尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

On Tuesday, while the US was voting, I heard a successful American businessman suggest at a dinner that the election could be framed as a choice between prioritising “capitalism” or prioritising “democracy”.

週二,在美國選民還在投票時,我聽到一位成功的美國商人在一次晚宴上建議,這次選舉可被看作在「資本主義」優先還是「民主」優先之間作出選擇。

During the campaign, Democrats often derided Donald Trump for his perceived onslaught on democracy, while Trump attacked Kamala Harris for her allegedly pro-government, anti-capitalist stance. Hence those “Comrade Kamala” memes.

在競選期間,民主黨人經常嘲諷唐納•川普對民主的所謂猛攻,川普則攻擊卡瑪拉•哈里斯所謂的親政府、反資本主義立場。因此還出現了「卡瑪拉同志」的圖梗。

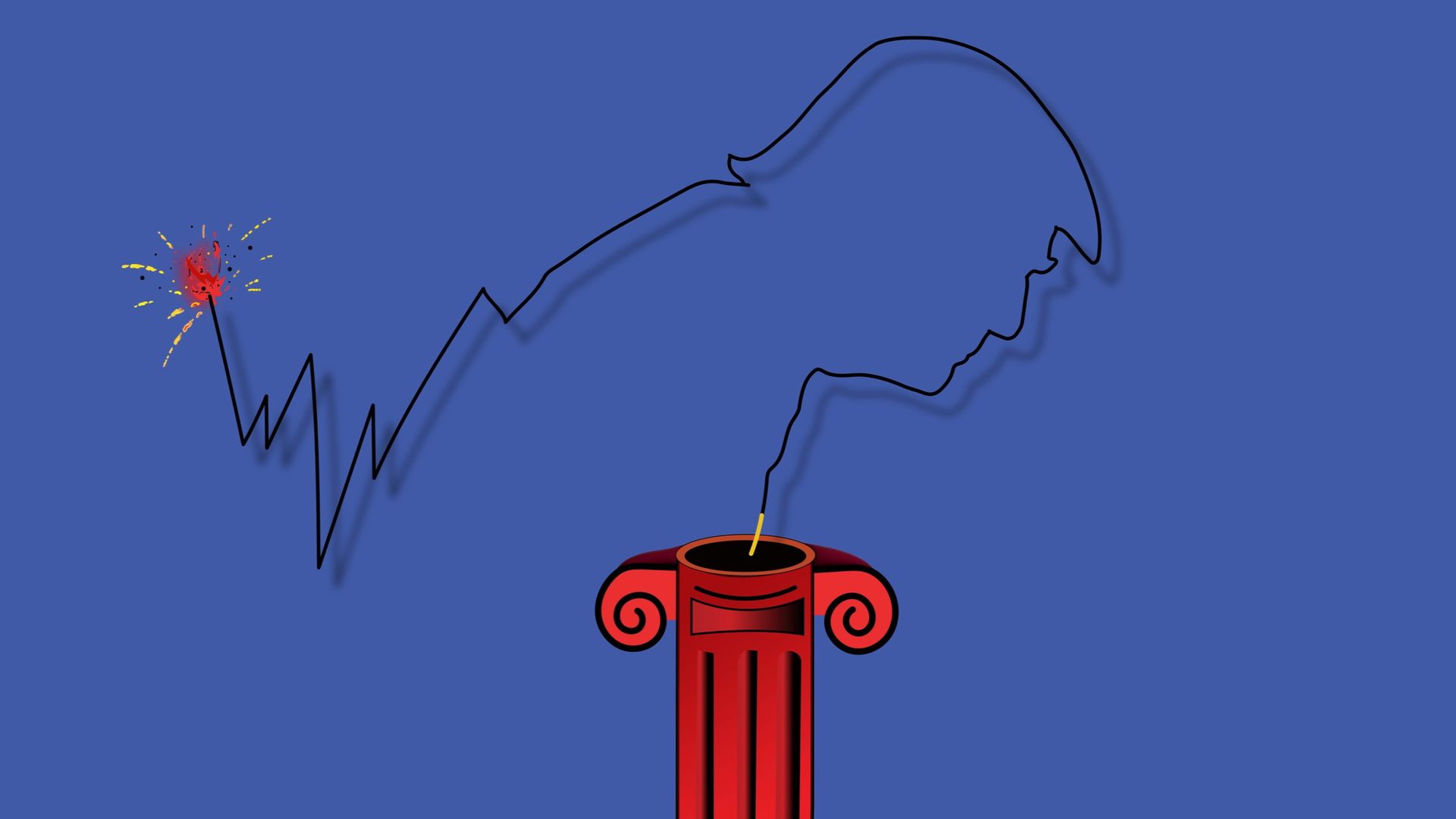

And while both candidates vehemently rejected those caricatures, the mudslinging seems to have stuck, at least in the minds of many business leaders and investors. Just look at the surge in stock prices after the election result, as investors concluded that Trump will be pro-growth and pro-business.

儘管兩位候選人都強烈反對這些誇張的描述,但這些惡意中傷似乎已經深入人心——至少在許多商界領袖和投資者心中。只需看看選舉結果出爐後飆升的股價,因爲投資者的結論是,川普將支援成長、支援商業。

The capitalist aura looks especially strong given that Elon Musk, the entrepreneur and co-founder of Tesla, is set to be influential in the next administration, along with hedge fund managers such as Scott Bessent, a leading candidate to be the next Treasury secretary.

考慮到創業家、特斯拉聯合創辦人伊隆•馬斯克(Elon Musk)將在下一屆政府中發揮影響力,以及衝基金經理斯科特•貝森特(Scott Bessent)成爲下一任財政部長的主要候選人,川普身上的資本主義光環看起來尤其強烈。

But as Trump selects his team in the coming weeks, the key question is what variant of “capitalism” the 47th president will uphold. The answer is not clear-cut.

但是,隨著川普在未來幾周挑選他的團隊,關鍵問題是這位第47任總統將奉行哪種「資本主義」。答案並不明確。

When Republicans toss the concept around, they often invoke Adam Smith, the 18th-century Scottish intellectual who pioneered free-market ideas. When I visited then vice-president Mike Pence during the first Trump administration, the only books in his office were the Bible, his boss’s The Art of the Deal and those of Jack Kemp, a Smith-loving ex-American football player turned congressman.

當共和黨人談論這一概念時,他們經常提及開創了自由市場理念的18世紀蘇格蘭思想家亞當•斯密。當我在川普第一任期期間拜訪時任副總統邁克•潘斯時,他辦公室裏擺放的書只有《聖經》、他老闆的《交易的藝術》和傑克•肯普的書,後者是一位崇拜斯密的前美式足球運動員,後來成爲國會議員。

Today, Trump continues to champion some of the concepts found in Smith’s 1776 classic The Wealth of Nations. He clearly believes in the power of profit-maximising incentives — or greed — to drive growth, echoing Smith’s concept of the “invisible hand”. He shares Smith’s distaste for excessive government interference and high taxes (though unfortunately he rejects Smith’s case for free trade).

如今,川普繼續倡導斯密1776年的經典著作《國富論》中的一些概念。他顯然相信利潤最大化的激勵(或貪婪)能夠推動成長,這與斯密的「看不見的手」概念不謀而合。他與斯密一樣厭惡政府的過度干預和高稅收(儘管遺憾的是他拒絕接受斯密支援自由貿易的理由)。

And there is another, oft-overlooked, point: an appreciation of family firms. When Smith developed his ideas about markets, the only enterprises around him were family-owned ones (with the notable exception of the joint-stock East India Company, which Smith decried).

還有一點常常被忽視:對家族企業的欣賞。當斯密提出其關於市場的理念時,他周圍的企業只有家族企業(除了股份制的東印度公司,斯密對其大加抨擊)。

Today, however, the discourse around capitalism is dominated by listed companies and public markets. But ironically, a company such as the Trump Organization would have seemed more familiar to Smith than our modern listed corporate behemoths.

然而,如今,圍繞資本主義的討論主要由上市公司和公開市場主導。但具有諷刺意味的是,斯密可能對川普集團這樣的公司比對現代上市企業巨擘更感覺熟悉。

But the key issue investors now need to ponder is where Trump stands in relation to the other half of Smith’s free-market vision contained in The Theory of Moral Sentiments. Smith viewed this book as his most important work, since he believed the key to building dynamic commerce and markets is to create a system based on shared moral values and trust. That requires transparency, fair play and consistent property rights, since “if [justice] is removed, the great, the immense fabric of human society . . . must in a moment crumble into atoms”. In short, he saw corporate monopolies and capricious abuses of power as anti-capitalist.

但投資者現在需要思考的關鍵問題是,川普對斯密在《道德情操論》中提出的另一半自由市場願景的態度。斯密認爲這本書是他最重要的著作,因爲他認爲建立充滿活力的商業和市場的關鍵在於成立一個基於共同道德價值觀和信任的體系。這就需要透明度、公平競爭和連續的產權,因爲「如果(正義)被剝奪,人類社會的偉大、巨大的結構......必會在頃刻間化爲烏有」。簡言之,他認爲企業壟斷和任性的權力濫用是反資本主義的。

Will Trump uphold that view too? There is reason to feel nervous. Musk presents himself as an arch capitalist, but has also spent his career railing against rules and seems untroubled by concentrations of power. Trump has faced multiple law suits, and has often appeared to have scant respect for legal contracts.

川普也會堅持這一觀點嗎?有理由感到擔憂。馬斯克自詡爲一個大資本家,但他的職業生涯也一直在抨擊各種規則,似乎毫不擔心權力集中。川普曾面臨多起法律訴訟,而且經常表現出對法律合同的漠視。

Meanwhile, figures such as Robert Lighthizer, Trump’s former US trade representative, have repeatedly threatened to rip up trade agreements. Bessent says that this rhetoric is just a negotiating ploy, intended to “escalate to de-escalate” — in other words, to scare opponents into submission. But I believe that a defining feature of the Trump approach is that it tends to embrace a situational, rather than universal, vision of the law. In other words, one that is shaped and applied by the context of power, not always in a uniform way. This runs counter to the ideals that have shaped much of the postwar western order. It is also at odds with the mantra of modern capital markets, which are supposed to be founded on consistent and predictable laws.

與此同時,川普的前美國貿易代表羅伯特•萊特海澤等人一再威脅要撕毀貿易協定。貝森特說,這種言論只是一種談判策略,旨在「以升級實現降級」——換句話說,就是爲了嚇唬對手屈服。但我相信,川普策略的一個決定性特徵是,它傾向於採用一種情境化而非普遍化的法律觀。換句話說,這種法律觀是由權力的背景塑造和應用的,而不總是以統一的方式。這與塑造戰後西方秩序的理念相悖。它也與現代資本市場的準則相悖,現代資本市場應該建立在連貫和可預測的法律之上。

Some Trump supporters disagree with me and point out that the capital markets flourished during the first Trump presidency. They also insist that it is the Democrats, not the Republicans, who have weaponised the law with politically motivated prosecutions of Trump (which may now be dropped).

一些川普的支持者不同意我的觀點,並指出資本市場在川普的第一任總統任期內蓬勃發展。他們還堅稱,是民主黨人,而不是共和黨人,將法律武器化,出於政治動機而起訴川普(現在可能會撤訴)。

In any case, Bessent and others know what it takes to maintain the confidence of capital markets, having lived in them for years, and seem determined to avoid anything that might spark a financial crash. Indeed, fear of falling asset prices could help to rein Trump in and dissuade him from pursuing more radical ideas.

無論如何,貝森特和其他人知道如何維持資本市場的信心,他們已經在資本市場縱橫多年,似乎決心避免任何可能引發金融崩潰的事情。事實上,對資產價格下跌的擔憂可能有助於制約川普,並阻止他追求更激進的想法。

Yet as equity markets surge amid excitement at the election of a supposedly pro-business, “capitalist” candidate, investors should remember the two sides to Smith. Unfettered competition can certainly drive growth — even crony capitalism can produce a sugar high. But “moral sentiments” — trust and the rule of law — are essential for long-term prosperity. Let us pray that the next administration remembers this.

然而,隨著股市在一位據稱親商的「資本主義」候選人勝選的興奮中飆升,投資者應該記住斯密論述的兩面。不受約束的競爭肯定能夠推動成長——即使裙帶資本主義也能帶來短時的繁榮。但「道德情操」——信任和法治——對長期繁榮至關重要。讓我們祈禱下屆政府能記住這一點。