尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

With Christmas just a couple of days away, it’s a good time to take stock of the shopping season. I think a fair bit about the luxury retail market, because where the rich lead, the market — and even the economy as a whole — tends to follow. This past year was the worst for the luxury industry since the great recession of 2007-09.

耶誕節即將來臨,現在是回顧購物季的好時機。我經常思考奢侈品零售市場,因爲富人的消費趨勢往往會引領市場,甚至影響整個經濟。今年是自2007-09年大衰退以來奢侈品行業最糟糕的一年。

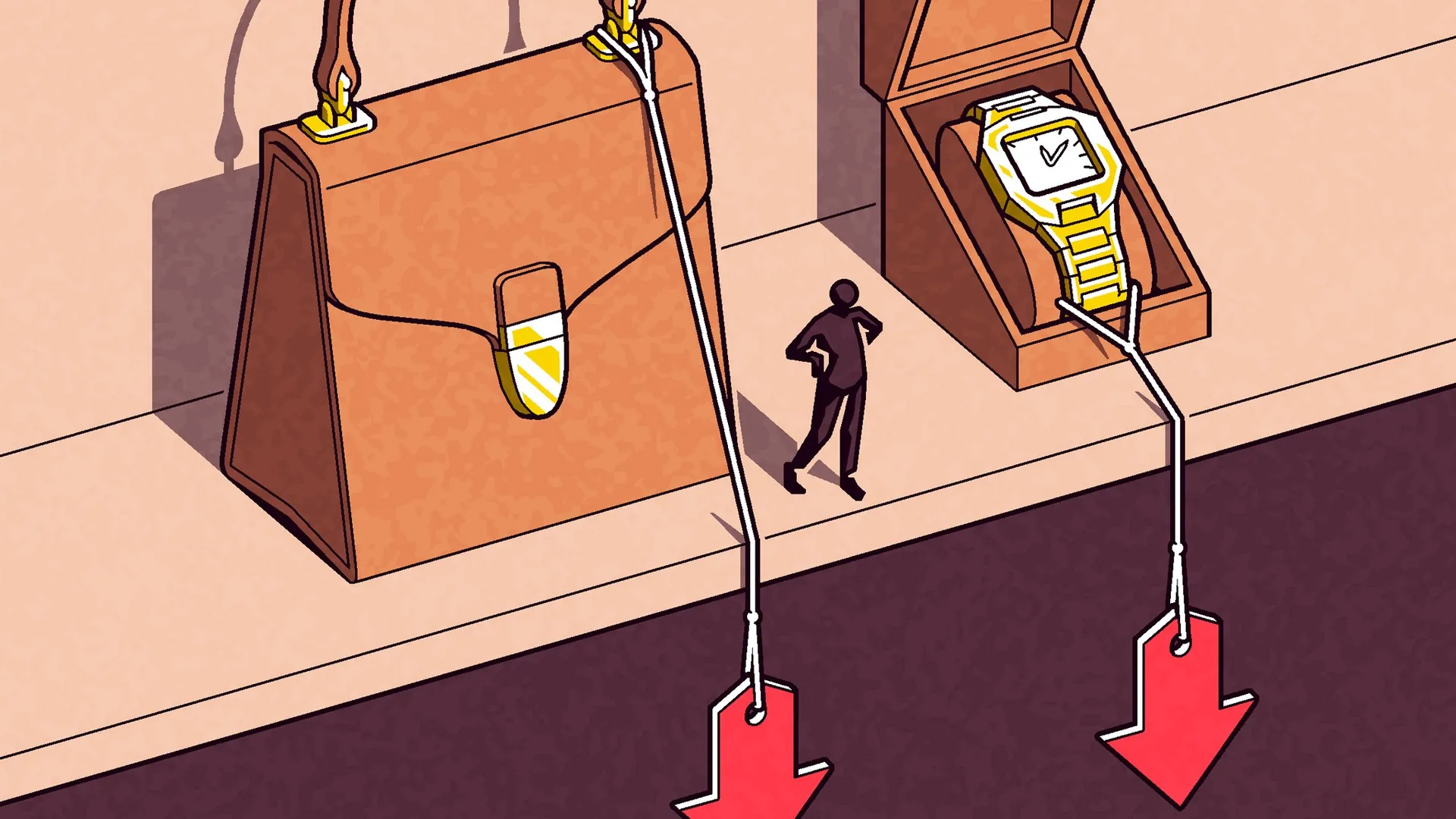

While the super-rich are still spending as if they exist in a separate gravitational orbit, the aspirational consumers who make up the all-important “mass luxury” part of the market are scaling back. That goes a long way to explaining why many of the world’s largest luxury companies have underperformed recently. There are, after all, only so many watches and handbags that the one per cent can buy.

儘管超級富豪們仍在揮霍無度,彷彿生活在一個獨立的引力軌道上,但構成市場重要部分的「大衆奢侈品」有抱負消費者卻在縮減開支。這在很大程度上解釋了爲什麼許多全球最大的奢侈品公司最近表現不佳。畢竟,百分之一的人羣能購買的手錶和手袋數量是有限的。

And the number of people who can afford this sort of thing is declining. The latest Bain luxury market report, released in November, found that the luxury market shrank by about 50mn consumers over the past two years, in part because younger consumers are turning away from traditional luxury goods. I suspect that this is one of the reasons you are (finally) seeing older people, particular older women, in advertising and even on fashion runaways. They are the only people buying stuff.

能夠負擔得起這種商品的人數正在減少。貝恩最新的奢侈品市場報告於11月發佈,發現奢侈品市場在過去兩年中減少了大約5000萬消費者,部分原因是年輕消費者正在遠離傳統奢侈品。我懷疑這就是爲什麼你(終於)在廣告中甚至時裝秀上看到老年人,特別是老年女性的原因之一。因爲她們是唯一還在購買這些商品的人。

But there are other reasons that luxury has lost its lustre, notable among them the pervasive feeling that economic insecurity may be around the corner, despite buoyant markets.

但奢侈品失去光彩還有其他原因,其中顯著的是儘管市場繁榮,人們普遍感到經濟不安全可能即將來臨。

If you discount the V-shaped Covid blip, we are six years overdue for a recession. Meanwhile, the bizarre world of the US equity markets, which are priced for perfection, has everyone at New York dinner parties talking about when (and if) they are planning to take at least some of their portfolios to cash.

如果不考慮V型的新冠疫情波動,我們已經六年沒有經歷經濟衰退了。同時,美國股市的奇異現象——其定價堪稱完美——讓紐約晚宴上的每個人都在討論他們何時(以及是否)計劃將至少部分投資組合轉換爲現金。

Despite this, or perhaps because of it, the super-rich can still spend. Those in the ultra-wealthy segment of the luxury market — meaning the people who spend their excess cash on yachts and jets (both sectors which are doing quite well) — have seen their net worth bolstered by double-digit asset market growth. There’s big fleet expansion in the super high-end cruise business, and growth in luxury cars and hotels is still strong.

儘管如此,或者正因爲如此,超級富豪仍然有能力消費。奢侈品市場中的超富裕羣體——即那些將多餘現金花在遊艇和私人飛機上的人(這兩個行業表現良好)——他們的淨資產因資產市場的兩位數成長而提升。超級高階郵輪業務正在大規模擴張,豪華汽車和酒店的成長依然強勁。

But less wealthy people who were once ready to splurge on that $500 handbag are being far more cautious. That’s because they, unlike the super-rich, still have to worry about working. Aspirational consumers’ disposable incomes are down, having been affected by reduced job openings and increasing voluntary turnover rates, according to the Bain study. That’s why overall luxury sales are expected to drop by about 2 per cent in 2024, and remain flat next year.

但那些曾經準備在500美元手袋上揮霍的較不富裕的人變得更加謹慎。因爲他們不像超級富豪那樣無憂無慮,還得擔心工作。根據貝恩的研究,渴望消費的有抱負消費者的可支配收入因職位空缺減少和自願離職率上升而下降。這就是爲什麼預計2024年整體奢侈品銷售將下降約2%,並在明年保持平穩。

So what does all this tell us about what’s to come in the broader economy in 2025? There are three key lessons.

那麼,這一切對我們2025年的整體經濟有何啓示呢?主要有三條經驗。

First, a US equity market correction will come, perhaps this year, perhaps next. But few rich people I speak with have any doubt that it’s on its way. The fact that even the affluent are scaling back purchases of fine wines, jewellery, watches, and art means that a lot of asset-wealthy consumers are expecting a slowdown and some kind of market correction, even if we don’t see a full-blown trade war.

首先,美國股市可能會出現回調,也許是今年,也許是明年。但與我交談的富人中,很少有人懷疑它正在到來。即使是富人也在減少對優質葡萄酒、珠寶、手錶和藝術品的購買,這一事實意味著,即使我們沒有看到全面的貿易戰,許多資產富裕的消費者已經預期經濟放緩和某種市場調整。

Second, if the latter did come to pass, the luxury sector, which is dominated by high-value European goods, would fall much faster and harder than other areas. Europe doesn’t have tech giants, but it has luxury conglomerates — two out of the top five largest European firms by market capitalisation are LVMH and Hermès.

其次,如果後者真的發生,奢侈品行業將比其他領域下滑得更快更嚴重,因爲該行業主要由高價值的歐洲商品主導。歐洲沒有科技巨擘,但有奢侈品集團——按市值計算,歐洲五大公司中有兩家是路威酩軒(LVMH)和愛馬仕。

One could easily imagine the products these companies make becoming targets for tariffs if Trump turns a critical eye to the continent. Remember when the EU retaliated against Trump’s steel and aluminium tariffs by putting tariffs on motorcycles, adding $2,200 to the price of a Harley-Davidson? European luxury brands — including German automakers and French fashion houses — would be easy political pickings.

我們不難想像,如果川普對歐洲大陸持批評態度,這些公司生產的產品會成爲關稅目標。還記得歐盟透過對摩托車徵收關稅來報復川普的鋼鋁關稅嗎?這使得一輛哈雷大衛森(Harley-Davidson)的價格增加了2200美元。包括德國汽車製造商和法國時裝品牌在內的歐洲奢侈品牌很容易成爲政治上的犧牲品。

Finally, there’s a growing sense in the luxury business that some of the price inflation we’ve seen over the past several years simply can’t last. Already, only the top name brands in any given category of personal luxury can hold their price points, as aspirational clients downshift to cheaper watches or spirits.

最後,奢侈品行業中越來越多的人意識到,我們在過去幾年中看到的一些價格上漲根本無法持續。目前,在任何個人奢侈品類別中,只有頂級名牌才能維持自己的價位,因爲有抱負的客戶會轉向價格更低的手錶或烈酒。

Ditto travel and leisure. I recently spoke to two private equity investors in the hotel business in the US who predicted that while top-notch markets such as Jackson Hole, Nantucket and Martha’s Vineyard would probably be fine in a downturn, nosebleed rates for rooms at a four-star hotel in Houston on a Tuesday night would come down at the first sign of a market correction.

旅遊和休閒行業也是如此。我最近與兩位在美國酒店業的私募股權投資者交談,他們預測,儘管像傑克森霍爾(Jackson Hole)、楠塔基特和瑪莎葡萄園(Martha』s Vineyard)這樣的頂級市場在經濟下行時可能會安然無恙,但在市場出現調整的第一個跡象時,休斯頓一家四星級酒店週二晚上的高價房費將會下降。

For those of us who’ve noticed that $500 seems to be the new $300 for hotel rooms in major American cities, that’s welcome news. But as we wait for rates to fall, there’s always the small splurge on a high-end beauty item.

對於我們這些注意到在美國主要城市,500美元似乎已經成爲新的300美元酒店房間的人來說,這是個好訊息。但在我們等待價格下降的同時,總是可以小小奢侈一下,購買一件高階美容產品。

The “lipstick index,” a term coined by beauty titan Leonard Lauder, posits that when purchases of small luxury items like a new cosmetic go up, a recession is imminent. In 2024, beauty was one of the few luxury categories with positive growth, as consumers sought out that small splurge.

「口紅指數」是美容巨擘倫納德•蘭黛創造的一個術語,它認爲當購買新化妝品等小奢侈品的數量增加時,經濟衰退迫在眉睫。2024年,隨著消費者尋求小額消費,美容是少數幾個正成長的奢侈品類別之一。

If my husband is reading this, I’m hoping for a tube of Celine’s Rouge Triomphe in the stocking.

如果我丈夫在讀這篇文章,我希望在聖誕襪裏能有一支Celine的Rouge Triomphe口紅。