尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

Should fossil fuel and industrial companies spend billions trying to build new, “cleaner” businesses? Or simply squeeze as much cash as possible from existing operations, even if they are in structural decline? This is one of the defining questions of the decade in many sectors.

化石燃料和工業公司是否應該投入數十億美元嘗試建立新的、更「清潔」的業務?還是應該儘可能從現有業務中榨取現金,即使這些業務正處於結構性衰退中?這是本十年許多行業面臨的關鍵問題之一。

Successful case studies backing up option A are becoming fewer and farther between. The 207-year-old British industrial group Johnson Matthey’s latest transformation shows how well-meaning ideas can turn into expensive misfires — as well as the dangers of becoming a “jam tomorrow” energy transition stock.

支援選項A的成功案例越來越稀少。擁有207年曆史的英國工業集團莊信萬豐(Johnson Matthey)的最新轉型顯示出,儘管初衷良好,但這些想法可能會變成代價高昂的失誤——而且公司有風險成爲「明日果醬」(jam tomorrow, 比喻實現不了的許諾——譯者注)能源轉型股票。

Standard Investments, Johnson Matthey’s largest shareholder, on Monday attacked the group for spending “significant capital” on “unproven” growth businesses. It is not hard to see why the group is coming under pressure: it trades about a fifth lower than rivals on a forward EV/ebitda basis on FactSet data.

莊信萬豐的最大股東Standard Investments週一批評該集團在「未經驗證」的成長業務上花費了「大量資本」。不難看出該集團爲何面臨壓力:根據FactSet的數據,其企業價值倍數(EV/ebitda)比競爭對手低五分之一左右。

Johnson Matthey is known for its catalytic converter business, which is still highly cash generative, despite pressures on the auto sector. Indeed, the company has said the division will generate at least £4.5bn of cash in the decade to 2031, £2bn of which has already been delivered.

莊信萬豐以其催化轉化器業務而聞名,儘管汽車行業面臨壓力,該業務仍然具有很高的現金生成能力。事實上,公司表示,到2031年,該部門將至少產生45億英鎊的現金,其中20億英鎊已經實現。

Trouble is, catalytic converters should — over time — become obsolete as consumers switch from combustion engines. Liam Condon, who took over as chief executive in 2022, has hence pursued a strategy which relies, in part, on a bet that other technologies, such as “clean” hydrogen, will take off.

問題在於,隨著消費者逐漸拋棄內燃機汽車,催化轉化器應該會逐漸過時。利亞姆•康登(Liam Condon)於2022年接任首席執行長,因此他採取了一種戰略,部分依賴於押注其他技術(如「清潔」氫能)將會興起。

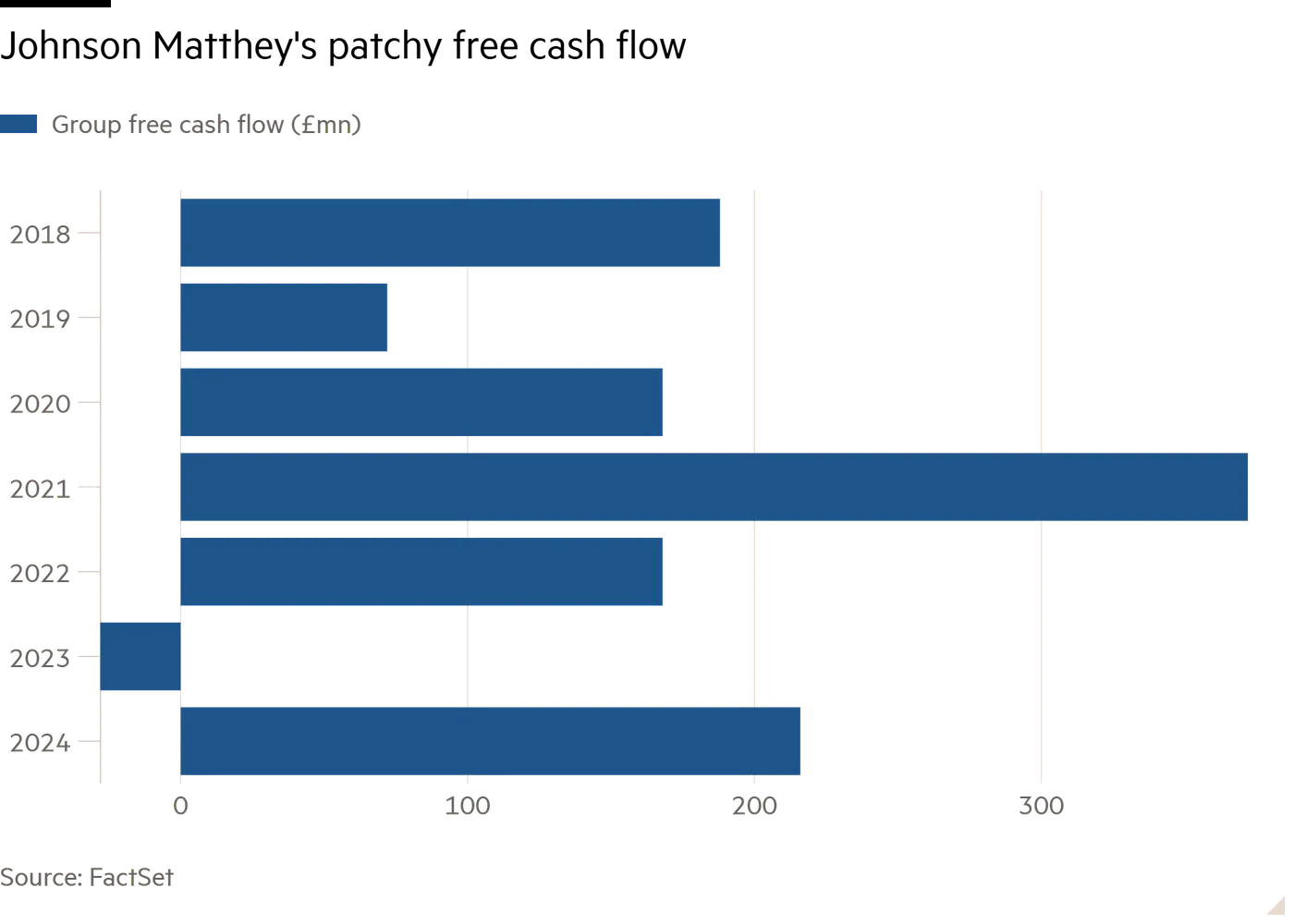

This involves substantial upfront investment. Excluding disposals, Johnson Matthey’s underlying business has since April 1 2021 burnt £135mn of cash, on Standard’s estimates. Growth businesses aren’t solely to blame: Johnson Matthey is also investing in its traditional businesses, including building a more efficient refinery in China for critical materials including platinum.

這涉及到大量的前期投資。根據Standard Investments的估算,自2021年4月1日以來,除去資產處置,莊信萬豐的基礎業務已經消耗了1.35億英鎊的現金。成長型業務並不是唯一的原因:莊信萬豐還在其傳統業務上進行投資,包括在中國建設一個更高效的精煉廠,用於處理包括鉑在內的重要材料。

The hydrogen division — which makes components for fuel cells and electrolysers — has consumed £310mn of cash since the 2022 fiscal year, says Standard. That’s a concern given the clean hydrogen industry is faltering.

Standard Investments表示,自2022財年以來,生產燃料電池和電解槽組件的氫能部門已經消耗了3.1億英鎊的現金。考慮到清潔氫能行業正在衰退,這令人擔憂。

Johnson Matthey may be hoping that shareholders will be willing to wait and see. Already, it has taken steps to stabilise the ship. It has delayed the start of production at a UK hydrogen components factory. Overall group capex, which totalled £1.1bn in the past three years, should reduce to £900mn over the next three. Cash flow generation should stabilise, reckons Panmure Liberum’s Lacie Midgley.

莊信萬豐可能希望股東願意耐心等待。公司已經採取措施來穩定局勢。它推遲了英國一家氫能組件工廠的生產啓動。過去三年,公司總資本支出爲11億英鎊,預計在未來三年將減少到9億英鎊。Panmure Liberum的萊西•米奇利(Lacie Midgley)認爲,現金流的產生應該會穩定下來。

The problem is shareholders have already been burnt by Johnson Matthey’s expensive foray into cathodes for electric vehicle batteries under previous management, which resulted in a £363mn impairment and restructuring charge.

問題在於,莊信萬豐在前任管理層的主管下對電動車電池陰極的昂貴嘗試,已經讓股東們受到損失,這導致了3.63億英鎊的減值和重組費用。

As others such as BP know only too well, patience is wearing thin with “cash tomorrow” energy transition promises — no matter how visionary the strategy.

正如英國石油(BP)等公司的慘痛教訓,人們對「明日現金」式的能源轉型承諾已經失去耐心——無論戰略多麼具有前瞻性。