尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

Uğur Şahin arrives at BioNTech’s headquarters in the German city of Mainz on the same battered bicycle he has been riding for 20 years. Developing the best-selling Covid-19 vaccine may have transformed BioNTech’s founders into billionaires, but the chief executive of the biotech business has resisted making changes in his personal life.

烏爾·沙欣(Uğur Şahin)騎著他已經20歲高齡的破舊自行車來到位於德國美因茨市的BioNTech總部。開發最暢銷的新冠疫苗可能使BioNTech的創辦人變成了億萬富翁,但這家生物技術企業的首席執行長卻抵制在個人生活中作出改變。

Şahin and his wife, chief medical officer Özlem Türeci, set up BioNTech in 2008 to create a toolbox to transform the treatment of cancer. Since finding fame, their vision has not shifted. When practising as doctors, the pair had become frustrated at the gap between the cancer drugs available on the wards — and what they believed was scientifically possible.

沙欣和他的妻子,首席醫療官奧茲萊姆•圖雷西(Özlem Türeci),在2008年成立了BioNTech,成立了一個工具箱,以改變癌症的治療。自從成名以來,他們的眼光並沒有改變。在當醫生的時候,面對病房裏提供的癌症藥物和他們認爲在科學上可行的藥物之間的差距,這對夫婦感到沮喪。

So, while the mRNA vaccine they developed with the American pharmaceuticals company Pfizer has saved millions of lives and brought economies around the world back to life, it was also, in some ways, a side hustle. BioNTech “is a cancer company that was able to drop everything they were doing to create a Covid vaccine,” says Akash Tewari, an analyst at Jefferies.

因此,儘管他們與美國輝瑞製藥公司合作開發的mRNA疫苗拯救了數百萬人的生命,並使世界各地的經濟恢復了活力,但在某些方面,這仍是一項副業。傑富瑞(Jefferies)的分析師阿卡什·特瓦里(Akash Tewari)說:BioNTech「是一家[研究]癌症的公司,能夠放下他們正在做的一切來創造一種新冠疫苗」。

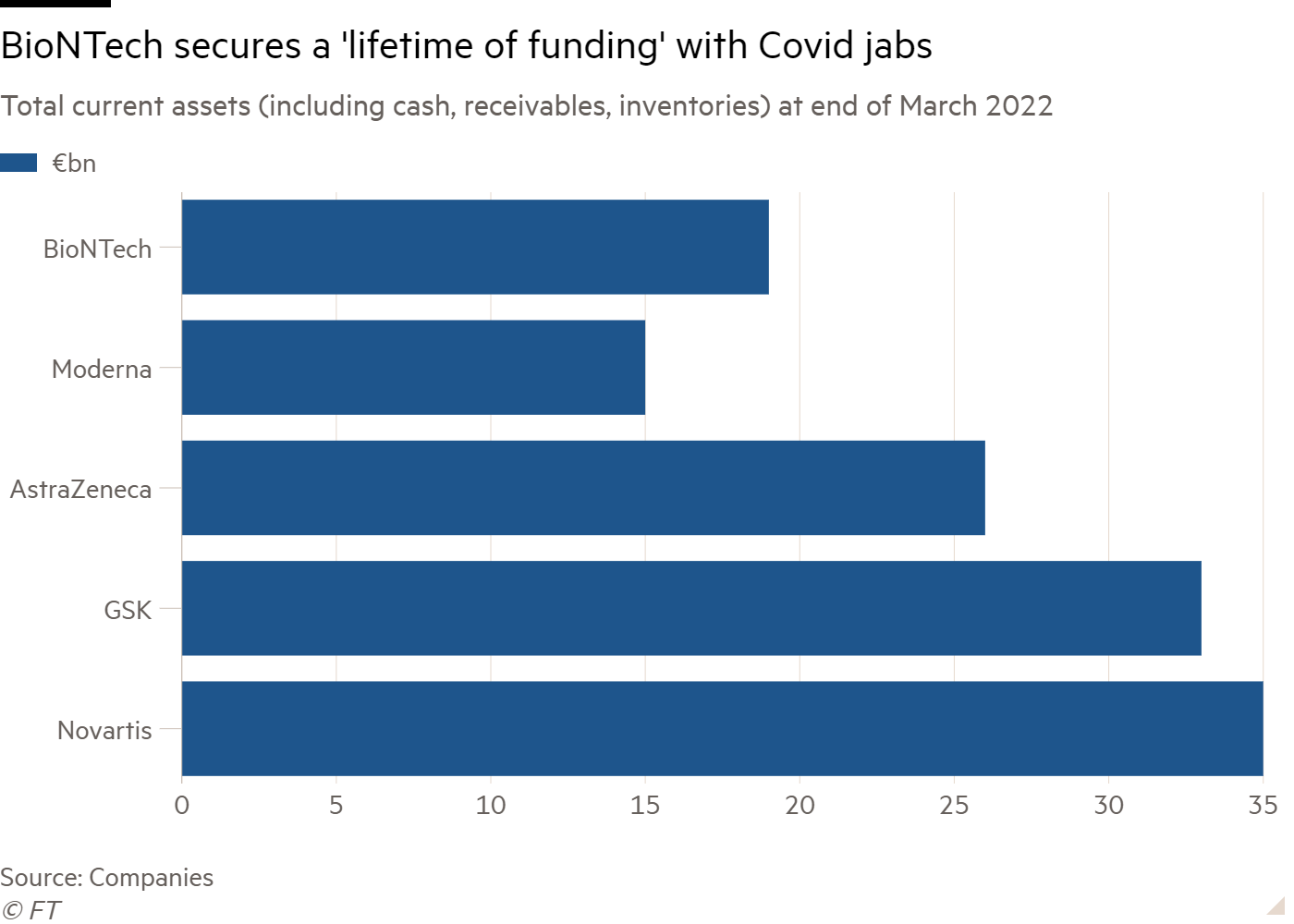

The decision to do so has brought an unprecedented windfall of cash to the company, which is now sitting on assets of €19bn, with billions more in revenue expected. That amount equates to “a lifetime of funding”, says Suzanne van Voorthuizen, co-head of life sciences securities at Dutch bank Kempen & Co.

這一決定爲該公司帶來了前所未有的現金橫財,該公司目前坐擁190億歐元資產,預計營收還將增加數十億歐元。荷蘭的銀行Kempen & Co.生命科學證券部門聯席主管蘇珊娜•範•沃特伊森(Suzanne van Voorthuizen)表示,這筆資金相當於「夠用一輩子」。

While some billionaires use their wealth to buy newspapers or fund extraterrestrial adventures, Şahin and Türeci will use theirs to fuel their ambitious — though still nascent — plans in oncology. They are doubling down on a hope that Şahin admits once sounded like science fiction: to be able to tailor drugs to each patient’s cancer.

當一些億萬富翁用他們的財富購買報紙或資助外星探險時,沙欣和圖雷西將用他們的財富來推動他們在腫瘤學方面的雄心勃勃的計劃——儘管仍處於萌芽狀態。他們正在加倍努力,實現沙欣承認曾經聽起來像科幻小說的希望:能夠爲每個病人的癌症量身定做藥物。

The company recently took steps in the right direction with two early stage trials showing promising data, one in pancreatic cancer and the other targeting solid tumours including ovarian and testicular cancer.

該公司最近朝著正確的方向採取了步驟,兩項早期試驗顯示出了有希望的數據,一項針對胰腺癌,另一項針對包括卵巢癌和睪丸癌在內的實體腫瘤。

Success would mean a new journey: reimagining the whole pharmaceutical industry.

成功意味著一段新的旅程:重塑整個製藥行業。

“We had this idea to develop technologies dedicated to really saving every single individual patient,” says Şahin. “Because every patient is different, and you can’t just take something off the shelf.”

沙欣說:「我們有這個想法,就是開發專門用於真正拯救每一位患者的技術。因爲每個病人都是不同的,你不能一招鮮喫遍天。」

The Covid cash

新冠現金

Şahin wheels his bike around the perimeter of a huge hole on the plot of the company’s site — the foundation for a new 20,000 square foot building. Across from his office, a three-storey temporary lab in portacabins has popped up to press on with the mission right away: this year research and development spending at BioNTech is doubling to €1.5bn.

沙欣騎著自行車繞著公司地塊上的一個巨大的洞口轉了一圈,這是一座2萬平方英尺的新建築的地基。在他的辦公室對面,一個三層樓高的臨時實驗室拔地而起,以便馬上完成任務:今年BioNTech的研發支出將翻倍,達到15億歐元。

Dropping his helmet in his office and donning a white coat, Şahin heads to the lab. Inside, a machine synthesises the DNA templates used to create messengerRNA, the technology BioNTech has helped to pioneer.

沙欣在辦公室放下頭盔,穿上白大褂,前往實驗室。在實驗室裏,一臺機器正在合成用於製造mRNA的DNA模板,這是BioNTech幫助開創的技術。

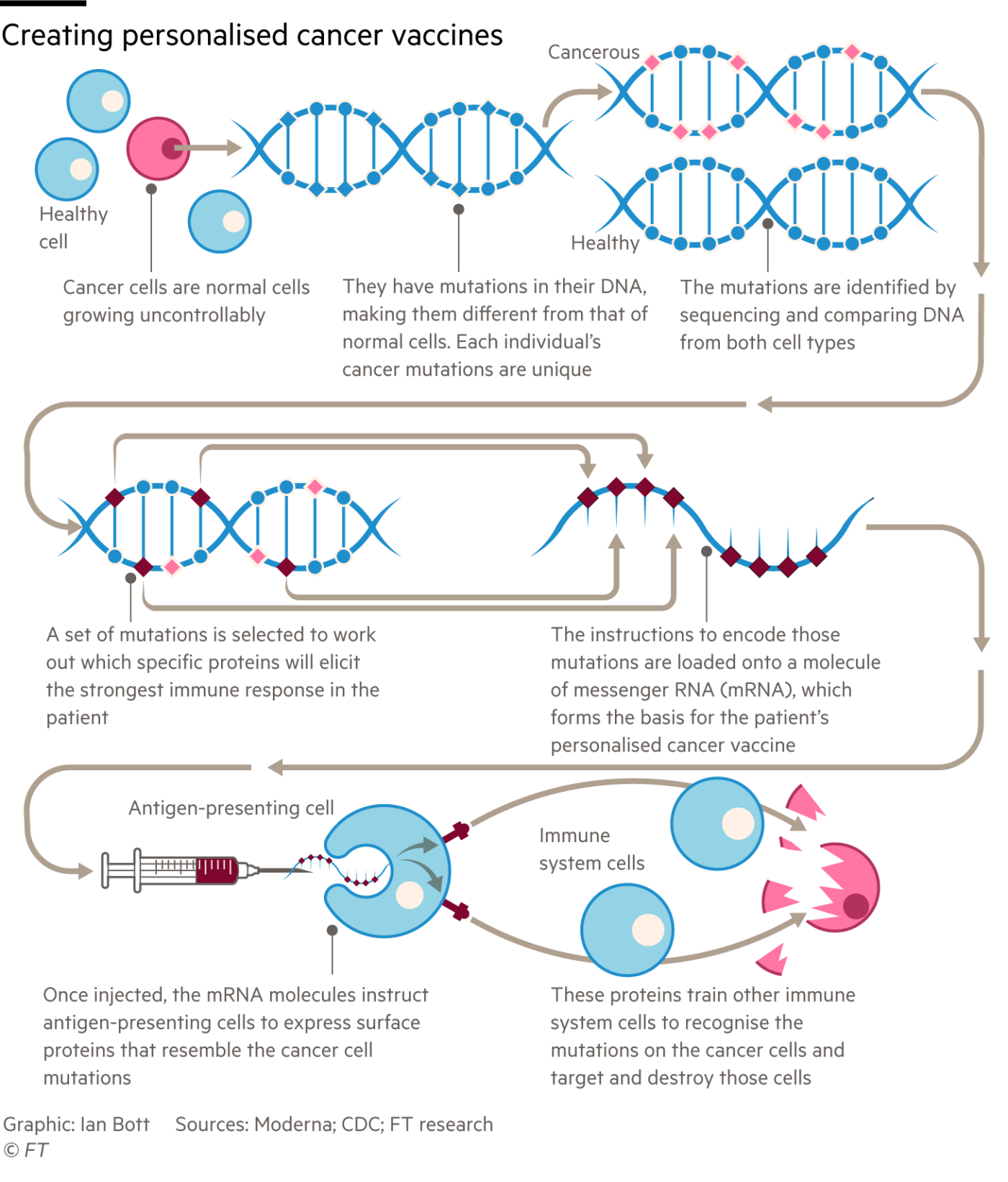

The mRNA acts as a set of instructions to cells, telling them to build certain proteins. The response to the pandemic proved for the first time that the technology could be used to create a highly effective vaccine: mRNA was deployed in a vaccine to help the immune system recognise and fight intruders such as the coronavirus Sars CoV-2. Next, BioNTech wants to use the code to prompt the body’s defences to tackle a tumour.

mRNA對細胞來說是一套指令,告訴它們要製造某些蛋白質。對新冠病毒大流行病的反應首次證明了該技術可用於創造高效的疫苗:mRNA被部署在疫苗中,幫助免疫系統識別和對抗冠狀病毒Sars CoV-2等入侵者。接下來,BioNTech希望使用該代碼來促使身體的防禦系統對付腫瘤。

Yet, unlike its American rival Moderna, which is focused on how to deploy mRNA across a range of infectious diseases and other conditions, BioNTech wants to use mRNA to tackle cancer, working in combination with other therapies. Şahin and Türeci believe the best hopes of a cure will come from combining different treatments, including cell therapies, antibodies and other ways of modulating the immune system.

然而,與美國競爭對手莫德納(Moderna)專注於如何將mRNA應用於一系列傳染病和其他疾病不同,BioNTech希望將mRNA與其他療法結合起來,用於治療癌症。沙欣和圖雷西認爲,治癒的最大希望來自於結合不同的治療方法,包括細胞療法、抗體和其他調節免疫系統的方法。

Before the pandemic, the company was a little known player in the $1.2tn global pharmaceuticals market that is dominated by long-established companies pursuing many disease areas at once. In its 2019 initial public offering, BioNTech struggled to get investors excited, raising just $150mn; two years later it had become the most promising biotech in Europe.

在疫情之前,該公司在1.2兆美元的全球製藥市場上是一個鮮爲人知的參與者,該市場由老牌公司主導,同時研究多個疾病領域。在2019年的首次公開發行(IPO)中,BioNTech難以讓投資者興奮起來,僅籌集了1.5億美元;兩年後,它已成爲歐洲最有前途的生物技術公司。

Matthias Kromayer, a managing partner at MiG Capital, who was a founding investor in BioNTech, says when he invested he didn’t even believe in the potential of mRNA. He gave the baby BioNTech money because the founders seemed to understand how technology would change healthcare, he says. “BioNTech isn’t just a biotech company. It is a multi-tech company and has been from the beginning . . . Ugur is always thinking 10 years ahead.”

米格資本(MiG Capital)的管理合夥人、BioNTech的創辦投資者馬蒂亞斯•克羅梅爾(Matthias Kromayer)表示,他在投資時甚至不相信mRNA的潛力。他說,他給剛剛創辦時的BioNTech投資,是因爲創辦人似乎明白技術將如何改變醫療保健。「BioNTech不僅僅是一家生物科技公司。它是一家多技術公司,從一開始就是這樣…烏爾·沙欣總是考慮未來10年。」

In April, BioNTech unveiled results of a study that combined mRNA with CAR-T-cell therapy to reprogramme a patient’s immune system. CAR-T is a complex treatment that involves collecting and modifying a patient’s immune cells to fight their cancer. So far, it has only worked in blood cancers. But BioNTech scientists created an mRNA booster that expanded the number of immune cells and improved their ability to kill a solid tumour, making it useful in a far larger range of cancers.

4月,BioNTech公佈了一項研究結果,該研究將mRNA與CAR-T細胞療法相結合,重新規劃病人的免疫系統。CAR-T是一種複雜的治療方法,包括收集和修改病人的免疫細胞來對抗他們的癌症。到目前爲止,它只對血癌有效。但是BioNTech的科學家們創造了一種mRNA助推器,擴大了免疫細胞的數量,提高了它們殺死實體腫瘤的能力,使其對更多的癌症有用。

Brad Loncar, a biotech investor who runs a fund focused on cancer, declared it “borderline revolutionary”. “It is so interesting that it has the entire field rethinking how to go after solid tumours,” he says.

生物技術投資者布拉德·朗卡(Brad Loncar)管理著一個專注於癌症的基金,他宣稱這是「邊緣革命」。他說:「這是非常有趣的,它讓整個領域重新思考如何治療固體腫瘤。」

BioNTech’s strategy is to invest in many different technologies at once. Şahin uses the analogy of a smartphone that becomes more useful as you discover its many functions. “You understand it is not just a smartphone, it is a calculator, it allows you to do anything,” he said. “Based on the powerful platforms that we are developing, we believe that we will be able to provide a lot of different solutions for many diseases.”

BioNTech的策略是同時投資多種不同的技術。沙欣使用了智慧型手機的比喻,當你發現它的許多功能時,它會變得更有用。他說:「你知道這不僅僅是一部智慧型手機,它還是一個計算器,它可以讓你做任何事情。基於我們正在開發的強大平臺,我們相信我們將能夠爲許多疾病提供許多不同的解決方案。」

Broadly speaking, the BioNTech founders see themselves as engineers of the immune system. Beyond cancer and infectious diseases, where the company continues to partner with Pfizer on vaccines, they also plan to tackle autoimmune conditions and regenerative medicine, which restores damaged or diseased cells. In total, the company is already running 19 early stage trials and 12 pre-clinical programmes.

一般來說,BioNTech的創辦人認爲自己是免疫系統的工程師。除了癌症和傳染性疾病,該公司繼續與輝瑞在疫苗方面進行合作,他們還計劃解決自身免疫疾病和再生醫學,即修復受損或患病細胞。總的來說,該公司已經在進行19個早期階段試驗和12個臨牀前項目。

Their newly bulging pockets permit such largesse, says one healthcare banker. A more cash-strapped company would have to be more selective and risk “throwing a great technology in the bin”. At the end of March, BioNTech’s assets were more than €19bn, surpassing even Moderna’s €16bn, and more than half that of large European pharma companies GlaxoSmithKline, AstraZeneca and Novartis.

一位醫療銀行家表示,他們最近鼓鼓的口袋允許了這樣的慷慨。一個資金更加緊張的公司將不得不更加挑剔,冒著「把一項偉大的技術扔進垃圾桶」的風險。3月底,BioNTech的資產超過190億歐元,甚至超過了莫德納的160億歐元,超過了歐洲大型製藥公司葛蘭素史克(GlaxoSmithKline)、阿斯特捷利康(AstraZeneca)和諾華(Novartis)的一半以上。

Cancer trials are expensive, especially if a company has to first buy the drug it wishes to combine with its treatment. And personalised products such as CAR-T have proven difficult to market in a global healthcare system that is more familiar with buying drugs off the shelf such as consumer goods.

癌症試驗是昂貴的,特別是如果一個公司必須首先購買它希望與治療相結合的藥物。像CAR-T這樣的個性化產品已經被證明很難在全球醫療體系中推廣,因爲全球醫療體系更熟悉購買現成的藥物,比如消費品。

With valuations of biotech companies dropping this year, Gareth Powell, a healthcare fund manager at Polar Capital, says BioNTech is lucky it can fund so many programmes. “If they didn’t have the Covid cash . . . I would imagine they would be under severe pressure,” he says. “The capital markets just wouldn’t be there for them to do this stuff.”

極地資本(Polar Capital)的醫療保健基金經理加雷思•鮑爾(Gareth Powell)表示,在今年生物科技板塊的估值下降之際,BioNTech很幸運,它能資助這麼多項目。「如果他們沒有來自新冠疫苗的現金……我可以想像,他們會承受巨大的壓力。資本市場不可能讓他們做這些事情。」

‘Money doesn’t grow on trees’

「錢不是從樹上長出來的」

Bryan Garnier & Co was part of a team of banks that helped take first Moderna and then BioNTech, public. Pierre Kiecolt-Wahl, co-head of equity capital markets at the French bank, says Moderna took a more incremental approach than BioNTech’s, focusing first on infectious diseases, where it hoped to show signs of success quickly that could persuade investors to put in more funds.

Bryan Garnier & Co是幫助莫德納和BioNTech上市的銀行團隊的一員。這家法國銀行股權資本市場聯席主管皮埃爾•基科爾-瓦爾(Pierre Kiecolt-Wahl)表示,莫德納采取了比BioNTech更循序漸進的做法,首先關注傳染性疾病,希望在這方面迅速顯示出成功跡象,從而說服投資者投入更多資金。

“Moderna knew money doesn’t grow on trees,” he says. By contrast, he says Şahin and Türeci were more confident that they had data to fight cancer.

「莫德納知道錢不是從樹上長出來的,」他說。他說,相比之下,沙欣和圖雷西更自信地認爲他們擁有對抗癌症的數據。

But even though it now has substantial financial resources, long-term success is not guaranteed. Loncar says it may yet turn out that mRNA doesn’t really work for cancer. “There’s a non-zero per cent chance that mRNA may completely strike out in cancer,” he says. “If that happens, BioNTech is going to feel it a lot harder than Moderna will.”

但是,即使它現在有大量的財政資源,長期的成功也不是板上釘釘的。朗卡說,mRNA仍有可能最終被證明對癌症真的不起作用。他說:「mRNA無法攻克癌症的可能性是有的。如果發生這種情況,BioNTech將比莫德納更困難。」

Oncology is far trickier than creating vaccines — Tewari, the Jefferies analyst, describes it as “scientifically byzantine” — and it is a hypercompetitive field, with almost every major pharmaceutical company scouring for treatments for the same conditions.

腫瘤學比創造疫苗要棘手得多——傑富瑞公司的分析師特瓦里將其描述爲「科學上神祕複雜」——而且它是一個競爭激烈的領域,幾乎所有的主要製藥公司都在爲相同的病症尋找治療方法。

BioNTech’s most advanced clinical oncology programme is for cancer vaccines. Unlike regular vaccines, they do not prevent the recipient from developing cancer, but are used as treatments to prompt the immune system to destroy mutated cells. In phase 2 trials, it has two FixVac programmes, where the vaccines are not personalised, and two where they are.

BioNTech最先進的臨牀腫瘤項目是癌症疫苗。與普通疫苗不同的是,它們不能防止受體患上癌症,而是用於治療,促使免疫系統破壞突變細胞。在第二階段試驗中,它有兩個疫苗不是個性化的FixVac項目,還有兩個是個性化的。

Hopes for creating cancer vaccines have been dashed many times before. “It is a concept that has been around for decades. But there has been failure, after failure, after failure,” says Loncar.

研製癌症疫苗的希望以前已經破滅過很多次。「這是一個已經存在了幾十年的概念。但失敗一直在發生,一次又一次的失敗,」朗卡說。

He says one problem could be that therapies are being deployed too late. New therapies are usually tried first in patients who have not responded to previous drugs and usually have later stage cancer, but he believes they might work better at an earlier stage, when the patient’s immune system is more robust.

他說,一個問題可能是治療方法部署得太晚。新療法通常首先在對以前的藥物沒有反應的病人身上嘗試,而且通常是晚期癌症,但他認爲這些療法在早期階段可能效果更好,因爲此時病人的免疫系統更加強大。

Şahin counters that BioNTech has overcome a number of “critical hurdles” and that its early data shows its mRNA cancer vaccines are eliciting immune responses several hundred times stronger than were previously reported for conventional cancer vaccines.

沙欣反駁說,BioNTech已經克服了許多「關鍵障礙」,其早期數據顯示,其mRNA癌症疫苗引發的免疫反應比以前報導的傳統癌症疫苗強數百倍。

The company is also doing trials in earlier stage cancers, and is particularly interested in giving the vaccines just after patients have had surgery to remove the primary tumour. In a phase 1 trial presented this month, the company showed positive results treating pancreatic cancer patients shortly after surgery.

該公司也在進行早期癌症的試驗,尤其有興趣在患者剛接受手術切除原發腫瘤後接種疫苗。在本月公佈的一期試驗中,該公司在治療胰腺癌患者術後不久就取得了積極的結果。

But as well as the scientific uncertainty, BioNTech will face practical challenges as it tries to disrupt the pharmaceutical business. The company will have to push regulators to adapt to individualised therapies that break the mould of conventional clinical trials. While such trials usually take several years and lead to an approved product that never changes, the founders want to be able to update their medicines — like an iPhone — as new data improves algorithms that predict the best way to target a tumour.

但是,除了科學上的不確定性,BioNTech在試圖顛覆製藥行業的過程中還將面臨實際挑戰。該公司將不得不推動監管機構適應打破傳統臨牀試驗模式的個性化治療。雖然這樣的試驗通常需要數年時間,並最終獲得一款永遠不會改變的獲批產品,但創辦人希望能夠更新他們的藥物——就像iPhone一樣——因爲新數據改進了演算法,可以預測瞄準腫瘤的最佳方式。

Türeci says the company has to take the “smallest steps” with “conservative” regulators whenever they enter new territory. “The problem with the way medicines are developed is that, at that time when you have something you can approve for patients and bring it to the market, the technology is already outdated [by] several years,” she says.

圖雷西表示,無論何時進入新領域,該公司都必須對「保守」的監管機構採取「最小的步驟」。她說:「藥物開發方式的問題是,當你有一種可以爲患者批准並推向市場的藥物時,這種技術已經過時好幾年了。」

The ‘smallest steps’

「最小的步驟」

While BioNTech’s has no need to beg investors for more capital, the company will still have to navigate expectations of shareholders who bought it as a Covid stock. Shares in BioNTech have fallen by about 20 per cent in the past year, after some investors sold in anticipation that sales of the Covid vaccine would slow. But the stock is still up more than fourfold since March 2020, when the company first announced it was developing a shot with Pfizer.

雖然BioNTech沒有必要乞求投資者提供更多資金,但該公司仍需應對作爲新冠股票購買其股票的股東的預期。在一些投資者預期新冠疫苗的銷售將放緩後,BioNTech的股價在過去一年下跌了約20%。但自2020年3月該公司首次宣佈與輝瑞合作開發一種疫苗以來,其股價仍上漲了四倍多。

Loncar, the cancer-specialist investor, does not own BioNTech primarily because it still trades as a Covid stock. He believes shareholders may be in for a surprise. “Investors have been really spoiled by how quickly the Covid-19 vaccines succeeded and how well they did. That’s not normally how drug development goes,” he says. “One thing I worry about is they have a shareholder base today that expects them to succeed in non-Covid things tomorrow.”

癌症專家投資者朗卡沒有持有BioNTech,主要是因爲該公司仍作爲新冠概念股交易。他認爲,股東們可能會大喫一驚。「新冠疫苗成功得如此之快,表現得如此出色,投資者真的被寵壞了。藥物開發通常不是這樣的,」他說。「我擔心的一件事是,他們今天的這些股東,會希望他們明天就在非新冠的項目上取得成功。」

Şahin tries to be sanguine about the company’s stock — he says he looks the price up about once a week, far less often than he checks medical journal sites. And he stresses that the company has always been clear with investors about its true vision: “We can’t guarantee to them what is going to happen in the next Covid season. This is more dependent on what’s happening in the world and how the virus is evolving, and less dependent on our competencies.”

沙欣試圖對公司的股票持樂觀態度——他說他大約每週檢視一次股價,比他檢視醫學雜誌網站的次數要少得多。他強調,該公司一直向投資者明確其真正的願景:「我們不能向他們保證下一個新冠季節會發生什麼。這更多地取決於世界上正在發生的事情以及病毒的演化方式,而不是依賴於我們的能力。」

Still he was surprised recently when the share price rose as investors anticipated the company would create a vaccine for monkeypox. (BioNTech has not started work on a jab for the spreading disease. Şahin says they are “preparing ourselves to be prepared” to do so, but it does not look like a global challenge yet.)

不過,最近他對公司股價上漲感到驚訝,因爲投資者預計公司將研發出猴痘疫苗。(BioNTech還沒有開始研究這種正在傳播的疾病的疫苗。沙欣表示,他們正在「做很少的準備」,但這看起來還不像是一個全球性的挑戰。)

Some investors are asking whether BioNTech can handle quite so much cash — and take on so many challenges at once.

一些投資者質疑,BioNTech是否能夠同時處理這麼多現金,並接受這麼多挑戰。

While the company has decided to use the vast majority of its vaccine proceeds for internal investment, with just a couple of small bolt-on acquisitions, it did announce plans to return almost €2bn to shareholders in a buyback and dividend. This also divided shareholder opinion, because it is so unusual for a biotech with many programmes in early stage development to cough up cash. “It was a terrible idea,” says Powell at Polar Capital. “It’s such a waste of money.”

儘管該公司已決定將其絕大部分疫苗收益用於內部投資(僅進行了幾筆小型補強性收購),但它確實宣佈了以回購和股息的方式向股東返還近20億歐元的計劃。這也引起了股東們的意見分歧,因爲對於一個有許多項目處於早期開發階段的生物技術公司來說,把錢送還給股東是非常不尋常的。極地資本的鮑爾表示:「這是一個糟糕的想法。這太浪費錢了。」

But analysts say that most long-term investors trust the founders who delivered the Covid vaccine at such scale and speed. Van Voorthuizen at Kempen says they are particularly “diligent” about structuring their trials so that they give solid answers to specific questions. “They will stop [a trial] if it doesn’t work. They are not depending on one or other programmes to make or break the company,” she says.

但分析人士表示,大多數長期投資者都信任以如此規模和速度推出新冠疫苗的創辦人。Kempen的範•沃特伊森說,他們特別「勤奮」地組織他們的試驗,以便對特定的問題給出可靠的答案。「如果(試驗)不起作用,他們就會停止。他們不會依賴於一個或幾個項目來成就或摧毀公司,」她表示。

The healthcare banker believes BioNTech is “by far the most exciting biotech in Europe”, adding that there are no founders more inspirational than Şahin and Türeci. “They are so insanely smart and they work so damn hard,” he says.

前文提到的那位醫療行業銀行家認爲,BioNTech是「迄今爲止歐洲最令人興奮的生物科技公司」,他補充稱,沒有哪家公司的創辦人比沙欣和圖雷西更鼓舞人心。「他們非常聰明,工作非常努力,」他說。

Türeci describes how Şahin can suck up information, rapidly reading dozens of papers on a new condition. “It’s sort of something like machine learning what he does,” she jokes. “In a weekend, the entire history of science on this specific topic.”

圖雷西描述了沙欣如何吸收資訊,快速閱讀幾十篇關於新狀況的論文。「他的這種方式這有點像機器學習,」她開玩笑說。「在一個週末,他會看完一個特定的話題的整個科學史。」

Governments from around the world are calling for advice for birthing their own versions of BioNTech, Türeci says. But, just as the company surprised the world in 2020 by navigating the uncharted waters of mRNA vaccine development, Türeci says they are once again heading into “unknown territory”. And this time, success is not likely to happen at lightspeed.

圖雷西說,世界各地的政府都在請教他們,如何才能在他們自己的國家孕育出BioNTech這樣的公司。但是,正如該公司在2020年透過駕馭mRNA疫苗開發的未知領域而令世界驚訝一樣,圖雷西說他們正再次進入「未知領域」。而這一次,成功不大可能會迅速到來。