尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

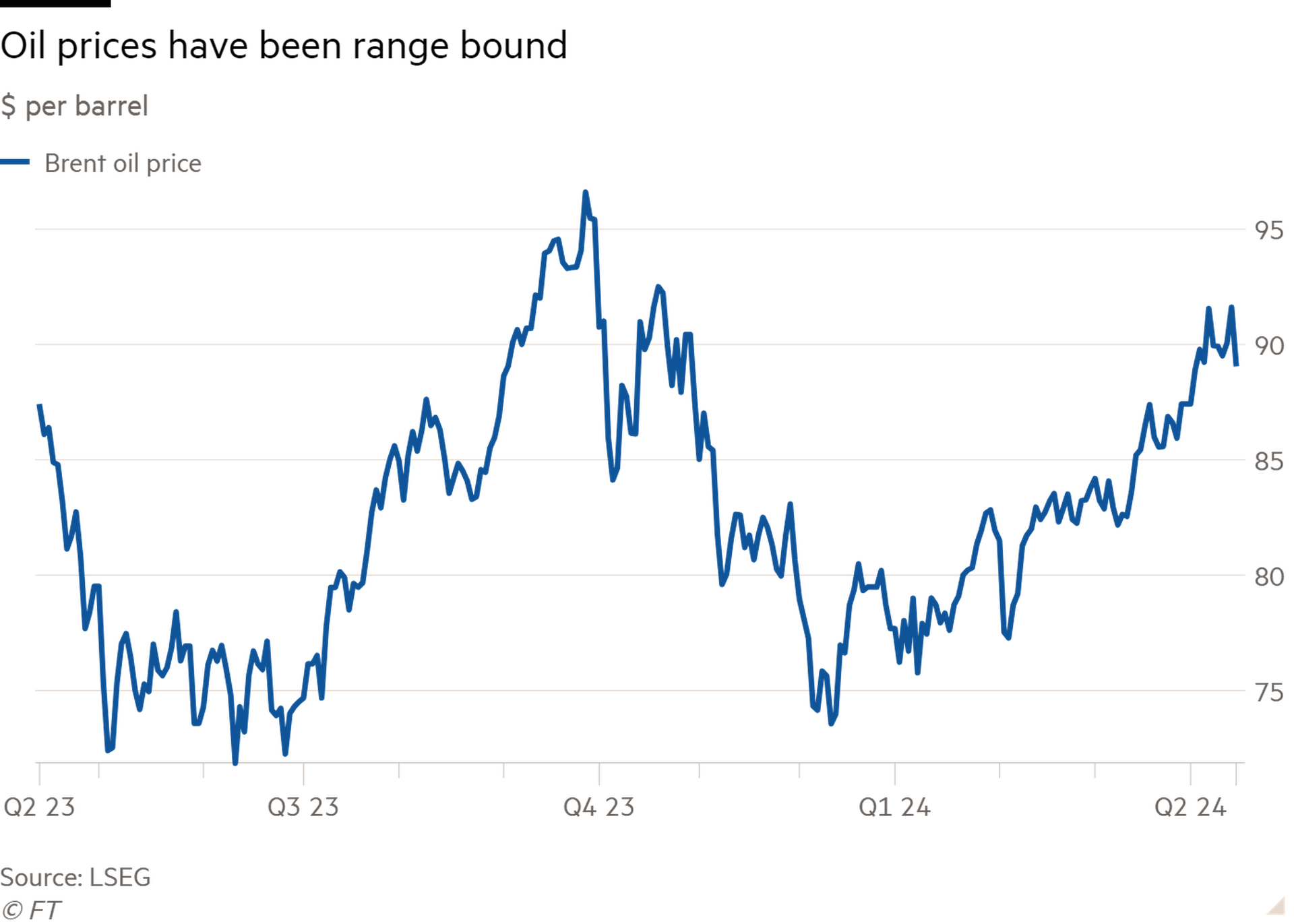

Despite crude oil’s combustible properties, armed conflict near large oil producers — Russia and now Iran — has not ignited a sustained rise in price. Brent crude fell on Monday, struggling to stay above $90 a barrel, after this weekend’s attack on Israel by Iran.

儘管原油具有可燃性,但大型石油生產國(俄羅斯和伊朗)附近的武裝衝突並沒有引發油價的持續上漲。在上週末伊朗襲擊以色列之後,布倫特(Brent)原油週一下跌,勉強維持在每桶90美元上方。

Why is the oil market so relaxed in the face of escalating regional tensions? The oil price may increasingly self-regulate in price terms. Higher oil prices just stoke fears of a reacceleration of broader price inflation. This would remove one of the factors behind the recent rally in equity prices. It is unlikely that commodity prices would continue to climb should central banks start to play down the prospect of interest rate cuts.

面對不斷升級的地區緊張局勢,石油市場爲何如此放鬆?油價可能越來越多地在價格方面自我調節。油價上漲只會加劇人們對更廣泛價格通膨再次加速的擔憂。這將消除近期股價反彈背後的一個因素。如果各國央行開始淡化降息的可能性,大宗商品價格不太可能繼續攀升。

World stock prices have rallied a fifth since October, anticipating an inflection point for interest rates. That hope has already dimmed. US Federal Reserve chair Jay Powell this month hinted that the central bank would move slowly. US bond yields, anticipating problems, have risen this year. Interest rate traders anticipate less than half as many reductions by global central banks as at the beginning of the year.

自去年10月以來,由於預期利率將出現拐點,全球股價已經上漲了五分之一。而這一希望已經變得渺茫。美聯準(Fed)主席傑伊•鮑爾(Jay Powell)本月暗示,央行將緩慢行動。由於預期會出現問題,美國債券收益率今年有所上升。利率交易員預計,全球央行的降息次數將不到今年年初的一半。

As a result, equity markets are already more jittery — not a positive for oil. Since 2000 oil prices have rarely continued rising when the S&P 500 has a sustained decline. That surely would happen if oil prices soared in an all-out war between Iran and Israel. Opec+ producers could also use their almost 6mn barrels per day of spare capacity were price rises seen to threaten central banks’ next move, thinks Rystad Energy.

因此,股市已經更加緊張不安,這對油價不利。自2000年以來,油價很少在標普500指數(S&P 500)持續下跌的情況下繼續上漲。如果伊朗和以色列之間的全面戰爭導致油價飆升,這種情況肯定會發生。Rystad Energy認爲,如果油價上漲威脅到央行的下一步行動,歐佩克+(Opec+)產油國也可以利用其每天近600萬桶的閒置產能。

Traders may also be questioning the extent of Iran’s military threat. The country will not want to hurt its own oil exports. These have picked up markedly in recent years, from a low of about 400,000 b/d in the pandemic year of 2020 to about 1.4mn b/d recently, according to Richard Bronze at Energy Aspects. Almost all of that is tanked to China from the Gulf through the Strait of Hormuz.

貿易商可能也在質疑伊朗軍事威脅的程度。該國不會希望損害自己的石油出口。Energy Aspects的理查德•布龍澤(Richard Bronze)表示,近年來,這一數字明顯上升,從疫情爆發之年2020年每天約40萬桶的低點升至最近的每天約140萬桶。幾乎所有這些都是透過荷莫茲海峽(Strait of Hormuz)從海灣用油輪運往中國的。

China brokered last March’s restoration of diplomatic relations between Iran and Saudi Arabia after a seven-year dispute. Iran’s largest customer will not want to see that undone, nor does Iran wish to threaten its export revenues. Its recent failed attempt to raise the cost of its discounted oil to its Chinese customers underscores a poor negotiating position.

去年3月,在中國的斡旋下,伊朗和沙烏地阿拉伯結束了長達7年的爭端,恢復了外交關係。伊朗最大的客戶不希望看到這一切被破壞,伊朗也不希望威脅到自己的出口收入。最近,伊朗試圖提高對中國客戶的折扣石油價格,但以失敗告終,這突顯出其糟糕的談判地位。

Yes, oil prices could well rise if further hostilities ensue. But as politicians rush to avoid further conflict, markets are already signalling their fears that central banks will keep rates higher for longer. That should help keep oil range bound in the months ahead.

是的,如果發生進一步的敵對行動,油價很可能會上漲。但在政界人士急於避免進一步衝突之際,市場已經發出信號,他們擔心各國央行將在更長時間內維持較高利率。這將有助於在未來幾個月內讓石油價格保持在區間波動。