尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

Corporate Turkey is finally feeling the pinch of President Recep Tayyip Erdoğan’s radical departure from years of unconventional economic policies. Not everyone is happy with the new normal.

土耳其企業終於感受到了總統雷傑普•塔伊普•艾爾段(Recep Tayyip Erdoğan)徹底背離多年來的非常規經濟政策所帶來的壓力。並非所有人都對新常態感到滿意。

Erdoğan, who once called high interest rates the “mother and father of all evil”, made the kind of volte-face after his re-election in May 2023 that seemed almost unimaginable to many Turkey watchers. He started by tapping Mehmet Şimşek, a highly-regarded former deputy prime minister and City of London bond strategist, as finance minister.

艾爾段曾稱高利率爲「萬惡之母和萬惡之父」,但在2023年5月連任後,他的態度發生了大轉變,這在許多土耳其觀察人士看來幾乎是不可想像的。他首先任命備受尊敬的前副總理、倫敦金融城(City of London)前債券策略師穆罕默德•希姆謝克爲財政部長。

Şimşek inherited a $1tn economy on the brink. Years of ultra-low interest rates fuelled runaway inflation, while a burst of pre-election stimulus — including a month of free gas for households and minimum wage rises — ignited furious demand for imports. Economists were concerned that Turkey was very close to a balance of payments crisis before Şimşek was appointed in June 2023.

希姆謝克接手的是一個瀕臨崩潰的1兆美元經濟體。多年的超低利率助長了失控的通貨膨脹,而大選前的一陣刺激政策——包括爲家庭提供一個月的免費天然氣和提高最低工資——引發了對進口商品的強烈需求。經濟學家擔心,在希姆謝克於2023年6月被任命之前,土耳其已經非常接近國際收支危機。

Şimşek wasted little time in vowing to reinstate “rational” economic policymaking and reshuffling the management of Turkey’s central bank. Erdoğan went so far as publicly vowing that “tight monetary policy” would be the tool for fighting inflation, an extraordinary reversal from his years-long insistence that low rates cure rather than cause rapid price growth.

希姆謝克沒有浪費多少時間,就發誓要恢復「理性」的經濟決策,並對土耳其中央銀行的管理層進行了改組。艾爾段甚至公開誓言,「緊縮貨幣政策」將是對抗通貨膨脹的工具,這與他多年來堅持的低利率能治癒而非導致物價快速成長的觀點大相徑庭。

The central bank, which is now run by former US Federal Reserve economist Fatih Karahan, has lifted its main interest rate from 8.5 per cent last June to 50 per cent in March. The mechanism for the transmission of monetary policy to the economy that was severed by the previous unorthodox measures appears now to be more functional, meaning once-easy financial conditions are tightening.

目前由美聯準前經濟學家法提赫•卡拉漢(Fatih Karahan)執掌的土耳其央行,已將主要利率從去年6月的8.5%上調至今年3月的50%。先前被非常規措施切斷的貨幣政策向經濟傳導的機制,現在似乎更有效了,這意味著曾經寬鬆的金融環境正在收緊。

“The business world has transitioned from a period of abundant cash with low interest rates but limited access to credit to a period of scarce cash and high loan interest rates, with even more limited access to credit,” said Süleyman Sönmez, president of the Turkish Business Confederation.

土耳其商業聯合會(Turkish business Confederation)主席Süleyman Sönmez表示:「商界已經從一個現金充裕、利率低但信貸管道有限的時期,過渡到一個現金匱乏、貸款利率高、信貸管道更有限的時期。」

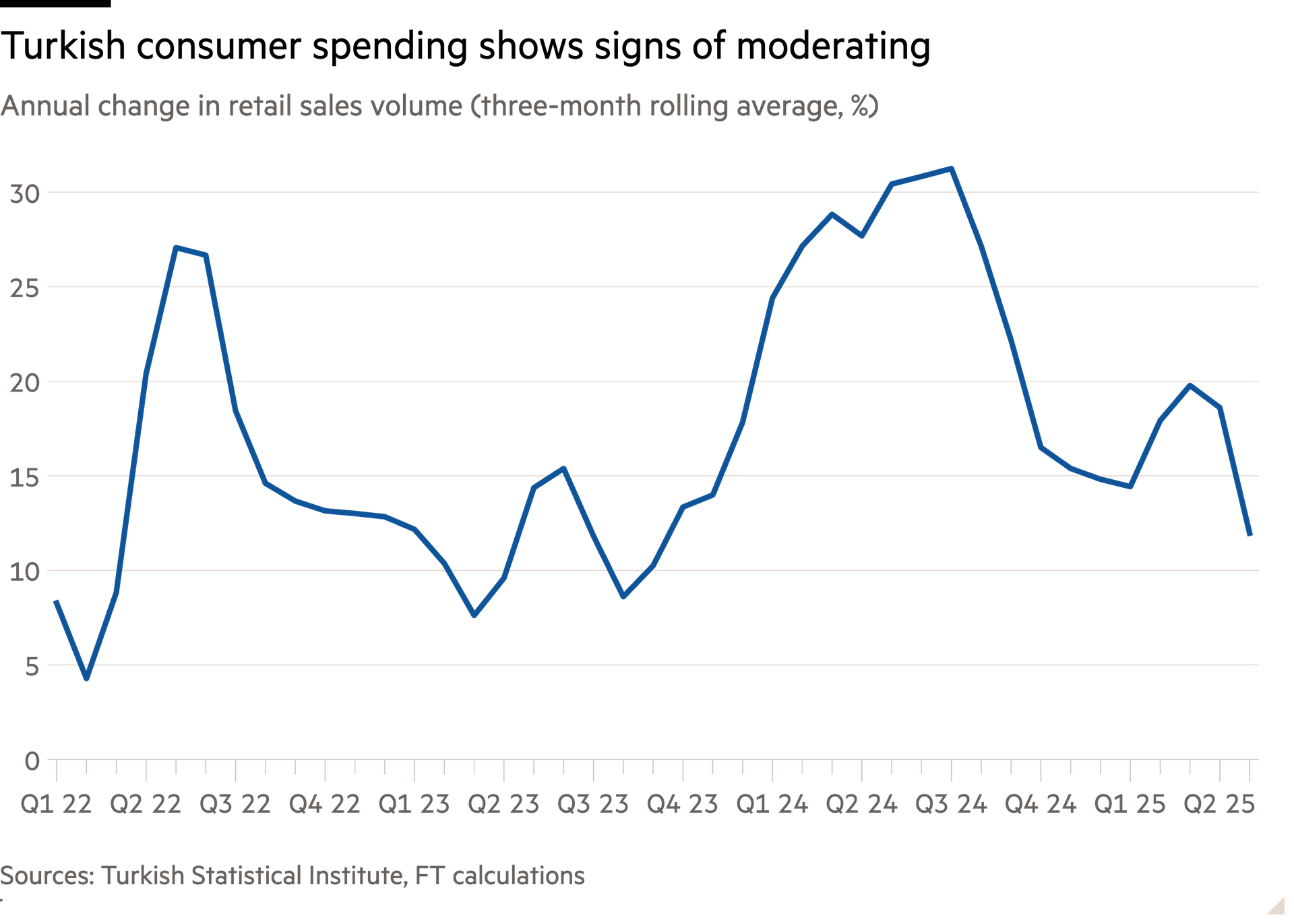

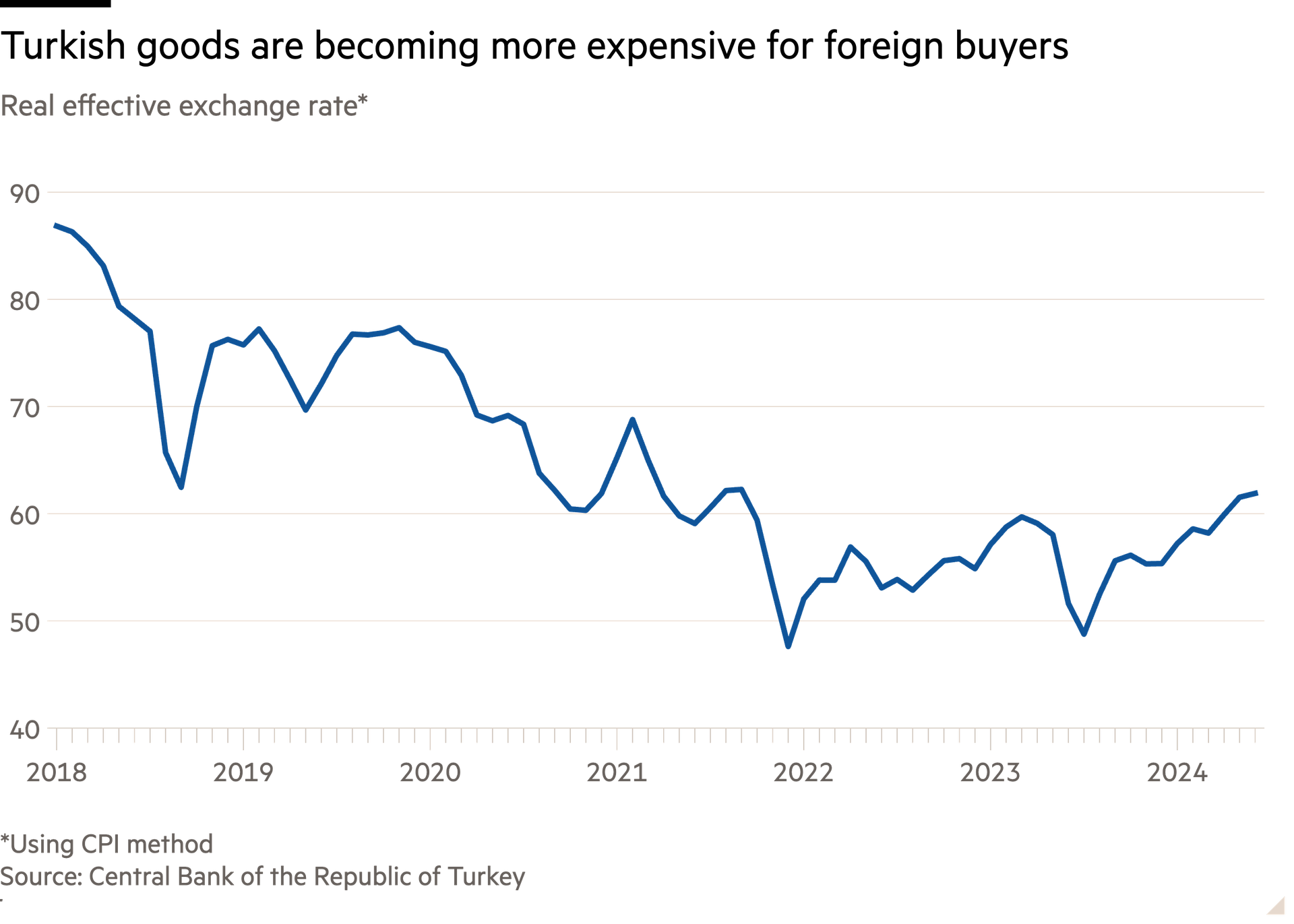

Consumer demand has remained robust, helped by the lingering effects of last year’s pre-election giveaways and because household debt levels remain low compared with other emerging markets. Such demand was one reason why many businesses were surprisingly sanguine about the inflation rate, which peaked above 85 per cent in late 2022 before cooling to 72 per cent last month. Exporters also were boosted by a 33 per cent decline in the real exchange rate, a measure of the competitiveness of Turkish goods, from the start of 2018 and May 2023.

消費者需求依然強勁,這得益於去年大選前政府贈款的持續影響,也因爲與其它新興市場相比,家庭債務水準仍然較低。這種需求是許多企業對土耳其通膨率出奇樂觀的原因之一。土耳其通膨率在2022年末達到85%以上的峯值,上月降至72%。從2018年初到2023年5月,衡量土耳其商品競爭力的實際匯率下跌33%,也提振了出口商。

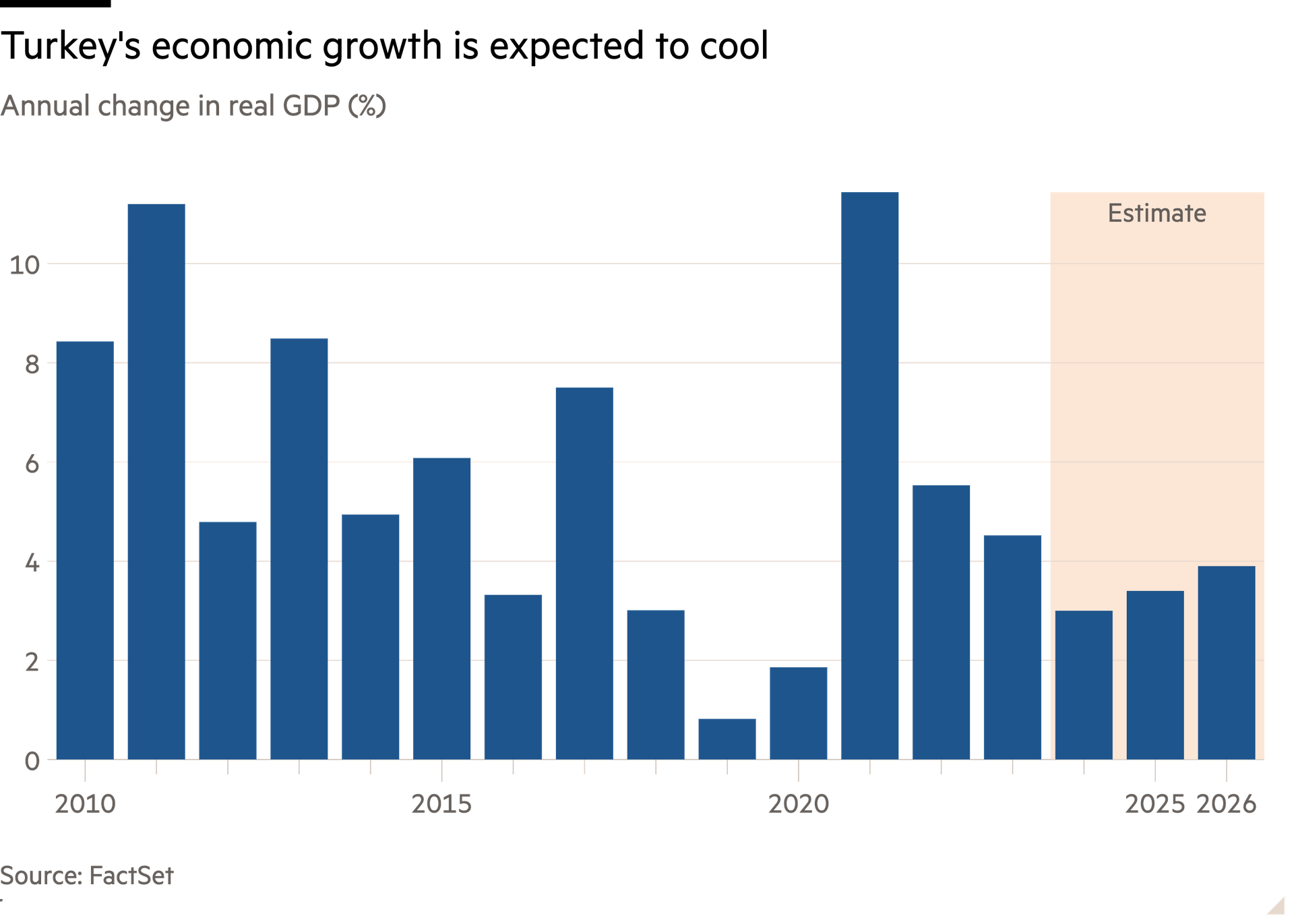

Still, once red-hot growth in consumption is cooling, and economists expect a further slowdown after policymakers refrained from a mid-year minimum wage rise. Şimşek is trying to engineer a soft landing: economists polled by FactSet expect inflation-adjusted output to grow 3 per cent this year, compared with an average rate of 5.2 per cent in the decade to 2023. This modest deceleration still represents a seismic shift for some companies.

然而,一度火熱的消費成長正在降溫,經濟學家預計,在政策制定者沒有在年中提高最低工資後,經濟成長將進一步放緩。 希姆謝克正試圖實現軟著陸:FactSet調查的經濟學家預計,今年經通膨調整後的產出將成長3%,而在2023年之前的十年平均成長率爲5.2%。對於一些公司來說,這種溫和的減速仍然代表著巨大的轉變。

Businesses have broadly backed Şimşek: “We recognise that the slowdown in growth is an integral part of the disinflation process,” said Sönmez. But behind the scenes, there is a growing sense of discontent in some corners of the business community. One former top economic official notes that more than a year into the policy shift, inflation is still far from stable and many companies are stuck in a “wait-and-see mode”, making it difficult to make long-term decisions.

企業普遍支援希姆謝克:「我們認識到成長放緩是反通膨過程的一部分,」Sönmez說。但在幕後,商界的某些角落出現了越來越多的不滿情緒。一位前高級經濟官員指出,政策轉變已經過去一年多,通膨仍然遠未穩定,許多公司陷入了「觀望模式」,這使得做出長期決策變得困難。

The ex-official said that there was also a feeling in the business community that Şimşek’s messaging had been too heavily focused on wooing international investors, who are now wading back into the Turkish lira and the domestic debt market that they had shunned for years. He added that many businesses had expected conditions to have started easing as soon as this summer and are beginning to run out of patience.

這位前官員說,商界還有一種感覺,即希姆謝克發出的資訊過於注重招攬國際投資者,而這些投資者現在又開始涉足他們多年來避之不及的土耳其里拉和國內債務市場。他補充說,許多企業原本預計今年夏天經濟形勢就會開始緩和,現在開始失去耐心。

Exporters have also grown increasingly frustrated at the 20 per cent rise in the real effective exchange rate over the past year. “Turkey is at least 40 per cent more expensive than its competitors in terms of dollar-based pricing. As a result, Turkey is losing its competitiveness,” said Mustafa Gültepe, head of the Turkish Exporters Assembly, at a recent press conference. Lenders are also bracing themselves for a potential rise in non-performing retail loans as conditions tighten, according to one senior Turkish banker.

過去一年,土耳其里拉實際有效匯率上升了20%,出口商也越來越感到沮喪。「以美元計價,土耳其的價格至少比競爭對手高出40%。因此,土耳其正在失去競爭力,」土耳其出口商大會主席Mustafa Gültepe在最近的一次新聞發佈會上表示。土耳其一位資深銀行家表示,隨著形勢收緊,各銀行還在爲不良零售貸款可能上升做準備。

Karahan has made a repeated vow to do “whatever it takes” to fight inflation. If price rises do not start to slow, businesses might need to prepare for a prolonged period of tight policy that eventually damps demand.

卡拉漢曾多次誓言要「不惜一切代價」抗擊通膨。如果價格上漲沒有開始放緩,企業可能需要爲長期的緊縮政策做好準備,這最終會抑制需求。