(三)長壽時代下日本的社會經濟變化分析

(c) Analysis of socio-economic changes in Japan in the age of longevity

日本目前是全球人口老齡化最嚴重的國家之一,世界銀行數據顯示,2014年其65歲以上人口比重達到25%,可以說率先跨入長壽時代。長壽時代下的日本社會經濟發生了深刻變化。我們根據前文提供的理論視角, 分析日本的變化,將會給未來的中國更加深入的啓示。

Japan is currently one of the countries with the oldest population worldwide. World Bank data shows that in 2014, the elderly aged 65 years and above made up 25% of the population, making the country one of the first to enter the age of longevity. Japan』s society and economy have undergone profound changes in the age of longevity. On the basis of the theoretical perspective that we detailed above, we will now analyse the changes that Japan has undergone in order to provide a more in-depth insight into China』s future.

人口紅利衰退,儲蓄率降低,經濟成長緩慢。第二次世界大戰後至20世紀70年代日本經濟進入高速成長時期。世界銀行數據顯示,1970年日本65歲及以上老齡人口占總人口的比重達到7%,社會開始正式步入老齡化。人口的拐點也標誌着勞動密集型經濟高速發展模式的結束。1994年日本老齡人口比重已達到14%,步入重度老齡化。與之對應的,20世紀90年代以來,日本經濟總體走下坡路,長期處於低迷狀態。這一期間,日本儲蓄率與15~64歲人口占比在1991年左右同時到達高點,之後開始步入漫長的下降通道。儲蓄的萎縮也帶來日本投資的萎縮。日本投資增速在從90年代初也開始震盪下行,隨後一直在0%附近徘徊。日本的利率也隨之持續下行,甚至進入負利率時代,背後主要原因是資金的需求(投資)下降速度快於資金供給(儲蓄)的下降速度。

The demographic dividend is fading, the savings rate is decreasing, and economic growth is sluggish. From the end of the Second World War until the 1970s, Japan underwent a period of rapid economic growth. World Bank data shows that in 1970, Japan』s elderly population aged 65 years and above accounted for 7% of the total population, after which its society formally began to age. This population inflection point also marked the end of the country』s labour-intensive development model, which once delivered rapid economic growth. By 1994, Japan』s elderly population accounted for 14% of the total, and the country entered a period of severe ageing. Correspondingly, the Japanese economy has generally declined since the 1990s, and has been in the doldrums for a long time now. During this period, Japan』s savings rate and the proportion of the population aged between 15-64 years both reached high points in around 1991, after which they began a slow downward trajectory. Shrinking savings also brought about a decline in Japan』s investment. Japan』s investment growth rate also began to fluctuate downward from the early 1990s onwards, and has since consistently hovered around 0%. Japan』s interest rates also continued to decline, even entering negative interest rate ranges. The main reason behind this is that demand for funds (investment) fell faster than the supply of funds (savings).

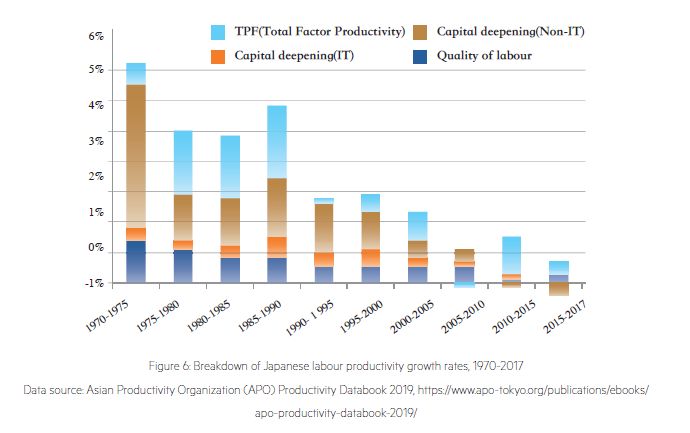

日本勞動生產率的成長放緩,技術替代加快。勞動生產率代表每單位有效勞動的平均產出,是決定一國經濟是否具有未來成長性的標誌性指標。日本勞動生產率增速在1970年後下行的趨勢明顯。勞動生產率來自三個方面,資本深化、勞動力素質、全要素生產率。資本深化即資本勞動比的提高。亞洲生產力組織(Asian Productivity Organization)的數據顯示(見圖6),近40年影響日本勞動生產率的三個要素都出現不同程度下降。資本替代方面,勞動力成本上升、數量短缺促使資本加大對勞動力的替代。但隨著資本對勞動的邊際替代率遞減和投資的萎縮,資本深化近幾年對勞動生產率甚至出現拖累。全要素生產率方面,老齡人口占比的增加刺激了技術替代,日本機器人和自動化等尖端技術高速發展。20世紀70~80年代日本全要素生產率強力支撐勞動生產率,但是泡沫破滅後這種支撐有所減弱。全要素生產率的逐步低迷也與長壽時代下日本社會階層固化和家長式企業管理結構抑制創新有關。勞動力素質方面,世界領先的高等教育普及率使得日本人口素質整體較高,高素質勞動力成爲對沖勞動生產率下行的重要因素。

Japan』s labour productivity growth has slowed, and technology substitution has accelerated. Labour productivity represents the average output per unit of effective labour, and is a landmark determinant of the future growth prospects of a country』s economy. The downward trend of Japan』s labour productivity after 1970 is all too obvious. Labour productivity comprises three aspects: capital deepening, the quality of the labour force, and total factor productivity. Capital deepening refers to increases in the capital-labour ratio. Asian Productivity Organization data (see Figure 6) indicates that over the last 40 years, these three factors influencing Japanese labour productivity have all decreased to varying degrees. In terms of capital substitution, rising labour costs and shortages have prompted capital to increase labour substitution. However, with a diminishing marginal replacement rate of capital for labour and shrinking investment, the deepening of capital has even dragged down labour productivity in recent years. In terms of total factor productivity, the increasing ageing of the population has stimulated technology substitution, and cutting edge technologies such as robotics and automation have developed rapidly in Japan. From the 1970s to the 1980s, Japan』s total factor productivity provided powerful support for labour productivity, but this support fell away following the bursting of the economic bubble. The gradual downturn in total factor productivity is also related to the social ossification of Japanese society in the age of longevity and the suppression of innovation by paternalistic corporate management structures. In terms of labour quality, the country』s world-leading higher education penetration rate ensured the high overall quality of Japan』s population, and this high-quality workforce has become a significant factor dampening the decline in labour productivity.

日本銀髮經濟相關消費需求提升,但並未完全迎來長壽經濟。長壽時代下消費是日本經濟成長最重要的驅動力,日本內閣府數據顯示,消費貢獻了近60%的GDP。雖然日本人口總量近年出現縮減,但日本的消費總量整體呈穩定低速成長態勢。日本社會與老年人相關的醫療保健、護理類消費支出在總消費中的佔比逐漸提升。日本的老年人更多扮演消費者的角色,透過消耗性的消費推動經濟進步。雖然日本也在適應老齡化的挑戰,部分老年人退休後仍參與勞動力市場,但我們認爲,其參與程度生產力規模和創造力還不足以使日本老年人成爲生產者和創新者的角色,長壽經濟還並未在日本完全實現。

Japan』s silver-haired economy related consumption demand has risen, but has yet to fully usher in a longevity economy. In the age of longevity, consumption is the most important force driving Japanese economic growth. Japanese Cabinet Office data shows that consumption contributes almost 60% of GDP. Although the country』s total population has shrunk in recent years, Japan』s overall consumption has shown stable, slow growth. Japanese society』s consumption of ageing-related healthcare and nursing has gradually increased its proportion of total consumption. In Japan, the elderly predominantly play a role as consumers, and promote economic progress through expendable consumption. Although Japan is also adapting to the challenges of ageing, and numbers of elderly people continue to participate in the labour market after retirement, we believe that the degree of participation and the scale of productivity and creativity remain too low to allow Japan』s elderly to become producers and innovators. The longevity economy has yet to come to full fruition in Japan.

老年貧困也加大了日本社會收入差距。隨著「老齡少子化」現象加劇和醫療成本提升,日本的老年貧困問題日益突出(丁英順,2017)。同時,勞動人口下降導致養老金缺口逐年擴大,對公共財政造成沉重壓力。由於收入相對較低的老齡人口的比例不斷提高,日本社會總體的收入差距呈擴大趨勢。從反映收入分配差異程度的基尼係數來看(見圖7),1985~2015年30年間,日本社會的基尼係數大幅上升。其他發達國家的數據也表明隨著老齡化進程加深,社會的不平等程度將會加深。

Old-age poverty has also increased the income inequality in Japan. Exacerbated by the lower numbers of children to support elderly parents and the increase in medical costs, the issue of old-age poverty in Japan has become increasingly apparent (Ding Yingshun, 2017). At the same time, the decline in the labour force has led to a pension deficit which is widening year by year, and which has put heavy pressure on public finances. As the proportion of the elderly population with relatively low incomes continues to increase, the overall income inequality in Japanese society continues to expand. Judging from the Gini coefficient, which reflects the degree of deviation in income distribution (see Figure 7), the Gini coefficient of Japanese society has risen sharply in the 30 years between 1985 and 2015. Data for other developed nations also indicates that as the ageing process continues, the degree of social inequality will also worsen.

(四)對中國的啓示

(d) Implications for China

1.透過教育提高人力資本,以抵消勞動力和生產率下降的影響

1. Improving human capital through education to offset the impact of declines in the labour force and productivity

與日本20世紀70年代相似,中國正處在經濟結構轉型的過程中,消費逐漸成爲經濟的驅動力,與之對應的,第三產業佔GDP比上升,第二產業佔比經歷頂峯後下降。產業結構轉型直接影響勞動力需求結構,以服務業爲代表的第三產業的勞動力需求也相應增加。

In the same way as Japan in the 1970s, China is in the process of transforming its economic structure, and consumption is gradually becoming the driving force of the economy. Correspondingly, the ratio of tertiary industry to GDP has risen, while that of secondary industry is falling after peaking. The transformation of the industrial structure has had a direct impact on the labour demand structure, and labour demand from the tertiary industry, represented by the service industry, is also increasing correspondingly.

服務社會下,教育帶來人力資本上升,可以抵消部分勞動力供給和勞動生產率下降的影響。不論是從個人收入還是從宏觀經濟角度,教育的投資回報率都極高(Psacharopoulos,1994)。教育是造成各國生產力差距的重要原因。勞動力受教育程度越高,生產力越發達(Mankiw et al,1992)。正如日本高素質勞動力是對沖勞動生產率下行的重要因素,教育紅利對勞動力需求有較強的替代作用。長壽時代下的老齡人口占比提升對經濟的負面影響主要集中在工業社會中,而透過投資教育提高人力資本,在服務社會下可以有效地抵消勞動力萎縮給經濟帶來的負面影響。

In a service society, education has brought about an increase in human capital to offset some of the impact of the decline in labour supply and labour productivity. Whether from a personal income or macro-economic perspective, the return on investment in education is extremely high (Psacharopoulos, 1994). Education is a major cause of productivity gaps between countries. The higher the level of education of the labour force, the higher the development of productivity (Mankiw et al., 1992). Just as Japan』s high-quality labour force is a significant factor dampening the decline in labour productivity, the education dividend plays a powerful substitution role for labour demand. In the age of longevity, the negative economic impact of an increase in the elderly proportion of the population is mostly concentrated in industrial society, whereas improvements in human capital through investment in education in a service society can effectively offset the negative impact of the contraction of the labour force on the economy.

2.加快技術替代,透過技術創新引導經濟成長

2. Accelerating technology substitution, and guiding economic growth through technological innovation

自動化和機器人的應用將成爲解決勞動力下降的重要手段。日本的例子中,自動化和機器人產業順應著長壽時代蓬勃發展,許多行業加快了機器和技術替代人力。隨著技術的不斷發展,經濟學家預言的機器人代替人工勞動的時代在不斷逼近。世界銀行的數據則顯示,OECD國家中將有57%的工人的工作能被機器取代。從1993年到2007年,歐美已經投入經濟生產的機器人成長了4倍,數量大概在150萬~175萬之間。波士頓諮詢估計,這一數量在2025年將會成長至400萬~600萬。各行業使用機器人情況分別爲:汽車行業使用了39%的機器人,居各行業之首;電子、金屬、塑膠化工行業分別爲19%、9%和9%(Acemoglu and Restrepo,2017)。機器人替代傳統人力,將提高生產效率,加速自動化及相關行業的發展,進而進一步引導創新促進經濟成長。

The application of automation and robotics will become an important means for resolving the decline in the labour force. In the case of Japan, the automation and robotic industries are booming in the age of longevity, and many industries have accelerated the replacement of manpower with machinery and technology. As technology continues to develop, economists predict that an era in which robots replace human labour is approaching. World Bank data shows that in OECD countries, the tasks performed by 57% of employees can be done by machines. Between 1993 and 2007, the number of robots put into economic production in Europe and the US grew four-fold, totalling between 1.5 and 1.75 million units. Boston Consulting estimates that this number will grow to between 4 to 6 million by 2025. Robot use differs by industry: 39% of robots are used in the automotive industry, the highest of any industry; the figures for the electronics, metallurgical, and plastics and chemicals industries are 19%, 9% and 9% respectively (Acemoglu and Restrepo, 2017). The substitution of traditional manpower with robots will increase production efficiency, accelerate the development of automation and other associated industries, and show the way for further innovation to promote economic growth.

3.透過建設有效的資本市場提升第二次人口紅利的效率

3. Improving the efficiency of the second demographic dividend by building effective capital markets

有效資本市場是釋放第二次人口紅利的最佳管道。改革開放促進中國第一次人口紅利釋放。隨著勞動力素質提高、社會公共環境改善,第二次人口紅利機會視窗已經開啓。第二次人口紅利的條件要求更高,人均資本的提升要轉化爲經濟成長,需要依賴外部的制度性建設,尤其是資本市場的建設。如果資本市場的市場化程度低,融資管道單一,會造成融資成本高,資源難以有效分配。日本的例子顯示,社會進入長壽時代也會直接影響利率及投資收益率。未來如果全球新興市場都進入長壽時代,全球的資本市場和投資收益也必將進入新的均衡態。另一方面養老金資產規模持續成長使得獲得高收益的難度增加。上述幾重作用將挑戰中國養老財富的長期投資收益率是否能持續顯著超越通貨膨脹,實現保值增值。因此中國的養老金投資機構需要重視權益資產配置,提升對資本市場直接融資水準。

Effective capital markets are the best channels for unleashing the benefits of the second demographic dividend. Reform and opening up promoted the release of China』s first demographic dividend. Improvements in labour force quality as well as in the social and public environments opened the window of opportunity for the second demographic dividend. The requirement for obtaining the second demographic dividend are even higher, because the transformation of the increase in per capita capital into economic growth is dependent on external institutional construction, and that of capital markets in particular. Excessively low marketisation of capital markets and unitary financing channels will result in high financing costs, and make the effective allocation of resources more difficult. The example of Japan shows that the entry of society into the age of longevity will also have a direct impact on interest rates and return on investment. In the future, if global emerging markets enter the age of longevity, global capital markets and returns on investment will certainly arrive a new equilibrium. On the other hand, the continued increase in the size of pension assets will make it harder to achieve high returns. The various roles mentioned above will challenge whether the long-term returns on investment on China』s old-age wealth will be able to continue to significantly surpass inflation, and whether pension wealth can achieve the preservation and appreciation of value. Therefore, China's pension investment institutions must pay attention to the allocation of equity assets, and improve the level of direct financing in the capital market.

4.引入長壽經濟,創造第三次人口紅利

4. Introducing the longevity economy and creating the third demographic dividend

引入長壽經濟理念,讓老年人「持續」生產和創新,創造屬於他們自己的「第三次人口紅利」,需要改變原有的受教育、工作、退休三段式的工業時代用工方式,需要運用新思路創造屬於老年人的消費和生產方式。

Introducing the concept of the longevity economy, enabling the elderly to 「sustainably」 produce and innovate, and creating their own 「third demographic dividend」 will require changes to the original, three-phase industrial-era approach of education, work and retirement, and will require new lines of thinking to create means of consumption and production which belong to the elderly.

傳統理論認爲老齡化對經濟的負面作用主要來自於勞動力短缺,對資源的消耗和階級固化對創新的阻礙。長壽經濟下,情況可能變化。首先勞動力短缺可以透過機器人和人工智慧替代,同時受過良好教育的老齡人口有能力和意願參與生產,某種程度上可以緩解傳統勞動力下降的壓力。另一方面老年人閱歷、經驗、學識豐富,可以增加智力要素的供給。其次資源的消耗可以透過發展新興健康產業減少資源擠佔。過往老齡化對投資的擠出作用主要來自醫療、護理等環節消耗資源。而這些部門是從急症診療角度提供產品,造成資源的浪費,甚至阻礙經濟的成長。在認識到老人帶病生存問題後,新的健康產業將以基礎醫療和慢病管理爲中心,這就減少了資源的擠佔。最後創新的阻礙可能會在長壽經濟新的組織形態下得到緩解。當全球步入長壽時代,在傳統經濟之外將產生圍繞老齡人口的長壽經濟,其範疇和結構、組織形態和生產方式都是新的,可視爲社會經濟的增量。在增量經濟的影響下,不同年齡層人口的社會矛盾和衝突可能緩解。

Traditional theory believes that the negative effect of ageing on the economy is mainly attributable to labour shortages, crowding-out effect on investments, and class solidification which hinders innovation. In the longevity economy, this situation may change. First of all, labour shortages will be alleviated through its substitution with robots and artificial intelligence, while at the same time, the well-educated elderly population will be able and willing to participate in production, which will to a certain degree alleviate the pressure from the decline in the traditional labour force. On the other hand, the wealth of knowledge, experience and expertise of the elderly may also increase the supply of the intellectual factor. Secondly, through developing emerging health industries, elder consumption may take less resource. In the past, the crowding-out effect of ageing on investment was mainly due to the consumption of resources in medical treatment, nursing, and other areas. These provided products from an emergency diagnosis and treatment perspective, causing a waste of resources, and even hindering economic growth. As they become aware of the issue of the survival of the elderly with illness, these emerging health industries will focus on basic medical care and the management of chronic diseases, reducing resource consumption. Finally, obstacles to innovation may be eased under the new patterns of organisation in the longevity economy. As the world enters the age of longevity, in addition to the traditional economy, a longevity economy will emerge around the elderly population. Its scope and structure, organisation patterns and means of production will all be new, and should be seen as an increment to the social economy. Under the influence of this incremental economy, social contradictions and conflicts between different age segments of the population may ease.

在中國老齡人口占比持續提升的背景下,在需求側,適應老年人需求的創新將在更大程度上拉動經濟,比如無人駕駛、智慧家居可能成爲重要的產業;醫養結合社區更好地滿足老年人的生活需要,與之相關的養老產業鏈也將蓬勃發展。在供給側,如何讓老年人也能夠「持續」生產,創造屬於他們的「第三次人口紅利」也值得探索。在長壽時代的主題下,長壽經濟與科技將可能產生前所未有的生產方式。自動化與人工智慧技術進一步對初級勞動力進行替代,資訊化和網路化強化智力要素供給,全新的經濟形態、生產方式會出現,勞動生產率或將大幅提升。全新的生產需要的勞動力素質將不同於傳統,對教育部門提出終身教育的需求,並促進勞動力市場在年齡結構上達到一個新的平衡。

In the context of a continuous increase in the elderly proportion of China』s population, on the demand side, innovations which meet the needs of the elderly will drive the economy to a much greater extent, and some, such as autonomous vehicle and smart homes, may become major industries. The medical and nursing communities will be better able to meet the daily living needs of the elderly, and the associated eldercare industrial chain will also flourish. On the supply side, it is worth exploring ways of enabling the elderly to 「sustain」 production, as well as to create their own 「third demographic dividend」. Within the framework of the age of longevity, the longevity economy and technologies may likely bring about unprecedented means of production. Automation and artificial intelligence technologies will continue to replace the primary labour force, while informatisation and Internetisation will enhance the supply of intellectual-focused factors. All-new economic patterns and means of production will emerge, and labour productivity will improve sharply. The labour force quality required by this all-new production will differ from its traditional counterpart, and will require the education sector to offer lifelong learning, and encourage the labour market to achieve a new equilibrium within the age structure.

5.重塑政府職能,促進長壽時代下的社會公平

5. Reshaping government functions, and promoting social equity in the age of longevity

在長壽時代,社會面臨的最大挑戰是財富不平等加劇,以及與之伴生的健康不平等問題。如何確保低收入者也能保持健康長壽是政策制定者需要考慮的關鍵議題。日本相對完善的老齡人口社會保障體系固然可以借鑑,同時也要看到由於日本經濟成長遲緩、快速老齡化使公共養老金支出不斷上升,給政府造成沉重的財政壓力,帶來了政府債務風險(張士斌等,2012)。我們認爲,政府更重要的職能是激發長壽時代的經濟活力,促進個人在不同生命階段的財富積累,如提高教育水準、倡導終身學習和職業教育、鼓勵企業面向老齡人口創新、允許更靈活的就業形式和用工形式;同時提升基本醫療衛生服務水準,提升衛生服務的效益,滿足多層次的醫療健康需求;在全面提高國民在人力資本和財富積累的基礎上進行合理的再分配,縮小收入差距,提高弱勢羣體的生活質量和健康水準。

In the age of longevity, the most significant challenge facing society will be the exacerbation of wealth inequality, and the associated issue of inequality in health. Ensuring that low-income people are also able to maintain a healthy, lengthy life is a key issue that decision-makers must come to grips with. Japan』s relatively well-established social security system for its elderly population can certainly be used as a reference, but it must at the same time also be borne in mind that Japan』s slow pace of economic growth and its rapidly ageing population have caused public pension expenditures to rise on an ongoing basis, placing heavy financial pressure on the government, and bringing with it the risk of government debt (Zhang Shibin et al., 2012). We believe that the most important function of a government is to stimulate the economic vitality of the age of longevity, and encourage the accumulation of personal wealth over the different stages of their life, for example by improving education levels, advocating lifelong learning and professional education, encouraging companies to innovate for the elderly, and allowing more flexible employment and ways of working. At the same time, the levels of basic medical and healthcare services must be improved, and the effectiveness of healthcare services must be enhanced in order to meet medical and healthcare needs at multiple levels. A comprehensive improvement in the accumulation of human capital and wealth should form the basis for a rational redistribution thereof, so as to narrow the income gap, and improve the quality of life and levels of health of vulnerable groups.