尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

Last week, before the global market meltdown, three dozen luminaries of American finance gathered for a summer lunch, where they conducted informal polls about the outlook. The results were pretty dull.

上週,在全球市場崩盤之前,三十多位美國金融的知名人士齊聚一堂,共進夏日午餐,並對市場前景進行了非正式調查。結果相當沉悶。

The majority at the table voted for a so-called “soft landing” for the US economy, with rates of 3-3.5 per cent in a year’s time, and a swing of 10 per cent, or less, for stock prices (evenly split between up and down).

與會的大多數人投票支援美國經濟實現所謂的「軟著陸」,即在一年內將利率維持在3%至3.5%的水準,並且股票價格波動在10%或更低(漲跌各半)。

The only notable, truly spicy detail was that these luminaries now view the US election race as a toss-up — while three weeks earlier there was near-unanimity at another lunch that Donald Trump would win. No one projected an imminent market crash.

唯一值得注意的、真正辛辣的細節是,這些知名人士現在認爲美國大選是一場膠著局面——而在三週前的另一場午餐會上,他們幾乎一致認爲唐納•川普(Donald Trump)會贏。沒有人預測到即將發生的市場崩盤。

There are two lessons here. The first is that not even ultra-well-paid financiers — be they hedgies, private equity players or bankers — can really forecast the precise moments of market meltdowns. Yes, fundamental strains and cracks can be identified. But judging when these will cause a market earthquake is as hard as real geology; humility is required. And doubly so given that the rise of algorithmic trading is creating dramatically more price volatility and feedback loops.

這裏有兩個教訓。第一個是,即使是薪酬極高的金融家,無論是對沖基金經理、私募股權投資者還是銀行家,也無法準確預測市場崩盤的確切時刻。是的,可以識別出基本的壓力和裂縫。但是判斷這些壓力何時會引發市場地震就像真正的地質學一樣困難;這需要謙卑。尤其是考慮到演算法交易的崛起正在創造更多的價格波動和反饋循環。

Second, this week’s market rout was driven not so much by panic around the “real” economy as by financial dynamics. Or, as Bridgewater wrote in a client letter: “We view the widespread deleveraging firmly as a market event and not an economic one,” since “periods of structurally low volatility have always been fertile ground for the accumulation of outsize positioning” — and eventually they unwind.

其次,本週的市場暴跌並非主要由於對「實際」經濟的恐慌,而是由金融動態所驅動。或者,正如橋水基金(Bridgewater)在一封給客戶的信中所寫道:「我們將廣泛的去槓桿化視爲市場事件而非經濟事件」,因爲「結構性低波動時期一直是積累超額倉位的肥沃土壤」,最終它們會解除。

Or, to put it another way, these events can be viewed as (yet another) aftershock from the unwinding of that extraordinary monetary policy experiment known as quantitative easing and zero interest rates. For while investors have normalised cheap money in recent years — and to such a degree that they barely notice the distortions this has caused — they are now belatedly realising how odd it was. In that sense, then, the dramas have been thoroughly beneficial — even if electronic trading has made that lesson more dramatic than it might have been.

或者換個說法,這些事件可以被視爲(又一次量化寬鬆和零利率這一非同尋常貨幣政策實驗逐漸解除所引發的餘震。因爲投資者在近年來已經習慣了廉價資金,以至於他們幾乎沒有注意到這種情況所帶來的扭曲,而現在他們才遲遲意識到這是多麼奇怪。從這個意義上說,這些戲劇性事件是非常有益的,儘管電子交易使得這個教訓比原本可能更加戲劇化。

The immediate display of this is the yen carry trade — the practice of borrowing short in cheap yen to buy higher-yielding assets such as US tech stocks. Cheap yen loans have fuelled global finance ever since the Bank of Japan embarked on QE in the late 1990s, albeit to a degree that has fluctuated, depending on US and European rates.

這種現象的直接體現就是日元套息交易——即借入廉價的日元來購買美國科技股等高收益資產。自從日本央行在上世紀90年代末開始實施量化寬鬆政策以來,廉價的日元貸款一直推動著全球金融,儘管程度有所波動,取決於美國和歐洲的利率。

But the carry trade appears to have exploded after late 2021, when the US moved away from QE and zero rates. Then, when the BoJ (finally) also started to tighten earlier this year, the rationale waned.

但是隨著美國在2021年末放棄量化寬鬆政策和零利率後,套息交易似乎爆發了。然後,當日本央行(終於)在今年年初開始收緊政策時,這種理由逐漸減弱。

It is impossible to know the scale of this shift. The Bank for International Settlements reports that cross-border yen borrowing rose $742bn since late 2021 and banks such as UBS estimate there was around $500bn in outstanding cumulative carry trades earlier this year. UBS and JPMorgan also think that about half of these have been unwound.

很難確定這種轉變的規模。國際清算銀行(Bank for International Settlements)報告稱,自2021年底以來,跨境日元借款增加了7420億美元,瑞銀(UBS)等銀行估計今年年初累計的套息交易約爲5000億美元。瑞銀和摩根大通還認爲其中約有一半已經解除。

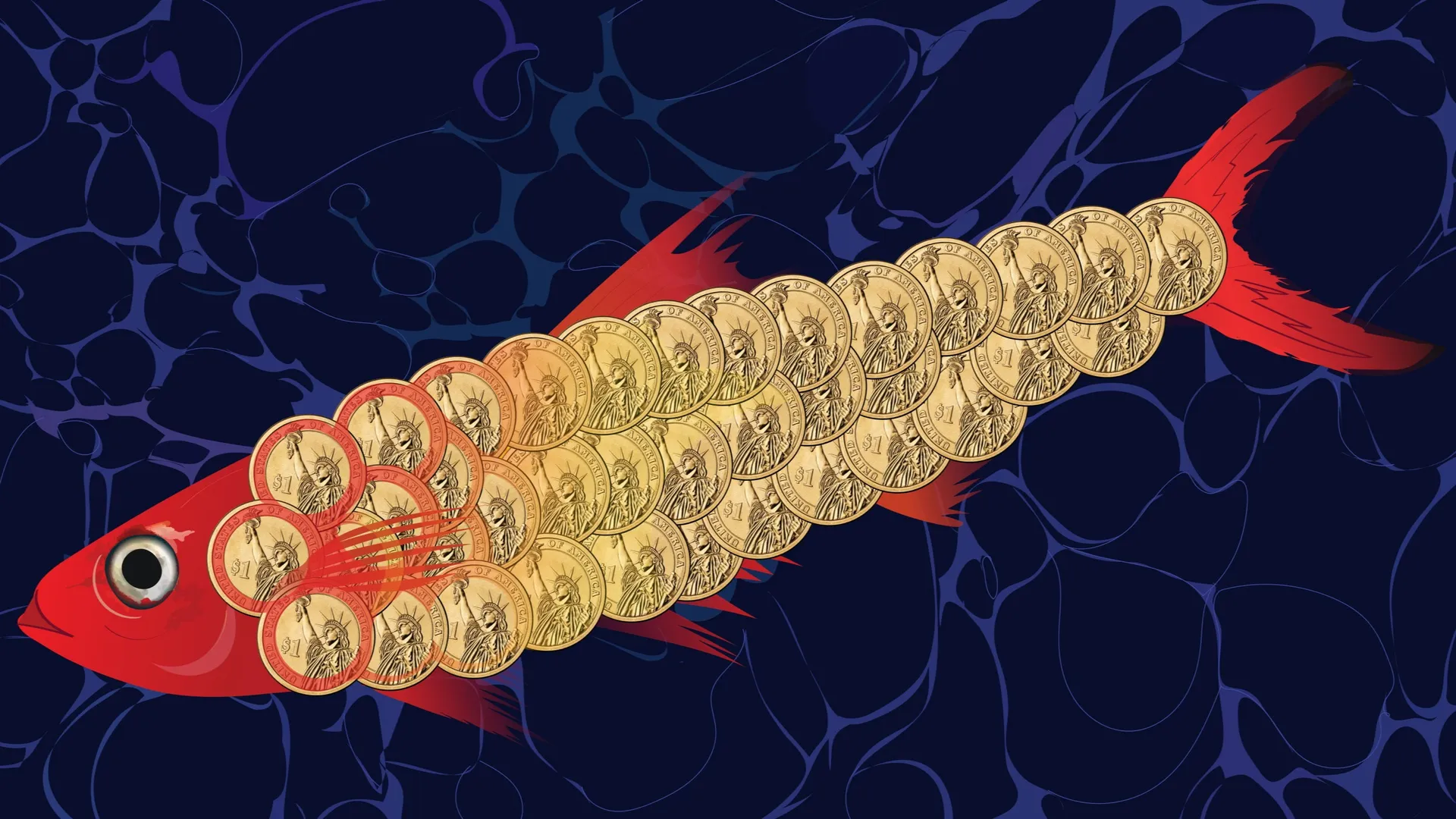

But analysts disagree on how far these trades pumped up US tech stocks, and thus account for recent declines. JPMorgan and UBS think it did contribute; Charlie McElligott, a Nomura strategist, considers the carry trade to be a “red herring”; he and other observers think concerns around overhyped US tech caused yen funding to be cut — not the other way round. Either way, the key point is that insofar as free(ish) money was fuelling asset inflation in America and Japan, this is coming to an end.

但對於這些交易在多大程度上推動了美國科技股的上漲,從而解釋了近期的下跌,分析師們意見不一。摩根大通和瑞銀認爲這確實起到了作用;野村(Nomura)策略師查理•麥克埃利戈特(Charlie McElligott)認爲套息交易是「障眼法」;他和其他觀察家認爲,對過度炒作美國科技股的擔憂導致了日元資金的削減,而不是相反。無論如何,關鍵的一點是,自由(等同)貨幣助長了美國和日本的資產膨脹,但這種情況即將結束。

Unsurprisingly, this leaves some investors hunting for other long-ignored QE distortions that could also unwind. This week FT readers asked me if there will be another shock when the BoJ or Swiss National Bank wind down the equity portfolios they acquired in recent years (the former owns an estimated 7 per cent of Japanese stocks; the SNB has big exposures to US tech names such as Microsoft and Meta).

毫不奇怪,這使得一些投資者開始尋找其他長期被忽視的量化寬鬆扭曲,這些扭曲也可能逆轉。本週FT的讀者問我,當日本央行或瑞士國家銀行(SNB)減持他們近年來收購的股票組合時(前者擁有日本股票約7%的估計份額;瑞士國家銀行在美國科技公司如微軟和Meta上有較大的敞口),是否會再次發生衝擊。

My answer is “not now”. Although these holdings look odd by historical standards, the BoJ insists it will not sell soon. But what is most interesting is that non-Japanese investors are waking up to this issue, after ignoring — that is to say, normalising — it for years.

我的回答是「現在不會」。雖然從歷史標準來看,這些持股看起來很奇怪,但日本央行堅持不會很快出售。但最有趣的是,非日本投資者在多年忽視這個問題——也就是將其視爲常態——之後,正在覺醒。

So, too, for US Treasuries. Many investors assume that demand for these will always be strong, irrespective of America’s deteriorating fiscal situation and electoral policy uncertainty, because the dollar is the reserve currency. Maybe so.

同樣,美國國債也是如此。許多投資者認爲,無論美國的財政狀況如何惡化,選舉政策如何不確定,對這些國債的需求將始終強勁,因爲美元是儲備貨幣。也許是這樣。

But this confidence — or complacency — has been reinforced by the Federal Reserve acting as a buyer of last resort for bonds during QE. As traders try to imagine a world where this changes, some tell me they are getting nervous. No wonder an auction for $42bn of 10-year bonds this week produced an unexpectedly weak result.

但這種信心——或自滿——是由美聯準在量化寬鬆期間充當債券的最後買家而得到加強的。當交易員們試圖想像這種情況發生變化的世界時,有些人告訴我他們感到緊張。難怪本週420億美元的10年期債券拍賣結果出人意料地疲軟。

A cynic might retort that all this mental readjustment may yet turn out to be unnecessary: if markets truly swoon, central banks will be pressured into propping up them up — yet again. Thus on Wednesday, the BoJ deputy governor pledged to “maintain current levels of monetary easing”, contradicting hints from the BoJ governor last week that more rises loom.

憤世嫉俗的人可能會反駁說,所有這些心理調整可能最終是不必要的:如果市場真的崩潰,央行將再次面臨支撐市場的壓力。因此,週三,日本央行副行長承諾「維持當前的貨幣寬鬆水準」,這與上週日本央行行長的暗示相矛盾。

But the key point is this: bountiful free money is not a “normal” state of affairs, and the sooner investors realise this the better — whether they are mom’n’pop savers, private equity luminaries, hedge funders or those central bankers.

但關鍵是:豐厚的免費資金並不是一種「正常」的狀態,投資者越早意識到這一點越好,無論他們是普通的儲蓄者、私募股權明星、對沖基金經理還是央行官員。