尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

In March, Phillip Swagel, director of the US Congress’s independent fiscal watchdog, told the Financial Times that America risked a Liz Truss-style market shock with its soaring debt pile. His reference to the former British prime minister’s “mini” Budget in September 2022 — which led to a sudden surge in UK government bond yields and ructions across financial markets — was an attempt to fend off complacency, rather than a warning of imminent implosion.

今年3月,美國國會獨立財政監督機構負責人菲利普•斯瓦格爾(Phillip Swagel)向英國《金融時報》表示,美國不斷飆升的債務規模可能會引發利茲•特拉斯(Liz truss)式的市場衝擊。他提到這位英國前首相在2022年9月提出的「迷你」預算——該預算導致英國政府債券收益率突然飆升,並在金融市場引發動盪——是爲了避免自滿情緒,而不是警告即將崩盤。

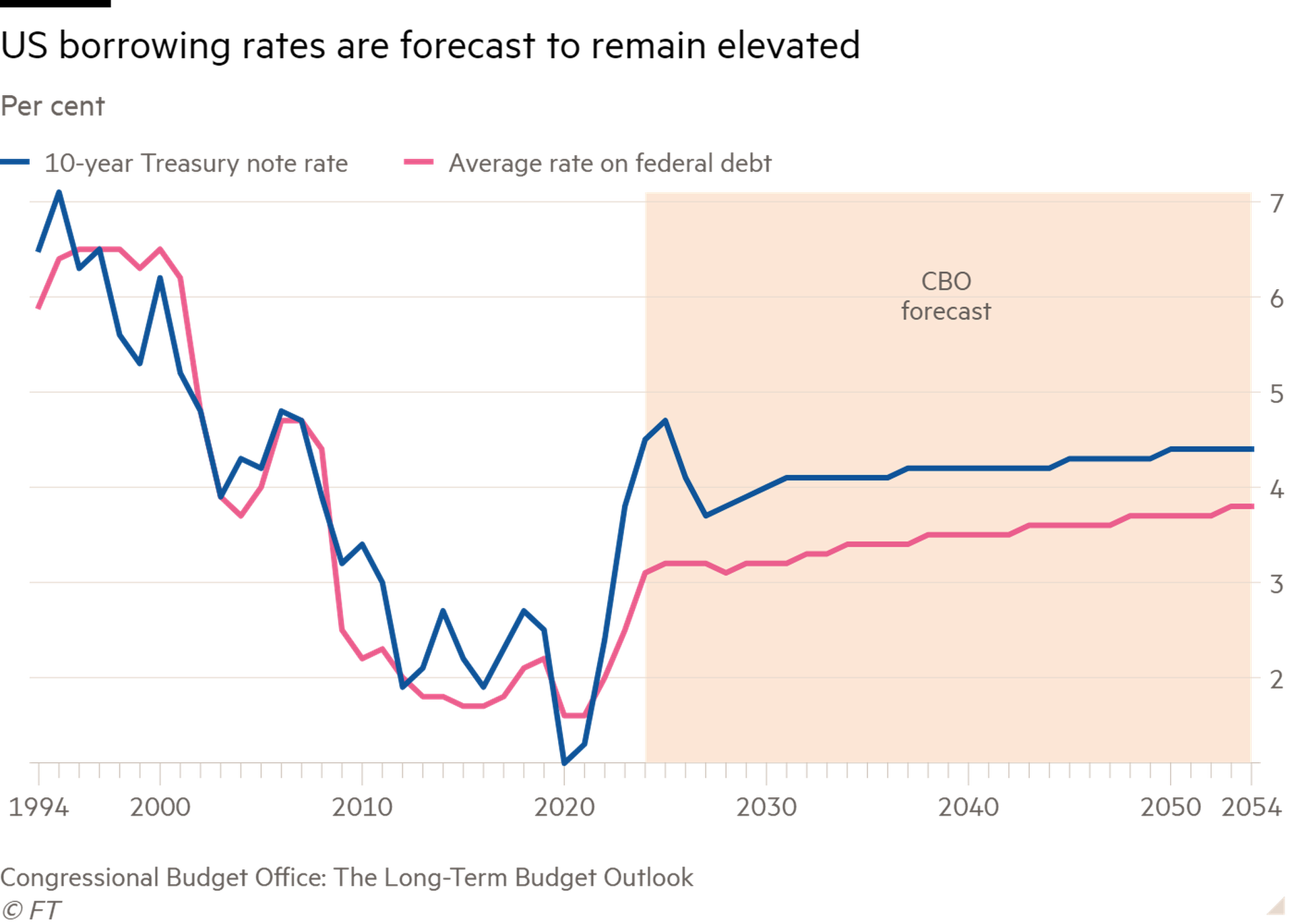

Swagel is right to sound the alarm. America’s debt is on an unsustainable path. The Congressional Budget Office projects America’s debt-to-GDP ratio will surpass its second world war high of 106 per cent by the end of the decade, and keep rising. The total deficit is forecast to average 5.5 per cent of GDP until 2030 — about 2 percentage points higher than the post-1940 mean. Net interest payments, which are currently around 3 per cent of GDP, are expected to keep creeping upward too.

斯瓦格敲響警鐘是正確的。美國的債務正在走上一條不可持續的道路。美國國會預算辦公室預計,到本十年末,美國的債務與國內生產總值之比將超過二戰時106%的高點,並將持續上升。預計到2030年,赤字總額將平均佔國內生產總值的5.5%,比1940年後的平均值高出約2個百分點。目前約佔國內生產總值3%的淨利息支出,預計也將繼續緩慢上升。

Politics is an aggravating factor. Both the Democrats and Republicans heed the importance of fiscal responsibility in theory, but neither is prepared to tighten belts, particularly in an election year. Joe Biden proposed a $7.3tn budget plan for 2025. His presidential rival, Donald Trump, has vowed to renew tax cuts enacted during his time in the White House, which could add another $5tn to the nation’s debt, according to the Committee for a Responsible Federal Budget, a think-tank.

政治是一個加劇因素。民主黨和共和黨在理論上都重視財政責任的重要性,但都不準備勒緊腰帶,尤其是在選舉年。喬•拜登爲2025年提出了73億美元的預算計劃。他的總統大選競爭對手唐納•川普(Donald Trump)誓言要延續自己在白宮期間實施的減稅政策,根據智庫負責任聯邦預算委員會(Committee for a Responsible Federal Budget)的數據,這可能會使美國的債務再增加5兆美元。

America’s growing debt puts upward pressure on its longer-term borrowing costs. Lax fiscal policy can raise inflation expectations and the perceived risk of holding debt for long periods. The hefty pipeline of debt issuance will also need to be absorbed by more price-sensitive investors, with the Fed now engaging in quantitative tightening.

美國不斷成長的債務給其長期借貸成本造成了上行壓力。寬鬆的財政政策會提高通膨預期和長期持有債務的感知風險。由於美聯準目前正在實施量化緊縮,大量即將發行的債券也需要由對價格更加敏感的投資者來消化。

Elevated yields raise the cost of borrowing and could undermine economic growth. There is an increased vulnerability to rapid and disruptive movements in US bond markets. This has knock-on effects for credit and financial stability abroad too, since US Treasuries act as a benchmark for pricing debt globally. IMF research suggests that a 1 percentage point spike in US rates led to a 90 basis point rise in other advanced economies’ bond yields, and an increase in emerging markets of 1 percentage point. Restraints on domestic and global growth will only heighten the debt reduction challenge.

收益率上升會提高借貸成本,並可能破壞經濟成長。美國債券市場更容易受到快速和破壞性波動的影響。由於美國國債是全球債務定價的基準,這也會對國外的信貸和金融穩定產生連鎖效應。國際貨幣基金組織的研究表明,美國債券收益率每飆升1個百分點,就會導致其他發達經濟體債券收益率上升90個基點,新興市場債券收益率上升1個百分點。國內和全球成長受到的限制只會加劇削減債務的挑戰。

America’s economic heft gives it substantial leeway. The dollar’s role as the international reserve currency means demand for US debt is ever-present, and AI-driven productivity growth could indeed help lessen its debt problems. But the country’s global influence may foster a dangerous complacency among its politicians. Ignoring the difficult tax and spending decisions needed to put debt on a more sustainable footing keeps the economy on a risky path amid political and economic uncertainty.

美國的經濟實力給了它很大的迴旋餘地。美元作爲國際儲備貨幣的角色意味著,對美國債務的需求始終存在,而人工智慧推動的生產率成長確實可能有助於緩解美國的債務問題。但該國的全球影響力可能會在其政客中滋生一種危險的自滿情緒。面對政治和經濟不確定性,忽視將債務置於更可持續基礎上所需的艱難的稅收和支出決策,會讓經濟走上一條危險的道路。

For instance, another Trump presidency would come with significant unknowns. Reports that his team is drawing up proposals to water down the Fed’s independence are deeply worrying for inflation control. A well-behaved bond market hinges on clarity and confidence in government policy — as Truss could attest. Rising geopolitical instability and risks in financial markets, from private capital to liquidity problems in Treasury markets, are also exposures. Shocks could damp growth and drive harmful spikes in yields, making debt dynamics even worse.

例如,川普再次擔任總統將帶來巨大的未知數。有報導稱,他的團隊正在起草削弱美聯準獨立性的提案,這讓人對通膨控制深感擔憂。一個表現良好的債券市場取決於政府政策的明確性和信心——特拉斯可以證明這一點。地緣政治不穩定的加劇和金融市場的風險,從私人資本到美國國債市場的流動性問題,也都是風險。衝擊可能會抑制經濟成長並導致收益率出現有害的飆升,使債務動態更加惡化。

Sooner or later policymakers need to engage in bipartisan efforts to think seriously about how America funds itself responsibly. If not, panicked bond traders may force them to. As the IMF chief economist, Pierre-Olivier Gourinchas, said last month: “Something will have to give.”

遲早政策制定者需要進行跨黨派努力,認真思考美國如何負責地爲自己籌資。否則,陷入恐慌的債券交易員可能會迫使他們這樣做。正如國際貨幣基金組織首席經濟學家Pierre-Olivier Gourinchas上個月所說:「有些東西必須要放棄。」