尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

US companies have been piling into the market for convertible bonds as they search for ways to keep their interest costs down, in a rare flurry of activity in otherwise subdued corporate fundraising markets.

尋找降低利息成本方法的美國企業紛紛湧入可轉換債券市場,成爲原本低迷的企業融資市場中罕見的一波活動。

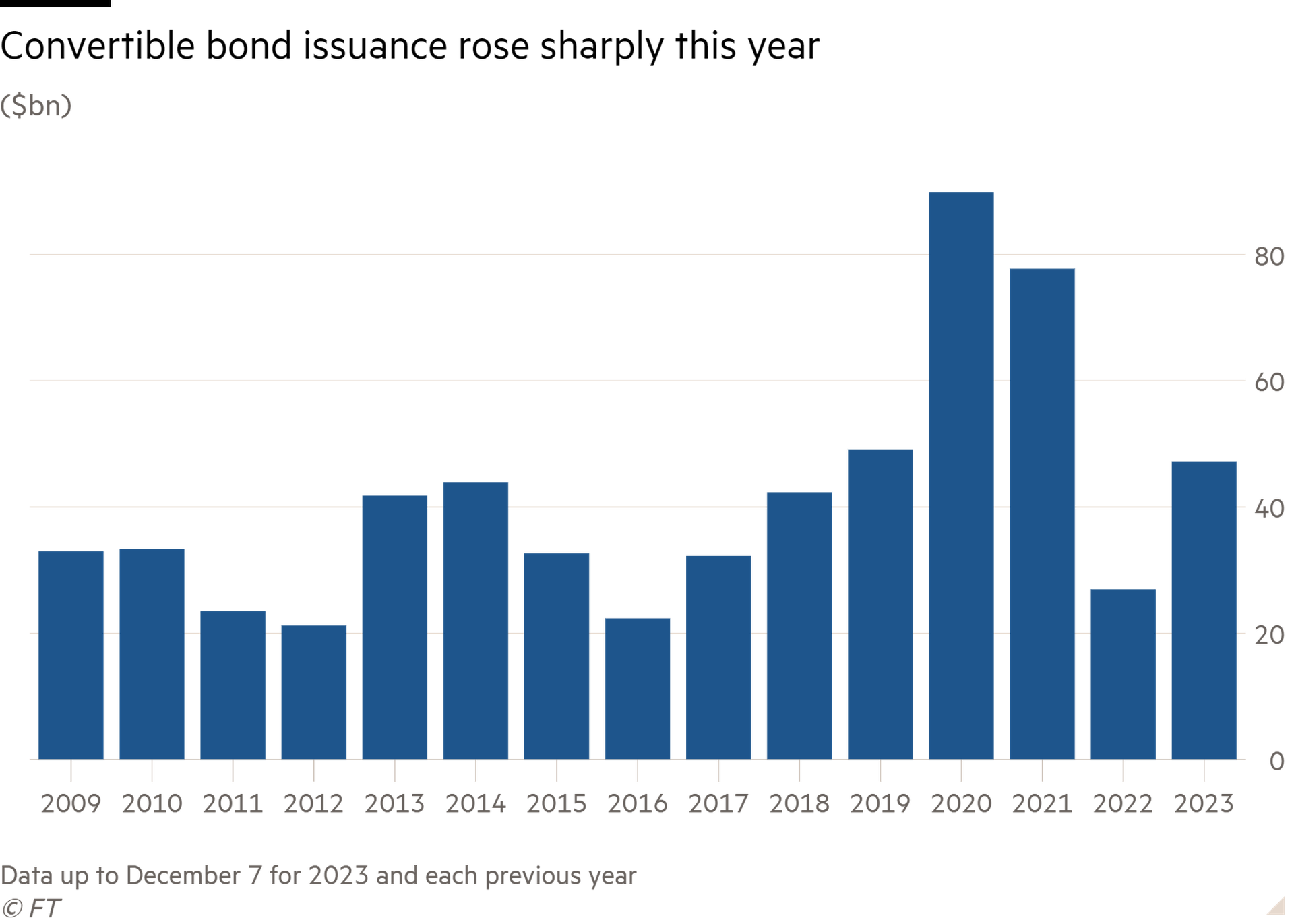

Issuance of convertible debt climbed by 77 per cent last year to $48bn, according to data from LSEG, making it one of the only areas of capital markets to return to pre-pandemic averages after 2022’s market downturn.

LSEG的數據顯示,去年可轉債發行量攀升77%,至480億美元,使其成爲資本市場在經歷2022年市場低迷後恢復到疫情前平均水準的少數幾個領域之一。

Experts say the boom in convertibles, a type of bond that can be swapped for shares if a company’s stock price hits a pre-agreed level, is likely to continue this year as companies refinance a wave of maturing debt.

專家表示,隨著企業對一波到期債務進行再融資,可轉債的熱潮今年可能會持續下去。可轉債是一種可以在公司股價達到預先商定水準時換成股票的債券。

The debt has traditionally been popular with younger technology and biotech groups that struggle to access mainstream bond markets. But more established companies have also dived in as the Federal Reserve’s interest rate hikes have driven up borrowing costs even for investment-grade companies.

傳統上,這種債券受到難以進入主流債券市場的年輕科技和生物技術企業的歡迎。但隨著美聯準加息,即使是投資級公司的借貸成本也在上升,更多的老牌公司也紛紛加入。

“Historically converts had sometimes been seen as one of those spivvier products that investment-grade names stayed away from,” said Bryan Goldstein, who advises companies on convertible deals at Matthews South. “Now some big name issuers have come to the market, that narrative has shifted — it is seen as an attractive product on its own merits.”

Matthews South公司可轉換債券交易顧問布萊恩•戈爾茨坦表示:「從歷史上看,可轉換債券有時被視爲投資級公司避開的那些較華而不實的產品之一。現在,一些知名發行人已經進入市場,這種說法發生了轉變——它本身被視爲一種有吸引力的產品。」

Convertibles offer borrowers lower interest rates than traditional bonds without the immediate dilution for shareholders that would come through selling new stock. While 2023’s total issuance was lower than the record levels hit in 2020 and 2021, when companies took advantage of net-zero interest rates to shore up their balance sheets, it was well above the average of $34bn for the decade to 2019.

與傳統債券相比,可轉換債券爲借款人提供了更低的利率,而且不會像發售新股那樣立即稀釋股東的權益。儘管2023年的總髮行量低於2020年和2021年創下的創紀錄水準(當時企業利用淨零利率來支撐資產負債表),但遠高於截至2019年的10年間340億美元的平均水準。

That is a stark contrast to the markets for initial public offerings, follow-on share sales, high-yield debt and leveraged loans, where volumes are still languishing well below pre-pandemic levels.

這與首次公開發行(IPO)、後續股票發行、高收益債券和槓桿貸款市場形成鮮明對比,這些市場的交易量仍遠低於疫情前的水準。

For borrowers, the savings can be substantial. The average yield on conventional investment-grade bonds has risen from 2.5 per cent at the start of 2022 to 5.2 per cent today, according to Ice BofA data. Average junk bond yields have risen from 4.9 per cent to about 7.8 per cent in that period.

對於借款人來說,可以節省大量成本。Ice BofA的數據顯示,傳統投資級債券的平均收益率已從2022年初的2.5%升至如今的5.2%。同期,垃圾債券的平均收益率已從4.9%升至7.8%左右。

By contrast, car-sharing group Uber issued a $1.5bn convertible in November at an interest rate of less than 1 per cent.

相比之下,汽車共享集團Uber去年11月以不到1%的利率發行了15億美元的可轉換債券。

Michael Youngworth, convertible bond strategist at Bank of America, said convertibles typically cut between 2.5 and 3 percentage points from the debt’s interest rate — translating into tens of millions of dollars in annual savings for a deal like Uber’s.

美國銀行的可轉換債券策略師Michael Youngworth表示,可轉換債券通常會將債務利率降低2.5-3個百分點——對於Uber的這一交易,相當於每年節省數千萬美元。

Other companies to have tapped the convertible bond market in recent weeks include utility giant PG&E — whose credit rating puts it at the higher end of the “junk” category — and fellow energy group Evergy, an investment-grade borrower.

最近幾周利用可轉債市場融資的其他公司包括公用事業巨擘PG&E(其信用評級處於「垃圾」級的高階),以及同類能源集團Evergy(投資級借款人)。

For both utilities, part of the rationale for issuing convertibles — worth $1.9bn and $1.2bn respectively — was to pay down existing non-convertible term loans.

對於這兩家公用事業公司來說,發行可轉換債券——分別價值19億美元和12億美元——的部分原因是爲償還現有的不可轉換定期貸款。

US investment-grade companies have a record $1.26tn of debt to refinance over the next five years, according to an October report from rating agency Moody’s, up 12 per cent from the previous half-decade period. Junk-rated companies have $1.87tn across both bonds and loans.

評級機構穆迪(Moody's) 10月份發佈的一份報告顯示,未來5年,美國投資級企業需要再融資的債務達到創紀錄的1.26兆美元,比上一個五年期增加了12%。垃圾級公司的債券和貸款合計達1.87兆美元。

“Converts are going to stay popular because we have a massive maturity wall that’s about to hit,” said Ken Wallach, co-head of global capital markets at law firm Simpson Thacher. “In 2020 and 2021, companies issued all this five-year paper in a much lower rate environment during the height of the pandemic.”

Simpson Thacher律師事務所全球資本市場聯席主管肯•瓦拉赫(Ken Wallach)表示:「可轉換債券將繼續受到歡迎,因爲我們即將撞上一堵巨大的到期牆。2020年和2021年,在疫情最嚴重的時候,企業在低得多的利率環境下發行了所有這些五年期債券。」