尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

After completing her first 5km run, Annette Ball was in floods of tears at the achievement.

在完成了她的第一次5公里跑後,安妮特·鮑爾(Annette Ball)因這一成就而熱淚盈眶。

It was the first milestone on a journey, starting in 2019, that has seen the 56-year-old music teacher from Coventry lose more than three stone in weight and establish a new regime of strenuous exercise nearly every day of the week.

這是始於2019年的一段旅程的第一個里程碑,這位來自考文垂的56歲音樂教師減掉了超過3英石的體重,並養成了幾乎每天都進行劇烈運動的新習慣。

Ball’s story is the kind of inspiring tale of self-improvement that flourishes on social media feeds, but what is more unusual is the company that she credits for getting her moving: her insurer.

鮑爾的故事是在社群媒體上盛傳的那種鼓舞人心的自我完善的故事,但更不尋常的是,她將自己的運動習慣歸功於:她的保險公司。

A points-based scheme offered by life and health insurer Vitality, which uses a wearable device to track physical activity and offers financial benefits and vouchers for progress, was instrumental to her lifestyle shift.

壽險和健康險公司Vitality提供的基於積分的計劃,使用穿戴式設備來跟蹤身體活動,併爲取得的進展提供經濟利益和代金券,對她的生活方式轉變起到了重要作用。

“The bottom line is that it is insurance, but what it has enabled me to do is get healthier,” Ball says. “It’s certainly changed how I live now.”

鮑爾說:「底線是,這是一種保險,但它使我能夠做的是變得更健康。這當然改變了我現在的生活方式。」

It is just one example of a shift that is reshaping the centuries-old insurance sector, fuelled by new technologies and real-time data that insurers are increasingly gathering on their customers.

在新技術和保險公司越來越多地收集客戶實時數據的推動下,具有數百年曆史的保險業正在發生一場改變,這只是其中的一個例子。

Vitality calls it “shared-value insurance”, others call it “active insurance”, but the core idea is the same — focusing more and more on preventing and mitigating claims. By working with consumers and businesses to change behaviour and reduce their risks, insurers hope to limit the likelihood and severity of payouts.

Vitality稱之爲「共享價值保險」,其他人稱之爲「主動保險」,但核心理念是一樣的——越來越注重預防和減輕索賠。透過與消費者和企業合作,改變他們的行爲,降低他們的風險,保險公司希望限制賠付的可能性和嚴重性。

Prevention has been an element of the insurance industry for centuries. In the aftermath of the Great Fire of London, the property insurers of the 17th century operated their own emergency services, as they sought to protect themselves as well as their clients. From burglar alarms on houses to wheel locks in cars, insurers have long urged clients to take more measures to avoid thefts that would result in claims.

幾個世紀以來,預防一直是保險業的一個組成部分。在倫敦大火(Great Fire of London)發生後,17世紀的財產保險公司開始運營自己的應急服務,以保護自己和客戶。從房屋的防盜警報器到汽車的車輪鎖,保險公司一直敦促客戶採取更多措施,以避免可能導致索賠的盜竊。

But smarter and widely available technology means insurers can now intervene earlier and in a greater variety of ways — an accelerating process that is starting to change large parts of the industry.

但更智慧和廣泛使用的技術意味著,保險公司現在可以更早地、以更多種方式進行干預——這一加速進程正開始改變該行業的大部分領域。

Companies have been experimenting with using these types of tools in health insurance for more than a decade. They are now increasingly prominent in areas ranging from floods to cyber attacks. Cyber insurance provider CFC has called its support services “

digital fire trucks”.

十多年來,各公司一直在嘗試在醫療保險中使用這類工具。它們現在在從洪水到網路攻擊等領域日益突出。網路保險提供商CFC將其支援服務稱爲「

數字消防車」。

“We’re investing heavily into risk prevention . . . in order to help turn insurance from just paying out to essentially helping people understand their risk and reduce their risk,” says Julian Teicke, co-founder of insurtech wefox. The company raised $400mn from investors earlier this month in its latest funding round and has recently established a research team in Paris to drive its prevention efforts.

「我們正在大舉投資於風險防範……以幫助將保險從僅僅支付轉爲實質上幫助人們瞭解其風險並降低風險,」保險科技公司wefox的聯合創辦人朱利安•泰克(Julian Teicke)表示。該公司在本月早些時候的最新一輪融資中從投資者那裏籌集了4億美元,最近還在巴黎成立了一個研究團隊,以推動預防工作。

Julian Teicke, co-founder of insurtech wefox, which has recently established a research team in Paris to drive its prevention efforts

保險科技公司wefox的聯合創辦人朱利安•泰克最近在巴黎成立了一個研究團隊,以推動其預防工作

The growing focus on prevention has prompted some industry leaders to question what the insurance business will look like in the future. In particular, some question whether the provision of insurance coverage — the financial risk taken by the provider, which has been the backbone of the industry — will end up as just one element in a wider package of services.

對預防的日益重視,促使一些行業領袖質疑保險業務未來會是什麼樣子。特別是,一些人質疑,提供保險承保——保險提供商承擔的財務風險,一直是行業的支柱——最終是否會只是更廣泛的一攬子服務中的一個組成部分。

“If prevention becomes really something mass market, the insurance product will be a smaller component [in] a broader suite of services,” said Raphaël Vullierme, chief executive of home insurtech Luko, earlier this year.

今年早些時候,住房保險公司Luko首席執行長Raphaël Vullierme表示:「如果預防真的成爲大衆市場的東西,那麼保險產品將是一系列更廣泛服務中的一個較小組成部分。」

The winners, he predicted, would be technology-focused groups used to building those services.

他預測,贏家將是那些習慣於構建這些服務的、以技術爲中心的集團。

Growing bill

不斷成長的賬單

Prevention is presented by insurers as a vital tool in dealing with the growing bill from threats such as the obesity crisis, cyber assaults and extreme weather.

保險公司認爲,預防是應對肥胖危機、網路攻擊和極端天氣等威脅帶來的日益成長的賬單的一個重要工具。

For life and health insurers, the aim is to encourage fitter, longer-living customers; for cyber insurers, it is to ensure fewer cyber attacks break through clients’ defences; for motor insurers, safer drivers; for home insurers, it means reducing damage from floods, and catching leaks early.

對於人壽和健康保險公司來說,其目的是鼓勵更健康、更長壽的客戶;對網路保險公司來說,這是確保更少的網路攻擊突破客戶的防禦;對汽車保險公司來說,更安全的司機;對於住房保險公司來說,這意味著減少洪水造成的損失,及早發現漏洞。

Customers are incentivised by the promise of lower insurance premiums if they reduce their risks, and companies’ profit margins should be boosted if the fall in claims outweighs those discounts.

如果客戶降低了風險,就會得到更低的保費,這樣的承諾會激勵客戶,而如果索賠減少的金額超過了這些折扣,公司的利潤率就會提高。

Zurich, one of Europe’s largest insurance companies, established a resilience services unit last year with 750 risk engineers working across 40 countries to help companies assess and mitigate their risks.

歐洲最大的保險公司之一蘇黎世去年成立了一個復原力服務部門,有750名風險工程師在40個國家工作,幫助公司評估和減輕風險。

“We want to keep customers in business and we want to reduce [their] cost of risk,” says Sierra Signorelli, head of commercial insurance at Zurich. The intensifying frequency and severity of storms is a key driver of take-up of resilience measures among companies, she adds.

蘇黎世商業保險主管塞拉•西諾雷利(Sierra Signorelli)表示:「我們希望留住客戶,並降低(他們的)風險成本。」她補充稱,風暴發生的頻率和嚴重程度不斷增加,是促使企業採取抵禦措施的關鍵因素。

One of Zurich’s clients is automaker Audi, whose Neckarsulm factory in south-western Germany was hit by the torrential rain storms that hammered Europe in 2016, sending mud and water pouring into the plant, damaging equipment and halting production.

蘇黎世的客戶之一是汽車製造商奧迪(Audi)。2016年,該公司位於德國西南部內卡蘇姆(Neckarsulm)的工廠遭遇了席捲歐洲的暴雨,泥漿和水湧入工廠,損壞了設備,導致生產中斷。

Audi then worked with Zurich’s risk engineers as well as local officials, the emergency services and other stakeholders to strengthen the plant’s defences and those of the surrounding area, including installing new retention basins.

隨後,奧迪與蘇黎世的風險工程師、當地官員、應急服務部門和其他利益相關方合作,加強了工廠及其周邊地區的防禦能力,包括安裝新的蓄水池。

Joshua Motta, chief executive of cyber insurer Coalition and a former CIA analyst, places as much attention on security services as insurance policies

網路保險公司Coalition首席執行長、前CIA分析師約書亞•莫塔對安全服務的關注不亞於對保單的關注

When heavy rainfall hit last year, the factory was ready. Alerted by an early warning system, workers teamed up with emergency services to inflate long water-filled barriers around the facility. Thanks to the countermeasures, the final repair bill was lighter and production did not have to stop.

去年大雨來襲時,工廠已做好準備。在早期預警系統的提醒下,工人們與應急服務部門合作,在工廠周圍築起長長的充水屏障。由於採取了應對措施,最後的維修費用較低,生產也沒有停止。

The cyber insurance market is increasingly a mixture of protection and cover: providers work with companies to patch holes in their digital defences, put in place extra security measures and offer emergency services to restore systems and recover data after attacks.

網路保險市場日益成爲保護和保障的混合體:供應商與公司合作,修補其數字防禦中的漏洞,採取額外的安全措施,並提供緊急服務,在攻擊後恢復系統和恢復數據。

Cyber insurer Coalition is one of a growing number of companies in this segment of the market and places as much attention on its security services as its insurance policies.

網路保險公司Coalition是這個細分市場中越來越多的公司之一,它對其安全服務的關注程度不亞於其保單。

“We look at our customers as if we were playing offence. We are looking for those nails that are sticking out,” says its chief executive Joshua Motta, a former CIA analyst.

「我們看我們的客戶,就像我們在進行網路攻擊。其首席執行長約書亞•莫塔(Joshua Motta)說,他曾是美國中央情報局的分析員,」我們正在尋找那些伸出來的釘子。」

Coalition says it scans more than 5bn IP addresses 400 times a month for vulnerabilities. That might be malware in a client’s system, or unpatched software that is vulnerable to hackers.

Coalition表示,它每月對50多億個IP地址進行400次漏洞掃描。這可能是客戶系統中的惡意軟體,或者是容易受到駭客攻擊的未打補丁的軟體。

Some insurers now demand that companies must have basic protections such as multi-factor authentication in order to receive cover, as the sector responds to the surge in ransomware attacks.

爲了應對勒索軟體攻擊激增的局面,一些保險公司現在要求公司必須具備多因素認證等基本保護措施,才能獲得保險。

Smarter tech

更智慧的技術

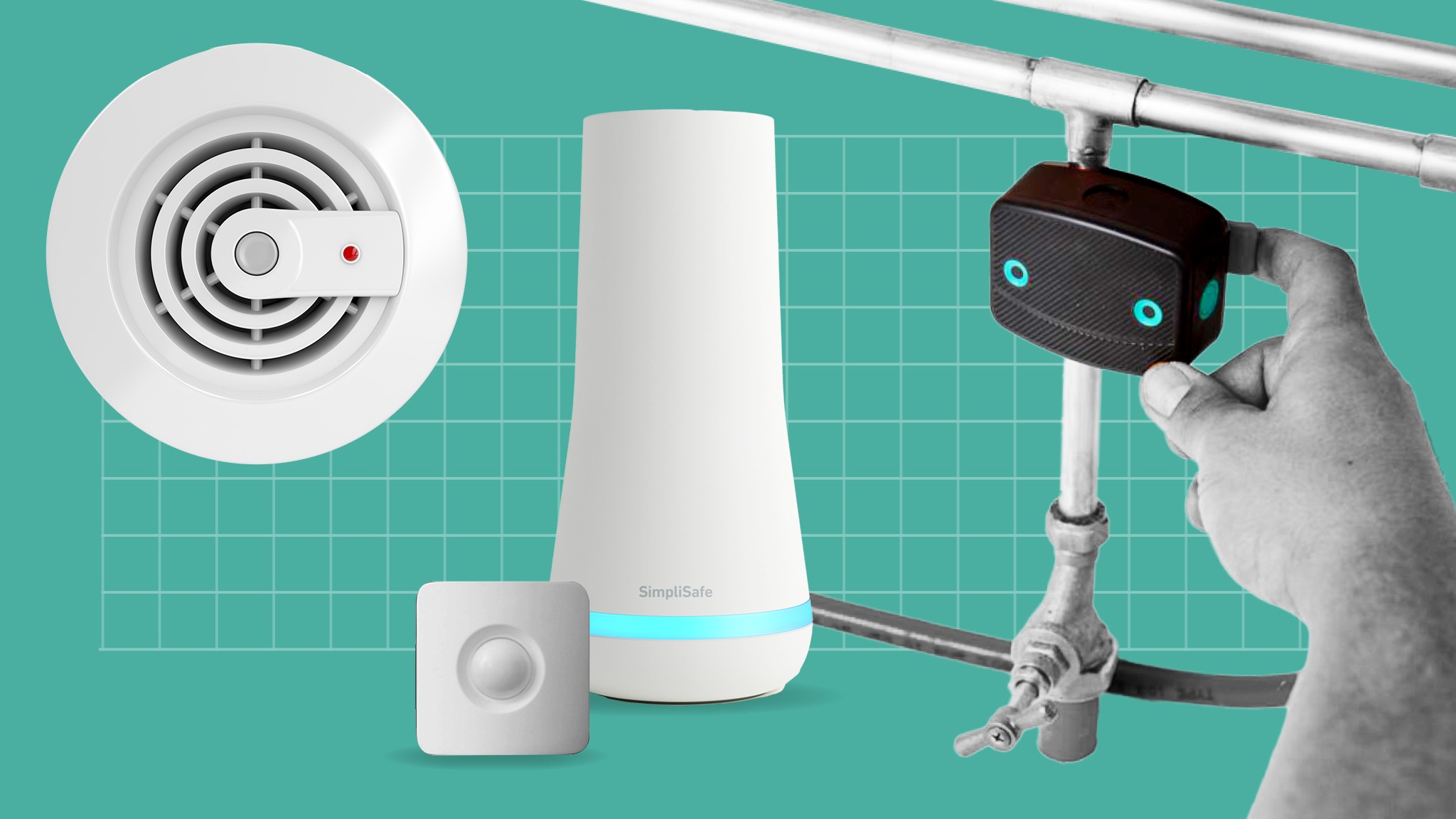

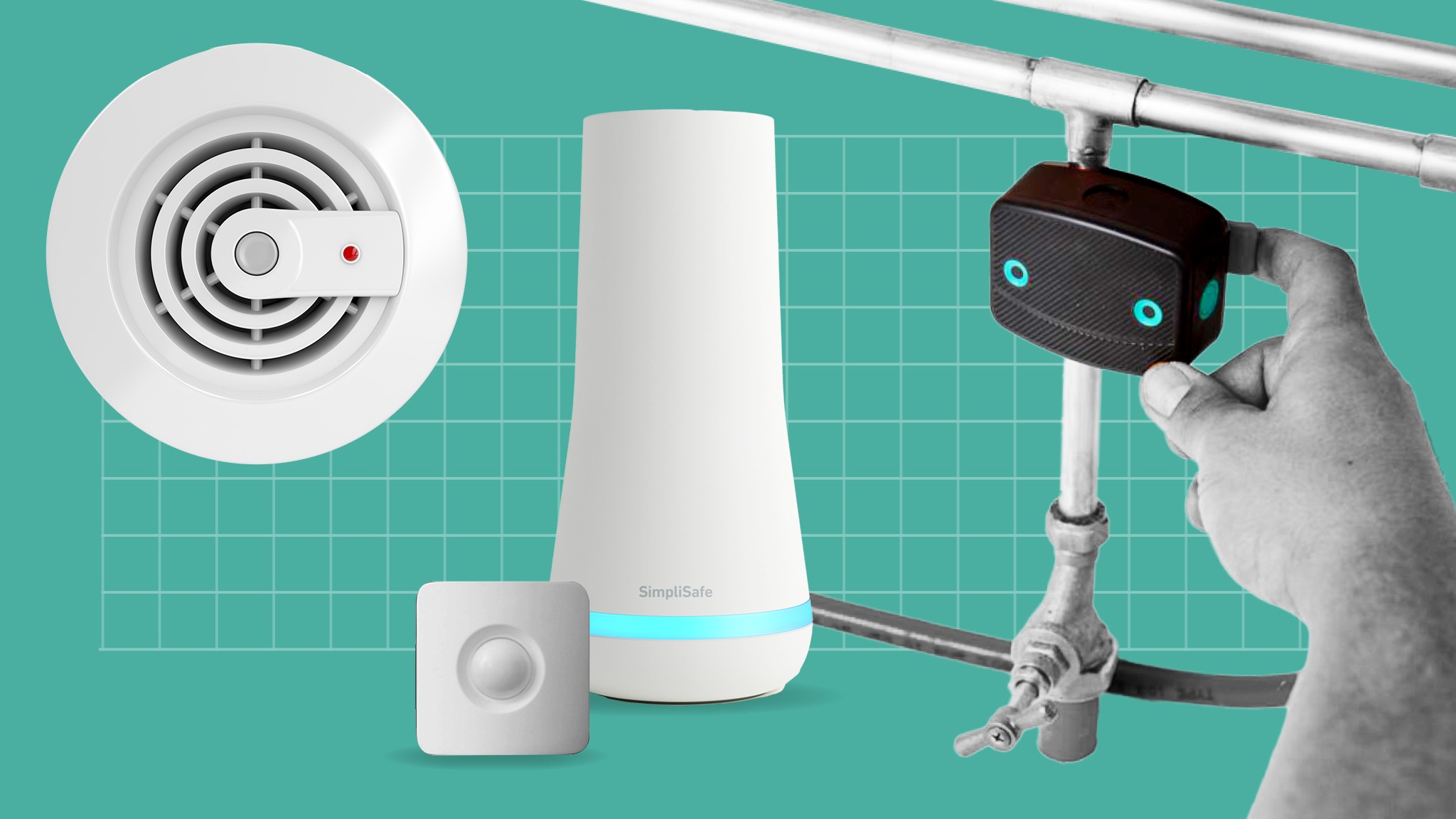

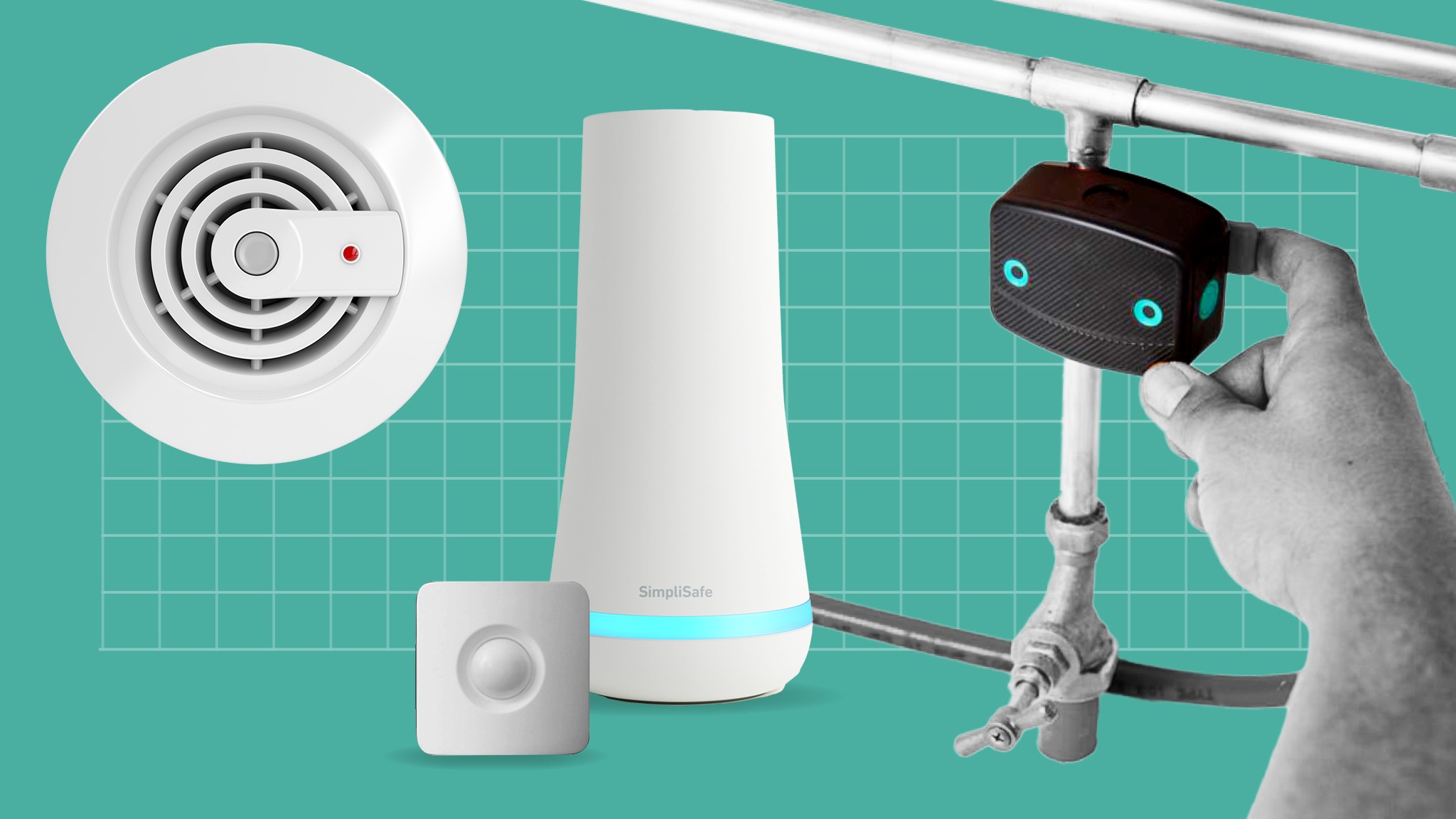

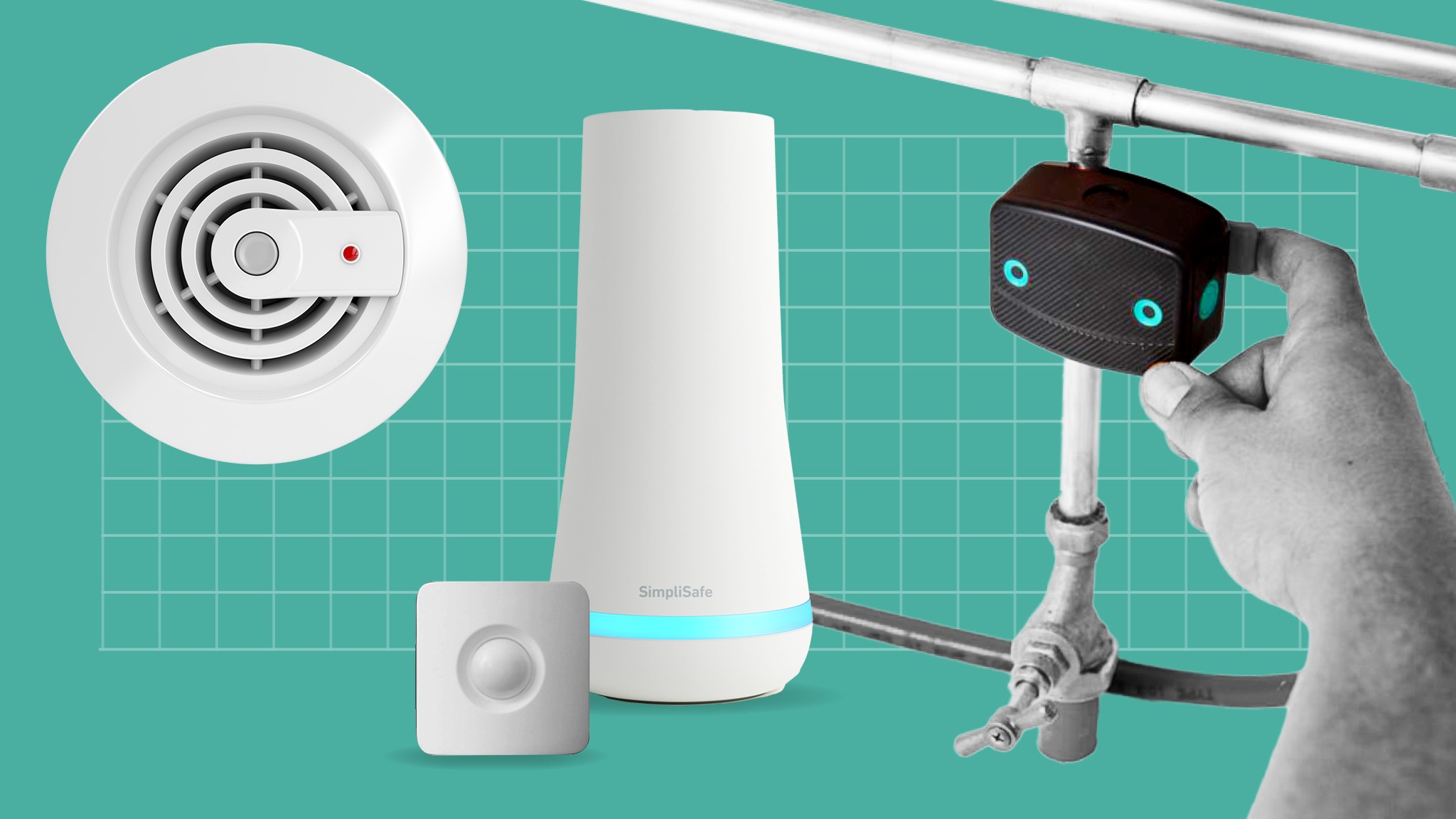

Home insurance is another frontier for prevention efforts. “The best claims experience is avoiding the claim entirely,” says Rick McCathron, chief executive at New York-listed home insurer Hippo, which supplies its customers with a range of detection systems including leak sensors, smoke alarms and motion detectors to try and stave off claims. Those who use the system can get a discount on their insurance — but only if they keep the system activated.

住房保險是預防工作的另一個前沿領域。在紐約上市的住房保險公司Hippo的首席執行長裏克•麥卡瑟隆(Rick McCathron)表示:「最好的理賠體驗是完全避免理賠。」Hippo爲客戶提供一系列探測系統,包括洩漏傳感器、煙霧報警器和運動探測器,以避免理賠。使用該系統的人可以在保險上獲得折扣,但前提是他們保持系統啟用。

This makes for a fundamentally different business, argues McCathron. “We’re not a home insurance company,” he says. “We are a home protection company.” Last year, it announced a partnership model with US homebuilders to install automatic shut-off valves in new-builds that it said would “meaningfully” reduce insurance costs.

麥卡瑟隆認爲,這將帶來一種根本不同的業務。「我們不是一家住房保險公司,」他說。「我們是一家住房保護公司。」去年,該公司宣佈與美國住宅建築商建立合作模式,在新建房屋中安裝自動關閉閥。該公司表示,這將「顯著」降低保險成本。

Insurers across the globe are investing in leak-detection systems to stem one of the most common sources of home insurance claims. Ondo, a London-listed provider specialising in this area of work, estimates its technology reduces water-damage claims by 70 per cent: equivalent to about £9bn of the industry’s annual water-leak payouts across the US and UK.

全球各地的保險公司都在投資於洩漏探測系統,以阻止最常見的住房保險索賠來源之一。Ondo是一家在倫敦上市的專門從事這一領域工作的供應商。該公司估計,其技術可使水損害索賠減少70%:相當於美國和英國水損害行業每年賠償金額的約90億英鎊。

Home insurance

Big insurers and start-ups are seizing on leak detection and prevention technologies as they seek to choke off one of the major sources of home insurance claims: water leaks. Some offer them alongside other smart tools like connected motion sensors and smoke detectors to combat other big threats.

住房保險

大型保險公司和新創企業都在抓住洩漏檢測和預防技術的機會,試圖阻止住房保險索賠的一個主要來源:漏水。一些公司還將它們與連接運動傳感器和煙霧探測器等其他智慧工具一起提供,以應對其他重大威脅。

Ondo announced last week that Admiral, the FTSE 100 insurer with more than 1mn home insurance customers in the UK, had agreed to provide its technology to 20,000 policyholders in a pilot that could lead to a wider rollout.

Ondo上週宣佈,富時100指數成分股、在英國擁有逾100萬住房保險客戶的保險公司Admiral已同意向2萬名投保人提供其技術,這是一項試點,可能導致更廣泛的推廣。

Claims can also lead to better prevention by exposing blind spots and bring about solutions. Flood Re, the UK’s reinsurance scheme for flood risk, earlier this year launched a “build back better” scheme in partnership with insurers.

索賠還可以透過暴露盲點來更好地預防,並帶來解決方案。英國洪水風險再保險公司Flood Re今年早些時候與保險公司合作推出了「更好地重建」計劃。

Customers with such policies who make a flood claim can receive up to £10,000 to make their home more resilient, such as installing flood doors and tile floors and moving electrical sockets higher.

擁有這類保險的客戶如果提出水災索賠,可以獲得高達1萬英鎊的賠償,以使他們的房屋更具彈性,例如安裝防洪門和瓷磚地板,以及將插座移到更高的位置。

Israel-based GeoX uses aerial imagery and other data to build a 3D image of a property that gauges risks such as roof condition, pointing customers towards preventive measures.

總部位於以色列的GeoX公司利用航空影像和其他數據建立房屋的3D影像,以評估屋頂狀況等風險,指導客戶採取預防措施。

‘Data harvesting’

「數據收割」

Motor insurtechs have developed a range of innovations to try and stave off claims. The use of real-time data in underwriting models has allowed start-ups such as the UK’s Zego and New York-listed Root, to reward people for safe driving, in the latest iteration of pay-how-you-drive-type policies. Increasingly, executives are talking about how they can provide feedback to customers and influence their behaviour.

汽車保險公司已經開發出一系列創新來試圖避免索賠。在承保模式中使用實時數據,使得英國的Zego和在紐約上市的Root等新創企業,能夠在「按駕駛方式付費」(pay-how-you-drive)保單的最新版本中,獎勵安全駕駛的人。越來越多的高階主管開始討論,如何向客戶提供反饋,並影響他們的行爲。

By Miles, a UK car insurtech, has been developing processes to contact customers in the event of a weather warning, encouraging them to move their vehicle to high ground, says chief executive James Blackham.

英國汽車保險技術公司By Miles首席執行長詹姆斯•布萊克漢姆(James Blackham)表示,該公司一直在開發在出現天氣預警時聯繫客戶的流程,鼓勵客戶將車輛轉移到地勢較高的地方。

In another recent episode, a customer in Sheffield in England managed to locate their stolen car to a local KFC car park using By Mile’s car-tracking tech.

在最近的另一期節目中,英國謝菲爾德的一名顧客使用By Mile的汽車追蹤技術,成功地將他們被盜的車定位到當地一家肯德基停車場。

In such cases, some customers end up not filing a claim at all, says Blackham. “Most people get the car back and [compared with] paying their excess, it doesn’t make any sense. It might need a bit of a vacuum round inside, or something like that.”

布萊克漢姆說,在這種情況下,一些客戶最終根本沒有提出索賠。「大多數人把車找回來,(與)支付多餘的費用相比,提出索賠沒有任何意義。它(找回來的車)可能會需要一個真空的內飾清潔,或類似的東西。」

Life and health insurance offers perhaps the greatest hopes for such a proactive approach to risk, powered by the growing use of wearables as well as more sophisticated real-time underwriting models.

由於穿戴式設備的使用越來越多,以及更復雜的實時承保模式的出現,人壽和健康保險或許爲這種主動應對風險的方式帶來了最大的希望。

Insurers talk excitedly about the potential to use genetic data to manage health problems years in advance, though use of such data is highly controversial and usually tightly regulated.

保險公司興奮地談論著利用基因數據提前數年管理健康問題的可能性,儘管這類數據的使用存在很大爭議,而且通常受到嚴格監管。

Car insurance

A flurry of start-ups have emerged in recent years promising customers lower premiums for safer driving, using phone apps to gather behavioural data and try and influence customers. Bigger insurers, which have used telematics to offer pay-how-you-drive policies for more than a decade, have also poured investment into technologies that provide personalised feedback and tips based on a customer’s driving style.

汽車保險

近年來湧現出了一批新創企業,它們承諾客戶爲更安全的駕駛降低保費,利用手機程式收集行爲數據,並試圖影響客戶。十多年來,大型保險公司一直在使用遠距信息技術提供「按駕駛方式付費」的保單。如今,它們也大舉投資於根據客戶駕駛風格提供個性化反饋和提示的技術。

China’s Ping An, one of the largest insurance groups by market value,

offers health cover that gives those diagnosed with type-2 diabetes a diet and exercise plan to reduce their risk of complications. Compliance can mean an insurance discount.

中國平安是市值最大的保險集團之一,它提供健康保險,爲那些被診斷爲2型糖尿病的人提供飲食和運動計劃,以減少他們的併發症風險。遵守規定可能意味著獲得保險折扣。

But some industry observers worry about where the closer relationship between insurers and their customers will lead.

但一些行業觀察家擔心,保險公司和他們的客戶之間更緊密的關係會導致什麼結果。

“No one ever talks about the negative side,” says Duncan Minty, an independent consultant on ethics in insurance. “Because risks do happen, there will be cases where things can go better for the consumer and cases where they go worse.”

「從來沒有人談論消極的一面,」保險道德獨立顧問鄧肯•明蒂(Duncan Minty)說。「因爲風險確實會發生,所以會有對消費者有利的情況,也會有對消費者不利的情況。」

Insurers argue that getting a more specific picture of an individual customer’s risks could actually increase the amount of people who can get insurance — including those they had previously been unwilling to cover.

保險公司認爲,對個人客戶的風險有一個更具體的瞭解,實際上可以增加可以獲得保險的人的數量--包括那些他們以前不願意承保的。

But Minty warns that wearables and real-time technology could lead to “data harvesting” — gaining granular and constantly updating detail about customers’ behaviour — that might be less about loss prevention and more about generating a closer risk profile of customers that is to the insurer’s advantage.

但明蒂警告稱,穿戴式設備和實時技術可能導致「數據收割」——獲取客戶行爲的細節並不斷更新——這可能與預防損失無關,而更多的是生成更接近客戶的風險概況,這對保險公司來說是有利的。

There is a “real chance”, he says, that customers might either be not offered a premium, or be offered one that is so high that it becomes unaffordable. Minty worries that insurers will ultimately use the data to create policy terms that demand compliance as a condition of remaining covered.

他說,有一個「真正的可能性」,即客戶可能買不到保險,或者被提供的保費太高,以至於無法負擔得起。明蒂擔心,保險公司最終會利用這些數據來制定保單條款,要求將遵守規定作爲繼續承保的條件。

Death of coverage

承保的死亡

There is potentially a self-defeating logic to prevention from the industry’s perspective. Claims are the lifeblood of insurance companies, the basis that allows companies to charge premiums, so meaningfully cutting them could reduce future revenues.

從行業的角度來看,防範可能存在一種弄巧成拙的邏輯。理賠是保險公司的命脈,是公司收取保費的基礎,因此大幅削減理賠可能會減少未來的收入。

But many claims cannot be prevented. Andrew Scott, who heads up research and development at the UK arm of insurer Vitality, divides risks into modifiable and non-modifiable ones.

但許多索賠是無法避免的。保險公司Vitality英國分公司研發主管安德魯•斯科特(Andrew Scott)將風險分爲可修改風險和不可修改風險。

That also provides an answer to the fairness question, he says. “We argue that it is fairer for people to pay for the unique risks that they present, if they are able to change those risks,” Scott adds.

他說,這也爲公平性問題提供了一個答案。斯科特補充說:「我們認爲,如果人們能夠改變這些風險,那麼爲他們所呈現的獨特風險付費是比較公平的。」

Life insurance

Life and health insurers have been early adopters of using wearable and app technology to incentivise their customers to get healthier, with the promise of lower insurance costs and other benefits. Reducing the risk of major illnesses can prevent or reduce claims, and longer-living life insurance customers means accruing more insurance premiums on a typical policy.

人壽保險

人壽和健康保險公司一直是使用穿戴式和應用技術來激勵客戶變得更健康的早期採用者,它們承諾提供更低的保險成本和其他福利。減少重大疾病的風險可以預防或減少索賠,而壽命較長的保險客戶意味著在一份典型的保單上積累更多的保費。

The reduced claims bill that comes from keeping customers healthier than they would be otherwise is “counterbalanced”, he adds, by the payouts for more advanced diagnosis and treatments.

他補充說,爲了讓顧客保持健康而減少的索賠賬單被用於更先進的診斷和治療的支出「抵消」。

Some industry experts think the pivot to more prevention and protection will reduce the primacy of the insurance coverage within the services that companies can offer.

一些行業專家認爲,將重心轉向更多的預防和保護,將降低公司所能提供的服務中保險承保的首要地位。

That might put insurers in greater competition with other tech and services groups. Almost half of the people cyber insurer Coalition hires are software engineers. Ondo, which proclaimed itself the first UK insurtech to list after joining the London stock market earlier this year, was spun out of Home Serve, which provides emergency repair for items such as boilers.

這可能會讓保險公司與其他科技和服務集團展開更激烈的競爭。網路保險公司Coalition僱傭的員工中,幾乎有一半是軟體工程師。今年早些時候,Ondo在倫敦股市上市,並自稱是英國首家上市的保險科技公司。該公司是從爲鍋爐等產品提供緊急維修服務的Home Serve分拆出來的。

Whether some of the new technologies do indeed lead to a lower loss ratio, a key profitability measure which shows claims as a proportion of premiums, remains an open question.

一些新技術是否真的會導致損失率降低,這是一個關鍵的盈利指標,顯示了索賠佔保費的比例,這仍然是一個懸而未決的問題。

Some of the highest profile insurtechs, such as Root, have suffered big underwriting losses as they try and grow their businesses — partially due to the uptick in claims that comes with new customers. This obscures the view of whether the newer technologies and behavioural nudges are helping them to price risks more effectively.

一些最知名的保險公司,如Root,在努力發展業務的過程中遭受了巨大的承保損失——部分原因是由於新客戶的索賠增加。這使得人們更難確定,新的技術和行爲推動是否有助於他們更有效地定價風險。

Another more immediate prize could be a deeper relationship with the customer, who might not so easily jump ship to another insurer.

另一個更直接的好處可能是與客戶建立更深層次的關係,客戶可能不會那麼容易跳槽到其他保險公司。

“I think I’ve got an awful lot out of it,” says Ball of her programme. “It’s certainly changed how I live now.”

鮑爾在談到她的保險服務時說:「我認爲我從中得到了很多。這當然改變了我現在的生活方式。」