尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

The humanoid robot Tesla is expected to unveil this month is an expert bit of stagecraft. Optimus, billed as the future of labour, is sci-fi come to life. But futuristic robots are not what investors in the electric carmaker care about. Production in China, progress at the new factory in Germany, material supply and rival vehicle sales all take precedence.

特斯拉預計將於本月推出一款人形機器人,該機器人將是舞臺技巧方面的專家。擎天柱(Optimus),被標榜爲未來的勞動力,是科幻小說的化身。但未來機器人並不是這家電動汽車製造商的投資者所關心的。中國的生產、德國新工廠的進展、材料供應和競爭對手的汽車銷售都是優先考慮的事項。

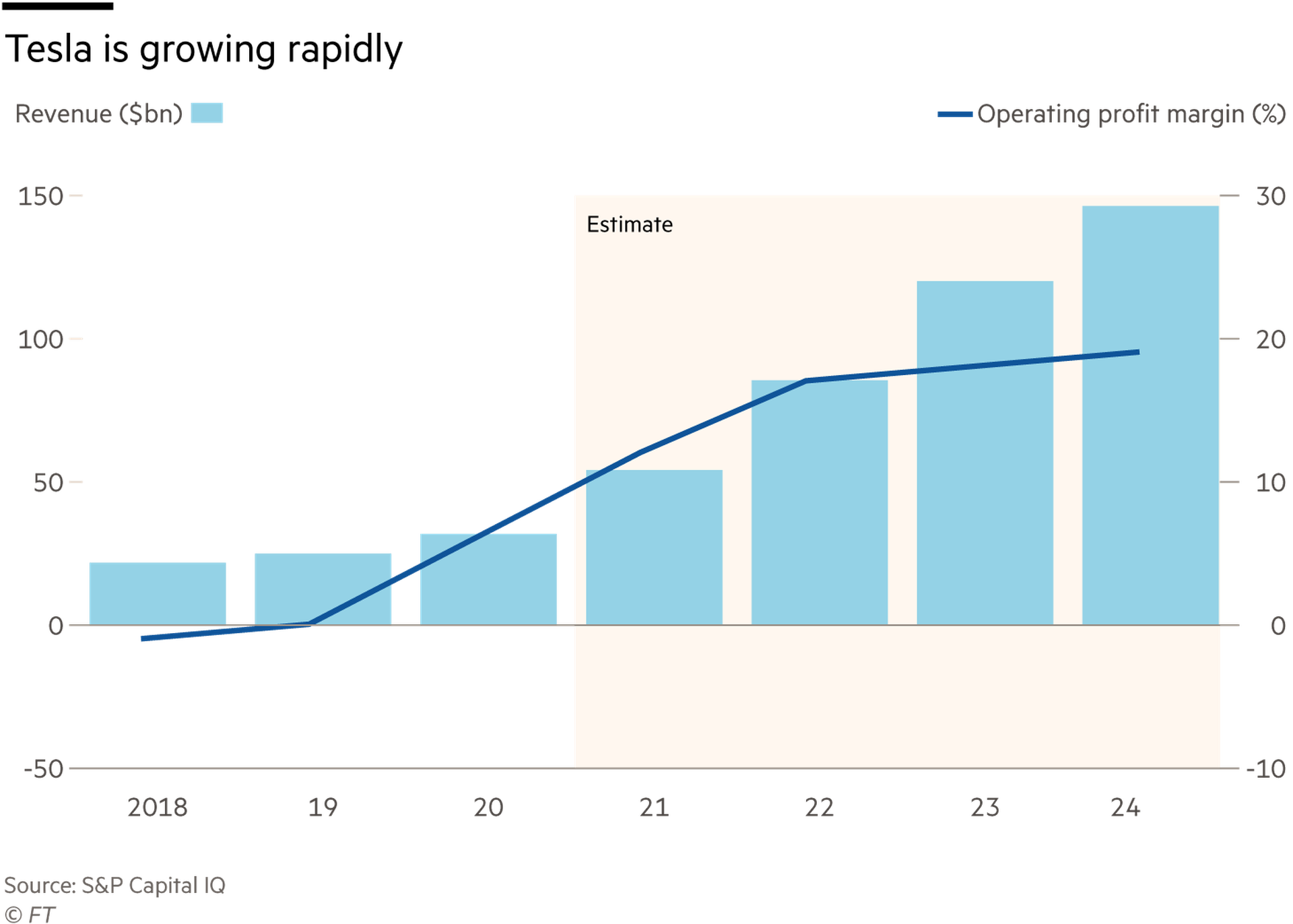

Tesla makes the most popular electric vehicle in the world. As more traditional carmakers enter the EV market this achievement becomes more impressive. Global demand for electric cars has kept pace with supply — thanks in no small part to Tesla’s ability to make them desirable. In the last quarter, its sales rose 42 per cent.

特斯拉制造了世界上最受歡迎的電動汽車。隨著越來越多的傳統汽車製造商進入電動汽車市場,這一成就變得更加矚目。全球對電動汽車的需求一直與供應保持同步——這在很大程度上要歸功於特斯拉(Tesla)讓電動汽車變得受歡迎的能力。上季度,該公司銷售額成長42%。

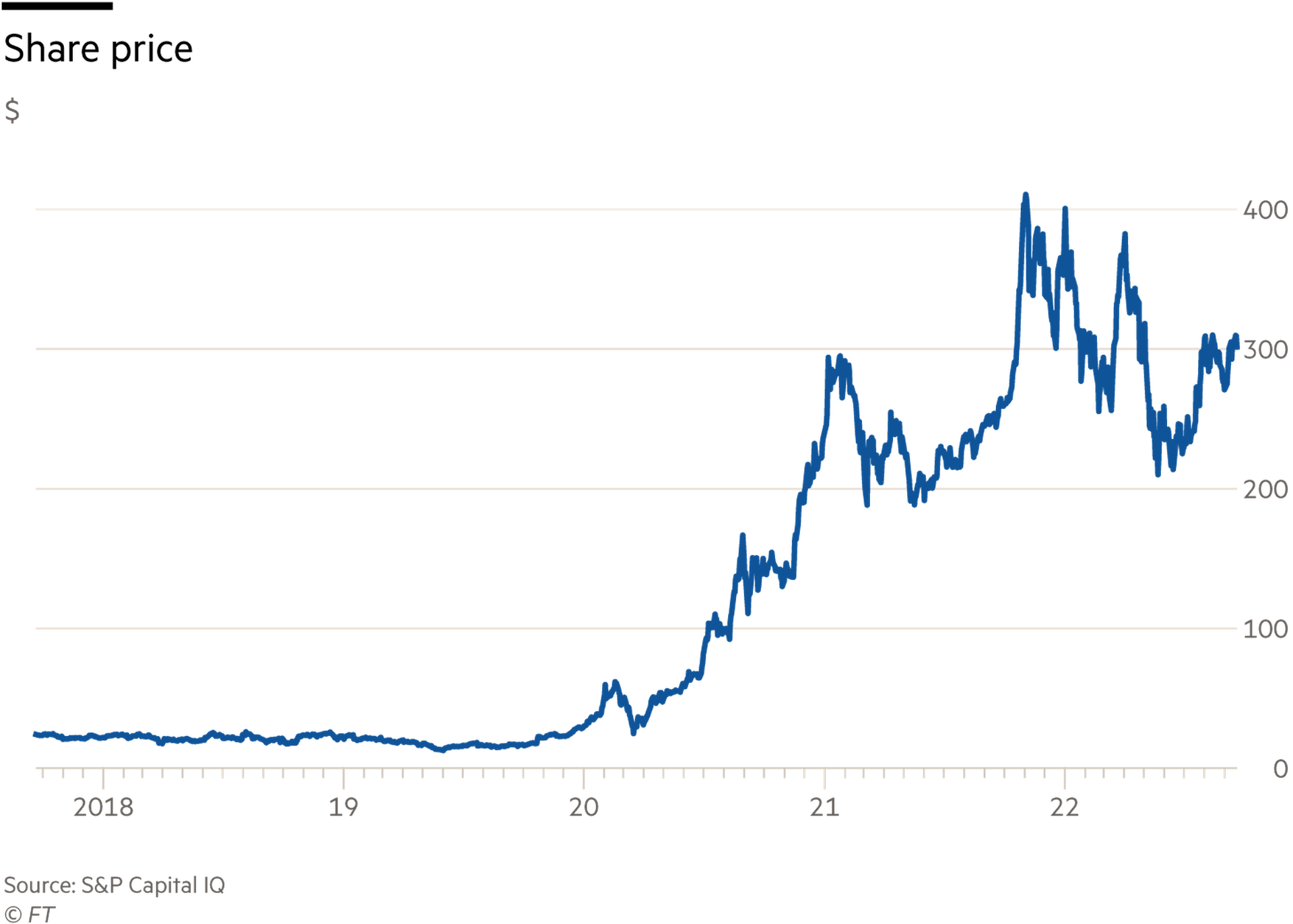

Over five years, the stock is up 1,200 per cent. That breeds investor loyalty. It might have lost about a quarter of its value in the year to date but it has avoided the 70 to 80 per cent price collapse that some tech stocks have suffered in the market rout.

5年來,該股上漲了1200%。這培養了投資者的忠誠度。今年迄今爲止,該股市值可能已縮水約四分之一,但它避免了一些科技股在市場暴跌中遭受的70%至80%的暴跌。

Yet is hard to see what could lift the price back to last year’s high. A stock split in August, the company’s second in two years, did not help. Stock splits can be used to attract more retail investors by offering a lower entry price per share. But Tesla already has a strong base of retail investors who hold about 37 per cent of the stock, according to S&P Global data.

然而,很難看出是什麼因素能將其股價推回去年的高點。今年8月,該公司進行了兩年內的第二次股票分拆,這對公司沒有任何幫助。股票分拆可以透過提供較低的每股入門價格來吸引更多散戶投資者。但標普全球(S&P Global)的數據顯示,特斯拉已經擁有強大的散戶投資者基礎,他們持有該公司約37%的股票。

Investors are right to be wary about the 60 times price-to-earnings ratio too — even if it has more than halved since November last year. It is more than ten times the size of larger, more established carmakers like Volkswagen. Even BYD, China’s electric car giant, trades at a far lower multiple. Musk fandom still accounts for a significant proportion of Tesla’s valuation.

投資者對60倍的市盈率保持警惕也是有道理的——儘管這一市盈率自去年11月以來已下降逾一半。它的規模是大衆(Volkswagen)等更大、更成熟的汽車製造商的十倍以上。就連中國電動汽車巨擘比亞迪(BYD)的市盈率也低得多。馬斯克的粉絲仍然佔特斯拉估值的很大一部分。

News about Optimus is expected to be released in Tesla’s upcoming artificial intelligence day. But Tesla’s ability to scale production and maintain profit will underpin the share price. The wild card is not robots but Twitter. Musk is still the largest investor in Tesla, though he has sold more than $15bn of shares to raise cash this year. If forced to go through with his deal to buy Twitter for $44bn he may be forced to sell more.

關於擎天柱的訊息,預計將在特斯拉即將到來的人工智慧日發佈。但特斯拉擴大生產和維持利潤的能力仍將支撐其股價。不確定因素不是機器人,而是Twitter。馬斯克仍然是特斯拉的最大投資者,儘管他今年爲了籌集現金,已經出售了超過150億美元的股票。如果被迫完成440億美元的Twitter收購,他可能會被迫出售更多資產。