尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

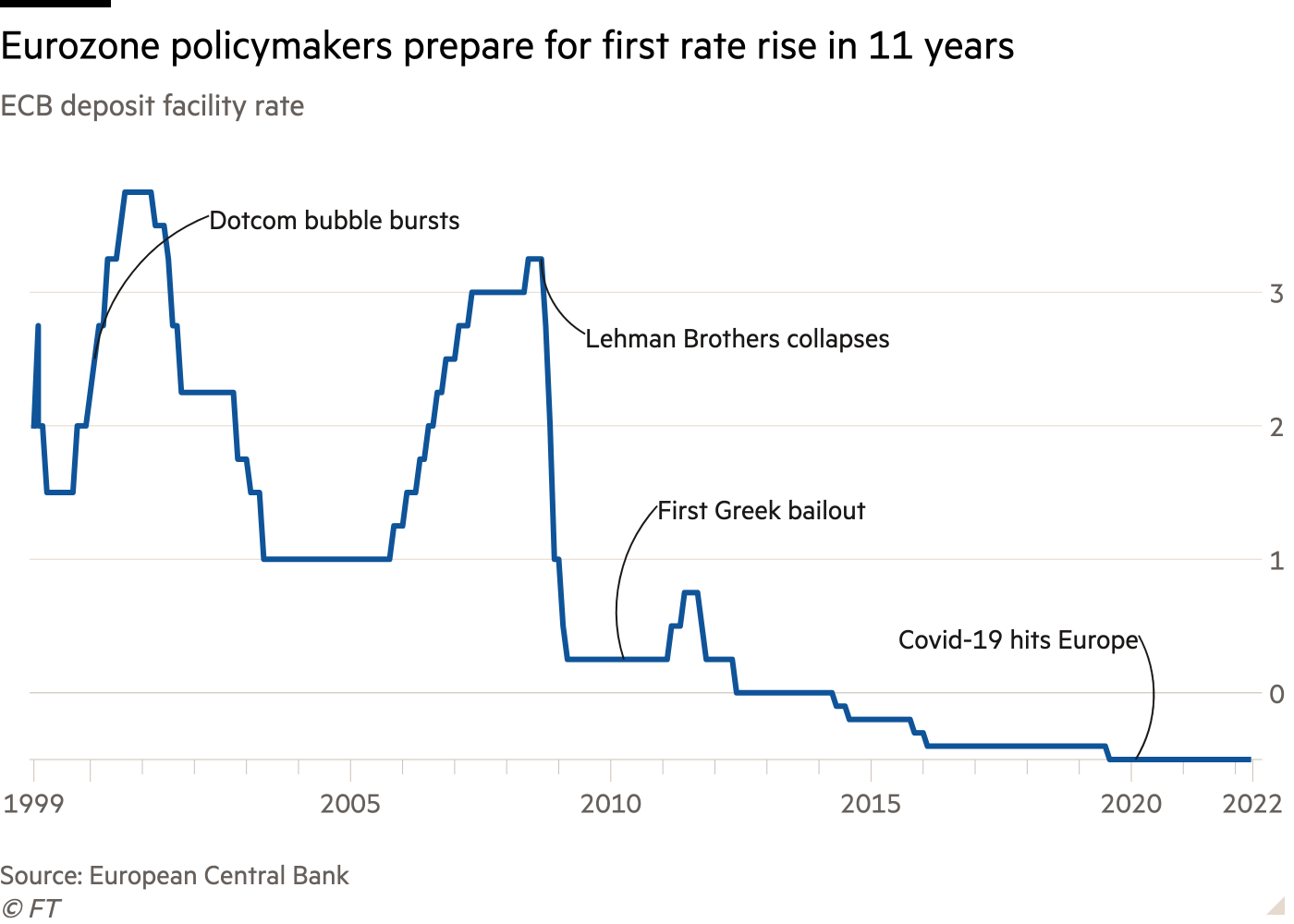

The last time the European Central Bank raised interest rates in 2011 it was forced to reverse the move within months as the eurozone was plunged into a wrenching debt crisis. The market panic that followed only subsided after Mario Draghi, then head of the ECB, declared it would do “whatever it takes” to save the euro.

歐洲央行上一次加息是在2011年,該行被迫在幾個月內改變了做法,因爲當時歐元區陷入了嚴重的債務危機。在時任歐洲央行行長馬里奧•德拉吉(Mario Draghi)宣佈將「不惜一切代價」拯救歐元之後,隨之而來的市場恐慌纔有所平息。

Fears of a similar outcome are front of mind for many as current president Christine Lagarde prepares the ECB’s first rate rise in 11 years. The move, to be announced on Thursday, will come alongside a new bond-buying plan that the central bank hopes will prevent rising borrowing costs from sparking another eurozone debt meltdown.

在現任歐洲央行行長克里斯蒂娜•拉加德(Christine Lagarde)準備進行歐洲央行11年來的首次加息之際,對類似結果的擔憂已縈繞在許多人的心頭。在週四宣佈這一舉措的同時,歐洲央行還將推出一項新的債券購買計劃,希望該計劃能防止借貸成本上升引發另一場歐元區債務危機。

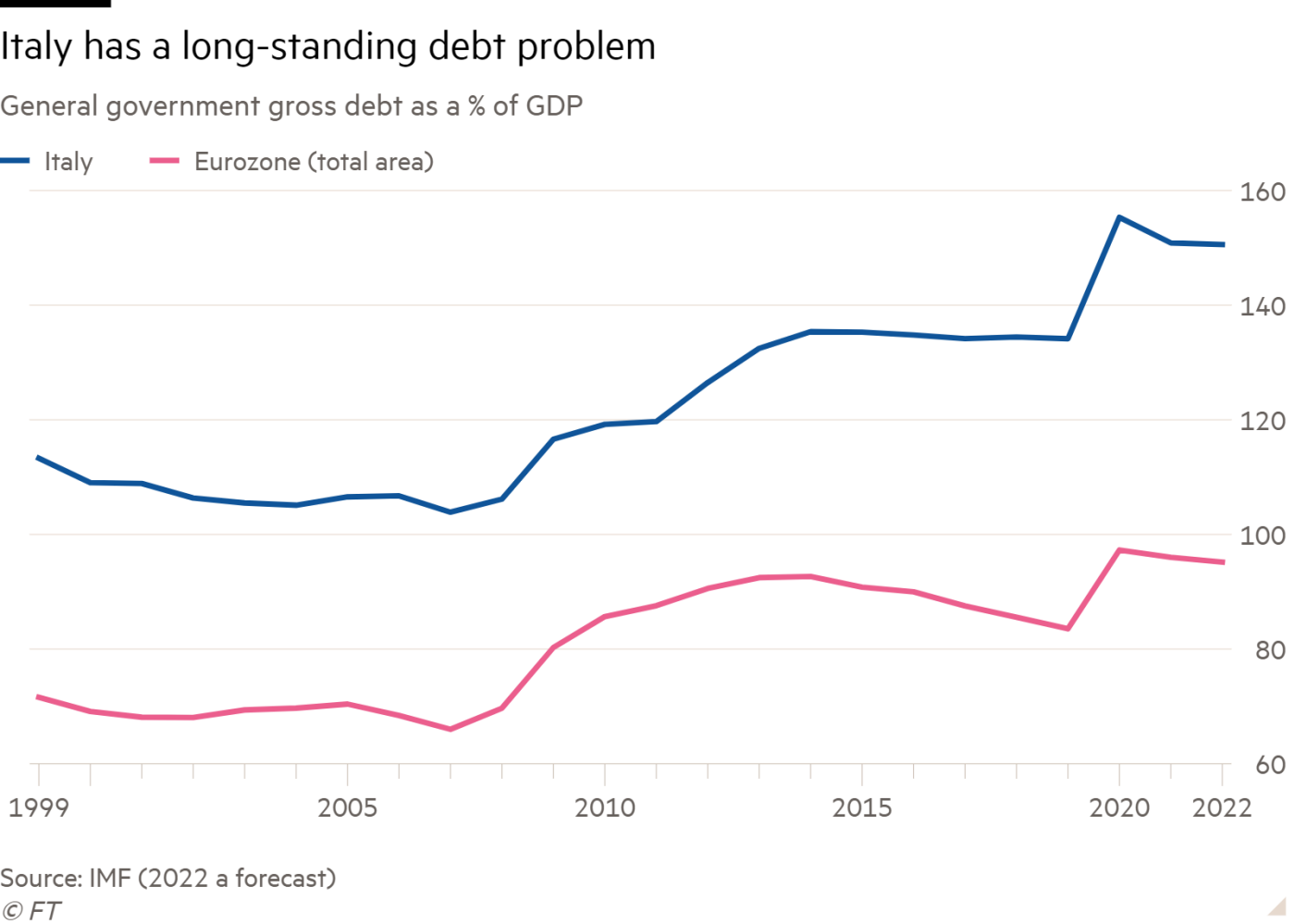

Draghi, who left the ECB in 2019 and became the Italian prime minister last year, seems bound to play a pivotal role once more as he prepares to address parliament in Rome on Wednesday, only days after his ruling coalition splintered. This has fuelled speculation about an early Italian election this year, which could shake investors’ confidence in the country’s ability to manage its swollen public debt that now stands at more than 150 per cent of gross domestic product.

德拉吉於2019年離開歐洲央行,去年出任義大利總理。在他準備於週三在羅馬向議會發表講話之際,他似乎註定要再次發揮關鍵作用。就在幾天前,他領導的執政聯盟出現分裂。這引發了有關義大利今年將提前舉行大選的猜測,這可能動搖投資者對該國管理龐大公共債務能力的信心。目前義大利公共債務與國內生產總值(GDP)之比已超過150%。

As well as political upheaval in Italy, economists also worry about a growing energy crisis in Germany, where officials are nervously waiting to find out if Russia will turn the gas back on this Thursday after a scheduled 10-day maintenance period for one of its main pipelines to Europe. If the gas does not flow or if there are further delays in winter, several EU countries that rely on it are set to impose energy rationing, starting with heavy industrial users, which is likely to trigger a severe economic downturn across the bloc.

除了義大利的政治動盪之外,經濟學家還擔心德國日益加劇的能源危機。德國官員正緊張地等待著,看俄羅斯是否會在本週四重啓輸往歐洲的一條主要管道。先前,按照計劃,俄羅斯的一條輸往歐洲的天然氣管道進行了爲期10天的維護。如果天然氣無法輸送,或者在冬季進一步推遲供應,幾個依賴天然氣的歐盟國家將從重工業用戶開始實行能源配給,這可能會引發整個歐盟的嚴重經濟衰退。

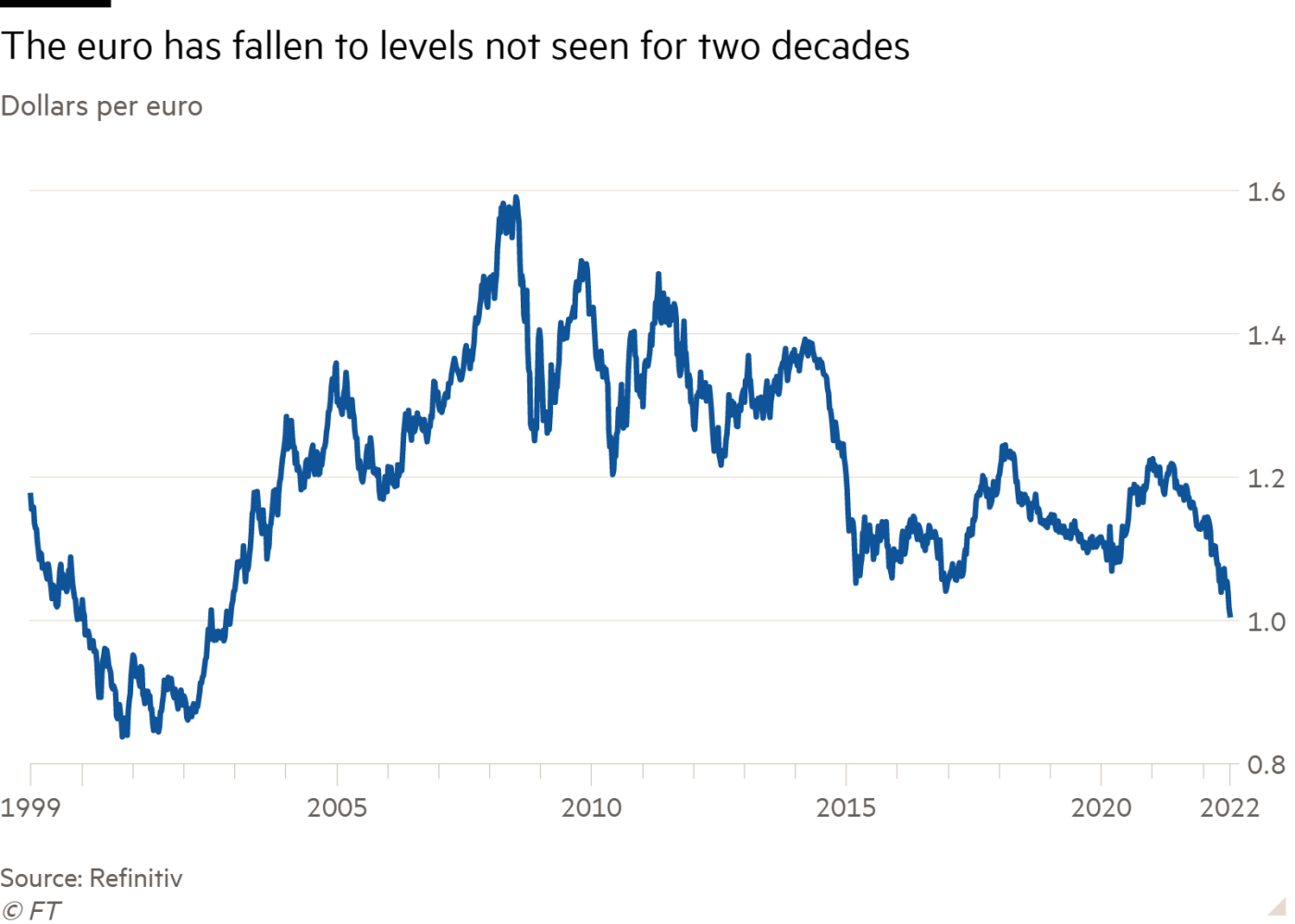

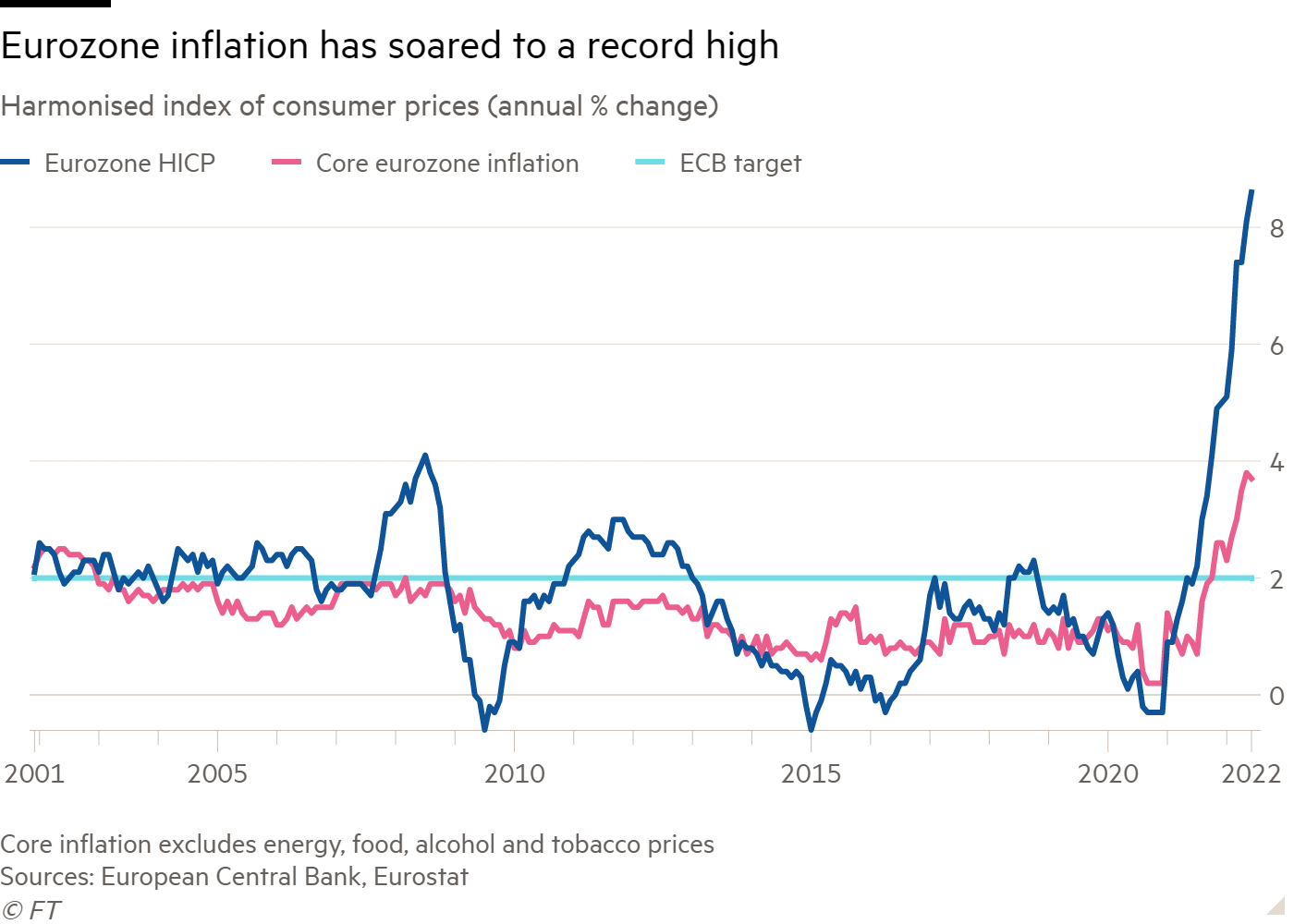

The worsening outlook is reflected in last week’s sharp fall in the euro below the value of the US dollar for the first time in 20 years. Yet the ECB has little choice but to start raising rates after inflation in the bloc surged to a record high of 8.6 per cent in the year to June, more than quadruple its target.

上週,歐元兌美元匯率的大幅下跌就反映了這種日益惡化的前景,這是歐元對美元20年來首次跌破平價。然而,歐洲央行別無選擇,只能開始加息,原因是,在截至今年6月的一年裏,歐元區通膨率飆升至8.6%的創紀錄高點,是其目標的四倍多。

“The risk ahead of us is that because of the energy crisis, the euro area could end up in recession, while at the same time the ECB will have to keep raising interest rates if inflation does not come down,” says Maria Demertzis, deputy head of the Brussels-based Bruegel think-tank. “It is an almost impossible situation.”

「擺在我們面前的風險是,由於能源危機,歐元區可能最終陷入衰退,而與此同時,如果通膨不降下來,歐洲央行將不得不繼續加息,」位於布魯塞爾的智庫Bruegel的副總裁瑪麗亞•德默茨(Maria Demertzis)表示。「這幾乎是一個不可能解決的局面。」

‘Too slow and too late’

「太慢也太遲了」

The ECB is grappling with more complex challenges than most major central banks. The eurozone is bearing the brunt of the fallout from Russia’s invasion of Ukraine. The war is driving up energy and food prices and fuelling political instability, while the risk of a fresh eurozone debt crisis is never far away due to the incomplete nature of its monetary union with different countries having separate budgets and bond markets.

與大多數主要央行相比,歐洲央行正在應對更爲複雜的挑戰。歐元區正承受著俄羅斯入侵烏克蘭的衝擊。這場戰爭推高了能源和食品價格,加劇了政治不穩定,而由於歐元區貨幣聯盟並不完整——不同國家擁有不同的預算和單獨的債券市場——歐元區爆發新的債務危機的風險從未遠離。

In these volatile circumstances, Lagarde has said the central bank intends to normalise policy “gradually” starting with a quarter point rise in its deposit rate to minus 0.25 per cent on Thursday ahead of a bigger rise above zero in September if price growth remains high.

在這種動盪的環境下,拉加德表示,歐洲央行打算「逐步」實現政策正常化,首先在週四將存款利率上調25個基點,至-0.25%,如果物價成長仍處於高位,9月份將更大幅度上調至高於零的水準。

The ECB has acted more cautiously than the Federal Reserve, which has already raised US rates three times and is next week expected to raise them again by at least three-quarters of a percentage point. The IMF said that over the past year 75 of the 100 central banks it tracks have raised rates on average almost four times each, by 3 percentage points in emerging markets and 1.7 points in advanced economies.

歐洲央行的行動比美聯準更爲謹慎。美聯準已三次上調美國的利率,預計將在下週再次加息至少0.75個百分點。國際貨幣基金組織(IMF)表示,過去一年,在其追蹤的100家央行中,有75家央行平均每家加息近4次,其中新興市場加息3個百分點,發達經濟體加息1.7個百分點。

Many believe the ECB is being too timid to curb inflation, which hit double-digit figures in nine out of the 19 eurozone countries in June. “The very gradual and cautious normalisation process the ECB started at the end of last year has simply been too slow and too late,” says Carsten Brzeski, head of macro research at Dutch bank ING.

許多人認爲,歐洲央行在抑制通膨方面過於膽怯。今年6月,歐元區19個國家中有9個的通膨率達到了兩位數。荷蘭國際集團(ING)宏觀研究主管卡斯滕•布爾澤斯基(Carsten Brzeski)表示:「歐洲央行去年年底啓動的非常漸進和謹慎的正常化進程,實在太慢也太遲了。」

Some members of the ECB’s rate-setting governing council — notably those in Baltic countries where inflation is close to 20 per cent — have broken ranks to call for a more aggressive half-point rate rise on Thursday.

歐洲央行負責制定利率的管理委員會的一些成員——尤其是那些通膨率接近20%的波羅的海國家的成員——週四打破傳統,呼籲更激進地加息50個基點。

“It is like antibiotics, it doesn’t help if you take them in September if you are ill now,” says one of the more hawkish ECB council members. “Interest rates are our medicine and the timing and size of the dosage are of utmost importance.”

「這就像抗生素,如果你現在生病了,在9月份服用是沒有用的,」一位較爲鷹派的歐洲央行理事會成員表示。「利率是我們的良藥,用藥的時機和劑量至關重要。」

Up to now, the eurozone economy has been relatively resilient, with retail sales and industrial production remaining above last year’s levels, while the lifting of Covid-19 restrictions has boosted summer travel and tourism.

截至目前,歐元區經濟相對有韌性,零售和工業生產仍高於去年水準,而新冠肺炎限制的解除促進了夏季旅遊和旅遊業。

But economists expect high prices to erode the spending power of European households and weigh on industrial output as companies reduce production.

但經濟學家預計,高物價將削弱歐洲家庭的購買力,並在企業減產之際打壓工業產出。

“If you are a company and gas is an essential input for production, you are probably going to [have started to] produce less already in anticipation of possible supply disruptions,” says Spyros Andreopoulos, senior European economist at French bank BNP Paribas. “We are already seeing signs of this starting to happen.”

法國巴黎銀行(BNP Paribas)高級歐洲經濟學家Spyros Andreopoulos表示:「如果你是一家公司,而天然氣是生產的重要投入,你很可能(已經開始)減少產量,因爲你預計供應可能會中斷。我們已經看到這種情況開始發生的跡象。」

Economists at Germany’s Deutsche Bank estimate the skyrocketing price of imported energy and food will deliver a €400bn negative hit to the eurozone’s balance of trade this year. This is already draining confidence among consumers and businesses, which points to a likely downturn later this year, especially as the US and Chinese economies are already slowing sharply.

德國德意志銀行(Deutsche Bank)經濟學家估計,進口能源和食品價格飆升,將給歐元區今年的貿易平衡帶來4000億歐元的負面影響。這已經削弱了消費者和企業的信心,預示著今年晚些時候可能會出現低迷,尤其是在美國和中國經濟已經大幅放緩的情況下。

But the single biggest thing keeping senior ECB officials awake at night is the fear that Russia is weaponising its energy exports to press for an advantage in its invasion of Ukraine by increasing the economic pain for Europe.

但讓歐洲央行高級官員夜不能寐的最大的一件事是,他們擔心俄羅斯正在將其能源出口武器化,透過加大歐洲遭遇的經濟陣痛,來爭取在入侵烏克蘭的行動中佔據優勢。

“The dependency of European countries — and the euro area is a case in point — on external supplies from foes, has had a major impact on prices,” Lagarde said in June. “That could contribute to inflation directly — if it leads to further rises in energy costs — or indirectly, if a higher level of energy prices makes some production uneconomic and leads to a durable loss of economic capacity.”

拉加德今年6月表示:「歐洲國家——歐元區就是一個典型的例子——對來自對手的外部供應的依賴,對價格產生了重大影響。」如果能源價格進一步上漲,這將直接導致通貨膨脹;而如果能源價格上漲使一些生產變得不經濟,並導致經濟產能的持久損失,這將間接導致通貨膨脹。」

Sven Jari Stehn, chief European economist at US investment bank Goldman Sachs, says eurozone inflation is likely to peak above 10 per cent in September. But if Russian gas flows stopped completely, he warns “the risks are skewed towards a sharp contraction and even higher inflation”, adding the eurozone economy would keep shrinking until the second quarter of next year in these circumstances.

美國投行高盛(Goldman Sachs)首席歐洲經濟學家斯文•賈裏•斯特恩(Sven Jari Stehn)表示,歐元區通膨率可能會在9月份達到10%以上的峯值。但他警告稱,如果俄羅斯的天然氣供應完全停止,「可能會出現急劇收縮和更高的通膨」。他補充稱,在這種情況下,歐元區經濟將持續收縮,直到明年第二季度。

“It is a nightmare scenario for economic policymakers,” says Lars Feld, an economics professor at the Albert Ludwigs University of Freiburg, who advises the German finance minister. “It is more difficult than in the 2012 debt crisis, when we had a clear choice between monetary policy or fiscal policy solutions, but now both are much less clear.”

「對經濟政策制定者來說,這是一場噩夢,」弗萊堡阿爾伯特•路德威格斯大學(Albert ludwig University of Freiburg)經濟學教授拉爾斯•費爾德(Lars Feld)說。他是德國財政部長的顧問。「現在比2012年債務危機時更困難,當時我們可以在貨幣政策或財政政策解決方案之間做出明確選擇,但現在兩者都不那麼明確了。」

Living with the ghosts of the debt crisis

與債務危機的幽靈共存

As long as inflation continues to rise, the ECB is expected to keep raising rates even if the economy starts to nosedive, while higher borrowing costs will make it harder for governments to spend more on shielding their citizens from the soaring cost of living. This is fuelling political tensions across Europe.

只要通貨膨脹繼續上升,歐洲央行預計將繼續加息,即使經濟開始暴跌,而更高的借貸成本將使政府更難花更多的錢來保護其公民免受飆升的生活成本的影響。這加劇了歐洲各地的政治緊張局勢。

Public anger over surging energy and food prices played a key role in the fracturing of Draghi’s ruling coalition in Italy, which resulted in him offering his resignation — only to have it turned down by the president. High inflation also eroded support for French president Emmanuel Macron and contributed to his failure to win a parliamentary majority in elections in June.

公衆對能源和食品價格飆升的憤怒在德拉吉領導的義大利執政聯盟破裂中發揮了關鍵作用,導致他提出辭職,但卻被總統拒絕。高通膨也削弱了法國總統埃馬紐埃爾•馬克宏(Emmanuel Macron)的支援率,導致他未能在6月份的選舉中贏得議會多數席位。

“I fear political instability in Europe, in Italy and, of course, in France,” says Vítor Constâncio, former vice-president of the ECB who is now economics professor at the University of Navarra in Madrid. “If Macron has problems approving the budget next year there could be elections in France and the prospect of an Italian election is also a complicating factor, no doubt.”

歐洲央行前副行長、現任馬德里納瓦拉大學(University of Navarra)經濟學教授的Vítor Constâncio表示:「我擔心歐洲、義大利、當然還有法國的政治不穩定。如果馬克宏在批准明年的預算方面有問題,法國可能會舉行選舉,毫無疑問,義大利選舉的前景也是一個使問題更復雜的因素。」

Borrowing costs are already rising faster for heavily indebted southern European countries, such as Italy, than for some of their more fiscally solid northern counterparts, recalling the demons of the sovereign debt crisis that nearly ripped the eurozone apart a decade ago.

義大利等債臺高築的南歐國家,其借貸成本的上升速度已經快於一些財政狀況更爲穩固的北歐國家,這讓人想起了10年前幾乎撕裂歐元區的主權債務危機的惡魔。

This is an uncomfortable reminder for the ECB that, unlike the Fed or the Bank of England, it sets monetary policy for 19 different countries, each with its own budget and — crucially — bond market. That leaves the single currency vulnerable to a divergence in borrowing costs between countries which can test the sustainability of national debt levels.

這令人不安地提醒歐洲央行,與美聯準或英國央行不同,歐洲央行爲19個不同的國家制定貨幣政策,每個國家都有自己的預算,最關鍵的是,還有各自的債券市場。這使得歐元很容易受到各國借貸成本差異的影響,這可能會考驗各國債務水準的可持續性。

“Of course you always have this general risk of a crisis in the periphery of the euro area playing out in the background,” says Dirk Schumacher, head of Europe macro research at French bank Natixis. “It is something the Fed doesn’t have to deal with.”

法國外貿銀行(Natixis)歐洲宏觀研究主管德克•舒馬赫(Dirk Schumacher)表示:「當然,總有這種歐元區外圍國家爆發危機的普遍風險在幕後上演。這是美聯準不必處理的事情。」

In response, the ECB is expected to announce that it will tackle any unwarranted divergence in a country’s bond yields by buying its bonds using a new scheme it calls the transmission protection mechanism.

作爲回應,預計歐洲央行將宣佈,它將使用一種名爲「傳導保護機制」(transmission protection mechanism)的新機制購買一國債券,以解決該國債券收益率出現任何不必要的背離。

Unlike the yield curve control policy of Japan’s central bank, which is buying as many bonds as needed to cap the country’s borrowing costs at a fixed level, the ECB is unlikely to target a specific bond yield for each nation and will instead use its judgment on when to intervene.

日本央行採取收益率曲線控制政策,日本央行會購買儘可能多的債券,以將該國的借貸成本限制在一個固定水準。與之不同的是,歐洲央行不太可能針對每個國家制定特定的債券收益率目標,而是會根據自己的判斷來決定何時干預。

That has sparked worries, particularly in more frugal countries such as Germany and the Netherlands, that the ECB will encourage fiscal profligacy among member states and stray into “monetary financing” of governments — the printing of money by a central bank to prop up a country’s budget — which is against the EU treaty.

這引發了人們的擔憂,尤其是在德國和荷蘭等更爲節儉的國家,人們擔心歐洲央行將鼓勵成員國的財政揮霍,並錯誤地進行政府「貨幣融資」——由一家央行印製鈔票以支撐一國預算——這違反了歐盟條約。

“Distinguishing what is political risk from market speculation empirically is impossible,” says Feld, the former chair of Germany’s council of economic experts. “The market pricing will have some disciplining effect on political decisions and we should let it work.”

德國經濟專家委員會前主席費爾德表示:「從經驗上講,不可能區分什麼是政治風險,什麼是市場投機。市場定價將對政治決策產生一定的約束作用,我們應該讓它發揮作用。」

Watching for market disruptions

留意市場動盪

The mounting anxiety in EU capitals over how best to respond to the punishing combination of rising prices and slumping growth is clear. While not forecasting a recession, the European Commission last week downgraded growth estimates and sharply increased predictions for inflation, which is now tipped to hit 7.6 per cent in the euro area this year and remain at twice the ECB’s 2 per cent target in 2023.

很明顯,歐盟各國政府對於如何最好地應對物價上漲和經濟成長下滑的雙重打擊越來越焦慮。儘管歐盟委員會(European Commission)預計不會出現衰退,但它上週下調了對經濟成長的預期,並大幅上調了對通膨的預期。目前,歐元區的通膨預期有望達到7.6%,並將在2023年維持在兩倍於歐洲央行2%目標的水準。

Draft commission proposals, due for release this week, would limit energy usage in public buildings, as it scrambles for ways of conserving gas given the threats from Moscow.

定於本週公佈的歐盟委員會提案草案,將限制公共建築的能源使用。考慮到來自莫斯科的威脅,該委員會正在努力尋找節約天然氣的方法。

Officials are blunt about the economic headwinds facing Europe. Klaus Regling, head of the European Stability Mechanism bailout fund, last week warned that while the economy and consumers were under “massive strain”, markets are facing greater volatility given the combination of higher inflation and interest rates — something many traders have never experienced in their professional lives.

官員們對歐洲面臨的經濟逆風直言不諱。歐洲穩定機制(European Stability Mechanism)救助基金負責人克勞斯•雷格林(Klaus Regling)上週警告稱,儘管經濟和消費者承受著「巨大壓力」,但鑑於通膨和利率的上升,市場正面臨更大的波動——這是許多交易員在職業生涯中從未經歷過的。

That does not mean we are facing a new “euro crisis”, insists Regling — a sentiment echoed by Paschal Donohoe, the eurogroup president, who has repeatedly stressed the stronger institutional set-up that the euro area enjoys today compared with a decade ago.

雷格林堅稱,這並不意味著我們正面臨一場新的「歐元危機」。歐元集團主席帕斯卡•多諾霍(Paschal Donohoe)也認同這一觀點。多諾霍曾多次強調,與10年前相比,歐元區如今享有更強大的制度架構。

Nevertheless, the dangers of a sudden loss of market confidence are hanging heavily over officials’ planning — with Italy front and centre of their concerns.

然而,市場信心突然喪失的危險正嚴重籠罩著官員們的計劃——義大利是他們最關心的問題。

The eurogroup last week discussed the creation of an informal task force of officials to monitor the markets during the summer break — a period in which low liquidity and thinly staffed trading floors can give rise to disruptive movements in bond yields and stock markets. The group will scan for emerging market hazards and have the power to convene policymakers if trouble erupts, according to people familiar with the plans.

歐元集團上週討論成立一個由官員組成的非正式特別工作組,在暑假期間監控市場。在暑假期間,低流動性和人手不足的交易大廳可能會引發債券收益率和股市的破壞性波動。知情人士稱,該組織將搜尋新興市場的風險,並有權在問題爆發時召集政策制定者。

The search for closer co-ordination between institutions and member states speaks to a broader concern among finance ministries — namely the risk of disjointed or contradictory action by different member states that ends up eroding, rather than shoring up, market confidence.

各機構與成員國之間尋求更密切的合作,反映出各國財政部更廣泛的擔憂——即不同成員國採取不連貫或相互矛盾的行動的風險,最終可能削弱、而非支撐市場信心。

Emerging from a meeting in Brussels last Tuesday, Sigrid Kaag, the Dutch finance minister, stressed the need for unity among the currency union’s capitals, warning: “Everyone is struggling with the same issues, and if a recession is looming . . . I think we need to meet and converge around the same choices”.

荷蘭財長西格麗德•卡格(Sigrid Kaag)上週二在布魯塞爾出席會議後,強調了歐元區各國政府團結一致的必要性,並警告稱:「每個國家都在努力解決同樣的問題,如果衰退即將到來……我認爲我們需要在相同的選擇上達成一致。」

The 19 eurozone finance ministers say they have already agreed not to boost demand via extra borrowing next year, to ensure they don’t further stoke inflationary pressures.

歐元區19國財長表示,他們已經同意明年不再透過額外舉債來提振需求,以確保不會進一步加劇通膨壓力。

Holding a clear agreed line will, however, be much easier said than done. Italy is the main focus of member states’ concerns, given the risk that Rome will fall behind on its reform commitments or fail to keep a tight grip on public borrowing.

然而,保持一個明確的一致立場,說起來容易做起來難。義大利是成員國擔憂的主要焦點,因爲義大利有可能無法履行改革承諾,或未能嚴格控制公共借款。

Giuseppe Conte, the head of the Five Star Movement, last week withdrew its support from Draghi’s national unity government, throwing the ruling coalition into chaos. Conte accused the prime minister of doing too little to help families clobbered by soaring energy and food prices.

五星運動(Five Star Movement)領導人朱塞佩•孔特(Giuseppe Conte)上週撤回了對德拉吉領導的民族團結政府的支援,使執政聯盟陷入混亂。孔特指責總理在幫助那些因能源和食品價格飆升而遭受打擊的家庭方面做得太少。

If the government were to collapse it would raise doubts about Rome’s ability to pass a budget in November, fanning fears in northern capitals that Italy will once again emerge as a dangerous weak spot in the euro area’s armour.

如果政府解體,將使人們對羅馬在11月透過預算的能力產生懷疑,這促使北歐國家擔心義大利將再次成爲歐元區盔甲中的一個危險的弱點。

Asked on Thursday about the situation in Rome, Paolo Gentiloni, the European economy commissioner, stressed the importance of not adding political tremors given the febrile global situation. “In these troubled waters — war, high inflation, energy risks, geopolitical tensions — stability is a value in itself. Now is the time for sticking together, for cohesion,” he said.

週四,當被問及羅馬的局勢時,歐盟經濟專員保羅•真蒂洛尼(Paolo Gentiloni)強調了在全球局勢緊張的情況下不增加政治動盪的重要性。他說:「在戰爭、高通膨、能源風險、地緣政治緊張等混亂局面中,穩定本身就是一種價值。現在是團結一致的時候了。」

After the Covid-19 pandemic hit in 2020, plunging much of Europe into a record postwar recession, Lagarde said there were “no limits” to the central bank’s commitment to the euro. That pledge may be about to be tested again.

2020年,新冠疫情爆發,歐洲大部分地區陷入戰後創紀錄的衰退,拉加德表示,歐洲央行對歐元的承諾「沒有限制」。這一承諾可能將再次受到考驗。