尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

To President-elect Donald Trump, “tariff” is the most beautiful word in the dictionary. His campaign-trail proposals included a 60 per cent duty on Chinese goods and 20 per cent on European ones. All things being equal, higher duties should translate into less trade. Isn’t that bad for shipping? Maersk shareholders think not.

對當選總統唐納•川普(Donald Trump)來說,「關稅」是字典裏最美的詞。他在競選期間的提議包括對中國商品徵收60%的關稅,對歐洲商品徵收20%的關稅。在其他條件相同的情況下,更高的關稅應該會導致貿易減少。這對航運業不利嗎?馬士基的股東們並不這麼認爲。

The 15 per cent rise in the Danish freight company’s stock over the past month suggests hope that — at least in the short term — Trump’s tariffs won’t entirely snarl up the shipping market. The US is a sizeable, rather than giant, tassel in the global trade tapestry. In tonnes, it accounts for 5 per cent of global seaborne imports, according to Clarksons, a shipping service provider. Bilateral US-China trade accounts for 1.4 per cent of global seaborne goods transport.

過去一個月,丹麥貨運公司的股票上漲了15%,這表明至少在短期內,人們希望川普的關稅不會完全擾亂航運市場。根據航運服務提供商克拉克森的數據,美國在全球貿易格局中是一個重要而非巨大的流蘇。按噸計算,美國佔全球海運進口的5%。美中雙邊貿易佔全球海運貨物運輸的1.4%。

Tariffs could even raise US imports, at first. A surge looks inevitable, as importers seek to stockpile goods ahead of the duties kicking in. Even thereafter, consumers may swallow higher prices to a degree, and companies settle for lower margins.

關稅起初甚至可能增加美國的進口量。由於進口商試圖在關稅生效前囤積商品,進口激增似乎不可避免。即便在此之後,消費者可能會在一定程度上接受更高的價格,而公司則可能接受較低的利潤率。

Where stuff just gets too expensive, other imports could take up the slack. A harder bludgeon for Chinese-made products would leave European companies at a relative advantage in the US market. And even where locally-produced goods shake out ahead, it would take US companies some time to increase their production capacities.

當商品價格過高時,其他進口商品可能會填補空缺。對中國製造產品採取更嚴厲的打擊將使歐洲公司在美國市場上處於相對優勢。即使本地生產的商品領先,美國公司也需要一些時間來提高生產能力。

The impact of a near-term surge in shipping demand would be amplified by the stretched state of the shipping market. Disruption in the Red Sea has lengthened journeys, and while freight rates are off their peak, the Shanghai Containerized Freight Rate is still more than twice as high as it was in 2023.

近期航運需求激增的影響將因航運市場的緊張狀態而被放大。紅海(Red Sea)的中斷延長了航程,儘管運費已經回落,但上海集裝箱運價(Shanghai Containerized Freight Rate)仍比2023年高出兩倍多。

By way of history, Trump’s last experiment with tariffs ended up clipping global seaborne trade — measured in tonnes/km — by only 0.5 per cent. Trouble is, such calculations only stack up if global growth holds up, and trade mostly moves around to adjust to tariffs. But trade wars have a habit of escalating as recipients slap on tariffs of their own. Over time, that would sink global GDP, and shipping demand with it.

從歷史上看,川普上次的關稅實驗最終只使全球海運貿易(以噸/公里計算)減少了0.5%。問題在於,這種計算只有在全球經濟成長保持穩定的情況下才成立,而貿易大多會爲了適應關稅而調整。但貿易戰往往會升級,因爲受影響國家也會加徵關稅。隨著時間的推移,這將導致全球國內生產總值下降,航運需求也會隨之下降。

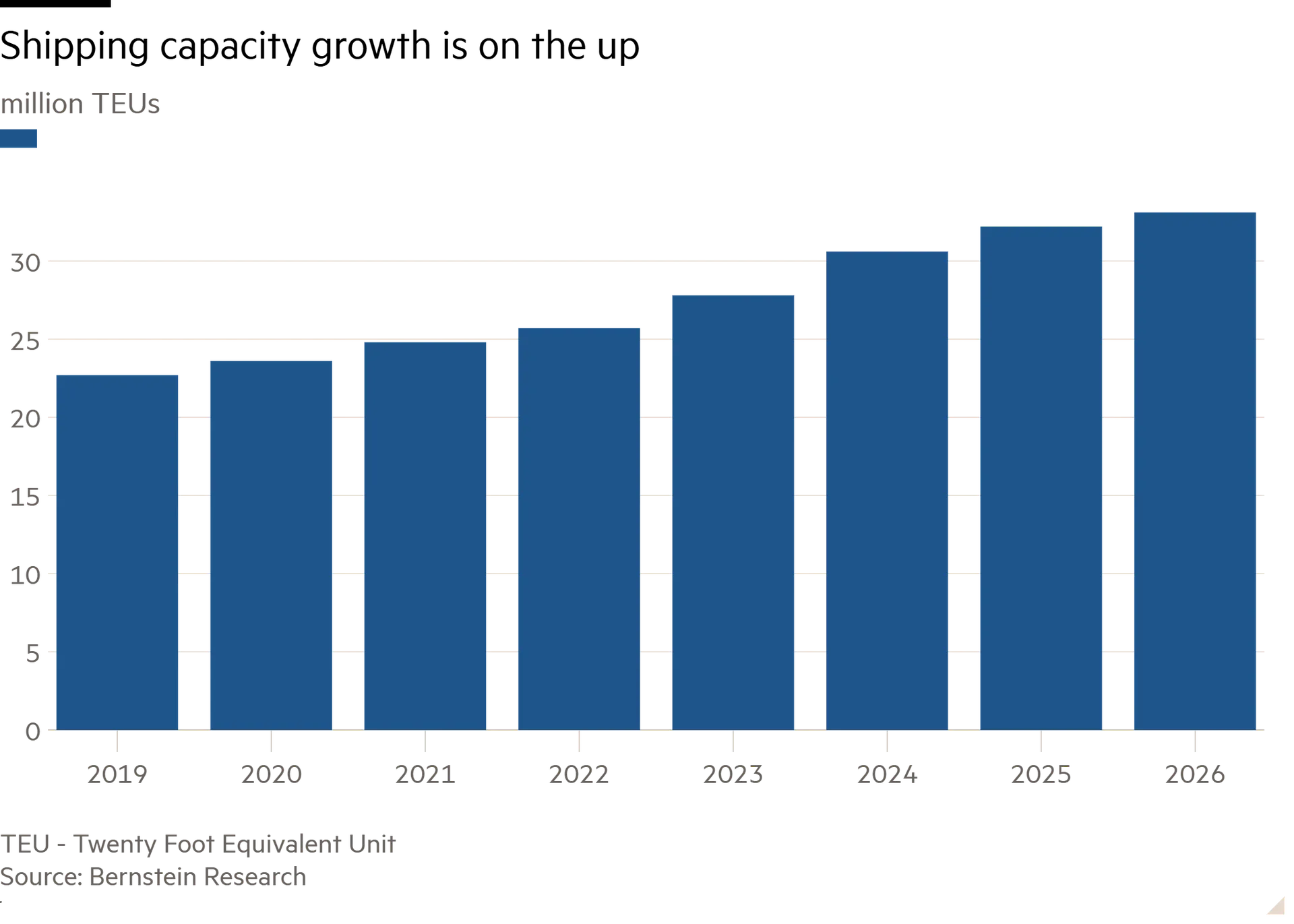

That’s particularly worrying given the sector spent its Covid-era bonanza on new ships. Next year’s fleet is set to be more than 40 per cent larger than that in 2019, according to Bernstein. The combination of looming risks to global growth and shipping overcapacity would certainly make for choppy waters.

這一點尤其令人擔憂,因爲航運業把新冠疫情時代的紅利都花在了新船上。伯恩斯坦認爲,明年的船隊規模將比2019年擴大40% 以上。全球經濟成長面臨的隱患和航運業運力過剩的雙重壓力,無疑會讓這片水域波濤洶湧。

The path from campaign pronouncement to actual policy is unclear, so it is hard to estimate with accuracy the size and shape of disruption to global trade. Investors are for now betting that it is nothing shipping companies like Maersk cannot navigate around.

從競選宣言到實際政策的路徑尚不明確,因此很難準確估計全球貿易中斷的規模和形式。投資者目前押注,像馬士基這樣的航運公司能夠應對這些挑戰。