尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

It’s hard to talk about 21st-century economic history without discussing the “China shock”. That is the term often used to describe China’s entrance into the global market, a change that brought rich countries an abundance of cheap goods, but left entire industries and workforces mothballed.

在談論21世紀的經濟歷史時,很難不提到「中國衝擊」。這個術語通常用來描述中國進入全球市場的過程,這一變化爲富裕國家帶來了大量廉價商品,但也使整個行業和勞動力陷入停滯。

DeepSeek may provide a sequel. A little-known Chinese hedge fund has thrown a grenade into the world of artificial intelligence with a large language model that, in effect, matches the market leader, Sam Altman’s OpenAI, at a fraction of the cost. And while OpenAI treats its models’ workings as proprietary, DeepSeek’s R1 wears its technical innards on the outside, making it attractive for developers to use and build on.

深度求索(DeepSeek)可能會爲這個故事帶來續集。一家鮮爲人知的中國對沖基金向人工智慧領域投下了一顆重磅炸彈,他們推出的大型語言模型實際上以極低的成本匹敵市場領導者薩姆•奧爾特曼(Sam Altman)的OpenAI。儘管OpenAI將其模型的運作視爲專有技術,深度求索的R1則公開其技術細節,使其對開發者來說更具吸引力,可以用於開發和構建。

Things move faster in the AI age; terrifyingly so. Five of the biggest technology stocks geared to AI — chipmaker Nvidia and so-called hyperscalers Alphabet, Amazon, Microsoft and Meta Platforms — collectively shed almost $750bn of market value before US markets opened on Monday. It could be particularly grim for Nvidia if it proves true that DeepSeek won without the use of its shiniest chips.

在人工智慧時代,事情發展得更快,甚至令人感到恐懼。五大與人工智慧相關的科技股——晶片製造商輝達(Nvidia)和所謂的超大規模公司Alphabet、亞馬遜(Amazon)、微軟(Microsoft)和Meta——在週一美國市場開盤前,總市值共蒸發了近7500億美元。如果事實證明深度求索在沒有使用輝達最先進晶片的情況下獲勝,這對輝達來說可能尤其嚴峻。

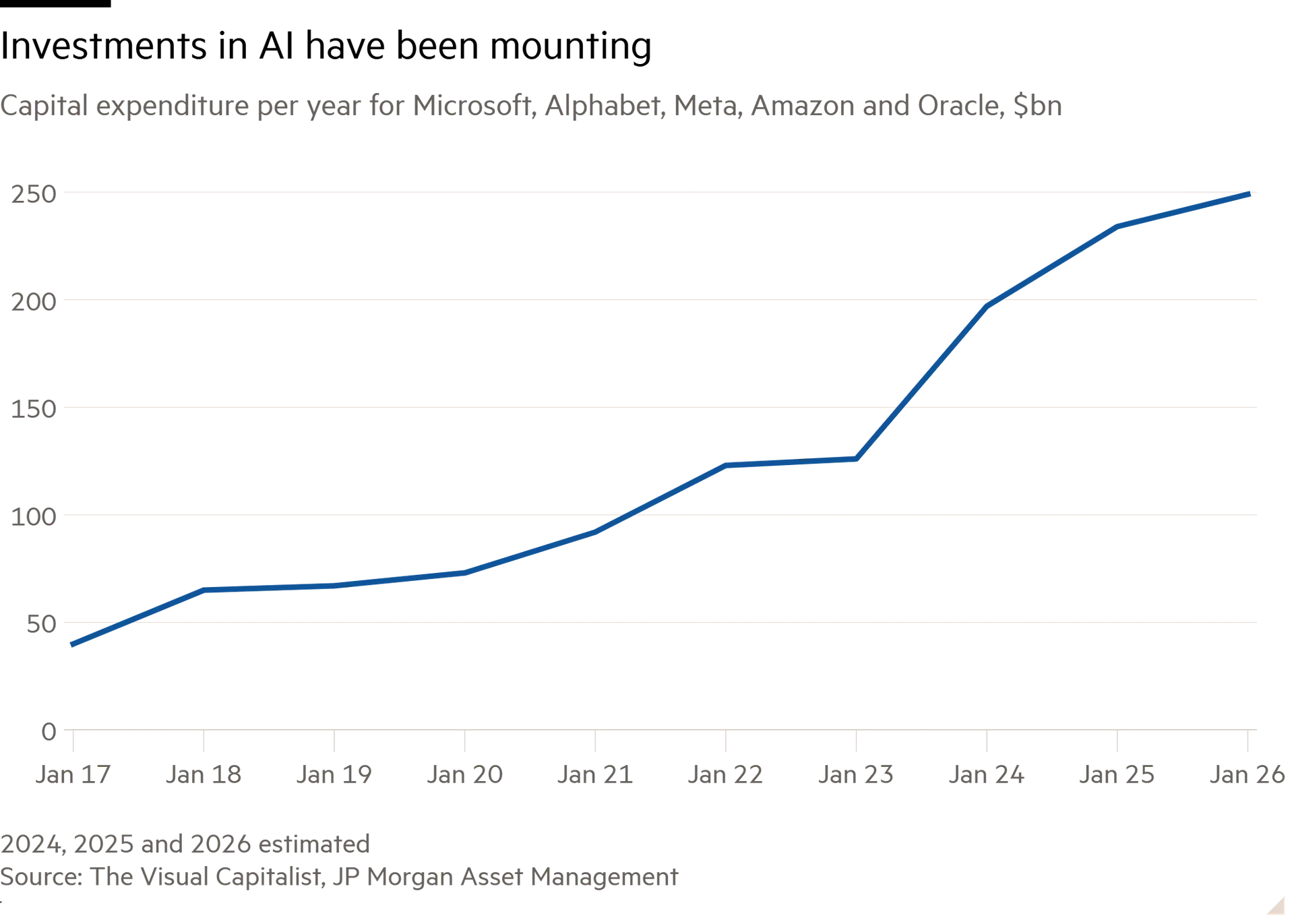

Investors in tech companies — including Europeans such as chipmaker ASML, and energy companies that investors hoped would get a boost from fuelling data centres — are left wondering whether their investments will go up in smoke. The hyperscalers were due to plough almost $300bn into capital expenditure this year, according to Visible Alpha estimates. Analysts expect that on Wednesday, when they report earnings, Meta and Microsoft will report investment for 2024 totalling $94bn.

投資於科技公司的投資者——包括歐洲的晶片製造商阿斯麥(ASML)和投資者希望透過爲數據中心提供燃料而獲得提振的能源公司——都在懷疑他們的投資是否會化爲烏有。根據Visible Alpha的估計,超大規模企業今年的資本支出將達到近3000億美元。分析師預計,Meta和微軟將在週三公佈收益時,報告2024年的投資總額爲940億美元。

In truth, the game isn’t over. DeepSeek’s actual potential is still unclear, and it has yet to achieve “artificial general intelligence”, the humanlike state that Meta and OpenAI are pursuing. But the rules might have changed. At the very least, DeepSeek may take some of the US giants’ customers. At worst, it has challenged the core belief that more hardware is the key to better AI. That principle has underpinned the market value of Silicon Valley companies as they invest hand over fist.

事實上,遊戲還沒有結束。深度求索的實際潛力仍不明朗,它尚未實現Meta和OpenAI所追求的「通用人工智慧」,即類似人類的狀態。但規則可能已經改變。至少,深度求索可能會吸引一些美國巨擘的客戶。最糟糕的是,它挑戰了認爲更多硬體是提升AI的關鍵這一核心信念。這個原則一直支撐著矽谷公司的市場價值,讓他們不斷地加大投資。

What’s bad for the hyperscalers could still be a windfall for everyone else. For most business users, having the absolute best model is less important than having one that’s reliable and good enough. Not every driver needs a Ferrari. Advances in reasoning such as R1 could be a big step for “agents” that deal with customers and perform tasks in the workplace. If those are available more cheaply, corporate profitability should rise.

對超大規模企業不利的事情可能對其他人來說仍然是意外之財。對於大多數商業用戶來說,擁有絕對最好的模型不如擁有一個可靠且足夠好的模型重要。並不是每個司機都需要一輛法拉利。像R1這樣的推理進步可能是處理客戶和在工作場所執行任務的「代理」們的一大進步。如果這些技術能夠更便宜地獲得,企業的盈利能力應該會提高。

In that sense, this second China shock could resemble the first. It could bring not just destruction but a reshuffling — albeit a painful one for many. Researchers have estimated that for every job lost to the China shock, US households’ purchasing power rose by more than $400,000. The race for AI supremacy is on pause; the great giveaway has begun.

從這個意義上說,第二次中國衝擊可能會像第一次一樣,不僅帶來破壞,還會帶來重組——儘管對許多人來說是痛苦的。研究人員估計,每失去一個因中國衝擊而失去的工作,美國家庭的購買力就增加了超過40萬美元。人工智慧霸權的競賽暫時停頓;大贈送已經開始。