尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

The market for new listings reheated somewhat in 2024, but has yet to fully crisp up. China’s WH Group hopes it can help: by relisting US pork producer Smithfield Foods. WH ought to keep its expectations lean.

2024年,新上市市場有所回暖,但尚未完全活躍。中國的萬洲國際(WH Group)希望透過重新上市美國豬肉生產商史密斯菲爾德食品(Smithfield Foods)來助力。萬洲國際應保持謹慎的期望。

WH, the world’s biggest pork purveyor, took Virginia-based Smithfield private in 2013. At the time, its $34 a share cash offer valued Smithfield’s equity at $4.7bn and represented a hefty 31 per cent premium over the prior day closing price. Now it is looking to sell up to 20 per cent of the company, and return it to US investors’ portfolios.

全球最大的豬肉供應商萬洲國際於2013年將總部位於維吉尼亞的史密斯菲爾德私有化。當時,其每股34美元的現金報價使史密斯菲爾德的股權估值達到47億美元,相較於前一日的收盤價溢價高達31%。現在,萬洲國際計劃出售公司最多20%的股份,並將其重新納入美國投資者的投資組合中。

Back then, paying top dollars for America’s biggest pork processor might have been justified by expectations that China’s growing middle class — tired of repeated food safety scandals — would stump up for safer American meat products.

當時,爲美國最大的豬肉加工商支付高價可能是合理的,因爲人們期望中國不斷壯大的中產階級——厭倦了頻繁的食品安全醜聞——會願意爲更安全的美國肉類產品買單。

But that narrative didn’t quite pan out. Exports to China took a hit after President Donald Trump’s trade war during his first term prompted Beijing to retaliate with a 25 per cent tariff on all US pork products. A second Trump administration could further inflame this. The Chinese economy’s post-Covid slowdown has emerged as an additional challenge.

但這種說法並未完全實現。在唐納•川普(Donald Trump)總統第一任期內發動的貿易戰後,對中國的出口受到了打擊,北京方面以對所有美國豬肉產品徵收25%的關稅進行報復。川普的第二屆政府可能會進一步加劇這一局面。中國經濟在疫情後的放緩成爲了另一個挑戰。

Culturally, Chinese consumers prefer to buy fresh — rather than frozen — pork, giving an edge to domestic producers. Packaged pork products — like the American-style bacon and lunch meats that make up a big chunk of Smithfield’s sales in the US — never quite took off in China.

從文化上講,中國消費者更喜歡購買新鮮豬肉,而不是冷凍豬肉,這使得國內生產商具有優勢。包裝豬肉產品,如在美國佔史密斯菲爾德銷售很大份額的美式培根和午餐肉,在中國從未真正流行起來。

With little apparent overlap between the two companies, small wonder WH is looking to relist Smithfield in the US again.

由於這兩家公司之間幾乎沒有明顯的重疊,難怪萬洲國際希望再次在美國重新上市史密斯菲爾德。

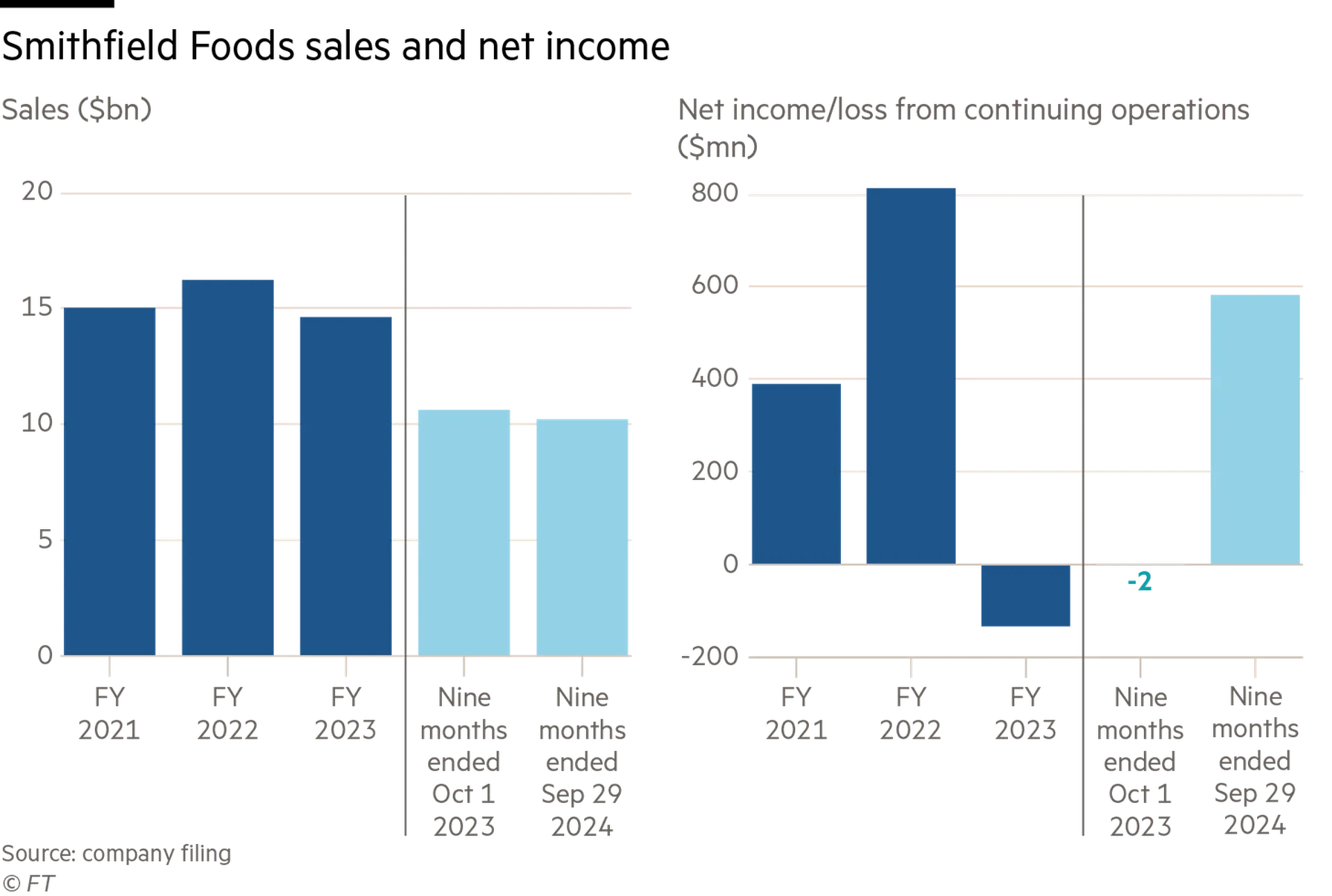

Yet the Smithfield being taken public is geographically smaller than when WH bought it over a decade ago. WH carved out the company’s European operations in August and kept it as one of its subsidiaries. The Smithfield on offer is made up of just the US and Mexico businesses. And performance has been lumpy.

然而,史密斯菲爾德被公開上市時,其地理規模比萬洲國際十多年前收購時要小。萬洲國際在8月份剝離了公司的歐洲業務,並將其保留爲子公司。此次出售的史密斯菲爾德僅包括美國和墨西哥的業務。而且其業績表現一直不穩定。

Smithfield’s packaged meat division is much more profitable than it was in 2014 — its operating margin has more than doubled to 15 per cent in the first nine months of 2024. Yet the similarly sized fresh pork business has a margin of just 3 per cent. Its hog farming division has struggled with high feed prices and oversupply.

史密斯菲爾德的包裝肉類部門比2014年盈利得多——在2024年前九個月,其營業利潤率翻了一倍多,達到15%。然而,規模相似的新鮮豬肉業務利潤率僅爲3%。其養豬部門由於飼料價格高企和供應過剩而舉步維艱。

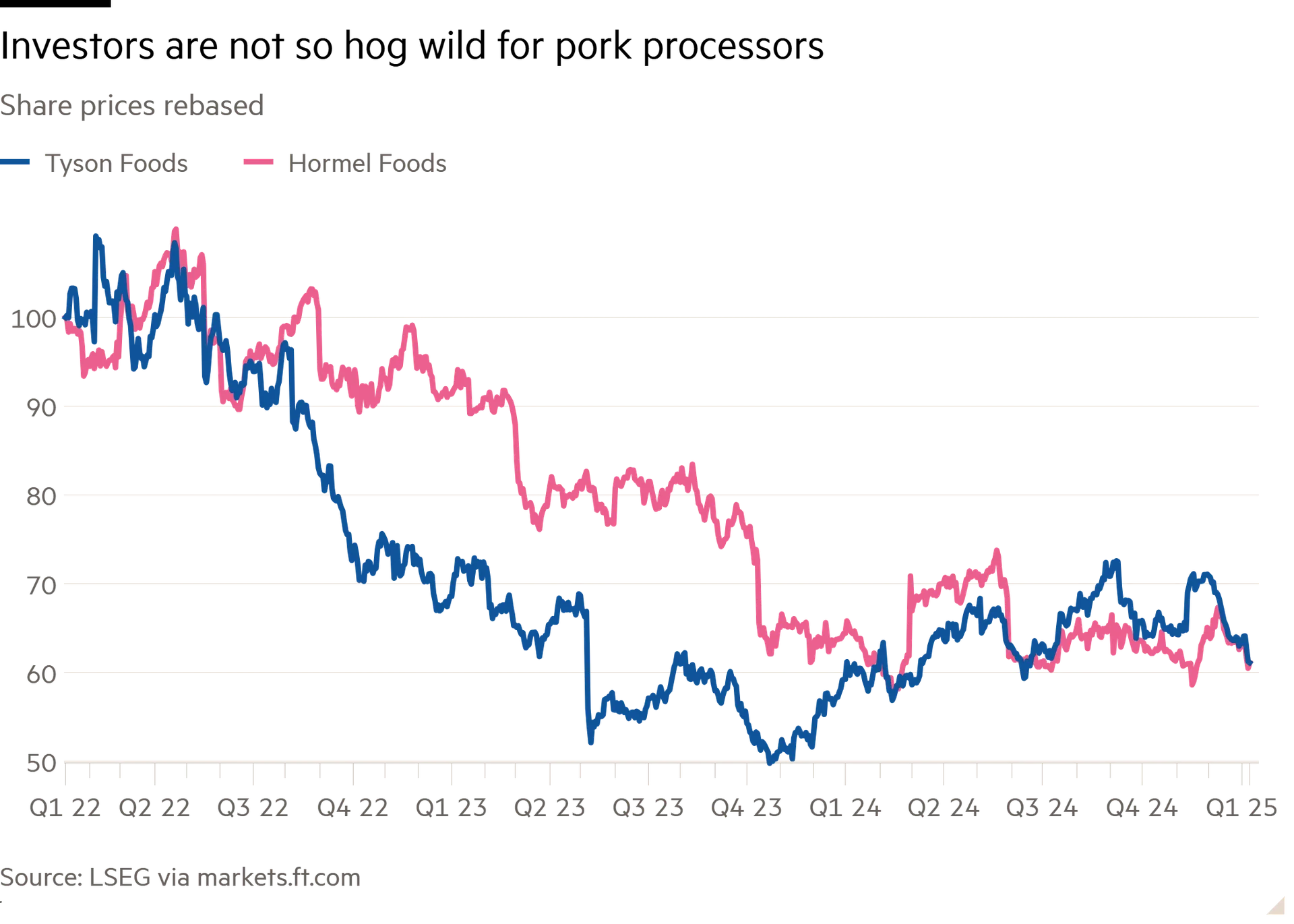

Lower grain costs will help improve the bottom line for 2024. Even so, a pure play on American and Mexican appetite for pork is a tough sell — especially one that will remain controlled by its Chinese parent. Shares in rival meat packers and producers such as Hormel Foods and Tyson Foods have underperformed the wider market. Brazilian meat giant JBS’s plans for a US listing have suffered repeated delays.

較低的穀物成本將有助於改善2024年的盈利狀況。即便如此,單靠美國和墨西哥對豬肉的需求仍然難以吸引投資者,尤其是那些仍由中國母公司控制的公司。荷美爾食品公司(Hormel Foods)和泰森食品公司(Tyson Foods)等競爭對手的肉類包裝商和生產商的股價表現均低於大盤。巴西肉類巨擘JBS在美國上市的計劃一再推遲。

In a market that has gone wild for artificial intelligence and speculative technologies, Smithfield is at least serving a familiar business model that customers and investors can get their teeth into. Its valuation will just need to reflect that reheated bacon isn’t to everyone’s taste.

在一個對人工智慧和投機技術狂熱的市場中,史密斯菲爾德至少提供了一種客戶和投資者都能深入瞭解的熟悉商業模式。其估值只需反映出重新加熱的培根並不符合所有人的口味。