題。

Data on more than 5,000 deals, shared with the FT, indicate that the top five banks by total deal value — which included BNP Paribas and the Industrial and Commercial Bank of China (ICBC) — struck almost 570 bond, credit, and underwriting deals with 20 agribusinesses over the period, worth a combined $32bn.

與英國《金融時報》分享的5000多筆交易的數據顯示,按交易總額計算的前五大銀行——包括法國巴黎銀行(BNP Paribas)和中國工商銀行(ICBC)——在這一時期與20家農業企業達成了近570筆債券、信貸和承銷交易,總價值達320億美元。

All five institutions except the ICBC have “no-deforestation” policies. All 20 agribusinesses have been publicly linked to deforestation, and were listed in a database of companies active in forest-risk sectors, such as soy palm and beef, assembled by the global coalition of campaign and research organisations under the Forests & Finance umbrella group.

除中國工商銀行外,所有五個機構都有「不砍伐森林」政策。所有20家農業綜合企業都與毀林有公開聯繫,並被列入一個在森林風險行業(如大豆、棕櫚和牛肉)活躍公司資料庫。由全球多家從事研究和倡導的組織發起的聯盟「森林與金融」(Forests & Finance)成立了這一資料庫。

“Despite the fact that many of these banks have voluntary commitments on deforestation and on climate change, they’re continuing to have relationships with companies that are linked to deforestation,” said Colin Robertson, senior forests investigator at Global Witness.

全球見證組織的高級森林調查員科林·羅伯遜說:「儘管許多銀行在森林砍伐和氣候變化方面都有自願承諾,但它們仍在繼續與那些與森林砍伐有關的公司保持關係。」

“The overarching problem is there is a lack of [legal] obligation on banks” to change practices, he added.

他補充稱:「最主要的問題是,銀行缺乏(法律)義務」來改變做法。

As the largest, China’s ICBC arranged financing for eight of the 20 companies, the data show. That included providing about $1.1bn worth of loans and revolving credit facilities to commodities trader Cofco International, which has been at the centre of allegations by advocacy group Mighty Earth that suppliers linked to Cofco had cleared more than 20,000 hectares of forest in Brazil between 2019 and 2021.

數據顯示,作爲最大銀行的中國工商銀行爲20家公司中的8家安排了融資。其中包括向大宗商品交易商中糧國際(Cofco International)提供價值約11億美元的貸款和循環信貸安排。倡導組織Mighty Earth指控與中糧有關聯的供應商在2019年至2021年期間砍伐了巴西逾2萬公頃森林,中糧國際一直處於這些指控的中心。

Cofco said that no illegal deforestation occurred on farms it sourced from during that time.

中糧表示,在此期間,其採購產品的農場沒有發生非法砍伐森林的情況。

JPMorgan, the second-largest financier, underwrote three bonds between 2018 and 2019 for commodities trader Cargill, which has been accused of sourcing soy grown in deforested areas.

第二大金融機構摩根大通在2018年至2019年期間爲大宗商品交易商嘉吉(Cargill)承銷了三筆債券。嘉吉一直被指採購毀林地區種植的大豆。

Last year, the salmon producer Grieg Seafood identified Cargill over its “soy-related deforestation risk in Brazil”. JPMorgan declined to comment.

去年,三文魚生產商Grieg Seafood就嘉吉「在巴西與大豆相關的毀林風險」對其施壓。摩根大通拒絕置評。

Cargill said it did not supply soy from farmers who cleared land illegally or in protected areas, and suspended suppliers that were found to be deforesting protected areas.

嘉吉公司表示,它不向非法開墾土地或在保護區內的農民供應大豆,並暫停了被發現在保護區內砍伐森林的供應商的資格。

Barclays and Santander, meanwhile, each underwrote three bonds between 2018 and 2019 for JBS, the meat producer that has faced scrutiny from activists and investors for links to destruction in the Amazon rainforest.

與此同時,巴克萊銀行(Barclays)和桑坦德銀行(Santander)在2018年至2019年期間分別爲JBS承銷了3隻債券。這家肉類生產商因與亞馬遜雨林的破壞有關聯而面臨社運人士和投資者的審查。

JBS said the company had a “zero-tolerance” policy for deforestation, and had stopped working with suppliers that breached it.

JBS表示,該公司對毀林採取「零容忍」政策,並已停止與違反這一政策的供應商合作。

Santander said the bank was “committed to protecting the Amazon” and expected its beef processing clients in the region to have a “fully traceable supply chain that is deforestation-free” by 2025.

桑坦德銀行表示,該行「致力於保護亞馬遜地區」,並預計到2025年,其在該地區的牛肉加工客戶將擁有一個「完全可追溯的、不砍伐森林的供應鏈」。

Although many banks and investment groups have “no-deforestation” policies, they can be limited in their scope. For example, they may define deforestation as the destruction of certain tropical or rare forests, rather than of any woodland. The ban may also not extend to legal deforestation.

儘管許多銀行和投資集團都有「不砍伐森林」的政策,但這些政策的範圍可能是有限的。例如,它們可能將毀林定義爲對某些熱帶或稀有森林的破壞,而不是對任何林地的破壞。禁令可能也不會延伸到合法的森林砍伐。

Policies can also be difficult to enforce and monitor. Banks may ask clients to ensure their suppliers are not involved in the destruction of forests, but many large food companies say they cannot account for the behaviour of every supplier.

這些也很難執行和監督。銀行可能會要求客戶確保他們的供應商沒有參與毀林,但許多大型食品公司表示,他們無法對每一家供應商的行爲負責。

Global Witness said the 20 agribusiness’s “problematic track records should have raised major red flags for bank compliance teams”.

全球見證組織表示,這20家農業企業的「有問題的記錄本應該引起銀行合規團隊的高度警惕」。

Although lawmakers in the EU, UK and US have proposed regulations designed to eliminate deforestation from businesses’ supply chains, none would extend the additional due diligence requirements to financial institutions.

儘管歐盟、英國和美國的立法者已經提議制定旨在消除企業供應鏈中毀林行爲的發揮,但他們都沒將額外的盡職調查要求擴展至覆蓋金融機構。

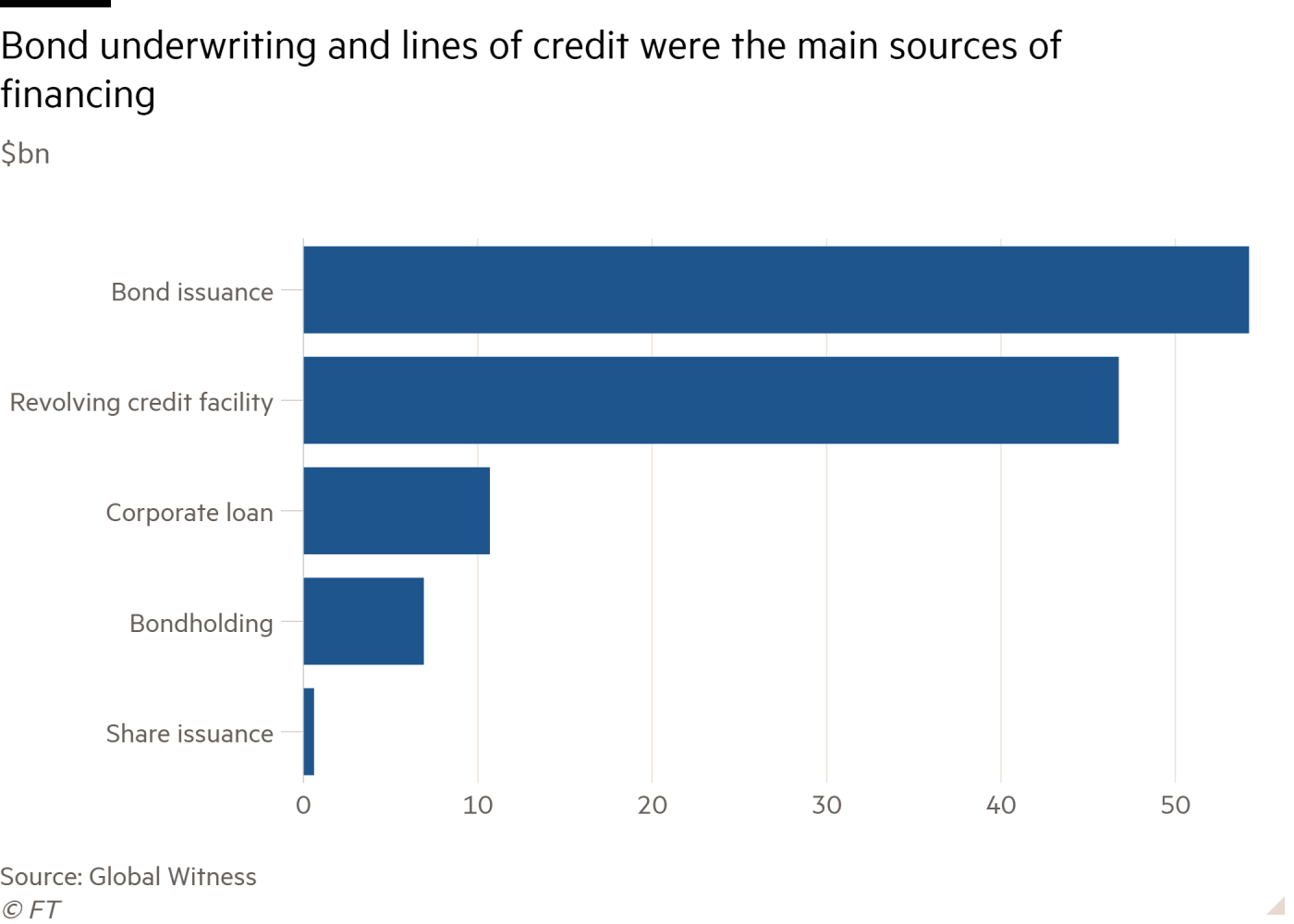

The Global Witness research involved analysis of bond and share issue underwriting agreements, as well as bond holdings and lines of credit from lenders headquartered in the UK, EU, US, and China. Bond issuances were the biggest source of funds, followed by revolving credit facilities and corporate loans. The year that Paris accord on global warming came into force, 2016, was the busiest dealmaking year by value, followed by 2019.

全球見證的研究包括分析債券和股票發行承銷協議,以及總部位於英國、歐盟、美國和中國的銀行的債券持有量和信貸額度。債券發行是最大的資金來源,其次是循環信貸安排和企業貸款。按價值計算,應對全球變暖的巴黎協定生效的2016年是最繁忙的交易年,其次是2019年。

In addition to direct financing, the 1,500 banks and asset managers tracked in the database held about $37.5bn worth of shares in the 20 agribusinesses, as of the fourth quarter of 2020, the data showed.

數據顯示,除直接融資外,截至2020年第四季度,資料庫中追蹤的1500家銀行和資產管理公司持有20家農業企業價值約375億美元的股份。

HSBC said the bank “has exited, is in the process of exiting or has no banking relationship related to forestry, palm oil or cattle with the majority of entities named in the report”.

滙豐銀行表示,該銀行「已經退出、正在退出或與報告中提到的大多數實體沒有與林業、棕櫚油或畜牧業有關的銀行業務關係」。

BNP said the list collated by Forests & Finance “does not identify actual deforestation practices but rather ranks all companies whose activities may be considered ‘at risk’ for forests”. Ceasing to fund companies in risky sectors “would have no positive impact on their practices, as they would continue to be able to rely on a number of other lenders”, it added.

法國巴黎銀行表示,森林與金融公司整理的這份名單「並沒有確定實際的森林砍伐行爲,而是對所有活動可能被認爲對森林『有風險』的公司進行了排名」。該機構補充稱,停止爲高風險行業的公司提供資金「不會對它們的做法產生積極影響,因爲它們將繼續能夠依賴其他一些銀行」。

Barclays, Bank of America and Olam declined to comment. ICBC did not respond to a request for comment.

巴克萊、美國銀行和Olam均拒絕置評。工行沒有回應記者的置評請求。

Follow @ftclimate on Instagram

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here