尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

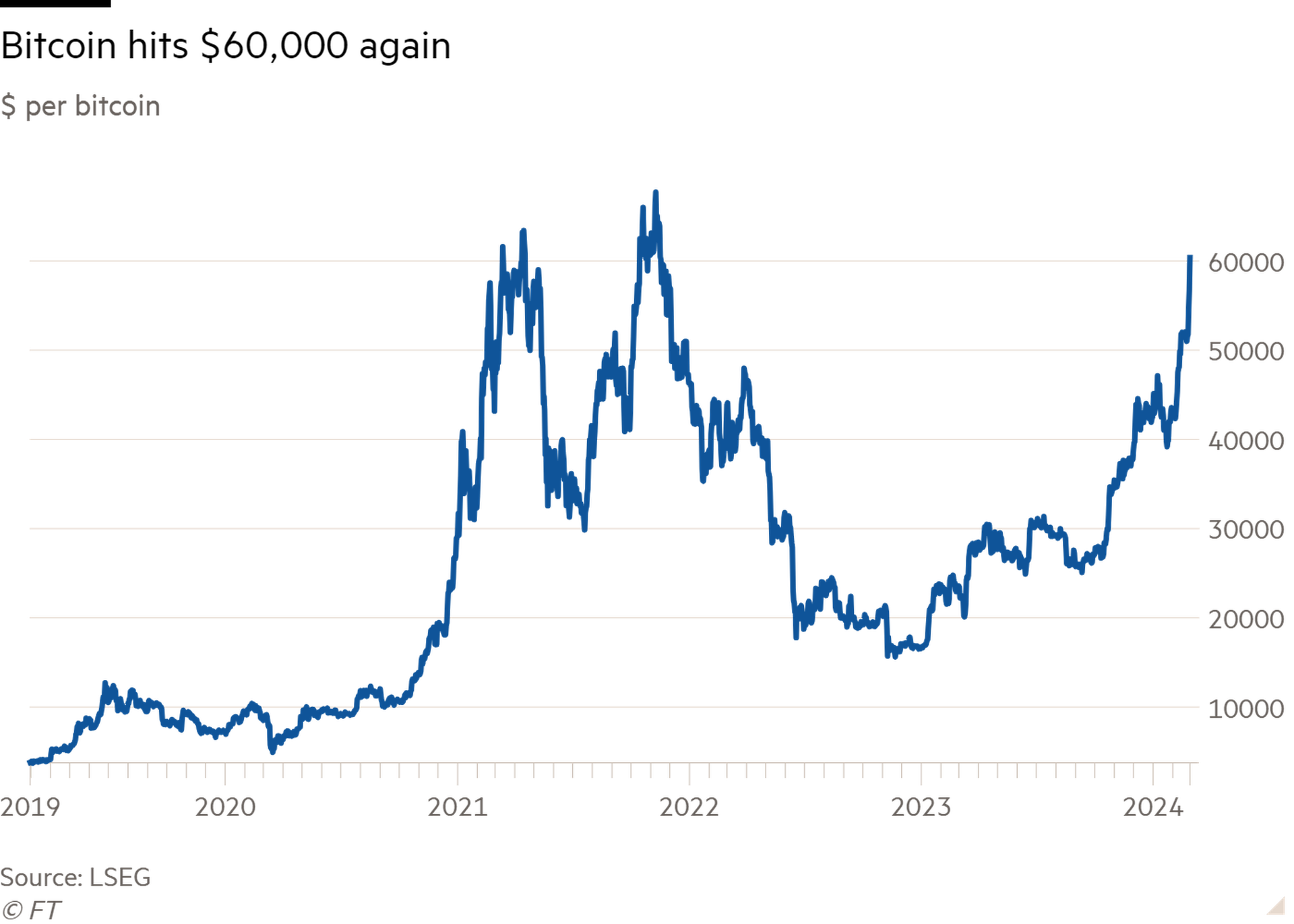

The price of bitcoin has climbed above $60,000 for the first time in more than two years, as a lightning rally puts the world’s biggest cryptocurrency within touching distance of its all-time high.

比特幣的價格兩年多來首次突破6萬美元,閃電般的上漲令這個全球最大的加密貨幣距離其歷史最高點僅一步之遙。

Bitcoin rose as much as 12.6 per cent to hit $63,968 on Wednesday, before falling back to about $60,000. The rally has brought its gains to 42 per cent in the first two months of this year.

週三,比特幣一度上漲12.6%,至63968美元,隨後回落至6萬美元左右。今年頭兩個月的漲幅已達42%。

The rapid ascent has revived memories of the crypto bull market that pushed the token to its record peak of nearly $69,000 in November 2021, as investors pile in amid “fear of missing out” on further price rises.

這一快速上漲喚起了人們對加密貨幣牛市的記憶。2021年11月,加密貨幣牛市將該代幣推至近6.9萬美元的創紀錄峯值,投資者因爲 「擔心錯過」(FOMO)進一步上漲而紛紛加入。

“This is insane,” said Timo Lehes, co-founder of blockchain company Swarm, adding that he expected more money to flow into the token.

「這太瘋狂了,」區塊鏈公司Swarm的聯合創辦人蒂莫•萊赫斯(Timo Lehes)說,並補充說,他預計會有更多的資金流入這種代幣。

“When people see these kinds of increases in a short period of time . . . then it just draws in people and Fomo does kick in,” he said.

「如果人們在短時間內看到這種成長……然後它就會吸引人們,Fomo就會開始發揮作用,」他說。

In January, US regulators approved the launch of spot bitcoin exchange traded funds by mainstream asset managers including BlackRock and Invesco, paving the way for an influx of new cash from investors looking to speculate on the cryptocurrency through a regulated vehicle. The 11 funds now hold 303,000 bitcoins, according to K33 Research, worth $18bn and equivalent to about 1.5 per cent of the total bitcoin supply.

今年1月,美國監管機構批准了貝萊德(BlackRock)和景順(Invesco)等主流資產管理公司推出現貨比特幣交易所交易基金(ETF),爲希望透過受監管工具投機比特幣的投資者湧入新資金鋪平了道路。K33 Research的數據顯示,這11隻基金目前持有30.3萬枚比特幣,價值180億美元,相當於比特幣總供應量的1.5%左右。

“We could see the all-time high being broken any day now,” said Simon Peters, an analyst at trading firm eToro. “The driving force behind it is without a doubt the [bitcoin funds].”

「我們現在隨時都可能看到歷史高點被打破。」交易公司eToro的分析師西蒙•彼得斯(Simon Peters)表示,「毫無疑問,背後的推動力是(比特幣基金)。」

The surge in bitcoin price comes amid a wider rally in traditional financial markets. Chipmaker Nvidia’s blockbuster results have fed an investor frenzy over the potential of artificial intelligence technology, helping push US and European stocks to all-time highs in the past week.

在比特幣價格飆升之際,傳統金融市場出現了更廣泛的反彈。晶片製造商輝達(Nvidia)的驚人業績,引發了投資者對人工智慧技術潛力的狂熱,推動美國和歐洲股市在過去一週創下歷史高點。

Crypto trading platform Coinbase blamed traffic that was 10 times normal for disruptions to some users, including displays of a zero balance in their accounts.

加密貨幣交易平臺Coinbase將一些用戶受到的干擾——包括賬戶顯示餘額爲零——歸咎於流量是正常情況下的10倍。

“We appreciate your patience,” Coinbase said. “We’re beginning to see improvement in customer trading. Due to increased traffic, some customers may still see errors in login, sends, receives and with some payment methods. Rest assured your funds are safe.”

「感謝您的耐心等待,」Coinbase說。「我們開始看到客戶交易情況改善。由於流量增加,一些客戶在登錄、發送、接收和某些支付方式時可能仍然會出現錯誤。請放心,你的資金是安全的。」

The price of bitcoin has soared despite US regulators’ clampdown on the biggest crypto companies and continued scepticism about the token. Last week, European Central Bank officials lambasted the cryptocurrency, saying “the fair value of bitcoin is still zero”.

儘管美國監管機構打擊了最大的加密公司,人們對這種代幣仍持懷疑態度,但比特幣的價格仍在飆升。上週,歐洲央行官員猛烈抨擊這種加密貨幣,稱「比特幣的公允價值仍然爲零」。

“For society, a renewed boom-bust cycle of bitcoin is a dire perspective. And the collateral damage will be massive,” they wrote, adding that the token’s price “is not an indicator of its sustainability”.

「對於社會來說,比特幣的新一輪繁榮-蕭條週期是一個可怕的前景。附帶損害將是巨大的,」他們寫道,並補充說,這種代幣的價格「不是其可持續性的指標」。

The crypto industry has been boosted by the belief that it is moving on from the scandals of recent years. The Securities and Exchange Commission hit Binance, the world’s biggest crypto exchange, with a record $4.3bn fine in November for crimes including failing to protect against money laundering and breaching international sanctions.

人們相信,加密行業正在從近年來的醜聞中走出來,這推動了加密行業的發展。去年11月,美國證交會(SEC)對全球最大的加密貨幣交易所幣安(Binance)處以創紀錄的43億美元罰款,罪名包括未能防範洗錢和違反國際制裁。

Binance’s rival, FTX, collapsed in 2022 and its founder Sam Bankman-Fried was found guilty on seven charges of fraud and money laundering. This week, his legal team argued for the former crypto tycoon to spend just a few years in prison, rather than the 100-year sentence he could face.

幣安的競爭對手FTX於2022年倒閉,其創辦人薩姆•班克曼-弗利德(Sam Bankman-Fried)因七項欺詐和洗錢指控被判有罪。本週,他的法律團隊表示,這位前加密貨幣大亨只需服刑幾年,而不是他可能面臨的100年徒刑。