尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

A lot was happening in markets when Covid-19 shut down the world in March 2020. One of the most noted happenings was how the price of many fixed-income ETFs became unmoored from the value of the bonds they contained.

2020年3月,當新冠疫情關閉世界時,市場上發生了很多事情。其中最引人關注的是許多固定收益ETF的價格是如何脫離其所含債券的價值的。

It seemed like vindication for people like Carl Icahn and Michael Burry, who had warned that ETFs had become so big that they were dangerous — especially in less traded markets like bonds. Finally, the illusory liquidity of the ETFs had collided with the harsh reality of the illiquid assets they held!

這似乎是對卡爾•伊坎(Carl Icahn)和邁克爾•伯裏(Michael Burry)這樣的人的平反,他們曾經警告說,ETF已經變得如此龐大,以至於非常危險——尤其是在債券等交易量較少的市場。最終,ETF虛幻的流動性與它們所持有的流動性較差的資產的嚴酷現實發生了碰撞!

However, an

interesting paper from Anna Helmke of the University of Pennsylvania’s Wharton School takes the other side, arguing that ETFs are actually a

better fit for illiquid asset classes.

然而,賓州大學沃頓商學院的安娜•赫爾姆克(Anna Helmke)發表的一篇有趣的論文持相反觀點,認爲ETF實際上更適合流動性較差的資產類別。

ETFs may be more suited for less liquid index market segments favored by long-term investors, whereas MFs may be a better fit in liquid fund market segments favored by investors with short-term liquidity needs, such as money market funds. Both funds are virtually perfect substitutes in highly liquid market segments, such as large-cap domestic equities.

ETF可能更適合長期投資者青睞的流動性較低的指數細分市場,而共同基金可能更適合有短期流動性需求的投資者青睞的流動基金細分市場,如貨幣市場基金。在高流動性的細分市場,如國內大盤股,這兩種基金幾乎是完美的替代品。

Full disclosure: I am particularly keen on this paper because it corroborates something that has been my cautious view

since at least April 2020. And despite the often

-cough- robust feedback since then, I’ve become increasingly convinced this is right.

充分披露:我對這篇論文特別感興趣,因爲它證實了我至少從2020年4月以來一直堅持的謹慎觀點。儘管從那以後經常有強烈的反饋,但我越來越相信這是正確的。

Here’s the basic argument: Traditional mutual funds guarantee investors that they will be able to redeem their money in cash at the fund’s end-of-day net asset value — the NAV. Most of the time that works fine, and as Helmke points out, that commitment is quite valuable to a lot of investors that don’t need intraday liquidity.

基本論點如下: 傳統的共同基金向投資者保證,他們可以按照基金的日終資產淨值以現金贖回資金。大多數情況下,這種方式運作良好,正如赫爾姆克所指出的,對於很多不需要日內流動性的投資者來說,這種承諾非常有價值。

But in times of serious stress, bond market liquidity often gums up. Bond funds therefore tend to sell their best, most liquid bonds first to meet a rush of redemptions (because these will sell at the lowest discount). That leaves a less liquid, junkier fund for the investors who remain.

但在壓力嚴重的時候,債券市場的流動性往往會出現問題。因此,債券基金傾向於首先出售其最好、流動性最強的債券,以應對贖回潮(因爲這些債券將以最低折扣出售)。這樣就給留下來的投資者留下一隻流動性較差的更垃圾的基金。

That’s obviously not attractive, so there’s an inherent bank-run dynamic at play. Investors have a strong incentive to get out as fast as possible to avoid getting penalised financially — or in extremis getting stuck if the fund depletes all its easily sellable assets and is forced to gate.

As the IMF said in 2022:

這顯然沒有吸引力,所以有一種內在的銀行擠兌動力在起作用。投資者有強烈的動機儘快退出,以避免在財務上受到懲罰——或者在極端情況下,如果基金耗盡了所有易於出售的資產,被迫停止贖回,就會陷入困境。正如國際貨幣基金組織在2022年所說:

Investors can sell shares daily at a price set at the end of each trading session, but it may take fund managers several days to sell assets to meet these redemptions, especially when financial markets are volatile.

Such liquidity mismatch can be a big problem for fund managers during periods of outflows because the price paid to investors may not fully reflect all trading costs associated with the assets they sold. Instead, the remaining investors bear those costs, creating an incentive for redeeming shares before others do, which may lead to outflow pressures if market sentiment dims.

Pressures from these investor runs could force funds to sell assets quickly, which would further depress valuations. That in turn would amplify the impact of the initial shock and potentially undermine the stability of the financial system.

投資者可以每天以每個交易日結束時設定的價格出售股票,但基金經理可能需要幾天時間才能出售資產以滿足這些贖回,尤其是在金融市場動盪的時候。

在資金外流期間,這種流動性錯配可能是基金經理的一個大問題,因爲支付給投資者的價格可能無法完全反映與他們出售的資產相關的所有交易成本。相反,剩下的投資者要承擔這些成本,從而刺激他們搶先贖回股票,如果市場情緒低迷,這可能會導致資金外流壓力。

這些投資者擠兌帶來的壓力可能會迫使基金迅速出售資產,這將進一步壓低估值。這反過來又會放大最初衝擊的影響,並可能破壞金融體系的穩定。

In contrast, ETFs trade like shares on an exchange. In the background, their shares are being constantly created and redeemed by specialist ETF market-makers known as “authorised participants” to match supply and demand. Because if the stock price drifts away from the value of the bonds the ETF contain, it opens up a lucrative arbitrage for APs.

相比之下,ETF的交易方式就像交易所的股票一樣。在後臺,被稱爲「授權參與者」的專業ETF做市商不斷創造和贖回其股票,以匹配供需。因爲如果股票價格偏離ETF所含債券的價值,就會給授權參與者帶來利潤豐厚的套利機會。

When the ETF price is higher than the NAV they can buy bonds that match the index and exchange them for new shares in the ETF. If the price falls below the NAV of the underlying bonds, they can redeem the shares for a basket of the underlying bonds and then sell them. Most of the time this arbitrage keeps ETFs closely tied to their indices.

當ETF價格高於資產淨值時,他們可以購買與指數匹配的債券,並將其兌換成ETF中的新股票。如果價格低於標的債券的資產淨值,他們可以用股票贖回一籃子標的債券,然後出售。大多數時候,這種套利使ETF與其指數緊密相連。

However, when the bond market freezes, the arbitrage breaks down. APs can’t sell the bonds. So they slow or stop redeeming shares in kind, even when the price of the freely-traded ETFs shares and the NAV diverge.

然而,當債券市場凍結時,套利就會瓦解。AP無法出售債券。因此,即使自由交易的ETF股票價格與資產淨值出現背離,它們也會放緩或停止以實物形式贖回股票。

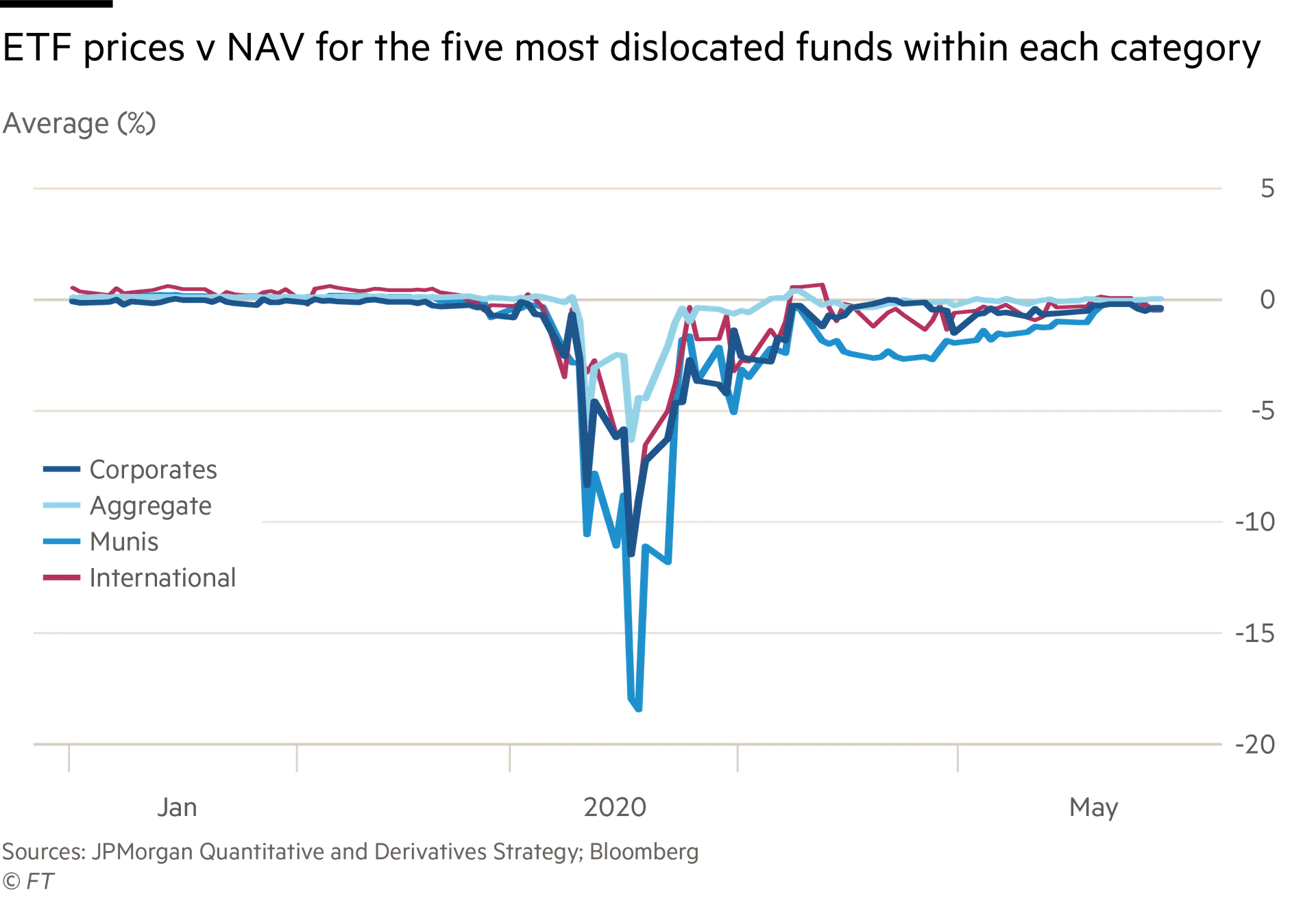

And in March 2020 the dislocation was wild, as you can see below:

2020年3月的錯配非常嚴重,如下圖所示:

However, this is a good thing.

然而,這是一件好事。

In essence, the secondary market trading of ETF shares acts almost like a pressure release valve when the underlying bond market seizes up. At a time when you couldn’t sell a swath of the fixed income markets, even at the peak of the turmoil, investors who needed to raise cash in a hurry could always ditch bond ETF shares. The NAVs were stale and misleading, because of the lack of underlying trading, while ETFs plummeted in value.

從本質上講,當基礎債券市場陷入困境時,ETF股票的二級市場交易幾乎就像一個壓力釋放閥。當你無法出售大量固定收益市場時,即使在動盪的高峯期,而需要迅速籌集現金的投資者總是可以隨時拋售債券ETF股票。由於缺乏基礎交易,NAV變得過時且具有誤導性,而ETF價值暴跌。

But most importantly — from a systemic risk point of view at least — the incentives are better than they are for traditional bond mutual funds. With ETFs, exiting investors are penalised (they sell at the discounted market price, not the NAV). With bond funds, remaining investors are penalised (because they are usually stuck in a junkier less liquid vehicle).

但最重要的是——至少從系統性風險的角度來看——這些激勵比對傳統債券共同基金更好。對於ETF,退出的投資者會受到懲罰(他們以折扣市場價格而不是NAV出售)。對於債券基金,留下的投資者會受到懲罰(因爲他們通常被困在一個更無價值的、流動性較差的工具中)。

One deters investor runs, the other encourages them. The clear corollary is that ETFs may actually be the better structure for less liquid asset classes like bonds, which goes against what many people have been arguing over the past decade (including me, at least before 2020).

一個阻止投資者拋售,另一個鼓勵投資者拋售。一個明顯的推論是,對於債券等流動性較差的資產類別而言,ETF實際上可能是更好的結構,這與許多人在過去十年所持的論點背道而馳(包括我在內,至少在2020年之前)。

As Helmke writes:

正如赫爾姆克寫道:

. . . ETFs’ market-based pricing mechanism gives rise to reverse run incentives, as strategic substitutabilities encourage shareholders to remain invested when intermediaries are balance sheet constrained. Investors who do not need immediate access to liquidity will always abstain from selling their ETF shares prematurely. The opposite is true for MFs. The insufficient flexibility of MF prices leads to payoff complementarities, encouraging early redemptions by long-term investors during periods of market illiquidity, potentially culminating in mutual fund runs.

. . . ETF基於市場的定價機制產生了反向操作激勵,因爲當中介機構受到資產負債表限制時,戰略可替代性會鼓勵股東繼續投資。不需要立即獲得流動性的投資者總是會避免過早賣出ETF股票。而MF則恰恰相反。MF價格的靈活性不足導致了回報互補,鼓勵長期投資者在市場流動性不足時提前贖回,最終可能導致共同基金擠兌。

A lot of people will howl that only the Federal Reserve’s remarkably aggressive interventions — including a vow to buy corporate bond ETFs — helped prevent a far worse disaster for ETFs.

很多人會哀嘆,只有美聯準非常積極的干預措施——包括承諾購買公司債券ETF——才能幫助ETF避免遭遇更嚴重的災難。

And sure, yes, if the Fed had just sat on its hands then things would have been far worse. But we were closer to mass gating across the bond mutual fund complex than we were to a serious bond ETF accident.

當然,如果美聯準袖手旁觀,情況會更糟。但是,與嚴重的債券ETF事故相比,我們更接近於在整個債券共同基金複合體的大規模止贖。

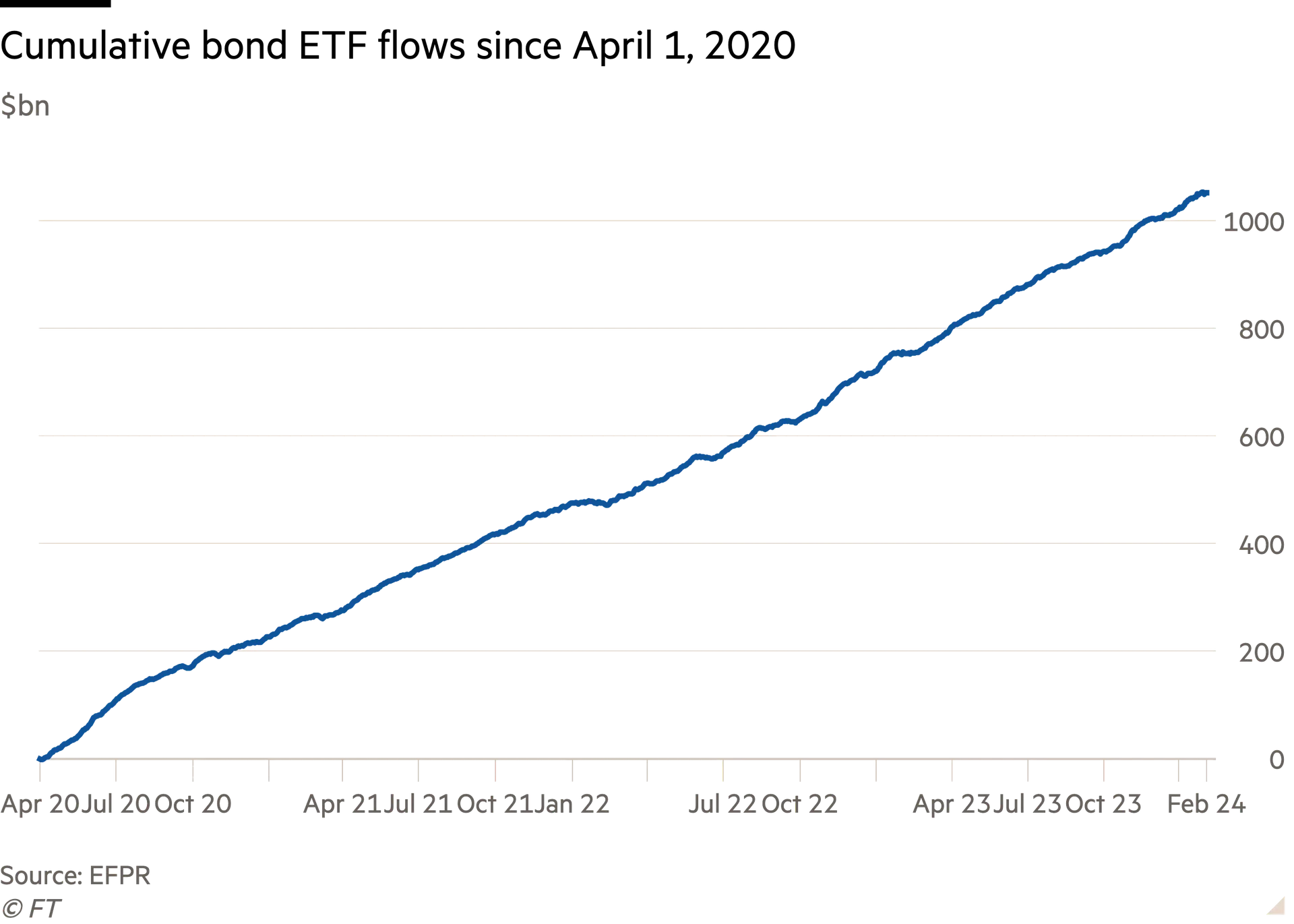

這就是爲什麼儘管出現了幾個世紀以來最大的固定收益熊市之一,債券ETF自2020年4月以來的淨流入仍超過1兆美元。

The downsides of end-of-day NAV redemptions for mutual funds are also why the SEC in 2022 proposed to introduce swing pricing to mutual funds, which would pass on the transaction costs of redemptions to exiting investors As chair Gary Gensler said at the time:

日終資產淨值贖回對於共同基金的弊端也是美國證交會(SEC)在2022年提議爲共同基金引入搖擺定價的原因,該定價機制將贖回的交易成本轉嫁給退出的投資者。正如其主席加里•根斯勒(Gary Gensler)當時所說:

A defining feature of open-end funds is the ability for shareholders to redeem their shares daily, in both normal times and times of stress. Open-end funds, though, have an underlying structural liquidity mismatch. This can raise issues for investor protection, our capital markets, and the broader economy. We saw such systemic issues during the onset of the COVID-19 pandemic, when many investors sought to redeem their investments from open-end funds. Today’s proposal addresses these investor protection and resiliency challenges.

開放式基金的一個決定性特徵是股東能夠在正常時期和壓力時期每天贖回股票。然而,開放式基金存在潛在的結構性流動性錯配。這可能會給投資者保護、我們的資本市場和更廣泛的經濟帶來問題。在新冠疫情爆發期間,我們看到了這樣的系統性問題,當時許多投資者試圖從開放式基金贖回投資。今天的提議解決了這些投資者保護和恢復能力方面的挑戰。

Swing pricing was

shouted down by the asset management industry last year.

去年,資產管理行業對擺動定價大加撻伐。