In March, Phillip Swagel, director of the US Congress’s independent fiscal watchdog, told the Financial Times that America risked a Liz Truss-style market shock with its soaring debt pile. His reference to the former British prime minister’s “mini” Budget in September 2022 — which led to a sudden surge in UK government bond yields and ructions across financial markets — was an attempt to fend off complacency, rather than a warning of imminent implosion.

Swagel is right to sound the alarm. America’s debt is on an unsustainable path. The Congressional Budget Office projects America’s debt-to-GDP ratio will surpass its second world war high of 106 per cent by the end of the decade, and keep rising. The total deficit is forecast to average 5.5 per cent of GDP until 2030 — about 2 percentage points higher than the post-1940 mean. Net interest payments, which are currently around 3 per cent of GDP, are expected to keep creeping upward too.

Politics is an aggravating factor. Both the Democrats and Republicans heed the importance of fiscal responsibility in theory, but neither is prepared to tighten belts, particularly in an election year. Joe Biden proposed a $7.3tn budget plan for 2025. His presidential rival, Donald Trump, has vowed to renew tax cuts enacted during his time in the White House, which could add another $5tn to the nation’s debt, according to the Committee for a Responsible Federal Budget, a think-tank.

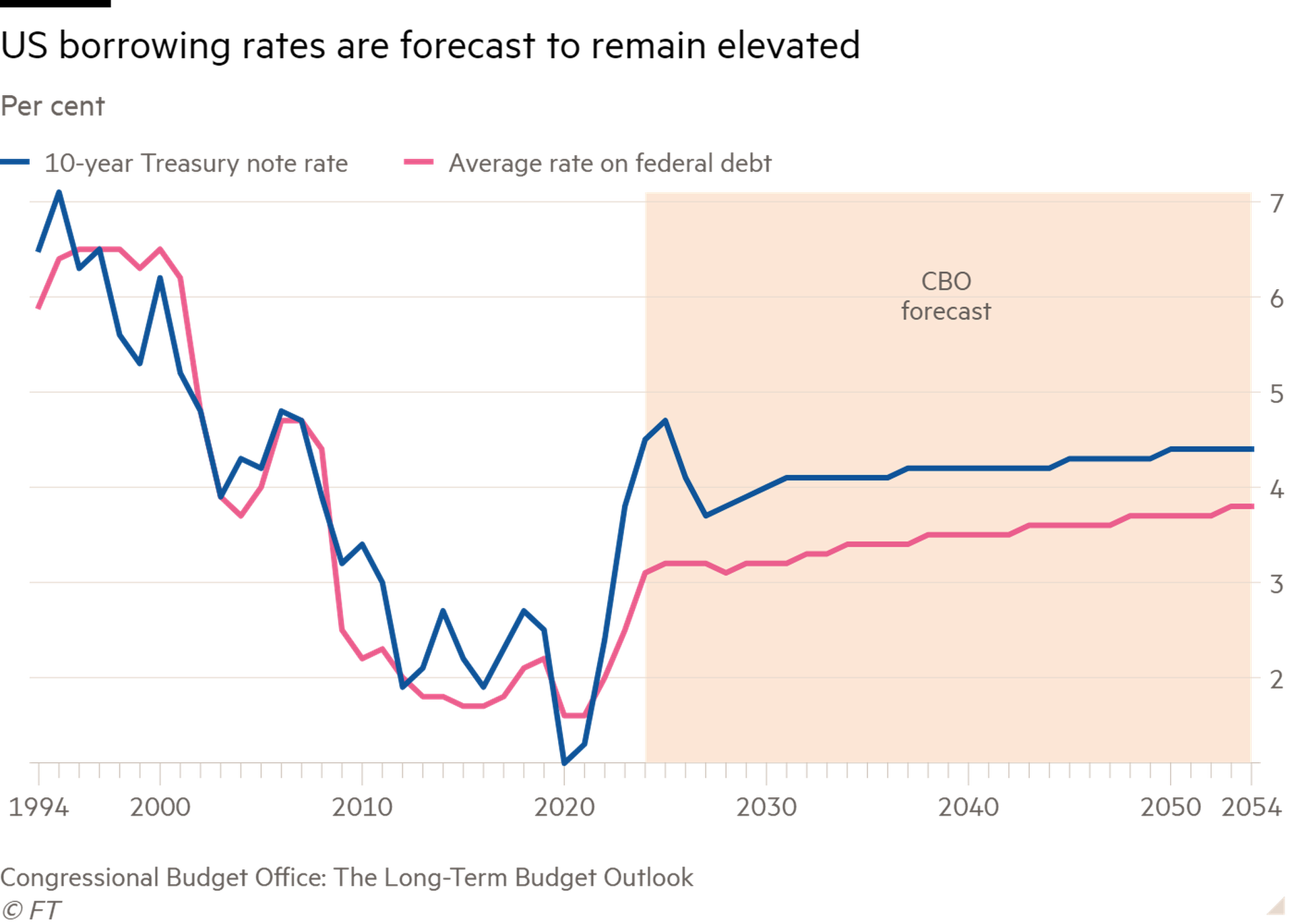

America’s growing debt puts upward pressure on its longer-term borrowing costs. Lax fiscal policy can raise inflation expectations and the perceived risk of holding debt for long periods. The hefty pipeline of debt issuance will also need to be absorbed by more price-sensitive investors, with the Fed now engaging in quantitative tightening.

Elevated yields raise the cost of borrowing and could undermine economic growth. There is an increased vulnerability to rapid and disruptive movements in US bond markets. This has knock-on effects for credit and financial stability abroad too, since US Treasuries act as a benchmark for pricing debt globally. IMF research suggests that a 1 percentage point spike in US rates led to a 90 basis point rise in other advanced economies’ bond yields, and an increase in emerging markets of 1 percentage point. Restraints on domestic and global growth will only heighten the debt reduction challenge.

America’s economic heft gives it substantial leeway. The dollar’s role as the international reserve currency means demand for US debt is ever-present, and AI-driven productivity growth could indeed help lessen its debt problems. But the country’s global influence may foster a dangerous complacency among its politicians. Ignoring the difficult tax and spending decisions needed to put debt on a more sustainable footing keeps the economy on a risky path amid political and economic uncertainty.

For instance, another Trump presidency would come with significant unknowns. Reports that his team is drawing up proposals to water down the Fed’s independence are deeply worrying for inflation control. A well-behaved bond market hinges on clarity and confidence in government policy — as Truss could attest. Rising geopolitical instability and risks in financial markets, from private capital to liquidity problems in Treasury markets, are also exposures. Shocks could damp growth and drive harmful spikes in yields, making debt dynamics even worse.

Sooner or later policymakers need to engage in bipartisan efforts to think seriously about how America funds itself responsibly. If not, panicked bond traders may force them to. As the IMF chief economist, Pierre-Olivier Gourinchas, said last month: “Something will have to give.”