尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

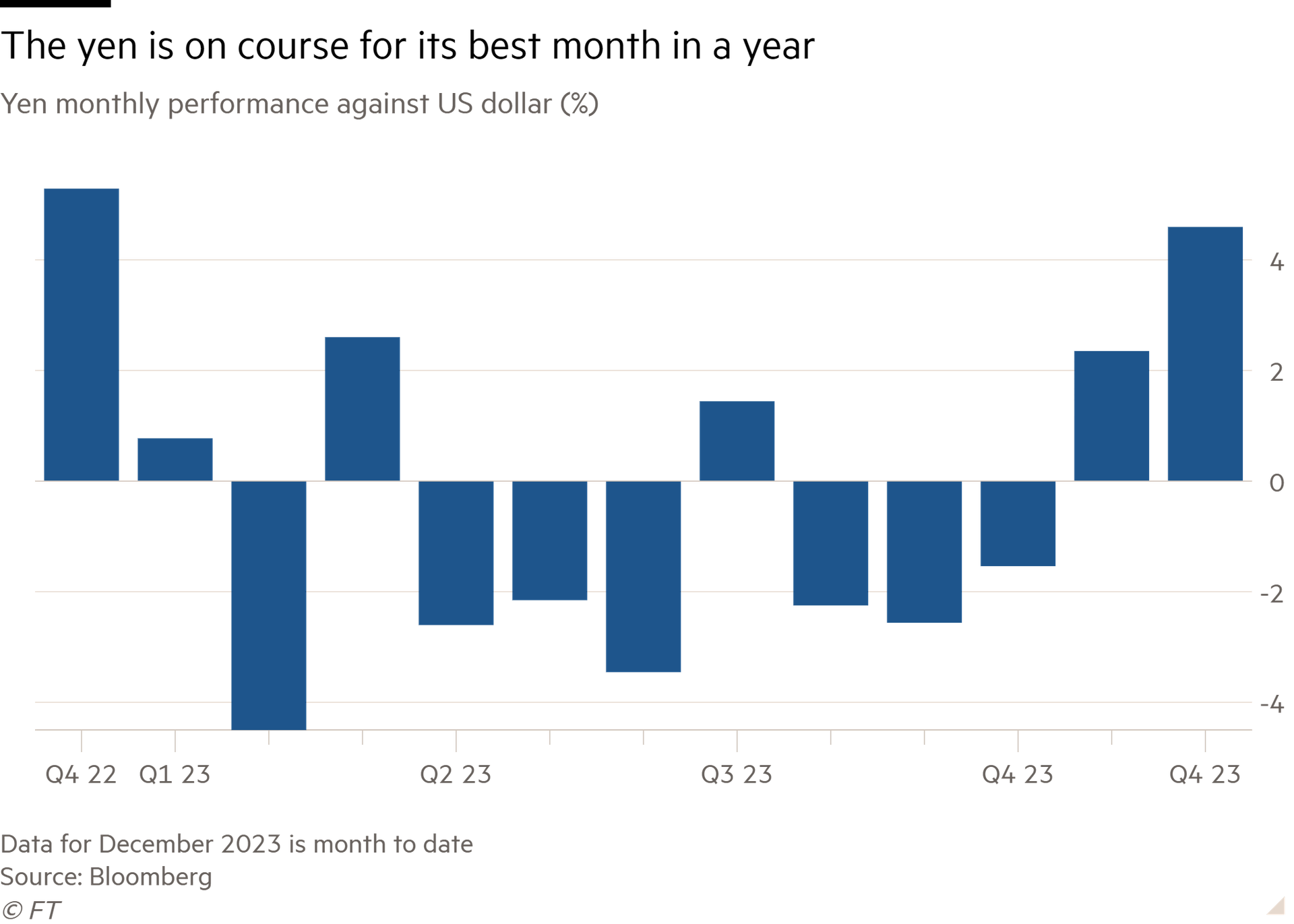

Japan’s currency has run up its biggest monthly gain against the dollar this year, reflecting growing expectations that the Bank of Japan will be forced to tighten monetary policy just as the US Federal Reserve is signalling rate cuts.

日元兌美元匯率創下今年以來最大單月漲幅,反映出在美聯準(Fed)發出降息信號之際,人們對於日本央行(Bank of Japan)將被迫收緊貨幣政策的預期越來越高。

The yen has climbed 7 per cent against the dollar since the middle of November to trade at ¥141.59, its strongest level since July, including a 4.4 per cent rise this month.

自11月中旬以來,日元兌美元匯率已攀升7%,至1美元兌141.59日元,爲7月以來的最高水準,其中本月的漲幅爲4.4%。

“It’s been a big move by any standard,” said Chris Turner, head of global markets at ING. “It started with the whole turn in the dollar when the market was turning more dovish on the Fed and then there were stories suggesting the Bank of Japan was ready to lift interest rates.”

荷蘭國際集團(ING)全球市場主管克里斯•特納(Chris Turner)表示:「無論以何種標準衡量,這都是一次重大舉措。這始於美元的全面轉向,那時市場對美聯準的態度變得更加鴿派,然後有傳言稱,日本央行準備加息。」

The move has helped ease the pressure from rising import prices, which have driven up living costs for consumers this year, but is a headwind for Japanese exporters.

今年以來,進口價格上漲推高了消費者的生活成本。此舉有助於緩解進口價格上漲帶來的壓力,但對日本出口商來說卻是一個不利因素。

The yen was turbocharged this week after the Federal Reserve surprised markets by signalling it would cut interest rates next year. BoJ governor Kazuo Ueda met Japanese Prime Minister Fumio Kishida last week and told the country’s parliament that managing monetary policy “will become even more challenging from the year-end and heading into next year”.

上週,在美聯準出人意料地暗示將於明年降息後,日元匯率大幅上漲。日本央行行長植田和男(Kazuo Ueda)近日會見了日本首相岸田文雄(Fumio Kishida),並向日本議會表示,對貨幣政策的管理「從今年年底到明年將變得更具挑戰性」。

However, the BoJ is widely expected to keep interest rates at minus 0.1 per cent next week at its final monetary policy meeting of the year. Traders in swaps markets are betting that the bank will scrap its negative interest rate in April or June next year.

然而,市場普遍預計,在本週舉行的今年最後一次貨幣政策會議上,日本央行將會把利率維持在-0.1%的水準。掉期市場的交易員押注日本央行將在明年4月或6月取消負利率。

“There is ample evidence now that inflation pressures are embedding in the Japanese economy and that Japan’s negative interest rate policy is inconsistent with the economic reality,” said Salman Ahmed, global head of macro at Fidelity International.

富達國際(Fidelity International)宏觀經濟全球主管薩爾曼•艾哈邁德(Salman Ahmed)表示:「目前有充分證據表明,通膨壓力正深入日本經濟,日本的負利率政策與經濟現實不符。」

The rapid decline of US bond yields eases the upward pressure on Japanese yields as the BoJ gradually unwinds its unconventional policy of holding down its benchmark borrowing costs. The spread — or gap — between 10-year US and Japanese government bond yields has narrowed to 3.2 percentage points, down from more than 4 percentage points in October.

隨著日本央行逐漸放鬆其壓低基準借貸成本的非常規政策,美國債券收益率的迅速下跌緩解了日本債券收益率的上行壓力。10年期美國和日本國債收益率之差(或稱利差)已收窄至3.2個百分點,低於10月份的逾4個百分點。

Michael Metcalfe, head of global market strategy at State Street, custodian to $40tn of assets, said fund managers had been adding to their yen positions over the past fortnight on speculation that the BoJ will soon tighten policy.

管理著40兆美元資產的道富銀行(State Street)的全球市場策略主管邁克爾•梅特卡夫(Michael Metcalfe)表示,過去兩週,由於市場猜測日本央行將很快收緊政策,基金經理一直在增持日元頭寸。

“The yen offers an attractive combination of valuation and the possibility of monetary policy becoming more, not less, supportive,” Metcalfe said, adding that the dollar was 40 per cent overvalued compared with the yen based on measures of purchasing power parity.

梅特卡夫表示:「日元提供了一種頗具吸引力的估值組合,同時貨幣政策的支援力度有可能加大而不是減弱。」他補充稱,以購買力平價衡量,美元兌日元被高估了40%。

Some currency strategists believe the yen will continue to strengthen next year, with the gap between US and Japanese interest rates expected to narrow. Many investors have been using the yen to fund so-called carry trades whereby they would borrow the yen and lend in dollars.

一些外匯策略師認爲,日元明年將繼續走強,美國和日本的利率差距預計將縮小。許多投資者一直在用日元進行所謂的套息交易,即借入日元,借出美元。

“The possibility that the Fed could ease policy in 2024 while the Bank of Japan begins to tighten puts the dollar-yen carry trade under pressure,” said Erik Norland, senior economist at CME Group.

芝加哥商品交易所集團(CME Group)高級經濟學家埃裏克•諾蘭德(Erik Norland)表示:「美聯準可能在2024年放鬆政策,而日本央行開始收緊貨幣政策,這一可能性使美元與日元間的套息交易面臨壓力。」

“In the past, the yen has been subject to rapid upward moves when carry trades liquidate.”

諾蘭德稱:「過去,當套利交易平倉時,日元會呈現快速上揚走勢。」