尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

One of the oldest and best-known hedge fund strategies has suffered nearly $150bn in client withdrawals over the past five years, as investors tire of their inability to capitalise on bull markets or protect them during downturns.

過去五年來,最古老、最著名的對沖基金策略之一已遭遇近1500億美元的客戶撤資,原因是投資者厭倦了它們無法在牛市中獲利或在股市低迷時提供保護。

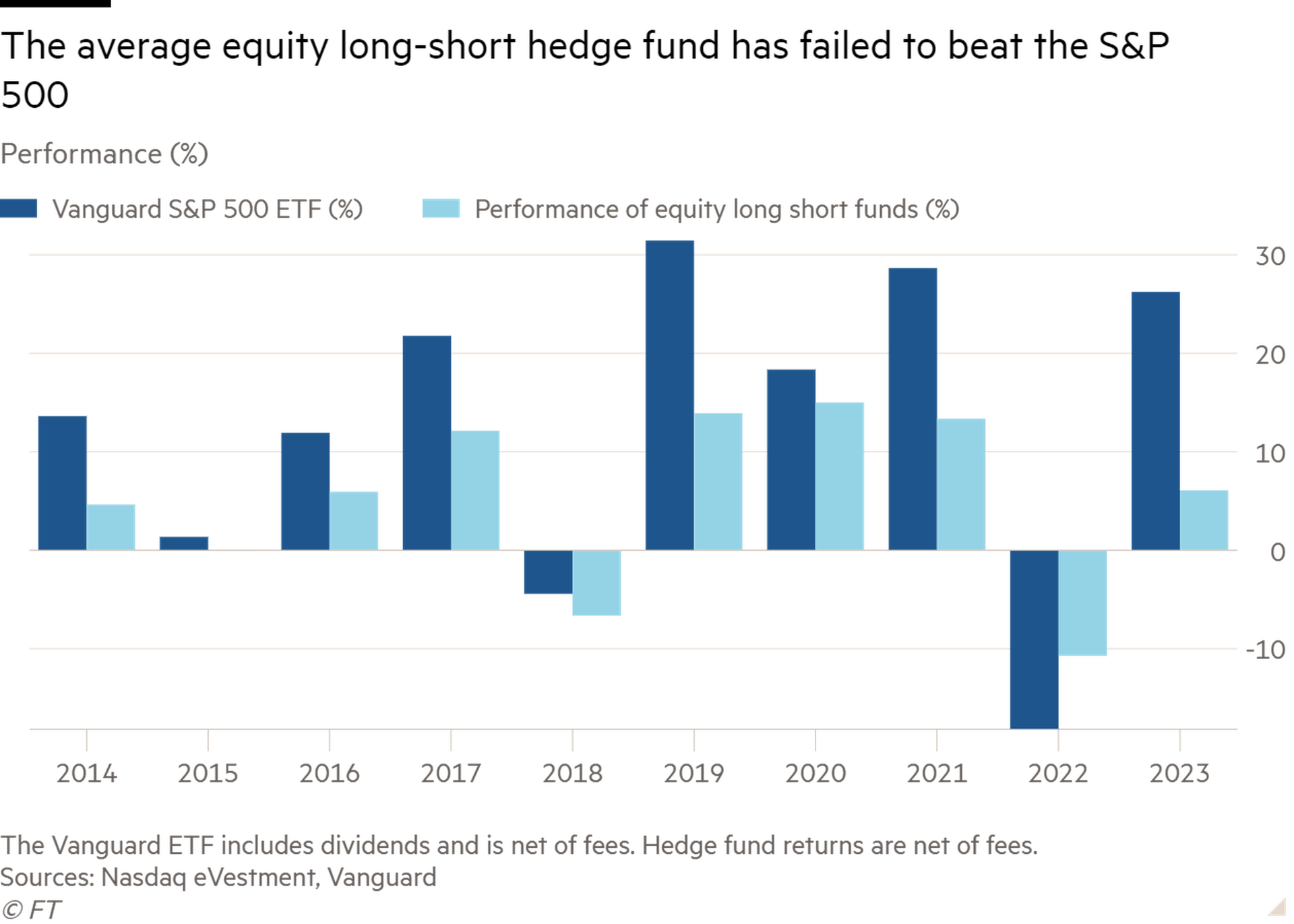

So-called equity long-short funds, which try to buy stocks likely to do well and bet against names set to perform poorly, have underperformed the US stock market in nine out of the past 10 years, according to Nasdaq eVestment, after failing to adapt to markets largely dominated by central banks.

根據那斯達克電子投資公司(Nasdaq eVestment)的數據,所謂的股票多空基金(同時持有股票多頭和股票空頭倉位)在過去10年中有9年的表現不及美國股市,因爲它們未能適應主要由央行主導的市場。

The poor performance and outflows mark a fall from grace for a strategy known for its star stockpickers such as Tiger Management’s Julian Robertson, GLG’s Pierre Lagrange and Egerton’s John Armitage.

業績不佳和資金外流標誌着以老虎管理公司(Tiger Management)的朱利安•羅伯遜(Julian Robertson)、GLG的皮埃爾•拉格朗日(Pierre Lagrange)和埃哲頓(Egerton)的約翰•阿米蒂奇(John Armitage)等明星選股人而聞名的投資策略失寵。

“Ten years ago people used to talk about the great equity stockpickers,” said Donald Pepper, the co-chief executive of hedge fund firm Trium, which manages around $1.7bn.

對沖基金公司Trium的聯合首席執行長唐納德•佩珀(Donald Pepper)表示:「十年前,人們經常談論偉大的選股人。」Trium管理著約17億美元。

“You still have some rock stars like [TCI’s] Chris Hohn, but there just aren’t many of him around anymore.”

「仍然有一些搖滾明星,比如(TCI的)克里斯•霍恩,但像他這樣的人已經不多了。」

Pioneered in 1949 by investor Alfred Winslow Jones — seen as the world’s first hedge fund manager — equity long-short funds were designed to “hedge” against overall market fluctuations through their bets on both winning and losing stocks.

股票多空基金於1949年由投資者阿爾弗雷德•溫斯洛•瓊斯(Alfred Winslow Jones)開創,他被視爲世界上第一位對沖基金經理,旨在透過同時押注上漲和下跌的股票來「對沖」整體市場波動。

The strategy made double-digit returns in almost every year of the 1990s bull market, according to data group HFR, with many funds then profiting by shorting wildly overvalued dotcom groups in the ensuing bust. During the global financial crisis, funds such as Lansdowne Partners made millions betting against doomed UK lender Northern Rock.

根據數據集團HFR的數據,在20世紀90年代的牛市中,該策略幾乎每年都能獲得兩位數的回報,許多基金在隨後的泡沫破裂中透過做空估值過高的網路集團而獲利。在全球金融危機期間,Lansdowne Partners等基金透過押注註定倒閉的英國北巖銀行(Northern Rock)獲利數百萬美元。

But since then many funds have struggled, coming unstuck in markets dominated by central bank bond-buying and low interest rates. In the meantime, they have badly lagged cheap index tracker funds that have reaped huge gains from the bull market.

但自那以後,許多基金一直在掙扎,在以央行債券購買和低利率爲主的市場中陷入困境。與此同時,它們嚴重落後於從牛市中獲得巨大收益的廉價指數跟蹤基金。

An investor who put $100 into an equity long-short hedge fund 10 years ago would now on average have $163, according a Financial Times analysis of figures provided by Nasdaq eVestment. Had they invested in Vanguard’s S&P 500 tracker with dividends reinvested they would have $310.

根據英國《金融時報》對那斯達克電子投資公司提供的數據的分析,10年前向股票多空對沖基金投資100美元的投資者現在平均擁有163美元。如果他們投資於Vanguard的標普500指數跟蹤基金,並將股息再投資,他們將擁有310美元。

“You don’t need your hedge funds to beat the S&P every year, but you do want them to beat it over time, for instance over the past decade,” said a pension fund adviser who allocates billions of dollars to hedge funds.

一位向對沖基金配置數十億美元資金的養老基金顧問表示:「你不需要你的對沖基金每年都擊敗標準普爾,但你確實希望它們能在一段時期擊敗它,比如在過去十年。」

Big-name funds have suffered. Some of the so-called Tiger cubs — managers who trace their roots back to Robertson’s firm — were among those hard hit in 2022’s market sell-off, including Chase Coleman’s once- high-flying Tiger Global and Lee Ainslie’s Maverick Capital.

大牌基金也遭受了損失。一些所謂的「虎崽」——經理來自羅伯遜的公司——在2022年的市場拋售中受到重創,包括Chase Coleman曾經高歌猛進的老虎環球(Tiger Global)和Lee Ainslie的Maverick Capital。

In October the FT highlighted billions of dollars of outflows from London-based hedge fund Pelham Capital, run by former Lansdowne portfolio manager Ross Turner, and it 2022 the FT revealed Roderick Jack and Marcel Jongen’s Adelphi Capital would return capital and become a family office.

10月,英國《金融時報》報導了總部位於倫敦的對沖基金Pelham Capital的數十億美元資金外流,該基金由前Lansdowne投資組合經理Ross Turner管理。2022年,英國《金融時報》透露Roderick Jack和Marcel Jongen的Adelphi Capital將退還資本,並變爲家族辦公室。

When Lansdowne shut its flagship Developed Markets equity fund in 2020, after admitting it had become hard to find stocks to short, many saw it as a sign of a deep malaise in the sector.

Lansdowne在承認已經很難找到可以做空的股票後,於2020年關閉了其旗艦發達市場股票基金,許多人認爲這是該行業陷入嚴重困境的跡象。

Long-short managers complained for years that ultra-low interest rates allowed weaker companies — which would previously have been excellent targets to short — to stumble on for longer and, in some cases, for their share prices to soar. That, they said, made it harder for them to profit.

多年來,多空基金經理們一直抱怨,超低利率讓實力較弱的公司(這些公司以前本是極佳的做空目標)能夠殘喘更長的時間,在某些情況下股價還會飆升。他們說,這使他們更難獲利。

But a sharp rise in interest rates over the past two years has failed to revive the strategy’s fortunes. After large losses in 2022’s downturn, funds were meant to have their breakout year last year as higher rates sifted stronger companies from weaker firms. But funds gained 6.1 per cent on average, compared with the S&P 500’s 26.3 per cent gain.

但過去兩年利率的急劇上升未能重振該策略的命運。在經歷了2022年的巨大損失後,隨著利率上升讓更強的公司從更弱的公司中脫穎而出,基金本應在去年迎來爆發之年。但基金平均上漲6.1%,而標普500指數上漲26.3%。

Adam Singleton, chief investment officer of external alpha at Man Solutions, which invests in other hedge funds, said low volatility and last year’s bull market made it hard for long-short managers to prove themselves.

投資於其他對沖基金的Man Solutions外部阿爾法首席投資官Adam Singleton表示,低波動性和去年的牛市使得多空基金經理很難證明自己。

“Higher interest rates should lead to more good companies succeeding and bad companies failing, but I think markets were very focused on what policymakers like the [US Federal Reserve] would do.”

「更高的利率應該導致更多的好公司成功,壞公司失敗,但我認爲市場非常關注像(美聯準)這樣的政策制定者會做什麼。」

After more than a decade of excuses, investors are losing patience. Richard Byworth, managing partner at Syz Capital, said his portfolios have not invested in equity long-short funds for close to two years.

經過十多年的辯解,投資者正在失去耐心。Syz Capital的管理合夥人Richard Byworth表示,他的投資組合已經有近兩年沒有投資股票多空基金了。

“With high fees, long-short managers are just not delivering performance anywhere near a level that would justify a position in our portfolio,” he said. “It is that simple.”

他說:「在高收費的情況下,多空基金經理的表現根本無法達到在我們的投資組合中佔有一席之地的水準。就是這麼簡單。」

After 23 consecutive months of investor withdrawals, assets in equity long-short funds are down to $723bn, below levels five years ago, according to Nasdaq eVestment. Some of this has flowed to multi-manager hedge funds, which spread clients’ money over a range of strategies including long-short equity. Such funds invest heavily in risk management and are far less affected by the performance of a star stockpicker.

根據那斯達克電子投資公司的數據,在投資者連續23個月撤資後,股票多空基金的資產已降至7230億美元,低於五年前的水準。其中部分資金流向了多管理人對沖基金,這些基金將客戶的資金分散到包括股票多空策略在內的一系列策略中。這類基金在風險管理方面投入巨大,受明星選股人表現的影響要小得多。

Not everyone is downbeat. There are early signs that shorting is finally becoming “more fruitful” as higher rates hit poor-quality companies, said one executive, while some allocators such as Kier Boley, co-head of alternative investment solutions at Swiss allocator UBP, think funds will profit as the market’s attention switches back to company fundamentals.

並非所有人都不樂觀。一位高階主管表示,隨著利率上升打擊劣質公司,有早期跡象表明做空終於變得「更有成效」,而一些配置者,如瑞士UBP的另類投資解決方案聯席主管Kier Boley認爲,隨著市場的注意力重新轉向公司基本面,基金將從中獲利。

“I am bullish on the prospects for long-short strategies,” said Mario Unali, a portfolio manager at investment firm Kairos. “We will see long-short funds likely roar back to pre-2008 levels.”

投資公司Kairos的投資組合經理Mario Unali表示:「我看好多空策略的前景。我們將看到多空基金可能會飆升至2008年之前的水準。」

But an executive at one top long-short fund was less optimistic, saying a widely anticipated fall in global interest rates would hurt the sector.

但一家頂級多空基金的高階主管則不那麼樂觀,稱普遍預期的全球利率下降將損害該行業。

“Which hedge fund has ever said that the next decade won’t be great [for their particular strategy]?” he said. “[But] long-short hedge funds will continue to dwindle if rates go back down to zero.”

他說:「哪家對沖基金說過未來十年(對他們的特定戰略)不會很好?(但)如果利率回落至零,多空對沖基金將繼續減少。」

Additional reporting by Laurence Fletcher

Laurence Fletcher補充報導