2.長壽時代使得帶病生存時間延長

2. The age of longevity prolongs the survival in disease

在長壽時代更多疾病將與高齡老人共存,帶病生存成爲長壽時代的普遍現象。如果將60歲以上老年人壽命分爲健康狀態和帶病狀態,就會發現人羣預期壽命增加主要是帶病生存時間的延長,特別是各種非遺傳性慢性病導致的健康損失並不會短期內致人死亡,而是與人長期共存。華盛頓大學健康指標與評估研究所對195個國家和地區的研究表明:1990~2017年間全球絕大部分國家的健康預期壽命③的增速要遜於預期壽命的增速,預期壽命增加7.4年,而健康預期壽命只增加了6.3年(Kyu et al.,2018)。英國學者基於歐洲25個國家的數據研究表明,2005~2011年,65歲老人的預期壽命增加了1.3年,而同期的健康預期壽命沒有變化(Brown,2015)。在中國,1993年的中國老年人供養體系調查顯示60歲以上老年人在60歲以後的預期壽命中約3/4的時間處於各種慢性病的狀態下(王梅,1993)。2018年的第四次中國城鄉老年人生活狀況抽樣調查成果顯示中國2018年人均預期壽命是77歲,健康預期壽命僅爲68.7歲,存在較大落差。

In the age of longevity, more diseases will coexist with the elderly, and survival in disease will become a common phenomenon. Dividing the lifespan of elderly persons aged 60 years and above into healthy and diseased states shows that the increase in life expectancy mainly comprises an extension of the survival in disease, particularly the loss of health caused by various non-hereditary chronic diseases. These do not cause death in the short term, and coexist with the individual involved over the longer term. The study of 195 countries and regions by the University of Washington』s Institute for Health Metrics and Evaluation shows that between 1990 and 2017, healthy life expectancy (3) in most countries worldwide grew at a slower rate than life expectancy. Life expectancy increased by 7.4 years, while health life expectancy only increased by 6.3 years (Kyu et al., 2018). Using data from 25 European countries, a British study shows that between 2005 and 2011, the life expectancy of a 65 year-old increased by 1.3 years, whereas there was no change in healthy life expectancy over the same period (Brown, 2015). In China, a 1993 survey of the Chinese elderly support system shows that elderly people above the age of 60 spent three quarters of their life expectancy beyond the age of 60 living with some form of chronic disease (Wang Mei, 1993).The results of the 2018 Fourth Sample Survey of the Living Conditions of China's Urban and Rural Elderly shows that China』s average life expectancy in 2018 was 77 years, whereas health life expectancy was only 68.7 years, indicating a relatively large gap.

我們可以看到全球發展趨勢表明:越是長壽,帶病生存越將成爲普遍現象。雖然我們壽命在不斷增加,但生存質量則不一定隨之變得更好。因此,獲得的額外壽命是處於身體健康還是疾病狀態這個問題變得越來越重要,如何面對長壽時代帶病生存的疾病負擔在未來將對衛生系統的規劃、健康相關支出和健康產業的發展產生重大影響。

We can see from global development trends that the longer we live, the more likely we are to survive in a disease. Although our life spans are continuously increasing, our quality of life is not necessarily increasing in equal measure. Therefore, the question of whether the extra life is spent in a state of good physical health or in a disease is becoming increasingly important. Finding ways to face the burdens of surviving in disease in the age of longevity will in future have a significant impact on the planning of health system, the expenditures of health-related activities and the development of the health industry.

3.長壽時代將促使健康產業發展

3. The age of longevity will encourage the development of health industry

長壽時代的帶病生存使得人們與健康相關的費用支出劇增。據國內外的有關資料,人均醫療費用和年齡密切相關,一般情況下,60歲以上年齡組的醫療費用是60歲以下年齡組醫療費用的3~5倍(李劍閣,2002)。同時,老齡人口規模的增加必然帶來社會醫療總費用的增加。日本研究顯示,醫療技術進步、經濟財富增加、人口老齡化和民衆患病結構的不斷變化共同導致醫療衛生支出不斷攀升,技術進步因素佔比40%,爲首要因素,其他因素分別佔26%、18%和16%(胡蘇雲,2013)。

Survival in disease in the age of longevity has led to a sharp increase in health-related expenditure. Domestically and abroad, the relevant data shows that the amount of medical expenses per capita is closely related to age. Generally speaking, medical expenses in age groups above 60 years of age are 3-5 times those of age groups below that limit (Li Jian'ge, 2002). At the same time, the increasing size of the elderly population will inevitably lead to an increase in the total cost of social care. Japanese research shows that advances in medical technology, increasing economic wealth, an ageing population and ongoing change in the population』s disease structure have all led to constantly rising medical and health care expenditures. Technological progress accounts for 40% of this, making it the primary factor, while the other factors account for 26%, 18% and 16% respectively (Hu Suyun, 2013).

醫療技術創新是近年推動醫療費用成長的最重要原因之一。回溯醫療技術的發展路徑,可以看到研究投入和醫療資源更多地向急性或者致死性疾病傾斜,在消除或延緩與年齡相關的慢性病和細胞變性類疾病方面卻投入不夠。這種不平衡的投入很大程度上是由於早期研究所處時代的人口結構不同造成的,那時人均期望壽命不超過80歲是常態,帶病生存的人口比例較小,對社會的影響也有限。在當前階段,人口結構已經開始發生重大變化,因此需要重新審視社會資源的分配方式。英國的一項研究顯示了這種資源的錯配情況,以呼吸道和神經精神類疾病爲例,指出兩種疾病的傷殘調整生命年(DALY)佔比分別爲8.3%和26.7%,而研究經費佔比僅爲1.7%和15.3%,表明這兩種疾病造成了較大的社會負擔卻未獲得對等的資源投入;此外,癌症的傷殘調整生命年(DALY)佔比爲15.9%,明顯低於神經精神類疾病,但研究經費佔比卻高達19.6%④。目前主流的醫療技術還是以醫院內使用的針對重大疾病的治療手段爲主,此類技術的成本和使用門檻高,導致費用昂貴。將患者從醫院引流進入基礎醫療機構,使用更多低成本的醫療技術,加強疾病預防和健康管理,將不僅對患者自身的健康有利,也將對遏制醫療費用的快速上漲起到積極的作用。

Medical technology innovation is one of the most significant drivers of the growth in medical expenses in recent years. Looking back over the development of medical technologies, we can see that research investment and medical resources have tended to focus on acute or fatal diseases, while there has been insufficient investment in the elimination or delay of age-related chronic disease and cell degenerative diseases. This uneven investment is largely due to the different population structure in the early years of research. At the time, average life expectancy did not normally exceed 80 years, only a small proportion of the population lived with an illness, and the social impact was also limited. At the current stage, however, the population structure has already begun to undergo significant change, and the way in which social resources are allocated therefore must therefore be re-examined. A British study illustrates this mismatch of resources, using respiratory and neuropsychiatric diseases as an example. The study finds that whereas the shares of these two diseases in disability-adjusted life year (DALY) were 8.3% and 26.7% respectively, the shares of research funding for them were 1.7% and 15.3% respectively. It indicates that although these two diseases pose a significant social burden, they have not been allocated equivalent investment resources. In addition, the disability-adjusted life year (DALY) share for cancer accounts for 15.9%, which is significantly lower than that for neuropsychiatric diseases, but the proportion of research funding is significantly higher, at 19.6% (4). At present, mainstream medical technology is still based on the treatment of major illnesses in a hospital setting, where the cost and use threshold for technologies of this kind are high, resulting in high expenditures. Transferring patients from hospitals to entry-level medical institutions, using more low-cost medical technologies, and enhancing disease prevention and health management initiatives will not only benefit the patient』s own health, but will also play a positive role in curbing the rapid increase in medical costs.

我們可以預見到,長壽時代將促使健康產業結構升級。在長壽時代,隨著人體的衰老,不可避免地出現相關健康問題,帶病生存成爲常態,健康將成爲個體關注的第一要素和最寶貴財富。第四次中國城鄉老年人生活狀況抽樣調查顯示老年人照護服務需求持續上升:2015年,我國城鄉老年人自報需要照護服務的比例爲15.3%,比2000年的6.6%上升近9個百分點;城鄉老年人的居家養老服務需求項目排在前三位的分別是上門看病、上門做家務和康復護理,其比例分別是38.1%、12.1%、11.3%。這些都是老年人羣龐大的潛在需求,目前來看,只有部分社區提供這些服務,大部分社區都存在供給短缺(楊曉奇、王莉莉,2019)。

We can foresee that the age of longevity will encourage the upgrading of the structure of the health industry. In the age of longevity, health problems associated with physical ageing will inevitably appear, survival with illness will become increasingly normal, and health will become an individual』s primary focus of concern, as well as one of their most precious assets. The Fourth Sample Survey of the Living Conditions of China's Urban and Rural Elderly shows that demand for elderly care services continues to increase: in 2015, the proportion of elderly individuals in urban and rural areas of China who self-declared a need for care services stood at 15.3%, an increase of nine percentage points over the 6.6% figure for 2000; the three most common home and elderly care services requested by the elderly in urban and rural areas were home visits for medical care, home housework-support visits, and rehabilitation care, making up 38.1%, 12.1% and 11.3% of the total respectively. There is huge potential demand from the elderly population, and at present, only a limited number of communities provide such services. The vast majority of communities suffer from supply shortages in this area (Yang Xiaoqi and Wang Lili, 2019).

長壽時代,龐大的健康需求將促進大健康產業的極大發展。爲人們提供健康生活解決方案,是大健康產業最大的商機,也將推動社會進入健康時代。在美國,衛生總支出佔GDP的17.9%,大健康是最大的產業。美國65歲及以上老人佔總人口比例爲16%,衛生總支出佔比達到36%;如果從55歲算起,29%的人口花費了56%的衛生支出⑤。目前,中國的經濟結構中,房地產佔比最高,其次是汽車,衛生總費用在GDP中佔比僅有6.4%。

In the age of longevity, massive demand for health will encourage the outsized development of the health industry. Providing people with healthy living solutions will be the health industry』s most significant commercial opportunity, and will also drive society into a new era of health. In the United States, total health expenditure makes up 17.9% of GDP, and health is the country』s largest industry. The elderly, 65 years and above, make up 16% of the US』s total population, and health expenditure in this segment accounts for 36% of the total. If calculated from the age of 55 onwards, 29% of the population spends 56% of total health expenditure (5). Currently, real estate accounts for the largest share of China's economic structure, followed by automobiles, while total health expenditure only accounts for 6.4% of GDP.

健康時代裏最核心的產業是醫藥工業、健康服務和健康保險。2019年《財富》世界500強榜單中,美國有15家大健康企業,中國只有2家算是大健康企業。按照《「健康中國2030」規劃綱要》的目標,到2020年,中國健康服務業總規模超8兆元,2030年達16兆元。可見,中國大健康產業具有巨大成長空間和產業結構轉變機會,未來有望成爲中國經濟中的支柱產業之一。

The core sectors in this era of health are the pharmaceuticals, healthcare services and health insurance industries. The 2019 Fortune Global 500 included 15 health conglomerates in the USA, whereas in China, only two companies could be considered as health businesses. In line with the objectives set forth in the outline for Healthy China 2030, the total scale of Chinese healthcare services will exceed CNY 8 trillion by 2020, and CNY 16 trillion by 2030. It can be seen that China』s health industry has huge potentials for growth and opportunities for industrial structural transformation, and it is expected to become a pillar industry in China』s future economy.

(三)長壽時代與財富時代

(c) The age of longevity and the era of wealth

長壽時代,人們的預期壽命延長,居民高度關注養老資金是否充沛。在公共養老資金有限的情況下,理性人將更有動機增加財富總量和延長財富積累期限來儲備養老資金,形成旺盛的財富管理需求,因此,與長壽時代相伴而生的是財富時代。

Human life expectancy rising extending in the age of longevity, and there is widespread popular concern over whether pension funds will provide sufficient coverage. Against a background of limited public pension funds, sensible people will be motivated to increase their total wealth, and extend the period over which they accumulate wealth in order to save for their pension funds, generating strong demand for wealth management services. This means that the age of longevity will be accompanied by an era of wealth.

1.長壽時代,養老金替代率是關鍵

1. In the age of longevity, the pension replacement rate is key

根據生命週期理論,人的儲蓄行爲受所處年齡階段影響(Ando and Modligliani,1963)。年輕時提供勞動力增加儲蓄,老年時用於消費。隨著預期壽命的增加和預期撫養比的上升,個體會透過調整消費和儲蓄行爲、年輕時增加資本積累等方式應對延長的老年生活消費所需(Lee and Mason,2006),以保證充足的替代率(平均養老金與社會平均工資之比)滿足平滑消費,實現與生命等長的現金流。

According to life cycle theory, people』s saving behaviour is influenced by their stage of life (Ando and Modigliani, 1963). When they are young, they provide labour to increase their savings, which they subsequently spend in their old age. As life expectancy and the expected dependency ratio rise, individuals will respond by adjusting their consumption and savings behaviour, and increasing their accumulation of capital while they are young, amongst other means, to meet the needs of their extended old age lifestyle (Lee and Mason, 2006), to ensure a sufficient replacement rate (the ratio of the average pension to the average social wage), and thus ensure uninterrupted consumption and cash flows throughout the length of their lives.

在老齡人口占比增多的背景下,公共養老金會持續承壓,老年撫養比的上升和領取養老金年限的延長勢必會導致狹義養老金替代率的下降。而廣義養老儲蓄資本(包括公共養老金和個人養老儲備)在提前籌劃儘早儲備的前提下可以實現隨老齡人口占比增多而提高。2019年墨爾本美世養老金指數報告樣本國家數據顯示,養老金充足率指數與老齡人口占比呈現正相關性,相關係數爲58%。養老金指數排名前三的荷蘭、丹麥,其養老金結餘資本與GDP之比分別是173.3%和198.6%,且隨著老齡人口占比的增加呈上升趨勢。荷蘭、丹麥等國家老齡人口占比更高,但因爲鼓勵養老儲蓄政策的存在,養老資金儲備保持了較高的充足率。

In the context of an increase in the proportion of the elderly population, pressure on public pensions will continue to rise, and the increase in the old-age dependency ratio as well as the extension of the pension period will inevitably lead to a drop in the pension replacement rate in its narrow sense. However, pension savings capital in the wider sense (including public pensions and private pension savings) can still be increased as the elderly proportion of the population grows, provided that planning for reserves is started as soon as possible. Sample country data from the 2019 Melbourne Mercer Global Pension Index shows that the pension adequacy ratio and the proportion of the elderly population have a positive correlation, with a correlation coefficient of 58%. The Netherlands and Denmark, which both rank in the Top 3 of the pension index, have ratios of pension surplus capital to GDP of 173.3% and 198.6% respectively, both of which are trending upwards as the elderly proportion of the population increases. Although the elderly proportion of the population is higher in countries such as the Netherlands and Denmark, pension fund reserves have maintained a relatively high adequacy ratio because of the existence of policies that encourage pension savings.

根據國家統計局數據顯示,自1997年中國城鎮居民基本養老體系改革以來,養老金社會平均工資替代率從71.51%降至45.92%。在廣義養老金總量上,與發達國家相比,中國的養老資金儲備有待提高。中國養老金三支柱佔GDP的比重僅爲8%,OECD國家平均佔比爲49.7%,而美國的佔比也達到146%(孫博,2018)。在養老金結構上,中國的養老儲備嚴重依賴第一支柱,第二支柱和第三支柱佔比過低。由於企業負擔和經濟結構的差異,中國發展第二支柱養老體系遲緩,亟須提高第三支柱佔比,讓個人養老保險發揮更大作用。

National Bureau of Statistics data shows that since the start of reforms to the basic pension system for urban residents in China in 1997, the social average wage replacement rate for pensions has dropped from 71.51% to 45.92%. In terms of the total pension amount in the wider sense, China's pension fund reserves need to be increased in comparison to developed countries. The three pillars of Chinese pensions only account for 8% of GDP, whereas the average for OECD countries is 49.7%; in the USA, the figure is 146% (Sun Bo, 2018). In terms of the pension structure, China's pension reserves are heavily reliant on the first pillar; the second and third pillars provide too low a proportion of this support. Due to differences in corporate burdens and the economic structure, China has been slow to develop the second pillar of its pension system, and further support from the third pillar is urgently required in order to enable personal pension insurance to play a greater role.

2.長壽時代帶來財富的成長

2. The growth in wealth brought about by the age of longevity

在人口紅利理論之後,人口經濟學家提出第二次人口紅利理論,即理性人會調整自己的消費和儲蓄行爲、人力資本投資行爲、勞動力供給行爲,以應對長壽時代的各項挑戰(Disney,2000;Lee and Mason,2006;蔡昉,2009)。

In line with demographic dividend theory, demographic economists proposed a second demographic dividend theory, namely that sensible people would adjust their own consumption and saving, human capital investment and labour supply behaviours to meet the challenges of the age of longevity (Disney, 2000; Lee and Mason, 2006; Cai Fang, 2009).

人力資本在第二次人口紅利形成中起到重要作用。經濟學家盧卡斯將人力資本定義爲「其質量取決於教育程度的有效勞動力」(Lucas,1988)。人力資本的重要成分包括健康和教育,在上一節我們已經對健康進行了討論,這裏我們將重點放在教育。個人層面,教育水準提高有利於受教育者競爭力的提升,促進職業生涯發展和工資收入提高。預期壽命的提高可以激勵教育投入。個體理性預期的調整包括基於人力資本積累預期的教育年限和教育投資調整(楊英、林煥榮,2013)。預期壽命的提高使得教育投入的受益時間拉長,個體更有激勵進行教育投資(Hansen and Lønstrup, 2012;Cervellati and Sunde, 2013)。宏觀層面,老齡人口占比提升加速產業結構調整,勞動密集型產業讓渡給資本、技術密集型產業,人力資本的價值更加重要。世界銀行數據顯示,預期壽命越長的國家受教育水準越高。預計中國勞動人口平均受教育年限將從2018年的10.5年上升至2035年的12年。總之,人力資本的質量提升將促進勞動生產率提升,居民收入水準亦將隨之增加,進而促進社會財富總量的發展。

Human capital plays a major role in the formation of the second demographic dividend. Economist Robert Lucas defined human capital as effective labour whose quality is dependent on the level of education (Lucas, 1988). Major components of human capital include health and education. In the previous section, we discussed health, and here, we will focus on education. At the personal level, improving education standards is conducive to enhancing the competitiveness of the educated individual, promoting their career development and boosting their wage income. Increased life expectancy can stimulate investment in education. Adjusting the rational expectations of an individual can include adjustments to their years spent in education and to their investment in education based on human capital accumulation expectations (Yang Ying, Lin Huanrong, 2013). Increases in life expectancy extend the period of time over which the benefits of investment in education are reaped, making individuals more motivated to invest in education (Hansen and Lønstrup, 2012; Cervellati and Sunde, 2013). At the macro level, the increase in the elderly proportion of the population accelerates adjustments to the industrial structure: labour-intensive industries give way to capital- and technology-intensive industries, and the value of human capital plays an even more important role. World Bank data shows that countries with longer life expectancy have higher levels of education. It is forecast that the average years of education received by China』s working population will increase from 10.5 years in 2018 to 12 years in 2035. In short, improving the quality of human capital will promote improvements in labour productivity, and income levels will increase accordingly, further promoting the overall development of social wealth.

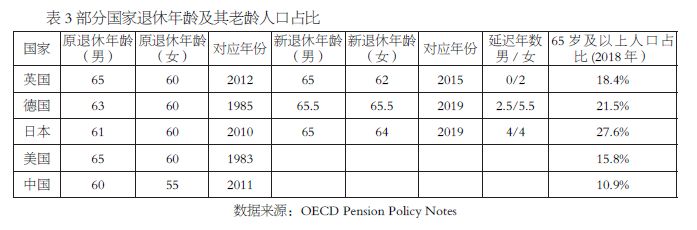

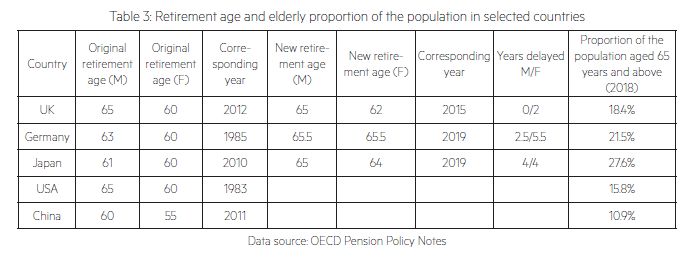

養老財富積累期限的延長,也將促進社會財富總量的發展。伴隨著人口預期壽命延長與健康水準提升,健康低齡老人人數將大幅增加,疊加教育投入增加帶來的人力資本質量提升,人力資本的折舊將放緩,該人羣具備延長工作年限的基本條件。如果勞動人口的工作年限延長,其養老的財富儲備期限將延長。事實上,多個老齡人口占比較高的國家採取了延遲法定退休年齡的方式來作爲應對措施之一。此外,爲應對長壽時代,理性人會在年輕時期更早地開始籌劃養老的財富儲備。以上兩種方式都將延長養老財富儲備的期限,提升社會財富總量。(見表3)

Extending the period over which old-age wealth is accumulated will also promote the development of a society』s total wealth. With the increase in the population』s life expectancy and improved health, the number of healthy young elderly (i.e. people aged 55-75) will increase substantially. As the increase in investment in education will boost the quality of human capital and the depreciation of human capital will slow, this population segment now fulfils the basic criteria for extending their working lives. Extending the working lives of the working population means that the period over which they accumulate wealth for their pensions will also be prolonged. In fact, many countries in which relatively high proportions of the population are elderly have chosen to delay the legal retirement age as a countermeasure. In addition, in response to the age of longevity, sensible people will start to plan their pension savings at an even earlier stage in their lives. Both of these methods will extend the duration of wealth accumulation for old age, and increase the total wealth of a society (See Table 3).

3.長壽時代居民的財富管理需求引領財富時代

3. Wealth management needs in the age of longevity will open up an era of wealth

長壽時代,居民將更加依賴投資回報和財富積累來養老,財富管理需求旺盛,長壽時代將帶來財富時代。隨著老齡人口總量和比例快速成長,公共養老金替代率呈下降趨勢。同時,少子化使得依靠子女養老的可能性下降。因此,個人和家庭的投資回報對於居民養老的重要性提高。以中國、美國、日本、英國、德國等老齡人口占比較高的國家近20年的數據爲例,隨著老齡人口占比的不斷提升,個人財富市場規模也持續增加。而且,一國個人財富市場規模與GDP的倍數關係基本趨於穩定,甚或上升。例如,根據瑞信2019年全球財富報告(Global Wealth Report 2019)顯示,近20年來,中國的老齡人口占比從7%上升至12%,個人財富市場規模從4兆美元上升至64兆美元,佔GDP的比例從3.1倍上升至4.7倍,倍數呈持續上升態勢;同期,美國的老齡人口占比從16%上升至19%,個人財富市場規模從42兆美元上升至106兆美元,佔GDP的比例從4.1倍上升至5.2倍,倍數呈上升趨勢。

In the age of longevity, people will increasingly rely on returns on investment and the accumulation of wealth to provide for their old age. This will create strong demand for wealth management, and the age of longevity will usher in an era of wealth. As the elderly population grows rapidly, in terms of both total numbers and their proportion of the total population, public pension replacement rates will record a downward trend. At the same time, the reduction in the birth rate reduces the possibility of relying on one』s children in one』s old age. Because of this, personal and family returns on investment have become more important to people』s pensions. If we look at data for the last 20 years in countries with relatively high proportions of the elderly in the population, such as China, the USA, Japan, the UK and Germany, the scale of the personal wealth market has continued to grow as the elderly proportion of the population has increased. Moreover, the relationship between the scale of a country』s personal wealth market and its multiple of GDP has basically stabilised, or even increased. For example, according to Credit Suisse』s Global Wealth Report 2019, over the last 20 years, the elderly proportion of the Chinese population has increased from 7% to 12%, whereas the scale of its personal wealth market has increased from USD 4 trillion to USD 64 trillion. The ratio of the scale of personal wealth market to GDP also increased from 3.1 to 4.7 , and this multiple is continuing to rise. Over the same period, the elderly proportion of the US population increased from 12% to 16% , the scale of the personal wealth market grew from USD 42 trillion to USD 106 trillion. The ratio of the market scale to GDP, which increased from 4.1 to 5.2 , is continuing an upward trend.

財富時代,中國居民財富結構將更加多元化。居民財富管理將直接影響居民消費,包括老年時期消費。根據西南財經大學與廣發銀行聯合發佈的《2018中國城市家庭財富健康報告》,中國居民財富管理的結構不合理,主要表現爲家庭住房資產佔比過高(70%),遠高於美國的31%,嚴重擠壓了金融資產配置。下一步,中國居民財富從房地產向金融資產轉移預計將是大趨勢,中國居民財富結構將更加多元化。另外經歷資本市場洗禮,個人投資者開始變得更加理性,更加成熟,更傾向於向專業的財富管理機構尋求投資建議。瑞信2019年全球財富報告中也指出,中國人均財富在近20年間從4293美元提升至5.85萬美元,成長了13倍;同期,與美國相比,中國人均財富水準從美國的1/49上升至1/7.5,仍有較大提升空間。隨著中國經濟的持續發展,中國人均收入水準也將不斷提升,個人財富市場規模將持續成長。

In the era of wealth, the household wealth structure of Chinese people will become more diversified. Wealth management will have a direct impact on consumption, including consumption in old age. According to the 2018 Wealth and Health Report for Chinese Urban Families jointly published by Southwestern University of Finance and Economics and China Guangfa Bank, the wealth management structure of Chinese citizens is currently irrational, mainly due to the excessively high proportion of domestic housing assets (70%), far higher than the US figure of 31%, and this forms a severe constraint on the allocation of financial assets. Next, the transfer of Chinese individuals』 wealth from real estate to financial assets is expected to become a major trend, and their household wealth structure will become more diversified. In addition, as they become more experienced in the capital markets, individual investors have begun to take a more rational and mature approach, and are more inclined to seek investment advice from professional wealth management institutions. The Credit Suisse Global Wealth Report 2019 also notes that over the past 20 years, China』s per capita wealth has grown from USD 4293 to USD 58, 500, a 13-fold increase. Over the same period, compared to the US, China』s per capita wealth has increased from 1/49 of the US level to 1/7.5, meaning that there is still plenty of room for improvement. As the Chinese economy has continued to develop, China's per capita income will also continue to increase, and the size of the personal wealth market will continue to grow.

綜上所述,長壽時代人口年齡結構將逐步形成新均衡,並以低死亡率、低生育率、預期壽命持續提升、人口年齡結構趨向柱狀、平臺期老齡人口占比超越1/4爲主要特徵。在長壽時代下,人類疾病譜轉向慢性非傳染性疾病,對健康壽命的關注將產生龐大的需求,促使健康產業結構升級,推動社會進入健康時代。同時,在長壽時代養老金替代率成爲關鍵,人力資本質量提升、養老財富積累期限延長將促進社會財富總量的發展,個人消費、儲蓄、財富積累的方式會爲之改變,財富管理的旺盛需求將引領財富時代。隨著人類邁入長壽時代,健康時代和財富時代必然隨之到來,需要用大健康的視角系統性地分析三者的關係。

In summary, the age structure of the population in the age of longevity will gradually establish a new equilibrium, characterised by low mortality and fertility, a continuing rise in life expectancy, a population age structure tending to become pillar-shaped, and an elderly proportion of the population which exceeds one quarter of the total during the plateau period. In the age of longevity, the spectrum of human disease will switch to chronic non-communicable diseases. The focus on a healthy lifespan will generate massive demand, promote a structural upgrading of the health industry, and drive society into an era of health. At the same time, the pension replacement rate will become key in the age of longevity. Improvements in the quality of human capital and the extension of the period of time over which old-age wealth is accumulated will promote the development of a society』s total wealth, and the ways in which individuals consume, save and accumulate wealth will change. Strong demand for wealth management will usher in an era of wealth. As mankind steps into the age of longevity, an era of health and an era of wealth will inevitably follow, and the relationship between the three of these must be systematically analysed from a broader perspective of healthcare.