尊敬的用戶您好,這是來自FT中文網的溫馨提示:如您對更多FT中文網的內容感興趣,請在蘋果應用商店或谷歌應用市場搜尋「FT中文網」,下載FT中文網的官方應用。

Something peculiar is afoot at MicroStrategy.

微策略(MicroStrategy)正在發生一些奇怪的事情。

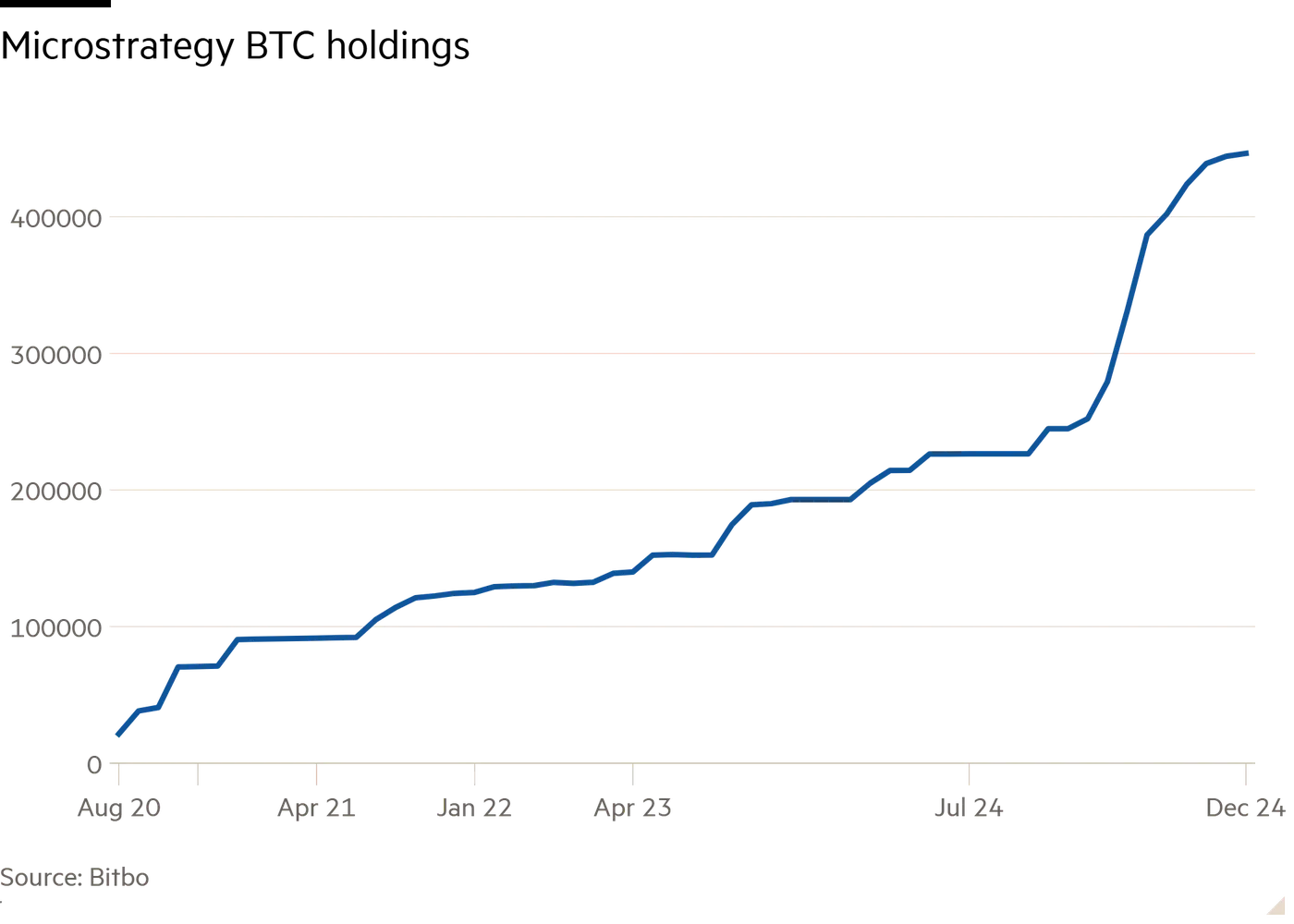

The company has amassed over two per cent of all bitcoin in existence, funded through a combination of shares and convertible bonds. This strategy has turned a humdrum business software firm into something akin to a bitcoin ETF, albeit one trading at a frothy premium to its net asset value. The stock is up over 20 times since the pivot to bitcoin in August 2020.

這家公司透過股票和可轉換債券的組合,積累了超過2%的現存比特幣。這一策略將一家平淡無奇的商業軟體公司轉變爲類似於比特幣交易所交易基金(ETF)的公司,儘管其交易價格相對於淨資產價值有很高的溢價。自2020年8月轉向比特幣以來,該公司股價上漲了20多倍。

Yet recent months have revealed some curious contradictions in this narrative. While bitcoin has maintained its stratospheric altitude at around $100,000 per coin, MicroStrategy’s stock has drifted lower, shedding 40 per cent since peaking intraday on November 21 at $550, which implied at the time a market cap of $124bn. Even its inclusion in the Nasdaq 100 index failed to boost the share price. Its premium to net asset value has meanwhile decreased from a high of 3.8 times to 1.9 times. This decline in the share price is happening even as the company continues to acquire more bitcoin.

然而,最近幾個月揭示了這一敘述中的一些奇怪矛盾。儘管比特幣的價格保持在每枚約10萬美元的高位,微策略的股票卻下跌了,自11月21日盤中達到550美元的峯值以來,已下跌了40%,當時市值爲1240億美元。即使被納入那斯達克100指數(Nasdaq 100)也未能提振其股價。同時,其相對於淨資產價值的溢價從最高的3.8倍下降到1.9倍。即便公司繼續收購更多的比特幣,其股價仍在下跌。

More telling still is the company’s frenetic execution of its $21bn “at-the-money” equity offering, announced with much fanfare on Hallowe’en. What was billed as a three-year marathon has been run at the pace of a sprinter on amphetamines, with over two-thirds of the allocation exhausted in just two months. This is odd behaviour for a strategy ostensibly designed for disciplined, incremental buying. There has been no buying on the dip. Even as bitcoin’s price has held firm near its peak, Michael Saylor, the company’s chair, has ramped up bitcoin purchases at breakneck speed.

更具說服力的是,該公司在萬聖節大張旗鼓地宣佈的210億美元「按市價」股票發行的瘋狂執行。原本計劃爲期三年的馬拉松,卻以短跑運動員服用安非他命的速度在兩個月內耗盡了超過三分之二的分配。這種行爲對於一個表面上是爲了有紀律、逐步購買的策略來說是很奇怪的。沒有在價格下跌時買入。即使比特幣的價格保持在高峯附近,該公司的主席邁克爾•塞勒(Michael Saylor)也以驚人的速度增加了比特幣的購買。

According to JPMorgan analysts, MicroStrategy accounted for an astonishing 28 per cent of capital inflows into the cryptocurrency market in 2024.

根據摩根大通分析師的說法,微策略在2024年佔據了加密貨幣市場資本流入的驚人28%。

There is also no time to waste. Last Friday the company announced plans to raise up to $2bn in perpetual preferred stock this quarter to buy more bitcoin, although the precise timing and terms have not yet been announced. This comes just over a week after MicroStrategy said it was seeking shareholder approval to increase its share count by over 3000 per cent from 330mn to 10.33bn.

時間也不容浪費。上週五,公司宣佈計劃在本季度發行高達20億美元的永久優先股以購買更多比特幣,儘管具體時間和條款尚未公佈。這距離微策略宣佈尋求股東批准將其股票數量從3.3億增加到103.3億,增幅超過3000%,僅過去一週多。

The timing smacks of opportunism, as if the company’s leadership recognises that the current NAV premium — the financial equivalent of finding money growing on trees — might not be permanent. There’s a hint of urgency (or desperation) in the air, an extreme haste to lock in this discrepancy between MicroStrategy’s stock and the bitcoin price before it is arbitraged away.

時機帶有機會主義的意味,彷彿公司的領導層意識到當前的淨資產價值溢價——在金融上相當於發現錢在樹上生長——可能不是永久的。空氣中瀰漫着一絲緊迫感,極力想在微策略的股票與比特幣價格之間的差異被套利消除之前鎖定這一差異。

Compounding the intrigue is the behaviour of MicroStrategy’s senior leadership. Saylor has publicly condemned diversification, urging investors to concentrate their portfolios in bitcoin with almost religious conviction. He has even suggested that people mortgage their homes to buy bitcoin!

微策略高層領導的行爲加劇了這種神祕感。塞勒公開譴責多元化,以近乎宗教般的信念敦促投資者將投資組合集中在比特幣上。他甚至建議人們抵押房產來購買比特幣!

His lieutenants, however, appeared to have missed the sermon, cashing in huge chunks of their stock holdings for the very fiat currency their boss routinely derides. November saw a flurry of insider selling, as executives converted their shares into good old-fashioned Yankee dollars. MicroStrategy shares may be a bitcoin proxy and so ostensibly a unique store of value, but with insider sales totalling $570mn in 2024, management is not HODLing the stock.

然而,他的副手們似乎錯過了這場佈道,紛紛拋售了他們的大量股票,換成了他們老闆經常嘲諷的法定貨幣。11月,內部人士紛紛出售股票,將其轉換爲傳統的美元,掀起了一股內幕拋售熱潮。微策略的股票可能是比特幣的代理,因此表面上是一個獨特的價值儲存,但隨著2024年內部銷售總額達到5.7億美元,管理層並沒有堅持持有這些股票。

The paradoxes don’t stop there. In following its strategy MicroStrategy appears structurally predisposed to buying bitcoin at ever-higher prices. During the crypto winter of 2022-2023, when bitcoin wallowed in the teens and twenties, the company’s purchases slowed to a crawl as its stock traded around NAV. Yet as bitcoin’s price soared, so too did MicroStrategy’s buying frenzy. The business model seems less a bet on bitcoin’s inherent value and more a wager on the fervour it inspires.

矛盾並未止步於此。按照其策略,微策略似乎在結構上傾向於以越來越高的價格購買比特幣。在2022-2023年的加密寒冬中,當比特幣價格徘徊在十幾到二十幾美元時,該公司的購買速度放緩,因爲其股票在淨資產值附近交易。然而,隨著比特幣價格飆升,微策略的購買狂潮也隨之而來。其商業模式似乎與其說是押注比特幣的內在價值,不如說是押注其激發的熱情。

The premium to NAV holds as long as bitcoin keeps ascending, and that premium is the glue that holds the entire strategy together. By selling stock at 2-3 times NAV, MicroStrategy is in effect buying bitcoin at a substantial discount. Without the NAV premium, the stock price falls, and much of the $7.2bn of convertible bonds outstanding risks being redeemed for cash at maturity, not converted into new shares. At that point, things get a lot stickier for MicroStrategy because its software business loses money and it generates no cash from bitcoin. (MicroStrategy trumpets a metric called “BTC yield”, which implies a return but really measures the percentage increase in bitcoin per share from its issue of stock and purchases of bitcoin. There is in fact no “yield” in the conventional sense of dividends or income streams.)

只要比特幣持續上漲,淨資產價值(NAV)的溢價就會保持,而這種溢價是維持整個策略的關鍵。透過以淨資產價值的2-3倍出售股票,微策略實際上是在以大幅折扣購買比特幣。沒有淨資產價值溢價,股價就會下跌,72億美元的可轉換債券中很大一部分面臨到期時被贖回現金的風險,而不是轉換爲新股。到那時,微策略的情況會變得更加棘手,因爲其軟體業務虧損,並且從比特幣中沒有產生現金。微策略宣揚一個名爲「BTC收益」的指標,這個指標暗示了回報,但實際上衡量的是透過發行股票和購買比特幣,每股比特幣的百分比成長。實際上,並沒有傳統意義上的股息或收入流的「收益」。

Perpetual appreciation is a demanding ask for any asset class, and the company seems to know it. Saylor’s relentless proselytising for bitcoin — an odd choice for someone accumulating the asset — suggests an acute awareness of the stakes. It’s also no surprise that he is cultivating government support, meeting with President-elect Donald Trump’s son Eric (which preceded a sharp 13 per cent rise in the stock on Friday) and advocating for a Strategic Bitcoin Reserve. It’s an ironic twist for a cryptocurrency long touted as a bulwark against government meddling. But when your playbook hinges on unrelenting enthusiasm, pragmatism trumps principle.

對於任何資產類別來說,持續升值都是一個苛刻的要求,而公司似乎對此心知肚明。塞勒對比特幣的不懈宣傳——對於一個正在積累該資產的人來說,這是一個奇怪的選擇——表明他對利害關係有著敏銳的意識。他尋求政府支援也不足爲奇,他與當選總統唐納•川普(Donald Trump)的兒子埃裏克會面(這導致公司股票在週五大漲13%),並倡導建立戰略比特幣儲備。對於一種長期被吹捧爲抵禦政府幹預的加密貨幣來說,這是一種諷刺的轉折。但當你的策略依賴於不懈的熱情時,務實勝過原則。

The question that lingers is whether MicroStrategy can maintain its premium valuation through sheer force of narrative much like the meme stocks that have defied conventional valuation metrics. The company has effectively become a publicly traded bet on bitcoin’s future, but one that still trades at a substantial mark-up to the underlying asset. This premium represents either the market’s faith in Saylor’s vision or a temporary, psychology-driven inefficiency waiting to be arbitraged away.

懸而未決的問題是,微策略能否像那些無視傳統估值指標的迷因股票一樣,僅憑敘事的力量維持其溢價估值。該公司實際上已成爲對比特幣未來的公開交易賭注,但其交易價格仍遠高於基礎資產。這種溢價要麼代表市場對塞勒願景的信任,要麼是一個暫時的、由心理驅動的低效現象,等待被套利消除。

The whole affair feels like a high-stakes game of musical chairs, and as the tempo quickens, even the insiders seem to be hedging their bets. Whether MicroStrategy’s gambit will be remembered as a stroke of financial genius or a cautionary tale remains unresolved. For now, the music plays on, with the volume dialled up to 11, and the faithful — or the merely hopeful — keep dancing.

整個事件感覺就像一場高風險的搶椅子游戲,隨著節奏加快,即使是內部人士似乎也在對沖他們的賭注。微策略的策略究竟會被記爲金融天才之舉還是警示故事,仍未有定論。目前,音樂繼續播放,音量調到11,忠實者——或僅僅是抱有希望的人——繼續跳舞。

Further reading:

延伸閱讀:

— 微策略的祕訣在於波動性,而非比特幣 (FTAV)

——審視微策略創紀錄的210億美元ATM(FTAV)

虛擬貨幣相關活動存在較大法律風險。請根據監管規範,注意甄別和遠離非法金融活動,謹防個人財產和權益受損。