尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

Argentina’s new president, the self-styled anarcho-capitalist Javier Milei, takes on one of the world’s toughest economic challenges on Sunday.

自封爲無政府資本主義者的阿根廷新總統哈維爾•米萊(Javier Milei)週日將面臨世界上最嚴峻的經濟挑戰之一。

The country is a big food exporter and used to be one of the wealthiest nations in the developing world, but decades of mismanagement have wrecked the economy and created a web of artificial price and exchange rate controls that have produced huge distortions.

該國是一個糧食出口大國,曾經是發展中國家中最富有的國家之一,但數十年的管理不善擊垮了經濟,並形成了一個人爲的價格和匯率控制網路,造成了巨大的扭曲。

A libertarian economist whose beloved pet dogs are named after ideological heroes such as Milton Friedman, Milei campaigned on promises of taking a chainsaw to the state, closing down the central bank and replacing the peso with the US dollar. But he has made a dramatic shift towards moderation since winning the election.

米萊是一位自由主義經濟學家,他心愛的寵物狗們都以米爾頓•弗利德曼(Milton Friedman)等意識形態英雄的名字來命名。他在競選時承諾,要對政府動用電鋸,關閉央行,並用美元取代比索。但自從贏得大選以來,他卻突然轉向了溫和派。

As Milei’s first day in office approaches, what are the main economic challenges that he will inherit?

隨著米萊即將上任,他將面臨的主要經濟挑戰是什麼?

Chronic overspending

長期超支

At the root of Argentina’s problems is the government’s chronic overspending. The size of the state has almost doubled over the past two decades, with the government expanding the public sector payroll, handing out hefty fuel and electricity subsidies and boosting welfare programmes.

阿根廷問題的根源在於政府長期的過度支出。在過去的20年裏,政府擴大了公共部門的工資,發放了鉅額的燃料和電力補貼,並加強了福利計劃,國家的規模幾乎翻了一番。

Public sector employment rose 34 per cent between 2011 and 2022, while private sector jobs increased only 3 per cent in the same period, according to a report by the IERAL think-tank. This has led to continual budget deficits of more than 4 per cent of gross domestic product, despite tax levels that are well above the Latin American average.

智庫IERAL的一份報告顯示,2011年至2022年間,阿根廷公共部門的就業人數成長了34%,而同期民營部門的就業人數僅成長了3%。這導致預算赤字持續超過國內生產總值(GDP)的4%,儘管稅收水準遠高於拉美平均水準。

Decline in the peso

比索貶值

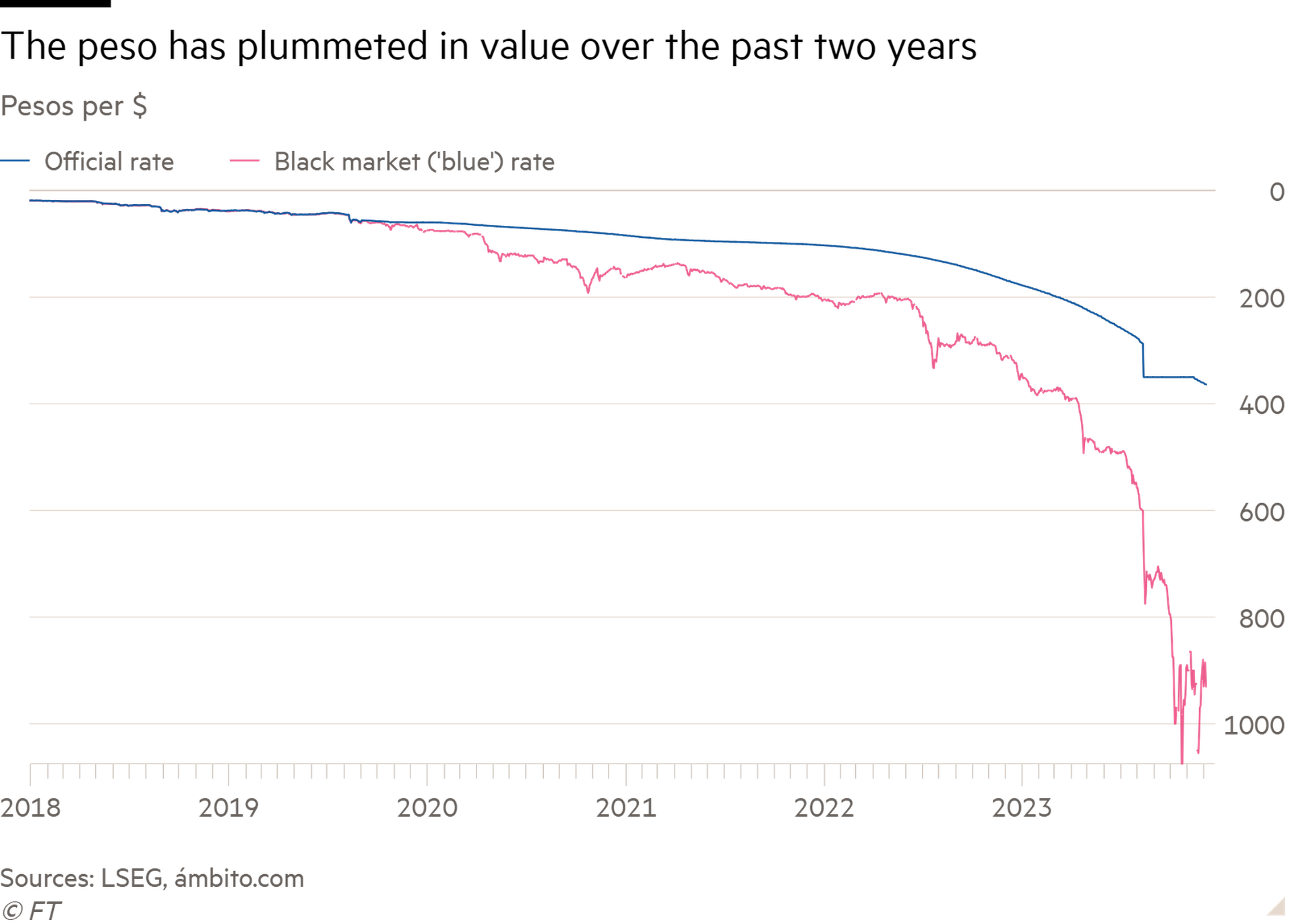

With the country cut off from borrowing on international capital markets since its ninth sovereign default in 2020, the current Peronist government has resorted to printing money to help fund the deficit. The money supply has exploded and the value of the peso has collapsed. Tight controls on foreign exchange have prompted a flourishing black market in the dollar and encouraged exporters to hoard goods, rather than ship them at artificially low official exchange rates. Argentina’s net international reserves are now negative, according to most economists.

自2020年發生第9次主權違約以來,該國已無法在國際資本市場上借款,現任庇隆主義(Peronist)政府已訴諸印鈔來幫助填補赤字。貨幣供應量暴增,比索貶值。對外匯的嚴格控制導致了美元黑市的繁榮,並鼓勵出口商囤積商品,而不是以人爲壓低的官方匯率發貨。多數經濟學家認爲,阿根廷的淨國際儲備目前爲負值。

Stubborn inflation

頑固通膨

The collapse in the peso’s value has fuelled inflation, which is now among the highest in the world. JPMorgan expects Argentina’s annual inflation to reach 210 per cent by the end of this year and warns that it is likely to rise further in the first half of next year — which could put it on a par with levels in Sudan and Zimbabwe. The central bank’s reference interest rate has shot up to 133 per cent to compensate depositors for rampant inflation.

比索貶值加劇了通膨,目前阿根廷的通膨率是世界最高之一。摩根大通(JPMorgan)預計,到今年年底,阿根廷的年通膨率將達到210%,並警告說,其明年上半年的通膨率可能會進一步上升——這可能會使阿根廷的通膨率與蘇丹和辛巴威的水準持平。該國央行的參考利率已飆升至133%,以補償儲戶因嚴重通膨造成的損失。

Rising liabilities

負債上升

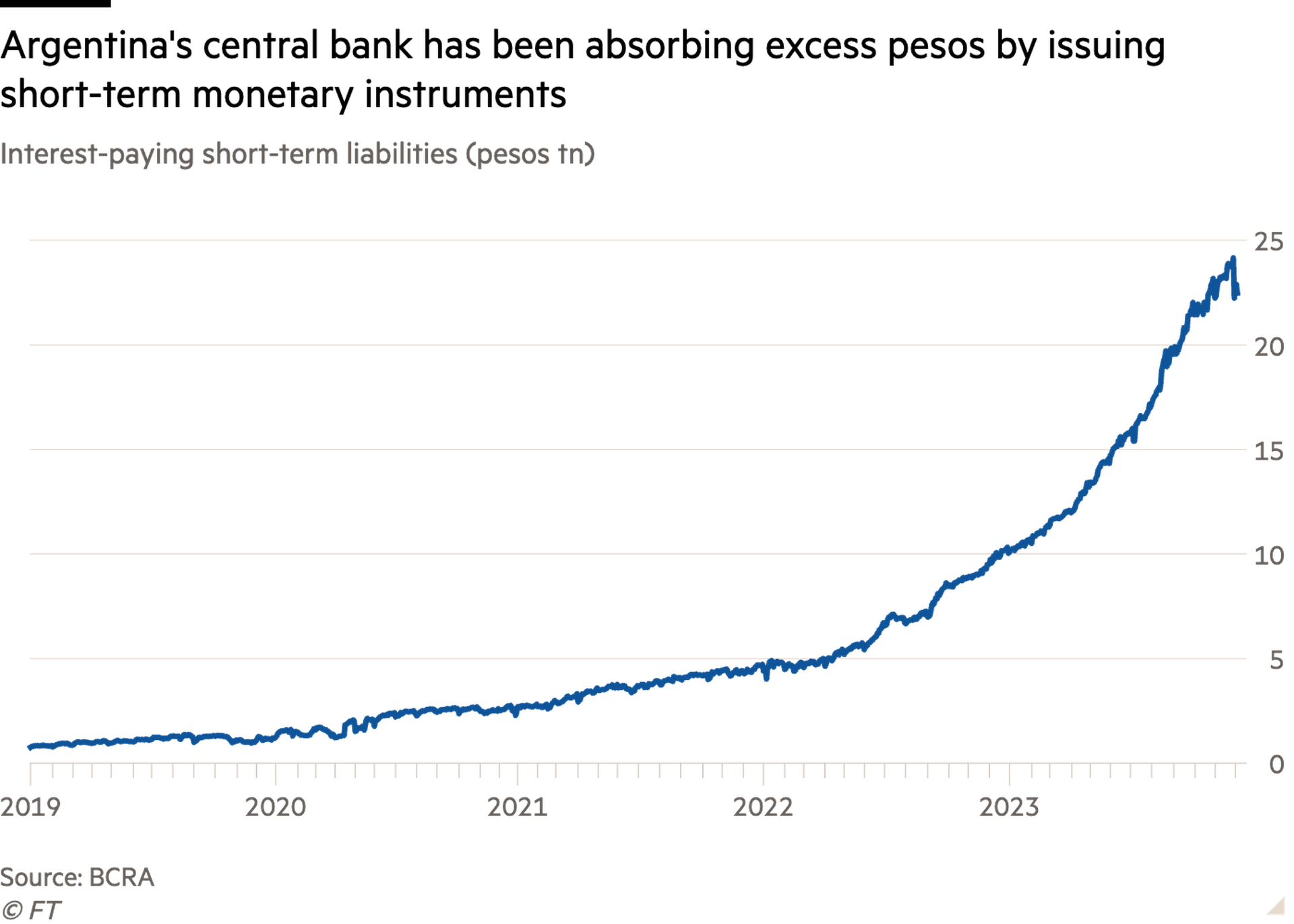

To soak up a large overhang of pesos in domestic markets, Argentina’s central bank has been issuing short-term interest-paying notes on local money markets. Those liabilities are more than 20tn pesos — nearly three times the monetary base — and generate hefty interest payments to the banks that hold them.

爲了消化國內市場上大量過剩的比索,阿根廷央行一直在國內貨幣市場上發行短期付息票據。這些債務超過20兆比索,幾乎是基礎貨幣的3倍,並向持有這些債務的銀行支付鉅額利息。

After a markets crisis in 2018, Argentina’s previous centre-right government turned to the IMF for a record-breaking bailout. It still owes the fund $43bn from that rescue, making it the biggest debtor to the Washington-based organisation. Argentina in 2020 also restructured $65bn of debt owed to private sector creditors. The IMF estimates that Argentina’s total foreign currency sovereign debt is $263bn.

在2018年的市場危機之後,阿根廷上一屆中右翼政府向國際貨幣基金組織(IMF)尋求破紀錄的救助。自那次紓困後,阿根廷仍欠國際貨幣基金組織430億美元,這使其成爲這家總部位於華盛頓的組織的最大債務國。阿根廷在2020年還重組了欠民營部門債權人的650億美元債務。國際貨幣基金組織估計,阿根廷的外幣主權債務總額爲2630億美元。

Cultural money habits

文化貨幣習慣

Argentines hold large amounts of dollars in cash within the country, as the US currency is widely used for savings and big transactions, such as property purchases. Central bank chief Miguel Pesce estimated in 2021 that Argentines held $200bn in cash within the country, which he said was 10 per cent of all US dollars in circulation in the world. A draft bill in Argentina’s Senate last year estimated that its citizens held another $418bn in mostly undeclared assets abroad.

阿根廷人在國內持有大量美元現金,因爲美元被廣泛用於儲蓄和大宗交易,比如購買房產。阿根廷央行行長米格爾•佩謝(Miguel Pesce)在2021年估計,阿根廷人在國內持有2000億美元現金,這佔全球流通美元總量的10%。據阿根廷參議院去年提交的一份法案草案估計,該國公民還在海外持有另外4180億美元的資產,其中大部分未申報。

The daunting task of straightening out Argentina’s dire public finances that Milei and his economy minister-designate Luis “Toto” Caputo face will include unwinding the current controls and distortions as well as stabilising the economy, all without triggering an explosion in inflation or a collapse in market confidence.

米萊和他任命的經濟部長路易斯•卡普託(Luis Caputo)面臨的艱鉅任務是整頓阿根廷糟糕的公共財政,包括解除目前的控制和扭曲,以及穩定經濟,並且所有這些都不能引發通膨的爆炸或市場信心的崩潰。

Alberto Ramos, chief Latin America economist at Goldman Sachs, said if Milei succeeded in curing Argentina’s economic ills, “it will be the best emerging market story in decades”.

高盛(Goldman Sachs)首席拉美經濟學家阿爾貝託•拉莫斯(Alberto Ramos)表示,如果米萊成功治癒了阿根廷的經濟弊病,「這將是幾十年來最好的新興市場故事」。

“He may try to do the right thing but may not be able to,” Ramos added, citing the difficulties of governing. Then there is the inherent volatility of the economic situation. “You are dealing with nitroglycerine. It can ignite overnight. Once you start the economic adjustment, you can lose control.”

拉莫斯補充說:「他可能會試圖做正確的事情,但可能做不到。」他提到了執政的困難。其次是經濟形勢的內在波動性。拉莫斯表示:「你要對付的是硝化甘油。它可以在一夜之間點燃。一旦開始經濟調整,你就可能會失去控制。」

Were that to happen, Ramos compared the challenge to a Formula One racing car that goes into a high-speed skid. “In this situation, there are no good or bad drivers because there is nothing you can do,” he said. “You take your hands off the wheel — and luck, the conditions and the state of the track will dictate where you end up and how much damage there is.”

如果發生了這種情況,拉莫斯將其面臨的挑戰比作一輛高速打滑的一級方程式賽車(Formula One)。他說:「在這種情況下,駕駛員沒有好壞之分,因爲你無能爲力。你把手從方向盤上移開——運氣、路況和賽道狀況將決定你的最終結果和損失程度。」

Additional reporting by Ciara Nugent

西婭拉•紐金特(Ciara Nugent)補充報導