尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

Dear reader,

親愛的讀者,

The tech sector has a new set of magic words: free cash flow. Even Uber, king of cash burn, is feeling the heat.

科技行業有一句新的魔法咒語:自由現金流。即使是Uber(Uber),燒錢之王,也感覺到了壓力。

“We need to show them the money,” wrote Uber chief executive Dara Khosrowshahi in a memo obtained by the Financial Times. It is an extraordinary message. Oh, NOW Uber needs to prove it can make money? What happened in the previous 13 years?

英國《金融時報》獲得的一份備忘錄中,Uber首席執行長達拉•科斯羅薩希(Dara Khosrowshahi)寫道:「我們需要讓他們看到錢。」這是一個非凡的資訊。哦,現在Uber需要證明它能賺錢嗎?在過去的13年裏發生了什麼?

The question of whether public markets are entering a sustained downturn has focused minds here in San Francisco. If central banks put a definitive end to the era of low rates that made money so cheap, the question is whether growth companies with high valuations will deflate to reasonable levels, or just crash and burn.

公開市場是否正在進入持續低迷的問題一直是舊金山人關注的焦點。如果央行最終終結了讓資金變得如此廉價的低利率時代,那麼問題就來了:估值高的成長型企業是會跌至合理水準,還是會崩盤燒錢?

Hence the focus on grown-up metrics such as free cash flow, or what’s left over after any investing. Shares in electric car company Tesla are down 39 per cent this year. But speaking at the FT’s Future of the Car conference this week, boss Elon Musk said that his company had a bright future “and I think we will throw off a tremendous amount of free cash flow”.

因此,我們關注的是成熟的指標,如自由現金流,或任何投資後的剩餘資金。電動汽車公司特斯拉(Tesla)的股價今年已下跌39%。但上週在英國《金融時報》舉辦的未來汽車大會(Future of the Car)上發言時,特斯拉首席執行長伊隆•馬斯克(Elon Musk)表示,特斯拉擁有光明的未來,「我認爲我們將產生大量自由現金流」。

But what do companies do when they have no clear path to profitability? Denver-based data analytics company Palantir tried to get around the problem by riffing on the state of the world.

但是,當公司沒有清晰的盈利路徑時,他們該怎麼辦呢?總部位於丹佛的數據分析公司Palantir試圖透過反覆分析世界狀況來解決這個問題。

Markets were not convinced. Its slowing revenue growth does not back up Palantir’s claim of thriving in good times and bad. Shares are down 61 per cent in the year to date. Lex thinks it will require a near-term forecast date for positive net income before Palantir’s shares recover.

市場並不信服。它的收入成長放緩並不支援Palantir公司在順境和逆境中蓬勃發展的說法。迄今爲止,股價在今年下跌了61%。萊克斯認爲,在Palantir的股價回升之前,它需要一個近期預測的淨收入爲正的日期。

New York-based meal-kit delivery service Blue Apron remains profitless after 10 years. This week, it had an even more worrying number to report — sales are half the level they were when it listed in 2017. Lex wonders why RJB Partners is investing $40mn in a private placement. Perhaps it will take the stock private but its behaviour so far has been odd.

總部位於紐約的送餐服務公司Blue Apron在10年後仍然沒有盈利。本週,該公司公佈了一個更令人擔憂的數據——銷售額僅爲2017年上市時的一半。Lex專欄想知道爲什麼RJB Partners要投資四千萬美元進行私募。也許它會將該股票私有化,但迄今爲止,它的行爲一直很奇怪。

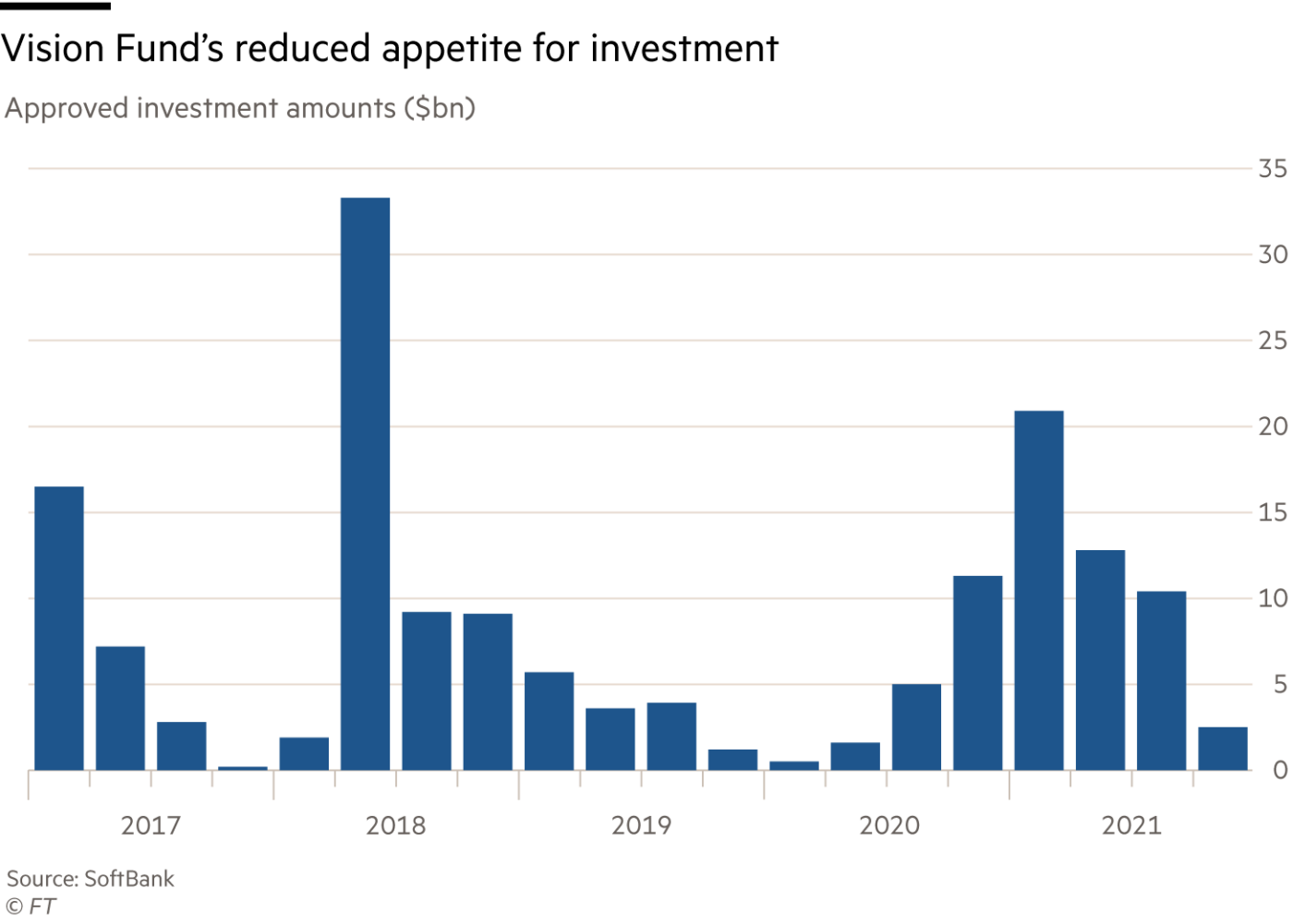

At Japanese technology investment group SoftBank, which has contributed to high tech valuations, Masayoshi Son has put the brakes on its investment pace. Annual net loss has reached ¥1.7tn ($13bn). Lex is curious about what will happen now to the $50bn in capital that has been earmarked for investments.

在日本科技投資集團軟銀(SoftBank),孫正義(Masayoshi Son)放慢了投資步伐。軟銀曾經爲高科技企業的估值推波助瀾。而今,其年度淨虧損達到1.7兆日元(合130億美元)。Lex專欄對已指定用於投資的500億美元資金現在會發生什麼感到好奇。

Lex does applaud founder Son for diversifying away from China as crackdowns increase. The possible US delisting of Chinese online housing platform owner KE Holdings has also encouraged Son to list it in Hong Kong. That will improve liquidity but do little to solve the real problem: China’s faltering property market.

Lex專欄對軟銀創辦人孫正義在打擊力度加大的情況下,撤離中國,到別處進行多元化發展表示讚賞。中國在線住房平臺所有者貝殼(KE Holdings)可能從美國退市,也鼓勵孫正義在香港上市。這將改善流動性,但對解決真正的問題——中國搖搖欲墜的房地產市場——沒有什麼作用。

Dating app Bumble is still hung up on using adjusted ebitda — but at least sales are growing. Lex is intrigued by the success of its acquisition of France’s Fruitz, which matches users via the medium of fruit. But adding more users via acquisitions will never take Bumble close to the almost 100mn users that Match boasts. Bumble shares are down 38 per cent so far this year.

約會程式Bumble仍然堅持使用調整後的EBITDA--但至少銷售額在成長。Lex專欄對其收購法國Fruitz公司的成功感到好奇,該公司透過水果這一媒介來匹配用戶。但是,透過收購增加更多的用戶,永遠不會使Bumble接近Match所擁有的近1億用戶。今年迄今爲止,Bumble股價下跌了38%。

Crypto investors have a much harder time pointing to a metric that might support prices. Bad news for US-listed cryptocurrency exchange Coinbase, whose price is firmly tethered to the fortunes of bitcoin, the largest cryptocurrency. Traders are being warned they could lose all of their crypto assets if the company goes bankrupt — a reminder that this sector lacks the safety net of banks.

加密貨幣投資者很難找到一個可能支撐價格的指標。對於在美國上市的加密貨幣交易所Coinbase來說,這是個壞訊息。Coinbase的價格與最大的加密貨幣比特幣的命運緊密相連。交易者被警告稱,如果該公司破產,他們可能會失去所有加密資產——這提醒人們,該行業缺乏銀行的安全網。

Speaking of tethered assets — the not-so stablecoin tether fell below the US dollar to which it is meant to be pegged. US Treasury secretary Janet Yellen has called for stablecoin rules and says there is a risk of financial instability. Lex agrees that if Tether liquidates its $34bn Treasury holdings or $24bn of corporate debt there will be market repercussions. That’s if those numbers are correct. We also point out that Tether has been in trouble over its claims before.

談到加密貨幣資產——並不穩定的Tether幣跌破了它所要掛鉤的美元。美國財政部長珍妮特·葉倫呼籲制定穩定幣規則,並表示存在金融不穩定的風險。Lex同意,如果Tether清算其持有的340億美元的國債或240億美元的公司債,將產生市場反響。這是在這些數字正確的情況下。我們還指出,Tether以前就曾因其債權而陷入困境。

Rising rates may spell doom for risky assets but European banks should be happy. Think again. At just over seven times forward earnings, Lex thinks the sector does look cheap but prone to credit risk should recession take hold in the next year.

利率上升可能意味著風險資產的末日,但歐洲銀行應該感到高興。再想想。Lex認爲,該行業的預期市盈率略高於7倍,看上去確實便宜,但如果明年經濟衰退持續,該行業可能面臨信貸風險。

Tangible assets are still rising in price though. Lex wonders if Andy Warhol prints offer an inflation hedge. Over the long term, prices have beaten inflation. But, of course, the pool of buyers is small and susceptible to impulse spending.

但實體資產的價格仍在上漲。Lex想知道安迪·沃霍爾(Andy Warhol)的版畫是否能對沖通膨。從長期來看,價格戰勝了通膨。但是,當然,買家羣體很小,容易受到衝動消費的影響。

Perhaps chipmakers are a better bet. Integrated device manufacturers such as Infineon and Samsung are busy completing back orders pushed higher by snagged supply chains. Gartner expects a 13.6 per cent increase in global semiconductor revenues this year.

或許晶片製造商是一個更好的選擇。英飛凌(Infineon)和三星(Samsung)等整合設備製造商正忙於完成因供應鏈受阻而推高的延遲訂單。Gartner預計,今年全球半導體收入將成長13.6%。

Russia is thinking carefully about its own supply chains as the EU threatens an oil embargo. Hungary wants a carve-out but, even with exemptions, Lex says an EU ban would have clout. Russia’s ability to replace its main customer will be hit by transport constraints. Energy prices are already rising amid the quarrel. Household bills too. Companies such as Centrica may find it increasingly hard to justify raising shareholder rewards, but the UK energy group will probably do so, believes Lex.

在歐盟威脅實施石油禁運之際,俄羅斯正在認真考慮自己的供應鏈。匈牙利希望脫離歐盟,但即使有豁免權,Lex認爲歐盟的禁令也會有影響力。俄羅斯替代其主要客戶的能力將受到運輸限制的影響。在這場爭吵中,能源價格已經在上漲。家庭支出也大幅增加。Lex認爲,Centrica等公司可能會發現,越來越難以證明提高股東紅利是合理的,但這家英國能源集團很可能還是會這麼做。

Oil market turmoil could accelerate the transition to clean energy. Shareholders are putting more pressure on global companies to make the change. Not BlackRock, though. The goliath of fund management is swerving some climate change resolutions. But as Lex points out, this is not such a radical decision. BlackRock supported less than half of environmental and social shareholder proposals last proxy season. Still, it is an unwelcome step back.

石油市場的動盪可能會加速向乾淨能源的轉變。股東們對全球公司施加了更大的壓力,要求他們做出改變。不過,貝萊德沒有。這個基金管理的巨擘正在迴避一些氣候變化的決議。但正如Lex所指出的,這並不是一個如此激進的決定。貝萊德在上個代理季支援了不到一半的環境和社會股東提案。儘管如此,這仍然是一個不受歡迎的退步。

Enjoy your weekend,

祝您週末愉快,

Elaine Moore

伊萊恩·摩爾(Elaine Moore)

Deputy Head of Lex

Lex欄目副主任

If you would like to receive regular updates whenever we publish Lex, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

如果您希望在我們發佈Lex時收到定期更新,請將我們新增到您的FT文摘中,我們每次發佈時,您都會收到即時電子郵件提醒。你也可以透過網頁看到Lex的每一篇專欄文章