尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

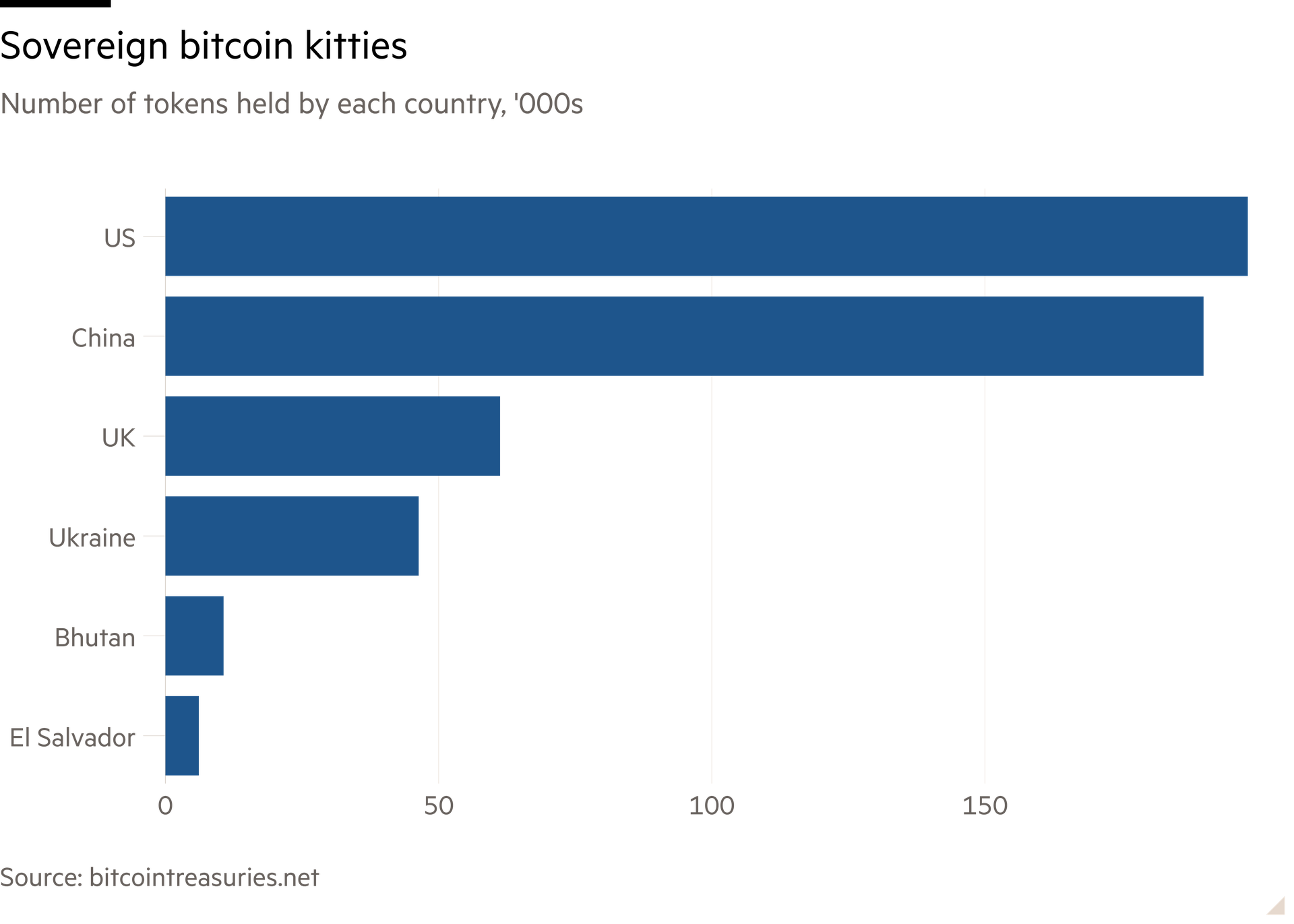

Donald Trump may have called for a strategic bitcoin reserve — but while the US president grabs headlines, other sovereigns are quietly amassing their own kitties. Bhutan, a tiny kingdom so esoteric it measures happiness the way more humdrum counties measure economic output, holds the fifth biggest national bitcoin stash.

唐納•川普(Donald Trump)可能呼籲建立戰略比特幣儲備——但在這位美國總統佔據頭條時,其他國家正在悄悄積累自己的儲備。不丹,這個以衡量幸福而聞名的小王國,擁有全球第五大國家比特幣儲備。

Countries come by their tokens in different ways. Crime kick-started Washington’s booty. US federal law enforcement seized bitcoin when taking down the Silk Road online marketplace — assets in this case being the bitcoin buyers used to purchase drugs, arms and other contraband on the dark web. Forfeits from crime also explain the UK’s 61,000-odd bitcoin, as of the end of December.

各國透過不同的方式獲得他們的代幣。犯罪活動是華盛頓獲得戰利品的開端。美國聯邦執法部門在取締絲綢之路在線市場時查獲了比特幣——在這種情況下,資產是買家用來在暗網上購買毒品、武器和其他違禁品的比特幣。犯罪所得的沒收物也解釋了截至12月底英國擁有的大約61,000個比特幣。

Bhutan’s haul derives from a more wholesome source. The Himalayan kingdom mines its own coins, harnessing rivers to power the computers. There is a nice circularity to this. Exporting hydropower would be expensive and inevitably require new infrastructure, not all of which would necessarily be aesthetically pleasing. So instead Bhutan monetises the energy — turning gigawatts into money — by mining bitcoin at home. That’s helpful for a country with few wealth-generating levers at its disposal; it imports nearly everything and manufacturing is a non-starter.

不丹的收益來自一個更健康的來源。這個喜馬拉雅王國透過開採自己的加密貨幣,利用河流爲電腦供電。這形成了一個良性循環。出口水電成本高昂,並且不可避免地需要新的基礎設施,而這些基礎設施未必都美觀。因此,不丹選擇在國內開採比特幣,將能源貨幣化——把千兆瓦轉化爲金錢。對於一個可供利用的財富生成手段很少的國家來說,這非常有幫助;不丹幾乎所有東西都依賴進口,製造業幾乎沒有起步。

Britain’s holding is around five times the size of Bhutan’s, but much smaller relative to the economy. Even at bitcoin’s peak it wouldn’t cover a fortnight’s funding for the health service.

英國的持有量大約是不丹的五倍,但相對於經濟規模來說要小得多。即使在比特幣的高峯期,這些持有量也不足以支付醫療服務兩週的資金。

Sovereigns talk up the inflationary hedge aspect of this “digital gold”. Like gold, its scarcity value theoretically protects it from inflationary pressures — although in practice bitcoin has proved too volatile to make the case.

主權國家強調這種「數字黃金」的抗通膨對沖功能。像黃金一樣,其稀缺性理論上可以保護它免受通膨壓力的影響——儘管實際上,比特幣的波動性過大,難以證明這一點。

But there are obvious risks to states holding chunks of a highly volatile asset backed by nothing more than lines of code. Current kitty sizes may not be enough to raise hackles, but recent months have highlighted yet again just how wild this ride can be. The Trump bump pushed bitcoin past $105,000 in January but, like other assets, it has since lost ground and now sits at just over $83,000.

但是,州政府持有由僅僅是代碼行支援的高度波動資產的部分存在明顯風險。目前的資金規模可能不足以引起警覺,但最近幾個月再次突顯了這種投資的波動性。川普效應在1月份將比特幣推高至10.5萬美元,但與其他資產一樣,它此後失去了部分價值,目前僅爲8.3萬美元。

Buyers in the wake of the coin’s Trump bump include Saudi Arabia, traders reckon. El Salvador, undeterred by the strings attached to a pending IMF bailout, continued to buy bitcoin last month.

交易者認爲,受川普效應影響的買家包括沙烏地阿拉伯。儘管即將到來的國際貨幣基金組織(IMF)救助附帶條件,薩爾瓦多(El Salvador)上個月仍繼續購買比特幣。

China may, or may not, have a kitty not far short of Washington’s. To a country keen to diversify away from the dollar and comfortable stockpiling everything from pork to critical minerals, a strategic bitcoin reserve might not seem outlandish. True, the token is banned in the People’s Republic, but exceptions can always be made.

中國可能擁有或可能沒有一個與華盛頓相差無幾的儲備。對於一個熱衷於擺脫美元並樂於囤積從豬肉到關鍵礦產的國家來說,建立戰略比特幣儲備可能並不顯得荒謬。誠然,這種代幣在人民共和國是被禁止的,但總是可以有例外。

Sovereign bitcoin reserves are a relatively small phenomenon but they are probably here to stay. One reason is that old-school currency reserves are also becoming riskier. See, for instance, speculation that the US might pursue a so-called Mar-a-Lago accord to weaken the dollar. Should a new monetary system come about, that might just create a space for an alternative like bitcoin.

主權比特幣儲備相對來說是一個較小的現象,但它們可能會長期存在。一個原因是傳統的貨幣儲備也變得更加風險。比如,有人猜測美國可能會採取所謂的「海湖莊園協議」來削弱美元。如果出現新的貨幣體系,這可能會爲比特幣這樣的替代品創造空間。

虛擬貨幣相關活動存在較大法律風險。請根據監管規範,注意甄別和遠離非法金融活動,謹防個人財產和權益受損。