尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

The US economy has done far better over the past few years than many would have expected, particularly given the multiple headwinds from the pandemic, US-China decoupling, the war in Ukraine and general political chaos in Washington.

過去幾年,美國經濟的表現遠遠好於許多人的預期,特別是考慮到疫情、中美脫鉤、烏克蘭戰爭和華盛頓普遍的政治混亂等多重不利因素。

The country has enjoyed an almost immaculate economic cooling, along with a still-robust jobs market and good overall gross domestic product growth. Particularly when compared with other countries, the US economy looks as good as it could be right now. However, there is one conspicuous fly in the ointment — housing.

美國經濟幾乎沒有出現明顯降溫,就業市場依然強勁,國內生產總值(GDP)總體成長良好。特別是與其他國家相比,美國經濟目前看起來好得不能再好了。然而,有一個問題十分突出,就是住房問題。

You can see it in last week’s consumer price index numbers, which showed inflation to be a bit higher than was forecast. The main culprit, aside from ever-volatile food and oil prices, was housing. The shelter index portion of the CPI was up 7.2 per cent over the past year, accounting for more than 70 per cent of the total increase in all items, aside from food and fuel.

從上週的消費者價格指數(CPI)數據中你就可以看到這一點,該數據顯示,通膨率略高於預期。除了不斷波動的食品和石油價格外,罪魁禍首是房地產。過去一年,消費者價格指數中的住房指數部分上漲7.2%,佔除食品和燃料外所有項目總漲幅的70%以上。

The inflation numbers raise the prospect of another Federal Reserve interest rate increase in the future, at a time when Wall Street was betting that hikes were over.

通膨數據提高了美聯準(Fed)未來再次加息的可能性,而此時華爾街正押注加息結束。

But would that be the best policy solution for the housing problem in the US? There’s a strong argument to be made that the answer is no. For some time now, the core inflation story in America has been all about housing. Unlike other markets, including the UK, where prices have dropped 13.4 per cent in real terms from their March 2022 peak, the American housing market is not cooling, despite multiple interest rate hikes.

但這是解決美國住房問題的最佳政策方案嗎?有一個強有力的論據可以證明答案是否定的。一段時間以來,美國的核心通膨都與房地產有關。與包括英國在內的其他市場不同,儘管美國多次加息,美國房地產市場卻並未降溫,而英國房價已從2022年3月的峯值實際下跌13.4%。

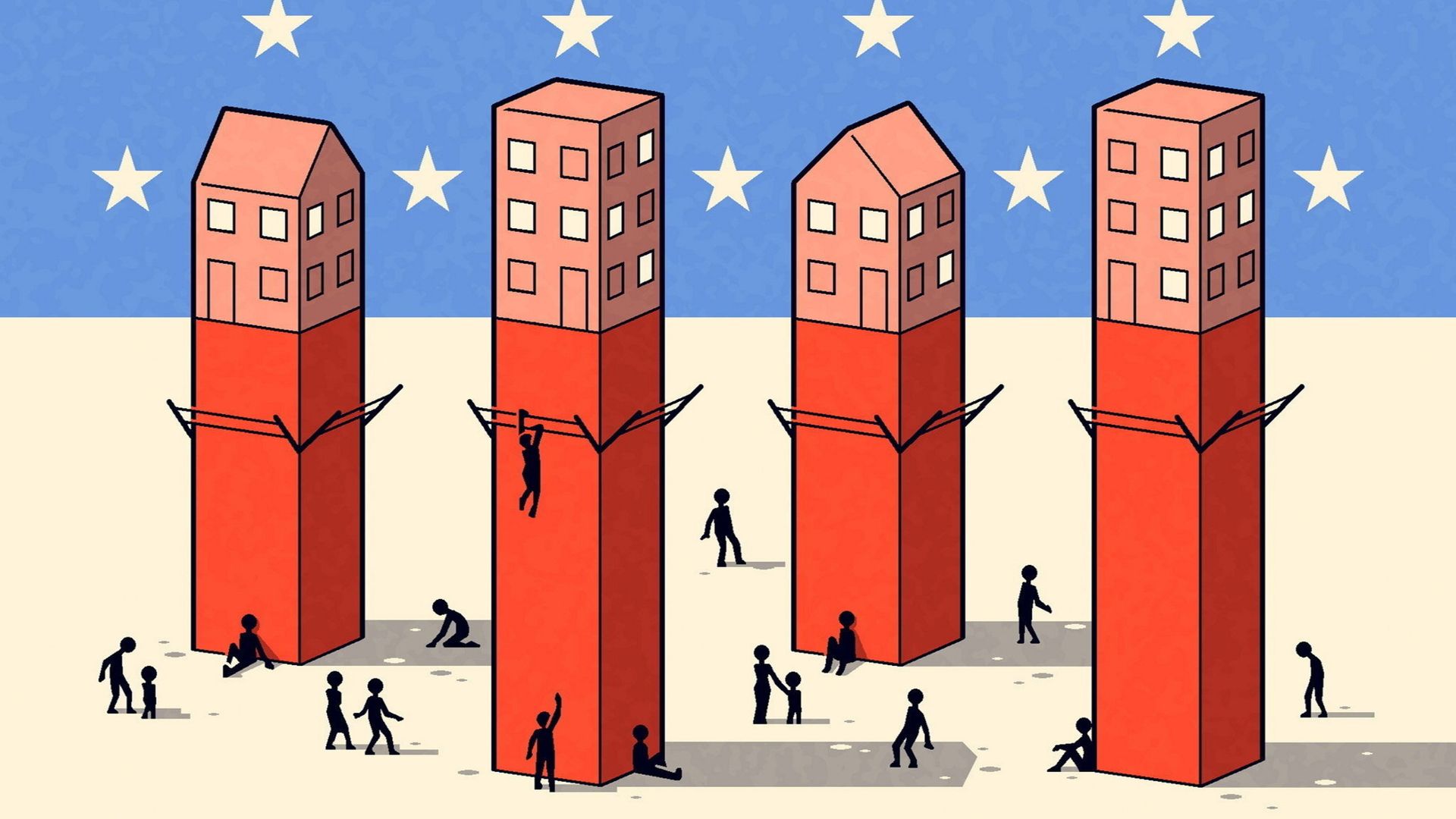

Indeed, you can argue that rate rises have made things worse in housing markets. How is this to be explained? Start with the fundamental problem, which is too little housing supply relative to demand in the US. The country’s housing production hasn’t kept pace with household formation since the Great Financial Crisis of 2008, when the number of housing unit starts dropped off a cliff. Since then, demand has far outpaced supply, leaving the US millions of units short of what its population needs.

事實上,可以說,加息使房地產市場的情況變得更糟了。這該如何解釋呢?先從根本問題說起,即美國的住房供應相對於需求太少。自2008年金融危機爆發以來,美國的住房產量急劇下降,一直跟不上家庭組建的速度。自那以後,需求遠遠超過供應,從而導致美國住房供不應求。

Part of this is about nimbyism, meaning the “not in my backyard” approach to housing policy at a local level. While plenty of Americans in big cities such as New York, Los Angeles or San Francisco would agree that there’s a need for more affordable housing, and indeed more housing in general, few prosperous homeowners (or even renters) would vote to locate such a project near them.

部分原因是「鄰避主義」(nimbyism),即在地方層面採取「不要在我家後院」的住房政策。雖然紐約、洛杉磯或舊金山等大城市的許多美國人都贊同需要更多的經濟適用房,總體上也確實需要更多住房,但很少有富裕的房主(甚至租房者)會投票贊成在他們附近建這樣一個項目。

Studies have found that city politics around zoning tends to favour the opponents of plans rather than the developers. This is a key reason that housing remains constrained.

研究發現,圍繞分區規劃的城市政治傾向於支援計劃的反對者,而不是開發商。這是房地產市場依然受限的一個關鍵原因。

This problem is being further fuelled by an influx of migrants to sanctuary cities in the US, where shelter is in theory guaranteed but in practice is not available. There are also lingering issues with inflation on materials and labour since the pandemic. These have either deterred new home construction or simply made it unaffordable.

大量移民湧入美國的庇護城市,進一步加劇了這一問題。在美國,庇護在理論上是有保障的,但實際上是沒有的。自疫情以來,材料和勞動力通膨問題也揮之不去。這些問題要麼阻礙了新住宅的建設,要麼乾脆讓人們負擔不起。

Housing is, in many ways, America’s last remaining supply chain problem. Fuel prices are up, as well, though that issue will eventually be resolved as US wells pump more and Opec adjusts supply. But the problem of housing inflation, which has been unwittingly exacerbated by the Fed, won’t go away any time soon. The home price/mortgage rate arbitrage is working against homeowner mobility.

在很多方面,住房是美國最後遺留下來的供應鏈問題。燃料價格也在上漲,不過隨著美國油井增加產量以及歐佩克(Opec)調整供應,這一問題最終將得到解決。但美聯準無意中加劇的住房通膨問題不會很快消失。房價/抵押貸款利率套利正在阻礙房主的流動性。

The current 30-year fixed mortgage rate in the US is around 8 per cent. That’s up from under 3 per cent in 2021. Meanwhile, the median house price is up 29 per cent, from $322,000 in 2020 to $416,000 today. Add to this the fact that many homeowners locked in very, very low rates over the past few years. Unless you are about to see your rate reset, it’s extremely hard to justify moving.

美國目前30年期固定抵押貸款利率約爲8%,而在2021年,這一數字還不到3%。與此同時,房價中位數上漲了29%,從2020年的32.2萬美元升至如今的41.6萬美元。除此之外,許多房主在過去幾年裏鎖定了非常非常低的利率。除非你的利率即將重置,否則很難證明搬家是合理的。

My husband and I, for example, have a variable rate of 2.875 per cent that won’t be reset till 2031. With my second child about to leave for college next year, I would love to downsize from the family home and move in to something smaller. But the combination of a still frothy housing market, coupled with high mortgage rates and the overall tax burden associated with home sales in places such as New York, means that it doesn’t make financial sense for us to leave — we would pay more for much less.

例如,我丈夫和我擁有的浮動利率爲2.875%,直到2031年纔會重置。我的第二個孩子明年就要上大學了,我想從家裏搬到小一點的地方住。但是,房地產市場仍然存在泡沫,加上抵押貸款利率高企,再加上紐約等地與房屋銷售相關的總體稅收負擔,這意味著我們離開這裏在財務上沒有意義——我們會爲更少的東西付出更多的錢。

This is the dynamic that is keeping prices high, even in the face of higher rates. And it’s a recipe for continued inflation, particularly if rates continue to rise.

這就是房價居高不下的動力,即使面對更高的利率也是如此。這也是導致持續通膨的原因,尤其是如果利率繼續上升的話。

Some economists are now calling on the Fed to rethink its traditional approach based on this confluence of factors. “I have moved from scratching my head, to being annoyed, to frankly being livid at central banker devotion to cyclical models that simply don’t apply to the post-pandemic era,” says Dan Alpert, managing partner of Westwood Capital. Alpert is a professor at Cornell Law School who has long advocated that the Fed should think more creatively about housing market inflation when considering new rate rises.

一些經濟學家現在呼籲美聯準根據這些因素重新考慮其傳統的做法。韋斯特伍德資本(Westwood Capital)管理合夥人丹•阿爾珀特(Dan Alpert)表示:「我已經從摸不清頭腦,變成惱火,坦率地說,我對央行行長對週期模型的執著感到憤怒,這些模型根本不適用於疫情後時代。」阿爾珀特是康乃爾大學法學院(Cornell Law School)的教授,他長期以來一直主張美聯準在考慮新的加息措施時,應該更有創造性地考慮房地產市場的通膨問題。

If the current paradigm of high prices, high rates and insufficient supply continues, something will have to give. We may not see a major housing market correction in the US soon, given how many people are locked into low rates, but unless a lot more homes are built in the next few years, it will be very difficult to manage America’s housing affordability crisis.

如果目前這種高價格、高利率和供應不足的模式繼續下去,有些東西就必須做出一些讓步。鑑於有很多人被低利率所困,我們可能不會很快看到美國房地產市場出現重大調整,但除非在未來幾年建造更多的房屋,否則將很難應對美國的住房負擔能力危機。