尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

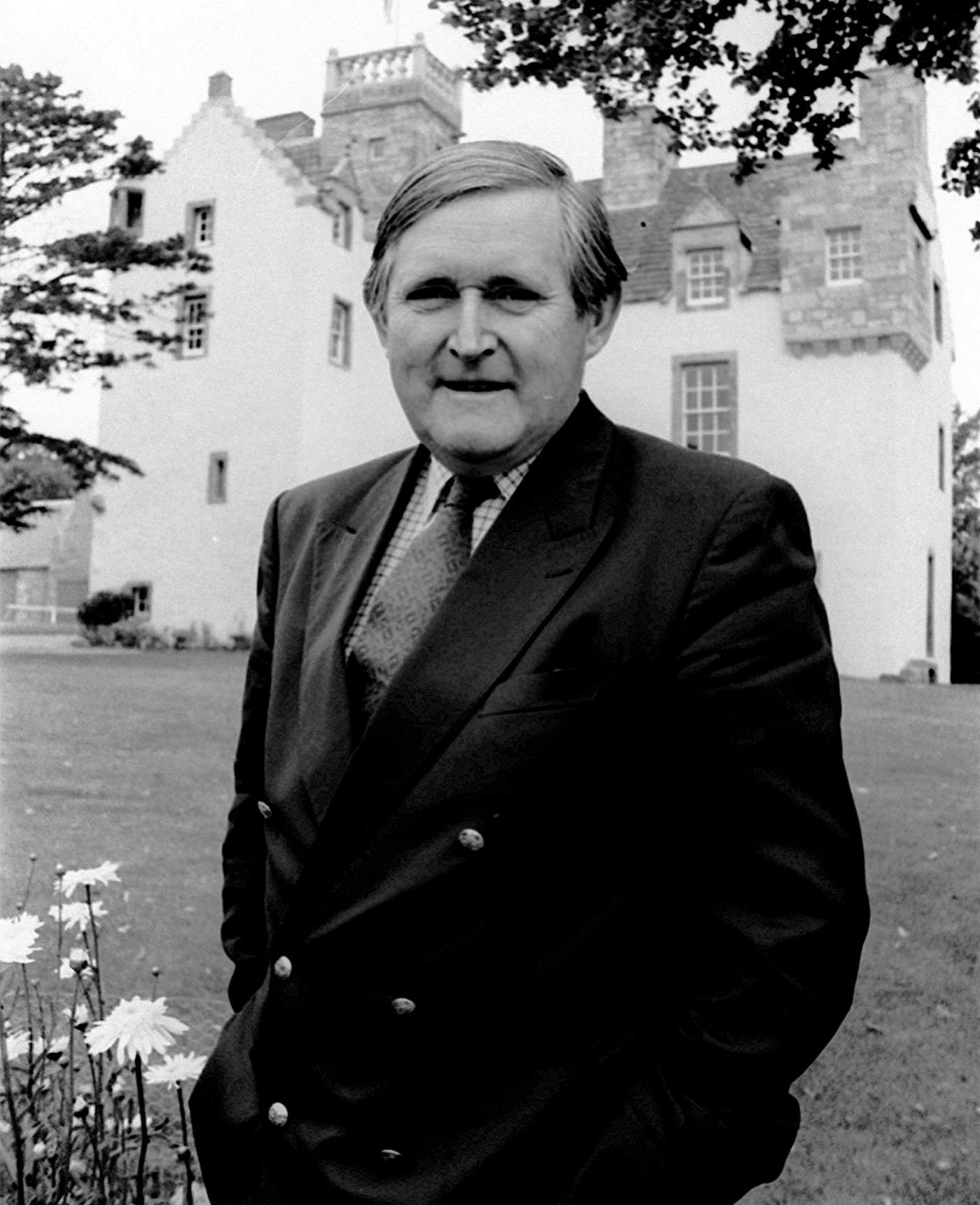

Sir Angus Grossart, merchant banker and patron of the arts, was for more than half a century an irresistible force in Scottish public life.

商業銀行家、藝術贊助人安格斯•格羅薩特爵士(Sir Angus Grossart),在半個多世紀的時間裏,一直是蘇格蘭公衆生活中一股不容忽視的力量。

He described himself, half in jest, as a member of the “Scotia Nostra”, a man who wielded great influence: first through Noble Grossart, the boutique investment bank active in several epic UK takeover battles in the 1980s, including the “whisky wars” involving Guinness and Distillers.

他半開玩笑地稱自己是「Scotia Nostra」的一員,這個人擁有巨大的影響力:先是透過操盤精品投資銀行Noble Grossart,這家銀行活躍於上世紀80年代英國的幾場史詩般的收購戰,包括涉及健力仕(Guinness)收購Distillers的「威士忌之戰」。

The banker was a ubiquitous string-puller in the cultural world. He chaired or squatted on the board of all the major museums and galleries in Scotland, chaired a private auction house (Lyon & Turnbull), and contributed to numerous philanthropic causes. “Angus was a Renaissance man,” said Sir Ewan Brown, his long-time partner at Noble Grossart, “but he was also a street fighter when required.”

這位銀行家是文化界無處不在的幕後操縱者。他擔任過蘇格蘭所有主要博物館和畫廊的主席,擔任過一傢俬人拍賣行(禮昂騰博Lyon & Turnbull)的主席,併爲許多慈善事業做出了貢獻。「安格斯是一個文藝復興時期的人,」他在Noble Grossart的長期合作伙伴尤恩•布朗爵士(Sir Ewan Brown)說,「但在需要的時候,他也是一個街頭鬥士。」

One of three sons of a Lanarkshire tailor, Grossart, who has died aged 85, claimed his first business experience was selling reject factory toffee on a street stall. A junior golfing champion, he studied law at Glasgow University but soon found the bar to be “a little cloistered”.

享年85歲的格羅薩特(Grossart)是拉納克郡一個裁縫的三個兒子之一。他聲稱他的第一次商業經驗,是在一個街頭攤位上拒絕銷售劣質的工廠的太妃糖。作爲青少年高爾夫冠軍,他在格拉斯哥大學學習法律。作爲一名初級高爾夫球冠軍,他在格拉斯哥大學(Glasgow University)學習法律,但很快發現法律生涯「有點與世隔絕」。

In 1969, he co-founded Noble Grossart with Sir Iain Noble, a Scottish landowner and Gaelic language activist. Noble soon left with a half-a-million-pound buyout, but Angus retained the name, turning an initial £30,000 investment into well over £300mn

1969年,他與伊恩·諾布爾爵士(Sir Iain Noble)共同創立了Noble Grossart,後者是蘇格蘭土地所有者和蓋爾語活動家。諾布爾很快就以50萬英鎊的買斷價離開了,但格羅薩特保留了諾布爾的名字,把最初的3萬英鎊投資變成了3億多英鎊。

During the 1970s, the bank prospered through word of mouth and patient growth, driven partly by the discovery of North Sea oil, which revived animal spirits in Scotland. Grossart took a lucrative stake in the Wood Group, the oil services firm, and backed entrepreneurs such as Kwik-Fit’s Sir Tom Farmer, Stagecoach’s Sir Brian Souter and banker Benny Higgins.

在20世紀70年代,該銀行透過口碑和低調發展而繁榮起來,部分原因是北海石油的發現使蘇格蘭的動物本能得到了恢復。格羅薩特在石油服務公司伍德集團(Wood Group)中獲得了利潤豐厚的股份,並支援Kwik-Fit公司的湯姆·法默(Tom Farmer)爵士、Stagecoach公司的布萊恩·索特(Brian Souter)爵士和銀行家本尼·希金斯(Benny Higgins)等企業家。

Grossart never met a title he did not like, a source of trouble in 2018 when he accepted the Medal of Pushkin for services to the arts from Vladimir Putin. He reluctantly agreed to hand it back after Russia’s invasion of Ukraine.

格羅薩特從未遇到過他不喜歡的頭銜,2018年,他從弗拉基米爾·普丁(Vladimir Putin)那裏獲授普希金勳章(Medal of Pushkin),以表彰他對藝術的貢獻,但這是當下麻煩的源頭。在俄羅斯入侵烏克蘭後,他勉強同意歸還。

As someone who loved dressing up, his great regret was that, though awarded a knighthood, he failed to make the Order of the Thistle — the equivalent in chivalry of England’s Order of the Garter. The explanation probably lies in the sorry saga of the Royal Bank of Scotland.

作爲一個喜歡打扮的人,他最大的遺憾是,雖然被授予了騎士頭銜,但他沒能獲得薊花勳章——相當於英格蘭嘉德勳章的騎士勳章。原因可能在於蘇格蘭皇家銀行(Royal Bank of Scotland)時的遺憾的韻事。

In 1981, when I first met him as a cub reporter on the Scotsman, Grossart led opposition to the Hong Kong and Shanghai Bank’s takeover of the Royal Bank. The “backwoodsman” (and they were all men) saw off the bid, arguing it would turn Scotland into a branch economy of the UK.

1981年,當我作爲《蘇格蘭人報》的一名小記者第一次見到他時,格羅薩特作爲領導,抵抗了滙豐銀行對蘇格蘭皇家銀行的收購意圖。這些「莊稼漢」(他們都是男的)拒絕了滙豐的提議,認爲這將使蘇格蘭變成英國的一個分支經濟體。

Two decades later, the Royal Bank launched an audacious takeover of the larger NatWest bank. There followed breakneck growth under Fred “The Shred” Goodwin and the calamitous implosion of RBS in the 2008 global financial crisis. Grossart, vice-chair, got out just in time in 2005, but like a generation of Scottish businessmen who packed the RBS board, his hard-earned reputation for prudence never quite recovered.

20年後,蘇格蘭皇家銀行發起了一項大膽的收購,收購規模更大的NatWest銀行。此後,在弗雷德•古德溫(Fred「The Shred」Goodwin)的領導下,該行實現了驚人的成長,卻在2008年全球金融危機中發生了災難性的內爆。2005年,副董事長格羅薩特及時離職,但就像蘇格蘭皇家銀行董事會的一代蘇格蘭商人一樣,他以謹慎行事而辛苦得來的聲譽從未完全恢復。

Noble Grossart’s heyday was over, a victim of both Big Bang deregulation which favoured capital-rich international investment banks and Grossart’s reluctance to offer equity to high-performing employees. His parsimony was legendary. “At the end of the RBS board meeting, Angus would help himself to two Havana cigars, in addition to the one he was smoking,” recalled Sir George Mathewson, former chief executive and chairman.

Noble Grossart的全盛時期已經結束,它是兩大因素的犧牲品:一方面是有利於資本豐富的國際投資銀行的「金融大變革」(Big Bang)去監管化,另一方面是該集團不願向業績優秀的員工提供股權。他的節儉是出了名的。蘇格蘭皇家銀行前首席執行長兼董事長喬治•馬修森爵士(Sir George Mathewson)回憶道:「在董事會會議結束時,安格斯除了正在抽的那支雪茄外,還會給自己拿兩支哈瓦那雪茄。」

But his generosity of spirit was notable, too. He was passionate about Scottish culture and history, from Sir Walter Scott to the Glasgow aesthetic movement, populating his private collection at home in Edinburgh and at Pitcullo Castle, a restored rural retreat in Fife.

但他的慷慨精神也值得讚賞的。他對蘇格蘭文化和歷史充滿熱情,從沃爾特•斯科特爵士(Sir Walter Scott)到格拉斯哥的美學運動,他在愛丁堡的家中以及法夫的鄉間別墅皮特庫羅城堡都收藏了大量藏品。

Sir Jonathan Mills, former director of the Edinburgh Festival, said Grossart skilfully combined business acumen with an eye for the visual arts and a deep knowledge of his subject. His greatest triumph was perhaps as head of the Burrell Renaissance in Glasgow. He donated £1mn to a £66mn restoration of the eponymous museum and successfully pleaded for a change in the will (and the law), allowing the former Scottish shipping tycoon’s eclectic private collection to tour abroad.

愛丁堡藝術節前總監喬納森•米爾斯爵士(Sir Jonathan Mills)表示,格羅薩特巧妙地將商業頭腦、視覺藝術眼光和對主題的深入瞭解結合起來。他最偉大的成就或許是作爲格拉斯哥伯勒爾文藝復興的領袖。他捐贈了100萬英鎊,用於6600萬英鎊的同名博物館的修復,併成功地請求修改遺囑(和法律),允許這位前蘇格蘭航運大亨不拘一格的私人收藏出國展覽。

This was Scotland in his own image: confident, outward-looking and determined to leverage its heritage. He celebrated this tradition in Gleneagles every December at “Scotland International”, a private gathering of 60 prominent figures from academia, the arts, business and the odd retired spy. Politicians were not welcome. “I belong to two parties,” he liked to say, “the Grossart party and the dinner party.”

這就是他心目中的蘇格蘭:自信、外向,並決心利用自己的傳統。每年12月,他都會在格倫伊格爾斯(Gleneagles)的「蘇格蘭國際」慶祝這一傳統,這是一個由60位來自學術界、藝術界、商界和古怪的退休間諜的知名人士參加的私人聚會。政客們不受歡迎。他喜歡說:「我屬於兩個派,格羅薩特派和宴會享樂派」。

Grossart never spoke on the vexed question of Scottish independence or the SNP’s record in power, but privately bemoaned the stifling of initiative and the “conspicuous” absence of non-political voices in contemporary Scotland. “Many follow, few lead,” he concluded, wistfully.

格羅薩特從未就蘇格蘭獨立或蘇格蘭民族黨執政記錄這一棘手問題發表過言論,但私下裏對當代蘇格蘭主動性的壓制和非政治聲音的「明顯」缺席表示遺憾。他躊躇滿志地總結說:「追隨者衆多,領導者太少。」