尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

Few people have had the sort of front-row seat to the rise of electric vehicles as JB Straubel.

很少有人能像J·B·斯特勞貝爾(JB Straubel)那樣,親眼目睹電動汽車的崛起。

The soft-spoken engineer is often considered the brains behind Tesla: it was Straubel who convinced Elon Musk, over lunch in 2003, that electric vehicles had a future. He then served as chief technology officer for 15 years, designing Tesla’s first batteries, managing construction of its network of charging stations and leading development of the Gigafactory in Nevada. When he departed in 2019, Musk’s biographer Ashlee Vance said Tesla had not only lost a founder, but “a piece of its soul”.

這位說話溫和的工程師通常被認爲是特斯拉背後的智囊:正是斯特勞貝爾在2003年的午餐會上說服了伊隆·馬斯克(Elon Musk),電動汽車是有未來的。隨後,他擔任了15年的首席技術官,設計了特斯拉的第一批電池,管理充電站網路的建設,並領導了內華達州Gigafactory的開發。2019年馬斯克離開時,馬斯克的傳記作者阿什利·萬斯(Ashlee Vance)表示,特斯拉不僅失去了一位創辦人,還失去了「一部分靈魂」。

Straubel could have gone on to do anything in Silicon Valley. Instead, he stayed at his ranch in Carson City, Nevada, a town once described by former resident Mark Twain as “a desert, walled in by barren, snow-clad mountains” without a tree in sight.

斯特勞貝爾本可以在矽谷做任何事情。相反,他住在內華達州卡森市(Carson City)的農場裏,這裏的前居民馬克·吐溫(Mark Twain)曾形容這個小鎮是「一片沙漠,被貧瘠、白雪覆蓋的山脈包圍著」,看不到一棵樹。

At first glance it is not the most obvious location for Redwood Materials, a start-up Straubel founded in 2017 with a formidable mission bordering on alchemy: to break down discarded batteries and reconstitute them into a fresh supply of metals needed for new electric vehicles.

乍一看,這裏並不是Redwood Materials最顯眼的位置。Redwood Materials是斯特勞貝爾於2017年成立的一家新創企業,它的艱鉅使命近乎鍊金術:將廢棄電池分解,重新組裝成新電動汽車所需的新金屬。

His goal is to solve the most glaring problem for electric vehicles. While they are “zero emission” when being driven, the mining, manufacturing and disposal process for batteries could become an environmental disaster for the industry as the technology goes mainstream.

他的目標是解決電動汽車最突出的問題。雖然它們在駕駛時是「零排放」的,但隨著技術的主流化,電池的開採、製造和處理過程可能會成爲該行業的環境災難。

“It’s not sustainable at all today, nor is there really an imminent plan — any disruption happening — to make it sustainable,” Straubel says. “That always grated on me a little bit at Tesla and it became more apparent as we ramped everything up.”

斯特勞貝爾說:「這在今天是不可持續的,也沒有一個迫在眉睫的計劃——任何破壞正在發生——來使它可持續。在特斯拉時,這一點總是讓我感到不快,隨著我們把所有東西都提升了,這一點變得更加明顯。」

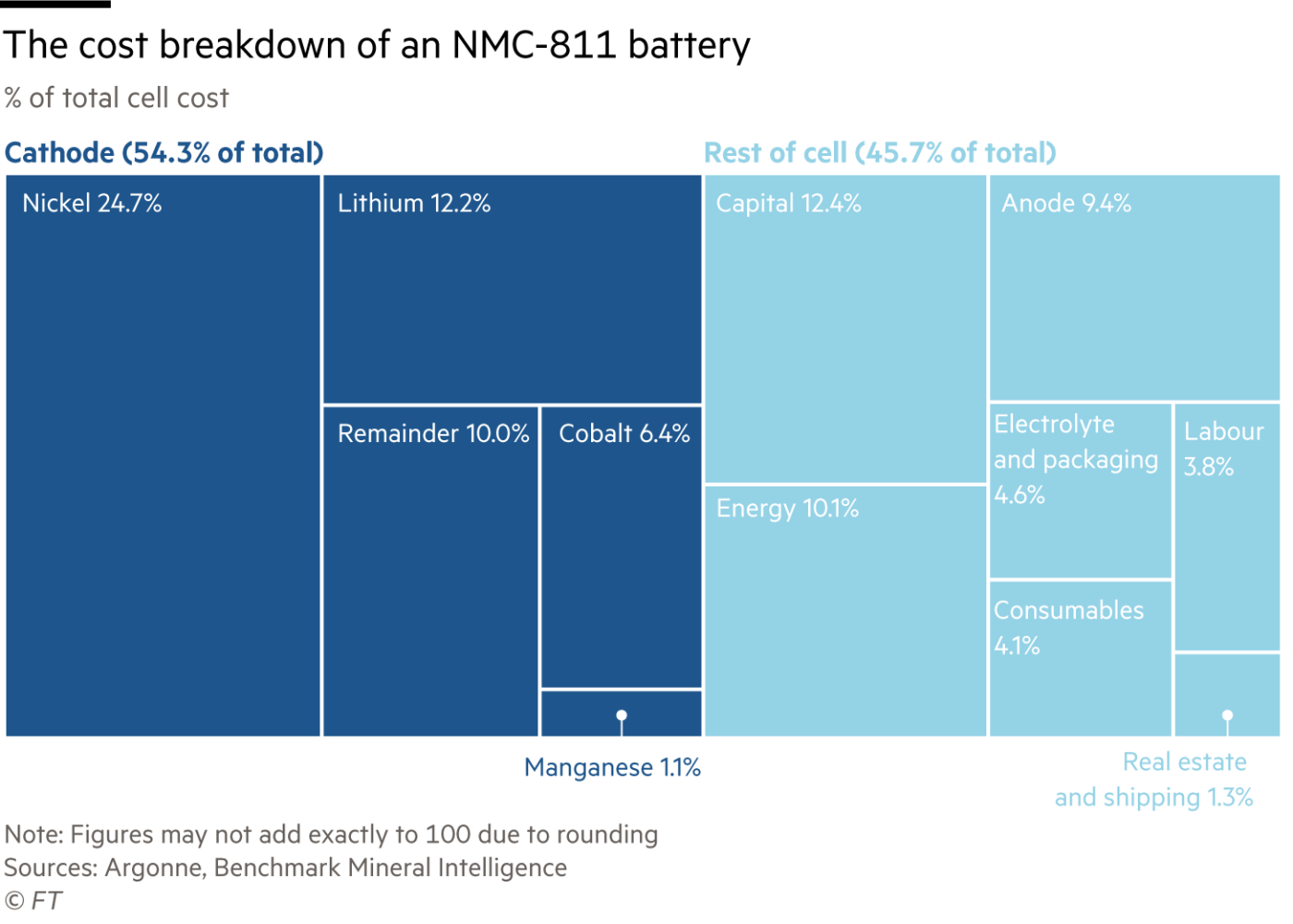

Redwood’s warehouse is the ultimate example of how one person’s trash is another person’s treasure. Each weekday, two to three heavy duty lorries drop off about 60 tonnes worth of old smartphones, power tools and scooter batteries. Straubel’s team of 130 employees then separates out the metals — including nickel, cobalt and lithium — pulverises them and treats them with chemicals so they can re-enter the supply chain as the building blocks for new lithium-ion batteries.

Redwood的倉庫是一個絕佳的例子,說明一個人的垃圾是另一個人的寶藏。每個工作日,兩到三輛重型卡車會運送大約60噸的舊智慧型手機、電動工具和踏板車電池。然後,斯特勞貝爾的130名員工團隊將金屬(包括鎳、鈷和鋰)分離出來,粉碎後用化學物質處理,這樣它們就可以重新進入供應鏈,作爲新型鋰離子電池的基石。

The metals used in batteries typically originate in the Democratic Republic of Congo, Australia and Chile, dug out of open pit mines or evaporated from desert ponds. But Straubel believes there is another “massive, untapped” source: the garages of the average American. He estimates there are about 1bn used batteries in US homes, sitting in old laptops or mobile phones — all containing valuable metals.

電池中使用的金屬通常產自剛果民主共和國、澳洲和智利,有的從露天礦場開採,有的從沙漠池塘中蒸發。但斯特勞貝爾相信還有另一個「巨大的、尚未開發的」來源:普通美國人的汽車修理廠。他估計,在美國家庭中,大約有10億塊廢舊電池,放在舊筆記型電腦或手機裏,這些電池都含有貴重金屬。

The process of breaking down these batteries and repurposing them is known as “urban mining”. To do this at scale is a gargantuan task: the amount of battery material in a high-end electric vehicle is roughly 10,000 times that of a smartphone, according to Gene Berdichevsky, chief executive of battery materials start-up Sila Nano. But, he adds, the amount of cobalt used in a car battery is about 30 times less than in a phone battery, per kilowatt hour. “So for every 300 smartphones you collect, you have enough cobalt for an EV battery.”

分解這些電池並將其重新利用的過程被稱爲「城市採礦」。要大規模做到這一點是一項艱鉅的任務:電池材料新創企業Sila Nano的首席執行長吉恩•貝爾迪切夫斯基(Gene Berdichevsky)表示,一輛高階電動汽車所用的電池材料大約是一部智慧型手機的1萬倍。但是,他補充道,汽車電池每千瓦時使用的鈷含量大約是手機電池的30倍。「所以,你每收集300部智慧型手機,就有足夠的鈷來生產電動汽車電池。」

Redwood is also building a network of industrial partners, including Amazon, electric bus maker Proterra and e-bike maker Specialized, to receive their scrap. It already receives e-waste from, and sends back repurposed materials to, Panasonic, which produces battery cells just 50 miles north at the Tesla Gigafactory.

Redwood還在建立一個工業合作伙伴網路,以接收他們的廢料,其中包括亞馬遜、電動巴士製造商Proterra和電動自行車製造商Specialized。它已經從松下(Panasonic)接收電子垃圾,並將重新利用的材料送回松下。松下在特斯拉超級工廠(Tesla Gigafactory)以北50英里處生產電池。

Straubel is betting part of his Tesla fortune that Redwood can play an instrumental role in the emergence of “the circular economy” — a grand hope born in the 1960s that society can re-engineer the way goods are designed, manufactured and recycled. The concept is being embraced by some of the world’s largest companies including Apple, whose chief executive Tim Cook set an objective “not to have to remove anything from the earth to make the new iPhones” as part of its pledge to be carbon-neutral by 2030.

斯特勞貝爾將他在特斯拉的部分財富押注於Redwood可以在「循環經濟」的出現中發揮重要作用。「循環經濟」是20世紀60年代誕生的一個偉大希望,社會可以重新設計商品的設計、製造和回收方式。這一概念受到了包括蘋果(Apple)在內的一些全球最大公司的歡迎。蘋果首席執行長蒂姆•庫克(Tim Cook)設定了一個目標,「不必從地球上拿走任何東西來製造新iphone」,作爲其到2030年實現碳中和的承諾的一部分。

Cobalt’s 20,000-mile journey

鈷的20000英里旅程

If the circular economy takes root, today’s status quo will look preposterous to future generations. The biggest source of cobalt at the moment is the DRC, where it is often extracted in both large industrial mines and also dug by hand using basic tools. Then it might be shipped to Finland, home to Europe’s largest cobalt refinery, before heading to China where the majority of the world’s cathode and battery production takes place. From there it can be shipped to the US or Europe, where battery cells are turned into packs, then shipped again to automotive production lines.

如果循環經濟紮根,今天的現狀在後代看來將是荒謬的。目前鈷的最大來源是剛果民主共和國,在那裏,鈷通常是在大型工業礦山中提取的,也經常是用基本工具手工挖掘的。然後,它可能會被運往歐洲最大的鈷冶煉廠所在地芬蘭,然後再運往世界上大部分陰極和電池生產的中國。在那裏,它可以被運往美國或歐洲,在那裏,電池被製成電池組,然後再被運往汽車生產線。

All told, the cobalt can travel more than 20,000 miles from the mine to the automaker before a buyer places a “zero emission” sticker on the bumper.

總而言之,在買家把「零排放」標籤貼在保險槓上之前,這種鈷可以從礦場運到汽車製造商那裏,行程超過2萬英里。

Despite this, independent studies routinely say electric vehicles cause less environmental damage than their combustion engine counterparts. But the scope for improvement is vast: Straubel says electric car emissions can be more than halved if their batteries are continually recycled.

儘管如此,一些獨立研究仍然認爲,電動汽車對環境的破壞要小於內燃機汽車。但改進的空間是巨大的:斯特勞貝爾說,如果電動汽車的電池不斷循環使用,其排放量可以減少一半以上。

In July, Redwood accelerated its mission, raising more than $700m from investors so it could hire more than 500 people and expand operations. At a valuation of $3.7bn, the company is now the most valuable battery recycling group in North America. This year it expects to process 20,000 tonnes of scrap and it has already recovered enough material to build 45,000 electric vehicle battery packs.

今年7月,Redwood加快了使命,從投資者那裏籌集了7億多美元,這樣它就可以僱傭500多名員工並擴大業務。該公司目前的估值爲37億美元,是北美最有價值的電池回收集團。今年,該公司預計將處理2萬噸廢料,並且已經回收了足夠製造4.5萬個電動汽車電池組的材料。

Advocates say a circular economy could create a more sustainable planet and reduce mountains of waste. In 2019 the World Economic Forum estimated that “a circular battery value chain” could account for 30 per cent of the emissions cuts needed to meet the targets set in the Paris accord and “create 10m safe and sustainable jobs around the world” by 2030.

支持者表示,循環經濟可以創造一個更可持續的地球,減少堆積如山的廢物。2019年,世界經濟論壇(World Economic Forum)估計,要實現《巴黎協定》(Paris accord)設定的目標,併到2030年「在全球創造1000萬個安全和可持續的就業崗位」,「一個循環電池價值鏈」可能佔到所需減排的30%。

Kristina Church, head of sustainable solutions at Lombard Odier Investment Managers, says transportation is “central” to creating a circular economy, not only because it accounts for a sixth of global CO2 emissions but because it intersects with mining and the energy grid.

Lombard Odier投資管理公司可持續解決方案負責人克里斯蒂娜•丘奇(Kristina Church)表示,交通運輸是成立循環經濟的「核心」,不僅因爲它佔全球二氧化碳排放量的六分之一,還因爲它與採礦和能源網路存在交集。

“For the world to hit net zero — by 2050 you can’t do it with just resource efficiency, switching to EVs and clean energy, there’s still a gap,” Kunal Sinha, head of copper and electronics recycling at miner Glencore says. “That gap can be closed by driving the circular economy, changing how we consume things, how we reuse things, and how we recycle.

礦業公司嘉能可(Glencore)銅和電子產品回收部門主管庫納爾•辛哈(Kunal Sinha)表示:「要想讓全球實現淨零排放——到2050年,光靠提高資源效率、改用電動汽車和乾淨能源是不可能的,目前仍有差距。透過推動循環經濟,改變我們消費、再利用和循環利用的方式,可以縮小這一差距。

“Recycling plays a role,” he adds. “Not only do you provide extra supply to close the demand gap, but you also close the emissions gap.”

「回收利用也發揮了作用,」他補充道。「你不僅可以提供額外的供應來縮小需求差距,還可以縮小排放差距。」

Unintended consequences

意想不到的後果

Although niche today, urban mining is set to become mainstream this decade given the broad political support for electric vehicles and policies to address climate change. Jennifer Granholm, US secretary of energy, has called for “a national commitment” to building a domestic supply chain for lithium-based batteries.

儘管現在只是小衆市場,但鑑於電動汽車和應對氣候變化的政策得到了廣泛的政治支援,城市採礦在未來十年將成爲主流。美國能源部長詹妮弗•格蘭霍姆呼籲「國家承諾」建立國內鋰電池供應鏈。

It is part of the Biden administration’s goal to reach 100 per cent clean electricity by 2035 and net zero emissions by 2050. Granholm has also said the global market for clean energy technologies will be worth $23tn by the end of this decade and warned that the US risks “bring[ing] a knife to a gunfight” as rival countries, particularly China, step up their investments.

這是拜登政府到2035年實現100%清潔電力、到2050年實現淨零排放目標的一部分。格蘭霍姆還表示,到本世紀末,全球乾淨能源技術市場的價值將達到23兆美元。格蘭霍姆警告稱,隨著競爭對手(尤其是中國)加大投資,美國可能是「拿著刀參加槍戰」(bring a knife to a gunfight)。

In Europe, regulators emphasise environmental and societal concerns — such as the looming threat of job losses in Germany if carmakers stop producing combustion engines. Meanwhile, Beijing is subsidising the sector to boost sales of electric vehicles by 24 per cent every year for the rest of the decade, according to McKinsey.

在歐洲,監管機構強調環境和社會方面的擔憂——比如,如果汽車製造商停止生產內燃機,德國可能面臨失業的威脅。與此同時,根據麥肯錫(McKinsey)的數據,中國政府正在補貼電動汽車行業,以便在本10年餘下的時間裏,每年將電動汽車銷量提高24%。

This support, however, could have unintended consequences.

然而,這種支援可能會產生意想不到的後果。

A shortage of semiconductors this year demonstrated the vulnerability of the “just-in-time” automotive supply chain, with global losses estimated at more than $110bn. The chip shortage is perhaps a harbinger of a much larger disruption caused by coming bottlenecks for nickel, cobalt and lithium as every carmaker looks to electrify their vehicle portfolio.

今年半導體供應短缺,顯示出「準時制」汽車供應鏈的脆弱性,全球虧損估計超過1100億美元。晶片短缺或許預示著,鎳、鈷和鋰的瓶頸即將到來,將引發一場規模大得多的混亂,每家汽車製造商都在尋求將自己的汽車組合實現電氣化。

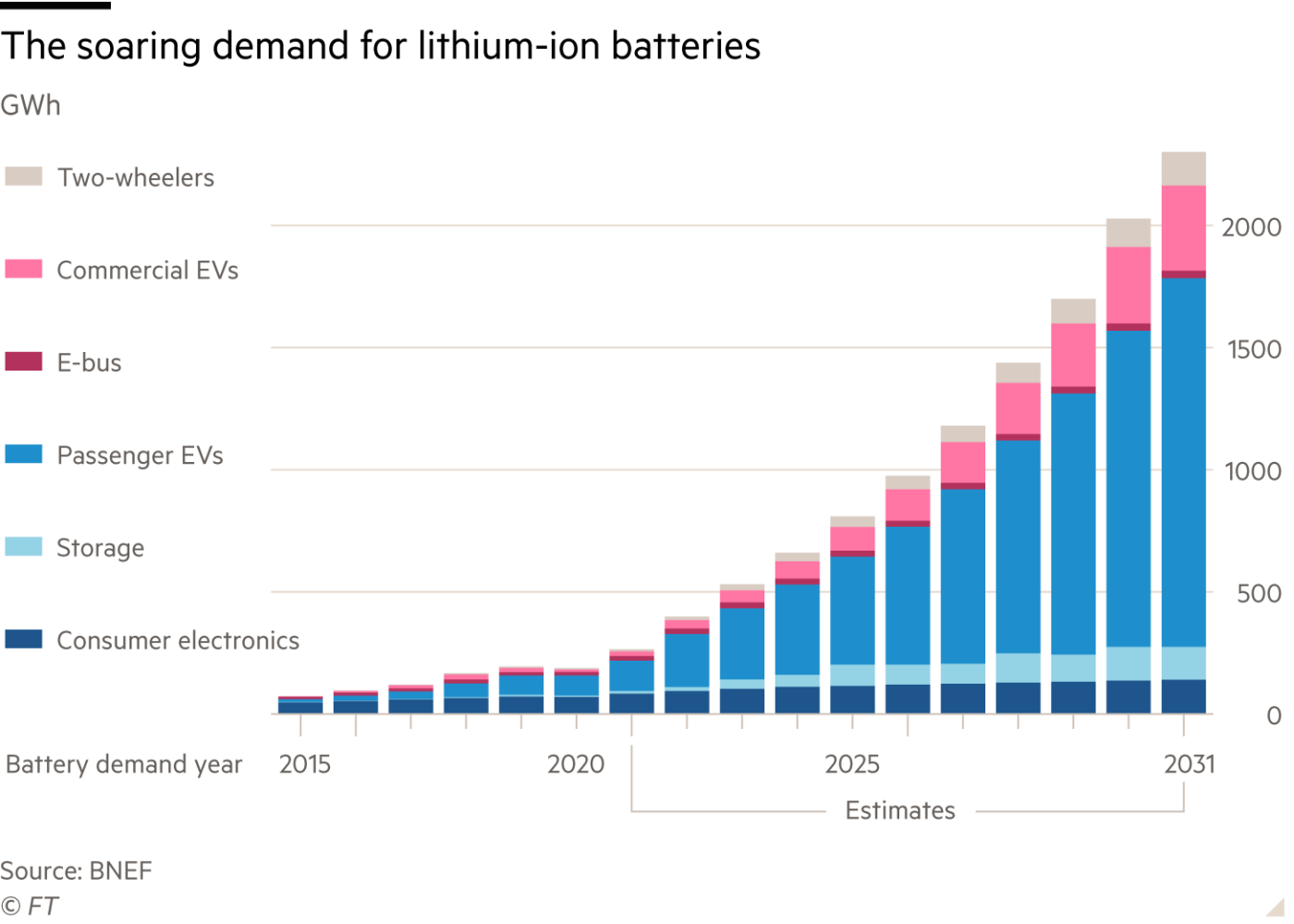

Electric car sales last year accounted for just 4 per cent of the global total. That is projected to expand to between 24 and 34 per cent in 2030 and then swell to between 30 and 70 per cent a decade later, according to BloombergNEF.

去年,電動汽車銷量僅佔全球總銷量的4%。據彭博NEF預測,到2030年,這一比例將增至24%至34%,10年後將增至30%至70%。

“There is going to be a mass scramble for these materials,” says Paul Anderson, a professor at the University of Birmingham. “Everyone is panicking about how to get their technology on to the market and there is not enough thought to recycling.”

伯明翰大學(University of Birmingham)教授保羅•安德森(Paul Anderson)表示:「對這些材料的爭奪將會非常激烈。每個人都對如何將自己的技術推向市場感到恐慌,對回收也沒有足夠的考慮。」

Monica Varman, a clean tech investor at G2 Venture Partners, estimates that demand for battery metals will exceed supply in two to three years, leading to a “crunch” lasting half a decade as the market reacts by redesigning batteries with sustainable materials. Recycled materials could help ease supply concerns, but analysts believe it will only be enough to cover 20 per cent of demand at most over the next decade.

G2 Venture Partners的清潔技術投資者莫妮卡•瓦爾曼(Monica Varman)估計,電池金屬的需求將在兩到三年內超過供應,隨著市場的反應是用可持續材料重新設計電池,將導致持續五年的「危機」。回收材料可能有助於緩解供應擔憂,但分析師們認爲,未來10年,回收材料最多只能滿足20%的需求。

So far, only a handful of start-ups besides Redwood have emerged to tackle the challenge of reconstituting discarded materials. One is Li-Cycle, based in Toronto and founded in 2016, which earlier this year raised more than $600m in a merger with a special purpose acquisition company valuing it at $1.7bn. Li-Cycle has already lined up partnerships with 14 automotive and battery companies, including Ultium, a joint venture between General Motors and LG Chem.

到目前爲止,除了Redwood公司,只有少數幾家新創公司已經出現,以應對重新組合廢棄材料的挑戰。其中一家是成立於2016年、總部位於多倫多的Li-Cycle。今年早些時候,該公司與一家特殊目的收購公司合併,融資逾6億美元,使其估值達到17億美元。Li-Cycle已經與14家汽車和電池企業建立了合作伙伴關係,其中包括通用汽車(General Motors)和LG化學(LG Chem)的合資企業Ultium。

Tim Johnston, Li-Cycle chair, says the group’s plan is to create facilities it calls “spokes” around North America, where it will collect used batteries and transform them into “black mass” — the powder form of lithium, nickel, cobalt and graphite. Then it will build larger “hubs”, where it can reprocess more than 95 per cent of the substance into battery-grade material.

Li-Cycle主席蒂姆·約翰斯頓(Tim Johnston)說,該組織的計劃是在北美各地建立名爲「輻條」的設施,在那裏收集用過的電池,並將它們轉化爲「黑色物質」——鋰、鎳、鈷和石墨的粉末形式。然後,它將建造更大的「樞紐」,在那裏,它可以將超過95%的這種物質再加工成電池級材料。

Without urban mining at scale, Johnston worries that the coming shortages will be like the 1973 Arab oil embargo, when US petrol prices quadrupled within four months, imposing what the US state department described as “structural challenges to the stability of whole national economies”.

約翰斯頓擔心,如果沒有大規模的城市採礦,即將到來的短缺將像1973年阿拉伯石油禁運時那樣,當時美國汽油價格在4個月內上漲了4倍,給「整個國家經濟的穩定帶來了美國國務院所說的結構性挑戰」。

“Oil you can actually turn back on relatively quickly — it doesn’t take that long to develop a well and to start pumping oil,” says Johnston. “But if you look at the timeline that it takes to develop a lithium asset, or a cobalt asset, or a nickel asset, it’s a minimum of five years.

「實際上,石油可以相對較快地恢復生產,開發一口井並開始抽油並不需要那麼長時間。」約翰斯頓說,「但如果你看看開發鋰、鈷或鎳資產所需的時間,至少需要5年。」

“So not only do you have the potential to have the same sort of implications of the oil embargo,” he adds, “but [the effects] could be prolonged.”

他說:「因此,不僅有可能產生與石油禁運相同的影響,而且(影響)可能是長期的。」

Design complications

設計複雜化

Beyond aiding supply constraints and helping the environment, urban mining could also prove cheaper. A 2018 study on the recycling of gold and copper from discarded TV sets in China found the process was 13 times more economical than virgin mining.

除了緩解供應限制和保護環境外,城市採礦也可能更便宜。2018年一項關於從中國廢棄電視機中回收金和銅的研究發現,這一過程的經濟效益是原始採礦的13倍。

Straubel points out that the concentration of valuable material is considerably higher in existing batteries versus mined materials.

斯特勞貝爾指出,與開採的材料相比,現有電池中有價值材料的濃度要高得多。

“With rock and ores or brines, you have very low concentrations of these critical materials,” he says. “We’re starting with something that already is quite high concentration and also has all the interesting materials together in the right place. So it’s really a huge leg up over the problem mining has.”

「在岩石、礦石或滷水中,這些關鍵物質的濃度非常低,」他說。「我們從濃度已經相當高的物質開始,而且所有有趣的材料都在正確的位置。因此,這確實是一個巨大的優勢,在礦業的問題。」

The top-graded lithium found in mines today are just 2 to 2.5 per cent lithium oxide, whereas in urban mining the concentration is four to five times that, adds Li-Cycle’s Johnston.

Li-Cycle公司的約翰斯頓補充說,目前在礦山中發現的頂級鋰只含有2%至2.5%的鋰氧化物,而在城市採礦中,鋰氧化物的濃度是這個水準的4至5倍。

Still, the process of extracting valuable materials from discarded products is complicated by designs that fail to consider their end of life. “Today, the design parameters are for quick assembly, for cost, for quality, fit and finish,” says Ed Boyd, head of the experience design group at Dell, the computer company. Some products take 20 or 30 minutes to disassemble — so laborious that it becomes impractical.

儘管如此,從廢棄產品中提取有價值材料的過程還是很複雜的,因爲這些設計沒有考慮到它們的壽命結束。電腦公司戴爾(Dell)體驗設計小組負責人埃德•博伊德(Ed Boyd)表示:「如今,設計參數是爲了快速組裝、成本、質量、裝配和精加工。」有些產品需要20或30分鐘才能拆卸——如此費力以至於變得不實用。

His team is now investigating ways to “drastically” cut back the number of materials used and make it so products can come apart in under a minute. “That’s actually not that hard to do,” he says. “We just haven’t had disassembly as a design parameter before.”

他的團隊現在正在研究如何「大幅」減少所用材料的數量,使產品可以在一分鐘內分解。他說:「這其實不難做到。我們只是以前沒有把拆卸作爲設計參數。」

‘Monumental task’

「艱鉅的任務」

While few dismiss the circular economy out of hand, there are plenty of sceptics who doubt these processes can be scaled up quickly enough to meet near-exponential demand for clean energy technologies in the next decade. “Recycling sounds very sexy,” says Julian Treger, chief executive of mining company Anglo Pacific. “But, ultimately, [it] is like smelting and refining. It’s a value added processing piece which doesn’t generally have enormous margins.”

儘管很少有人認爲循環經濟已經失控,但仍有很多人懷疑,這些過程能否迅速擴大,以滿足未來10年對乾淨能源技術近乎指數級的需求。「回收聽起來非常誘人。」礦業公司英美資源太平洋(Anglo Pacific)首席執行長朱利安•特雷格(Julian Treger)表示,「但歸根結底,(它)就像熔鍊和精煉。這是一種增值加工產品,通常利潤率不高。」

Brian Menell, the founder of TechMet, a company that invests in mining, processing and recycling of technology metals and is partly owned by the US government, calls it “a monumental task”. “In 10 years’ time a fully optimised developed lithium-ion recycling battery industry will maybe provide 25 per cent of the battery metal requirements for the electric vehicle industry,” he says. “So it will be a contributor, but it’s not a solution.”

TechMet是一家投資於科技金屬的開採、加工和回收的公司,部分歸美國政府所有。該公司創辦人布萊恩•梅內爾(Brian Menell)稱這是「一項艱鉅的任務」。「在10年的時間裏,一個完全優化的已開發的鋰離子回收電池行業可能會提供電動汽車行業25%的電池金屬需求。」他表示,「因此,它將是一個貢獻者,但不是一個解決方案。」

The real volume could be created when the industry recycles more electric vehicle batteries. But they last an average of 15 years, so the first wave of batteries will not reach their end of life and become available for recycling for some time. This extended timeline could be enough for technologies to develop, but it also creates risks. G2 Ventures’ Varman says recycling processes being developed now, for today’s batteries, risk being made redundant if chemistries evolve quickly.

當行業回收更多的電動汽車電池時,真正的產量就可以創造出來。但它們的平均壽命爲15年,所以第一批電池不會達到它們的壽命結束,並在一段時間內可以回收利用。這一延長的時間線可能足以推動技術的發展,但它也會帶來風險。G2 Ventures的Varman表示,如果化學成分發展迅速,目前正在開發的電池回收工藝可能會被淘汰。

Even getting consistent access to discarded car batteries could be a challenge, as older cars are often exported for reuse in developing countries, according to Hans Eric Melin, the founder of consultancy Circular Energy Storage.

諮詢公司Circular Energy Storage的創辦人漢斯•埃裏克•梅林(Hans Eric Melin)表示,即便是持續使用廢棄汽車電池也可能是一項挑戰,因爲老舊汽車經常出口到發展中國家進行再利用。

Melin found that nearly a fifth of the roughly 400,000 Nissan Leaf electric cars produced by the end of 2018 are now registered in Ukraine, Russia, Jordan, New Zealand and Sri Lanka — places where getting a hold of the batteries at end-of-life is harder.

梅林發現,2018年底生產的約40萬輛日產聆風電動汽車中,有近五分之一是在烏克蘭、俄羅斯、約旦、紐西蘭和斯里蘭卡註冊的,這些地方的電池壽命結束後更難獲得。

Berdichevsky of Sila Nano says his aim is to make EV batteries that last 30 years. If that can be accomplished, pent-up demand for recycling will be less onerous and costs will fall, helping to make electric vehicles more affordable. “In the future we’ll replace the car, but not the battery; of that I’m very confident,” he says. “We haven’t even scratched the surface of the battery age, in terms of what we can do with longevity and recycling.”

Sila Nano的伯爾迪切夫斯基表示,他的目標是製造續航30年的電動汽車電池。如果這一目標能夠實現,被壓抑的回收需求將變得不那麼繁重,成本也將下降,有助於讓電動汽車變得更便宜。「在未來,我們會更換汽車,但不會更換電池;我對此非常有信心。就壽命和循環利用而言,我們甚至還沒有觸及電池時代的表面。」