尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

M&G’s fund managers have supported numerous corporate demergers in the name of unlocking shareholder value. Indeed, the same logic was part of M&G’s separation from Asia-focused insurer and savings group Prudential at the end of 2019.

M&G的基金經理以釋放股東價值的名義支援了多起企業拆分案件。事實上,M&G在2019年底從專注亞洲的保險公司和儲蓄集團保誠集團(Prudential)分離出來,也是基於同樣的邏輯。

That move popped the joint valuation for a while. After this, Pru slipped on China worries and M&G moved sideways. Some investors are now mooting a further break-up of the UK savings and investments group.

這一舉動讓聯合估值一度出現了問題。在此之後,保誠因對中國市場的擔憂而下滑,M&G則分離出來。一些投資者目前正在討論進一步分拆這家英國的儲蓄和投資集團。

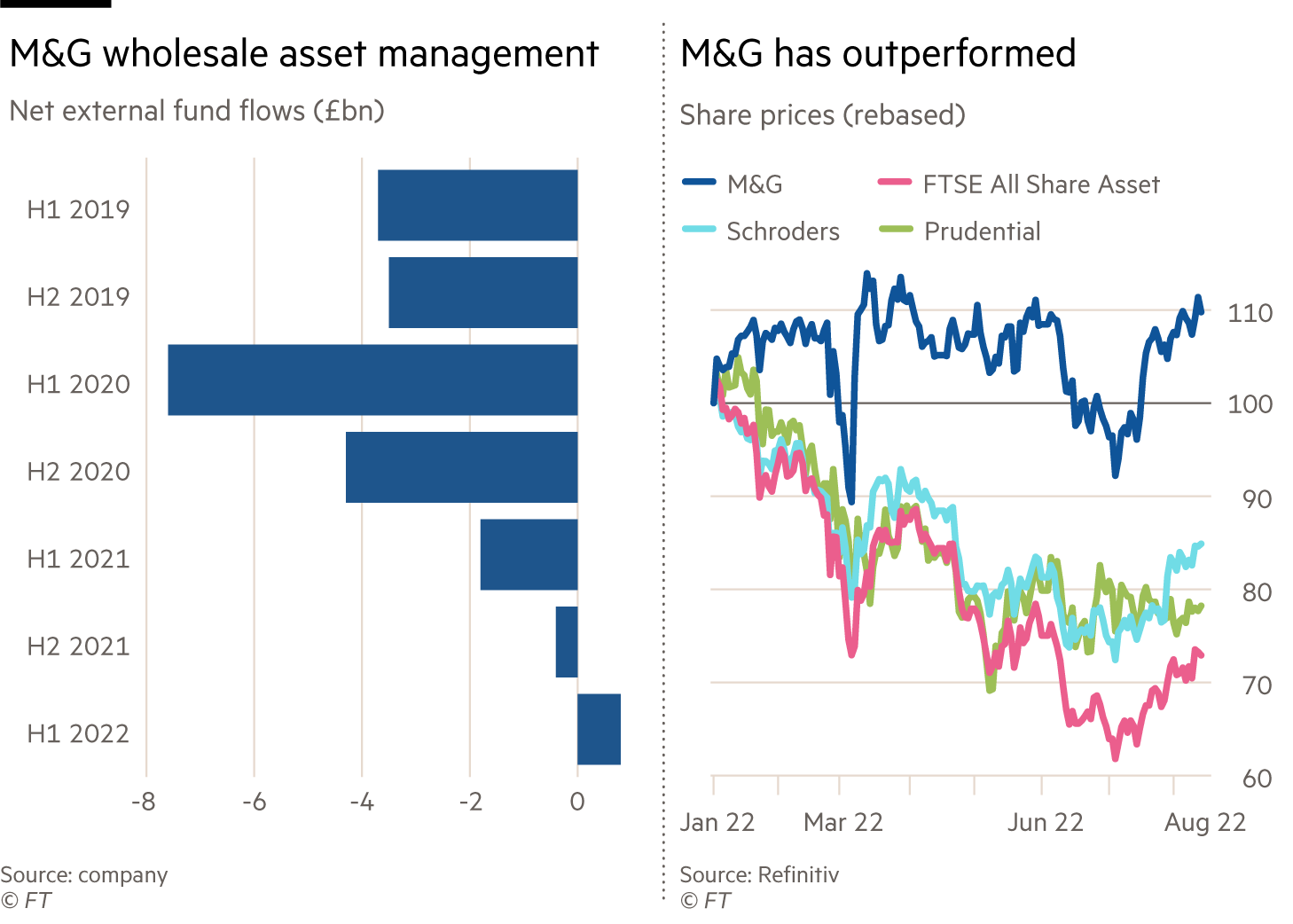

Schroders mulled a bid for M&G at the beginning of last year. It would have hung on to asset management while disposing of the life and pension businesses. The deal foundered over concerns about a culture clash and slumping investment flows.

去年年初,施羅德公司曾考慮競購M&G。M&G本可以在處置壽險和養老金業務的同時,繼續保留資產管理業務。但出於對文化衝突和投資流量下滑的擔憂,該交易失敗了。

These turned positive in the first half of this year for the first time since the demerger. A higher price for the group’s most valuable division should be warranted.

今年上半年出現分拆以來的首次正值。該集團最有價值的部門應該有理由獲得更高的價格。

At £5.6bn, M&G’s market value is just a hair below its listing value. A group valuation multiple of 10 times forward earnings is well below 14 times for Schroders. M&G’s lower rating reflects slower growth and its reliance on unfashionable savings and pension products.

M&G的市值爲56億英鎊,略低於其上市價值。其10倍遠期收益遠低於施羅德公司的14倍。M&G的較低評級反映了其成長放緩以及對不合時宜的儲蓄和養老金產品的依賴。

These include a large back book of annuities and with-profit insurance policies, along with the flagship PruFund, which remains open to new business.

這些產品包括大量的年金和分紅保險政策,以及仍對新業務開放的旗艦產品PruFund。

The with-profits businesses might be worth 20 per cent of own funds, or £3bn. Other insurance businesses could attract £4.5bn, including net debt, equating to 76 per cent of own funds, think analysts at RBC. Add in £2.4bn for the asset management business on a 14 times multiple and any savings a consolidator might find. That implies 40 per cent upside from a break-up over the current price.

分紅保險業務可能佔自有資金的20%,即30億英鎊。加拿大皇家銀行(RBC)的分析師認爲,其他保險業務可以吸引45億英鎊(包括淨債務),相當於自有資金的76%。再加上14倍下資產管理業務的24億英鎊,以及合併商可能找到的任何節省。這意味著拆分後的價格比目前的價格有40%的上升空間。

However, a deal would have to be all or nothing. A partial sale of the back book, for example, would scupper a dividend currently yielding over 8 per cent. Meanwhile, M&G is tipped to benefit from Solvency II reforms. Its shares have outperformed peers by nearly 40 per cent this year.

然而,一項交易要麼全有要麼全無。例如,出售部分過期賬本,將使目前逾8%的股息作廢。與此同時,M&G有望從Solvency II改革中受益。今年以來,該公司的股價表現比同行高出近40%。

Investors should wait and see whether a new chief executive can squeeze more value from M&G with lower risk than a break-up.

投資者應該拭目以待,看看新的首席執行長能否以比拆分更低的風險從M&G中獲得更多價值。